Proliferation of Electronics and Semiconductors Industry to Escalate Silicon Carbide Market Growth

According to our latest market study on “Silicon Carbide Market Forecast to 2027 – COVID-19 Impact and Global Analysis – by Type (Black Silicon Carbide and Green Silicon Carbide) and End-Use Industry (Automotive, Aerospace and Aviation, Military and Defense, Electronics and Semiconductor, Medical and Healthcare, Steel, and Others),” the market was valued at US$ 712.85 million in 2019 and is projected to reach US$ 1,810.56 million by 2027; it is expected to grow at a CAGR of 12.5% from 2020 to 2027. The report highlights key factors driving the market growth and prominent players along with their developments in the market.

Silicon carbide, also known as carborundum, is a semiconductor material widely used in electronics and semiconductor industries. The physical hardness of silicon carbide makes it fit for use as an abrasive in processes such as honing, water jet cutting, grinding, and sand blasting. It is also used in the components of pumps used to drill and extract the oil in oilfield applications. Rising demand for silicon carbide in various application industries has led to an increase in the investments by manufacturers, governments, and research institutes in its production.

Silicon carbide is being used widely in electronics and semiconductors industries as a replacement of silicon. It offers greater breakdown electric field strength, band gap, and thermal conductivity, along with enabling a wider range of p- and n-type control required for the construction of a device. For instance, silicon has a band gap of ~1.12, whereas silicon carbide offers a band gap of ~3.26. Similarly, thermal conductivity for silicon carbide is 1490 W/m-K, which is significantly higher than the thermal conductivity of silicon—150 W/m-K. A majority of silicon carbide is being used to make diodes that are used in power supplies and hybrid modules such as PV7. According to the statistics cited by the Semiconductor Industry Association (SIA), global sales of semiconductors witnessed a hike of 6% from October 2019 to October 2020, reaching a market value of US$ 39 billion. Moreover, 2021 is likely to be a promising year for semiconductors businesses as per the predictions by the World Semiconductor Trade Statistics (WSTS) organization. As per the WSTS, the global sales of semiconductors are expected to grow by 8.4% in 2021 compared with the sales in 2020. According to The Insight Partner’s analysis, the global electronics industry is expected to register an annual growth rate of 5–6% from 2020 to 2021, and North America and Asia Pacific are expected to register a higher growth than other regions during the same period. Thus, such promising statistics depict the growth of electronics and semiconductor industries, making them a lucrative market segment for the global silicon carbide market vendors.

Fiven ASA; AGSCO Corp; Carborundum Universal Limited; ESD-SIC; ESK-SIC GmbH; Futong Industry Co. Limited; Electro Abrasives, LLC; Washington Mills; Tifor B.V.; and Grindwell Norton Ltd are among the well-established players in the silicon carbide market.

Impact of COVID-19 Pandemic on Silicon Carbide Market

As of December 2020, the US, Brazil, India, Russia, Spain, and the UK are among the worst-affected countries in terms confirmed cases and reported deaths. The COVID-19 has been affecting economies and industries in various countries due to lockdowns, travel bans, and business shutdowns. Chemical and materials is one the world’s major industries suffering serious disruptions such as supply chain breaks, technology events cancellations, and office shutdowns because of this outbreak. China is the global hub of manufacturing and largest raw material supplier for various industries. The shutdown of various plants and factories in China is affecting the global supply chains and negatively impacting the manufacturing, delivery schedules, and sales of various materials. Various companies have already announced possible delays in product deliveries and slump in future sales of their products. In addition, the global travel bans imposed by countries in Europe, Asia, and North America are suppressing the business collaboration and partnership opportunities. Thus, these factors have been restraining the growth of the chemicals and materials industry, and other markets related to this industry.

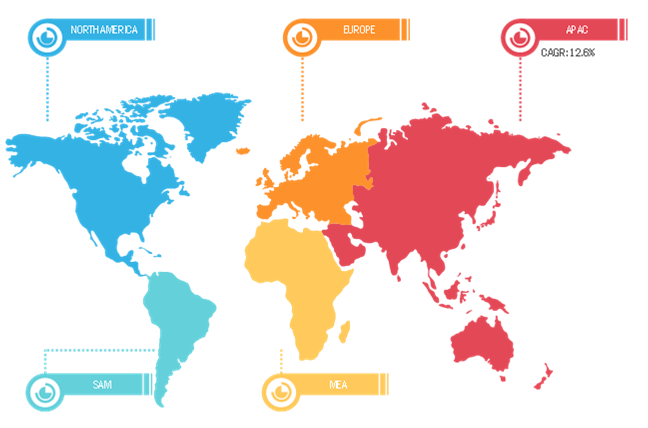

Silicon Carbide Market Breakdown – by Region, 2019

Silicon Carbide Market Analysis by 2027

Download Free Sample

Silicon Carbide Market Forecast to 2027 - COVID-19 Impact and Global Analysis By Type (Black Silicon Carbide and Green Silicon Carbide) and End-Use Industry (Automotive, Aerospace and Aviation, Military and Defense, Electronics and Semiconductor, Medical and Healthcare, Steel, and Others)

Silicon Carbide Market Analysis by 2027

Download Free SampleSilicon Carbide Market Forecast to 2027 - COVID-19 Impact and Global Analysis By Type (Black Silicon Carbide and Green Silicon Carbide) and End-Use Industry (Automotive, Aerospace and Aviation, Military and Defense, Electronics and Semiconductor, Medical and Healthcare, Steel, and Others)

The report includes the segmentation of the silicon carbide market as follows:

Silicon Carbide Market, by Type

- Black Silicon Carbide

- Green Silicon Carbide

- Silicon Carbide Market, by End-Use Industry

- Automotive

- Aerospace and Aviation

- Military and Defense

- Electronics and Semiconductor

- Medical and Healthcare

- Steel

- Others

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Rest of Europe

- Asia Pacific (APAC)

- Australia

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- Middle East and Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

- South America

- Brazil

- Argentina

- Rest of South America

- North America

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com