Testing Strip Under Product Segment to Bolster Self-Monitoring Blood Glucose Devices Market Size During 2021–2031

According to our latest study on "Self-Monitoring Blood Glucose Devices Market Forecast to 2030 – Global Analysis – by Product, Application, Testing Site, and End User," the market is expected to reach US$ 22.4 billion by 2031 from US$ 9.5 billion in 2023. The market report emphasizes the key factors driving the market and showcases the developments of prominent players. The high adoption of self-monitoring blood glucose devices amid the COVID-19 pandemic is a crucial factor propelling the self-monitoring blood glucose devices market size. However, product recalls impede the market growth.

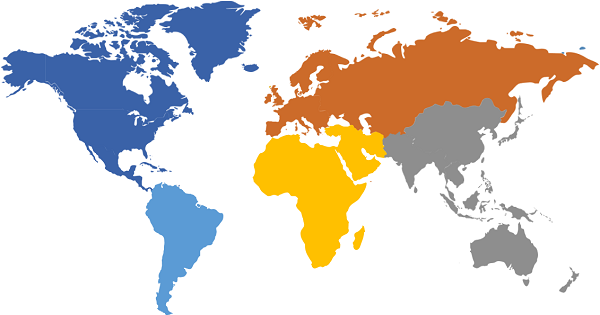

Regional Overview

Based on geography, the market is primarily segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America; North America held the largest market share in 2022. The US dominates the market in North America. Increasing number of product launches by top companies and the presence of key market players favors the self-monitoring blood glucose devices market growth in North America. Additionally, Asia Pacific is estimated to account for the highest CAGR in the market.

Self-Monitoring Blood Glucose Devices (SMBGDs) Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Testing Strips, Glucose Meters, Lancets, and Others), Application (Type 1 Diabetes and Type 2 Diabetes), Testing Site (Fingertip Testing and Alternate Site Testing), End User (Hospitals & Clinics and Self/Homecare), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Self-Monitoring Blood Glucose Devices Market Report - 2031

Download Free Sample

Market Driver

High Adoption of Self-Monitoring Blood Glucose Devices Amid COVID-19 Pandemic

There was an accelerating demand for home-use/remote blood glucose meters due to quarantine measures imposed across several countries in the wake of the COVID-19 pandemic. The FDA approved the use of remote blood glucose meters and considered it a vital option for diabetic people, which, in turn, limited the exposure to COVID-19. Also, the FDA encouraged hospitals and Long-Term Care Functional Screens to consider policies that allow patients to self-test blood glucose levels using home-based blood glucose meters. Therefore, modernized and advanced technology-based remote glucose monitoring devices provided wireless access to healthcare professionals, limiting the number of necessary patient contacts, reducing the risk of viral transmission, and preserving the hospital's limited supply of personal protective equipment (PPE), which, in turn, catapulted the self-monitoring blood glucose devices market.

Market Opportunity

Availability of Over-the-Counter (OTC) Self-Monitoring Blood Glucose Devices

In March 2024, the US FDA approved the marketing of the first OTC continuous glucose monitor (CGM). The first OTC CGM that received clearance was from Dexcom company. It is an integrated CGM recommended for patients aged 18 years and older. Therefore, the availability of self-monitoring blood glucose devices as an OTC product will provide lucrative opportunities for the self-monitoring blood glucose devices market in the coming years. For instance, in September 2020, the FDA released a guidance document for the manufacturers to conduct appropriate performance studies and prepare 510 (k) submissions for SMBG devices for availability as an OTC product.

Self-Monitoring Blood Glucose Devices Market, by Type:

Based on product, the self-monitoring blood glucose devices market analysis is carried out by considering the following subsegments: testing strips, glucose meters, lancets, and others. The testing strips segment held the largest self-monitoring blood glucose devices market share in 2023 and is anticipated to register the highest CAGR of 11.8% during the 2021-2031.

Self-Monitoring Blood Glucose Devices Market, by Application:

By application, the market is bifurcated into type 1 diabetes and type 2 diabetes. The type 2 diabetes segment held a larger self-monitoring blood glucose devices market share in 2023. The type 1 diabetes segment is anticipated to register a higher CAGR of 11.7% during the 2021-2031.

Self-Monitoring Blood Glucose Devices Market, by Testing Site:

By testing site, the market is classified into fingertip testing and alternate site testing. The fingertip testing segment held a larger market share in 2023 and is anticipated to register a higher CAGR of 11.8% during the 2021-2031.

Self-Monitoring Blood Glucose Devices Market, by End User:

By end user, the self-monitoring blood glucose devices market is categorized into hospitals & clinics and self/homecare. The self/homecare segment held a larger market share in 2023. The hospitals & clinics segment is anticipated to register a higher CAGR of 12.1% during the 2021-2031.The self/home care segment accounts largest market share due to innovative glucose monitoring devices availability in the market. For example, the self-glucose sensor systems communicate either via radio (manufactured by Medtronic) or Bluetooth (manufactured by Dexcom, FreeStyle Libre with transmitter) with the respective control centers. Such innovative self-glucose monitoring devices is one of the influential factors responsible for segment growth during 2021-2031.

Self-Monitoring Blood Glucose Devices Market, by Geography:

The geographic scope of the self-monitoring blood glucose devices market report encompasses North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Apart from factors driving the market, the self-monitoring blood glucose devices market report emphasizes prominent players' developments. B. Braun SE, F. Hoffmann-La-Roche, LifeScan Inc., Medtronic, Abbott, Ypsomed Holding AG, Sensionics, Nipro Corp, GE Healthcare, Terumo Corp are among the prominent players operating in the market.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com