Market in UAE to Grow Significantly During 2023–2031

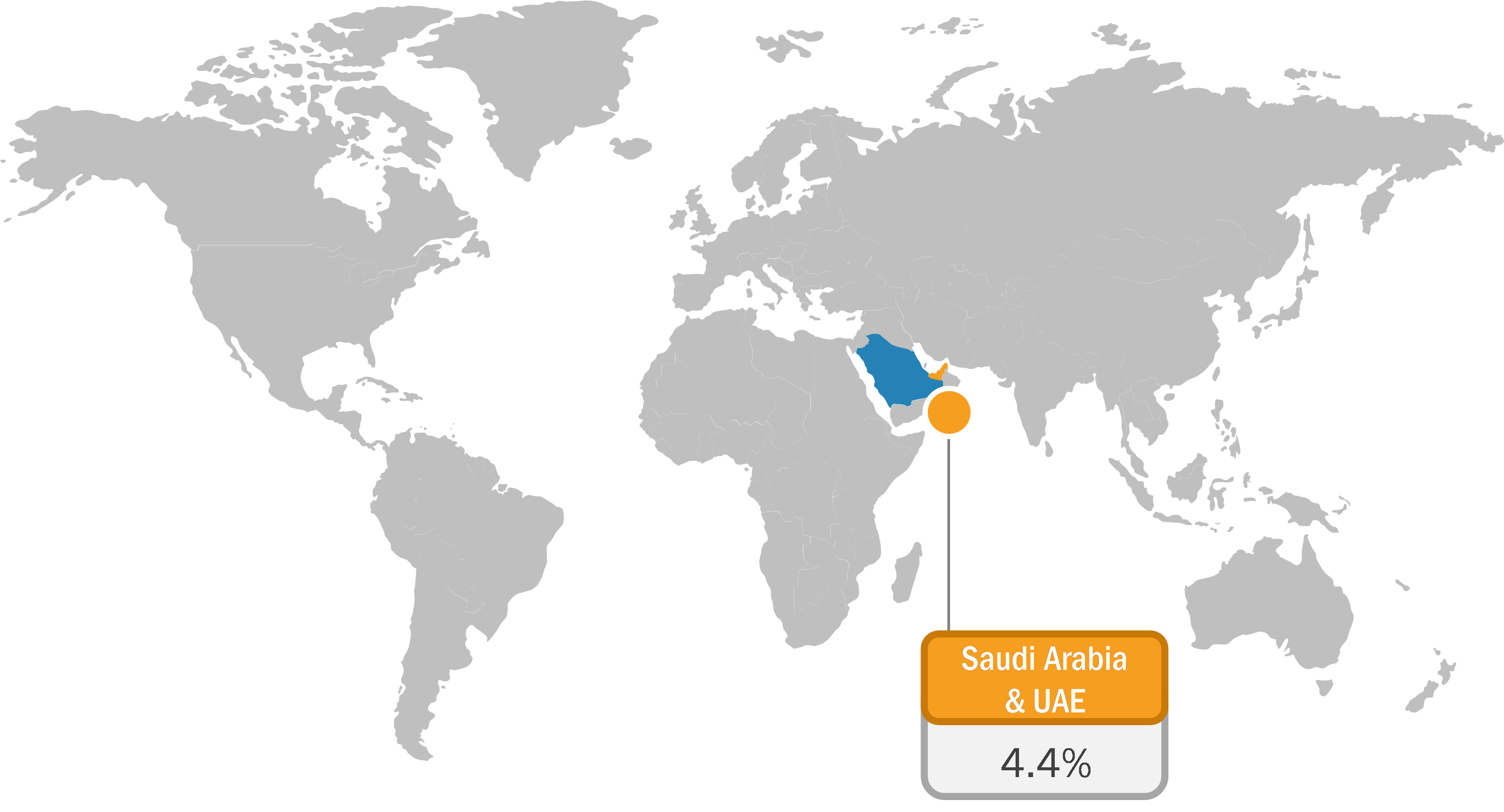

According to our new research study on "Saudi Arabia and UAE Frozen French Fries for Foodservice Market Forecast to 2031 – by Type, category, and End User," the market is projected to grow from US$ 435.10 million in 2023 to US$ 616.37 million by 2031; the market is expected to register a CAGR of 4.4% during 2023–2031. The report highlights key factors propelling the market growth and prominent players along with their developments in the market. Apart from growth drivers, the report covers the Saudi Arabia and UAE frozen French fries for foodservice market trends and their foreseeable impact during the forecast period.

The scope of the Saudi Arabia and UAE frozen French fries for foodservice market report focuses on the overall trends in foodservice sectors and consumption of frozen French fries in Saudi Arabia and UAE. The rapid growth in the foodservice and fast-food sectors is boosting the demand for frozen French fries in the UAE. Increasing disposable income, growing urban lifestyles, rising tourism, and evolving consumer preferences have propelled the growth of the foodservice sector in the country. Emerging trends in the market, such as food stalls and food trucks and the availability of a wide range of international cuisines, attract customers, boosting the demand for frozen food. Frozen potato products such as French fries are offered in the foodservice sector, which is propelling the market growth in the UAE.

Saudi Arabia and UAE Frozen French Fries for Foodservice Market

Saudi Arabia and UAE Frozen French Fries for Foodservice Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Regular Fries, Crinkle-Cut Fries, Steak-Fries, and Others), Category (Conventional and Organic), End User (Quick Service Restaurants, Fine Dining Restaurants, Cafes and Bars, and Others), and Country

Saudi Arabia and UAE Frozen French Fries for Foodservice Market 2031

Download Free Sample

The major factor boosting the market growth is the rapid expansion of fast-food and foodservice restaurants across the country. Chains such as KFC, McDonald's, Popeyes, Jollibee, Pizza Hut, and Domino's have a large footprint in the country. The demand for frozen French fries has increased in the country due to the surging requirement for various processed potato products in restaurants and the quick service restaurant (QSR) sector. Additionally, owing to the busy lifestyle, the demand for takeaways, on-the-go food service, and home delivery trends is fueling the growth of the foodservice sector. These factors are further projected to bolster the demand for frozen French fries in the foodservice sector.

The growing foodservice industry in Saudi Arabia drives the frozen French fries for foodservice market. For instance, Delfino Mayfair announced the opening of an Italian restaurant in Saudi Arabia in October 2023 to serve the growing inclination toward international cuisine in the country. In addition, in 2023, Arby's opened its first restaurant in Riyadh, Saudi Arabia. In 2023, the UAE-based burger chain Pickl planned to expand to 50 new GCC locations over the next five years. Pickl also announced the plans to open its first restaurant in Qatar in 2023. In August 2024, Smacks Hamburgers launched its burger chain in Dubai. Moreover, Five Guys, a burger chain, made its debut at Dubai International Airport in the UAE in June 2024. The growing consumer demand for potato snacks has encouraged foodservice operators and fast-food chains to include potato snacks and French fries as a part of their core menu. Thus, the expanding foodservice industry contributes to the growing Saudi Arabia and UAE frozen French fries for foodservice market size.

However, the risk of contamination in frozen food products is prevalent due to cross-contamination with physical contaminants such as metal, stones, and plastics, which is restraining the market expansion. In April 2024, 75 people were hospitalized in a food poisoning outbreak caused by the bacterium Clostridium botulinum in a fast-food chain in Riyadh (Saudi Arabia). As a result, Saudi Arabia's Ministry of Municipal and Rural Affairs and Housing announced a directive for restaurants and foodservice outlets to implement a tracking system for all ingredients and packaging used in food preparation. Thus, the risk of contamination and stringent government regulations slightly hamper the growth of the Saudi Arabia and UAE frozen French fries for foodservice market.

Saudi Arabia and UAE Frozen French Fries for Foodservice Market: Trends

The consumer preference for healthy and environment-conscious food choices is increasing in Saudi Arabia and the UAE. As awareness regarding the benefits of organic farming practices increases, customers in Saudi Arabia and the UAE actively seek pesticide and chemical-free produce. Organic frozen French fries are perceived as a safe and more sustainable option, aligning with the desire for a clean and natural diet. This trend is specifically driven by health concerns associated with chemically grown crops and a global movement toward sustainable agriculture. As consumers prioritize environmental and personal well-being, the demand for organic frozen French fries in Saudi Arabia and the UAE is likely to grow steadily, influencing agricultural practices in the country. The emphasis on organic frozen French fries also aligns with a desire for transparency in the food supply chain.

Food operators are seeking information about the origins of their food, and the organic label assures that the produce has met specific standards of cultivation. This demand for transparency reflects a growing consciousness about the impact of food choices on consumer well-being, environmental sustainability, and the local economy. According to Business Start Up Saudi Arabia, the number of organic farms increased by 28% in 2021 due to the country's US$ 200 million strategy for innovation plan. The plan aims to increase the capacity of organic farming by 300% in the coming years. The country also introduced a traceability mechanism to offer product transparency to consumers. As per the Organic Trade Association, organic packaged food consumption was recorded to be US$ 36.2 million in 2023. Thus, the rising demand for organic food products is expected to boost the Saudi Arabia and UAE frozen French fries for foodservice market growth during the forecast period.

Saudi Arabia and UAE Frozen French Fries for Foodservice Market: Segmental Overview

The Saudi Arabia and UAE frozen French fries for foodservice market analysis has been performed by considering the following segments: type, category, and end user.

By type, the market is segmented into regular fries, crinkle-cut fries, steak-fries, and others. The regular fries segment held the largest Saudi Arabia and UAE frozen French fries for foodservice market share in 2023. These French fries can be paired with a variety of seasonings and coatings, enhancing the flavor. This shape and size allow for even and quick cooking on all sides, and it is great for eating with burgers, sandwiches, and meat and seafood appetizers. They are a popular side dish in burger joints, fast-food restaurants, and cafes.

In terms of end user, the market is segmented into quick service restaurants, fine dining restaurants, cafes and bars, and others. The quick service restaurants segment held the largest Saudi Arabia and UAE frozen French fries for foodservice market share in 2023. Due to the rising fast-food trend, foodservice operators face challenges related to rapid turnaround time. Thus, they prefer to sell products that require minimum preparation time. Frozen French fries require minimal time for preparation as they just need to be fried or baked. Moreover, they have a high shelf life when stored at optimum temperature conditions. These factors contribute to the Saudi Arabia and UAE frozen French fries for foodservice market growth for the segment.

Lamb Weston Holdings Inc, McCain Foods Ltd, GOLDEN DUNES GENERAL TRADING LLC, Seara Foods, Sunbulah Food & Fine Pastries Manufacturing Co Ltd, Saudia Dairy & Foodstuff Company (SADAFCO), BRF SA, Ecofrost, AJC International, Inc, Mondial Foods BV, Al Kabeer Group ME, Almunajem Foods Co, Del Monte Foods (U.A.E.) FZE, Crown Food, and Farm Frites International BV. are among the leading companies profiled in the Saudi Arabia and UAE frozen French fries for foodservice market report.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com