Increasing Demand from Automotive and Telecommunication Industry Drives Southeast Asia Redistribution Layer Material Market

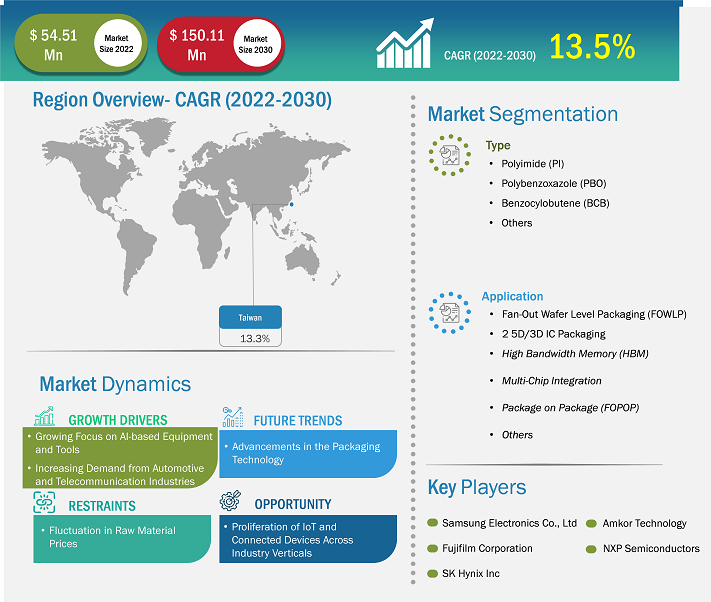

The Southeast Asia redistribution layer material market is expected to grow from US$ 54.51 million in 2022 to US$ 150.11 million by 2030; it is expected to register a CAGR of 13.5% from 2022 to 2030.

The redistribution layer (RDL) is the thin film or layer of conductive material used to route and redistribute electrical signals within an integrated circuit (IC) or semiconductor device. This layer is essential for connecting components, such as transistors, capacitors, and resistors, within the IC and ensuring signals can flow effectively between them. The Southeast Asia redistribution layer material market is experiencing significant growth, driven primarily by the surging demand from two key industries: automotive and telecommunication. The ever-expanding production needs of the automotive industry propel the growth of the market. According to the ISEAS-Yusof Ishak Institute, Southeast Asia is also an important automobile production base. Southeast Asia is the seventh largest automotive manufacturing hub worldwide, producing 3.5 million vehicles in 2021. Within the region, Thailand is the largest car producer, producing over 1.6 million motor vehicles in 2021, followed by Indonesia (1.1 million), Malaysia (0.48 million), and Vietnam (0.16 million). As vehicles become increasingly reliant on advanced electronics for safety, entertainment, and autonomous capabilities, the demand for semiconductors has soared. These automotive chips require intricate packaging solutions, often employing redistribution layers, to enable compact design and efficient interconnections.

Southeast Asia Redistribution Layer Material Market Size and Forecasts (2020 - 2030), Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Polyimide (PI), Polybenzoxazole (PBO), Benzocylobutene (BCB), and Others) and Application (Fan-Out Wafer Level Packaging (FOWLP) and 2 5D/3D IC Packaging [High Bandwidth Memory (HBM), Multi-Chip Integration, Package on Package (FOPOP), and Others])

Southeast Asia Redistribution Layer Material Market to Grow at a CAGR of 13.5% to reach US$ 150.11 million from 2022 to 2030

Download Free Sample

The telecommunication sector is evolving rapidly, particularly with the deployment of 5G technology. There is a widespread rollout of 5G networks in Southeast Asian countries, which has led to an increased demand for smartphones and other consumer electronics products. For instance, in October 2021, AIS and Samsung jointly launched a voice-over 5G radio service enabling voice calls on AIS’s 5G standalone (SA) network in Thailand. In Vietnam, Samsung Electronics and Viettel announced the 5G commercial trials launched in Da Nang in December 2021. Viettel is piloting 5G services in 11 provinces and cities, namely, Ho Chi Minh City, Hanoi, Bac Ninh, Vinh Phuc, Bac Giang, Dong Nai, Ba Ria-Vung Tau, Binh Phuoc, Thua Thien-Hue, and Da Nang. This revolution is driving the development of high-frequency, high-performance devices and systems. These requirements extend to the material used in redistribution layers, which must meet stringent specifications to ensure seamless connectivity and signal integrity. In addition, the push for miniaturization is a common thread between these industries. Smaller, more powerful devices are in demand, necessitating thinner and more advanced redistribution layer materials. These materials play a critical role in enabling high-density interconnections within compact electronic packages. All these factors are driving the Southeast Asia redistribution layer material market growth.

Advanced Semiconductor Engineering, Inc.; Amkor Technology; Fujifilm Corporation; DuPont; Infineon Technologies AG; NXP Semiconductors; Samsung Electronics Co., Ltd; Shin-Etsu Chemical Co., Ltd; SK Hynix Inc; and Jiangsu Changjiang Electronics Technology Co., Ltd are among the key players operating in the Southeast Asia redistribution layer material market.

Impact of COVID-19 Pandemic on Southeast Asia Redistribution Layer Material Market Growth

The Southeast Asia redistribution layer material market witnessed growth before the onset of the COVID-19 pandemic due to the increased use of redistribution layer in the electronics & semiconductor industry. The COVID-19 pandemic adversely impacted the Southeast Asian economy and slowed down the growth of various industries in 2020. The pandemic adversely affected the semiconductor industry, resulting in the shutdown of manufacturing facilities, challenges in procuring raw materials, and restrictions on logistic operations. The unprecedented rise in the number of COVID-19 cases across the country and the subsequent lockdown of numerous manufacturing facilities negatively influenced the growth of the Southeast Asia redistribution layer material market. Further, the overall disruptions in manufacturing processes and research and development activities hindered the Southeast Asia redistribution layer material market growth. The severely decreased manufacturing activities and disrupted supply chain hampered the demand for redistribution layer material in Southeast Asia.

The market is reviving due to the government's significant measures, such as vaccination drives. The growing demand for redistribution layer material from the semiconductor sector is propelling the Southeast Asia redistribution layer material market growth. Moreover, various players in the country are seeking more investment opportunities as businesses gain confidence in stabilizing economies and increasing demand, thereby providing the impetus for the Southeast Asia redistribution layer material market share.

The "Southeast Asia Redistribution Layer Material Market Analysis to 2030" is a specialized and in-depth study of the chemicals & materials industry, focusing on the Southeast Asia redistribution layer material market trend analysis. The report aims to provide an overview of the market with detailed market segmentation. The Southeast Asia redistribution layer material market is divided on the basis of type and application. Based on type, the market is segmented into polyimide (PI), polybenzoxazole (PBO), benzocylobutene (BCB), and others. Based on application, the market is segmented into Fan-Out Wafer Level Packaging (FOWLP) and 2 5D/3D IC packaging (High Bandwidth Memory (HBM), multi-chip integration, Package on Package (FOPOP), and others). In 2022, the polyimide (PI) segment dominated the Southeast Asia redistribution layer material market. Polyimides are polymer-based thermoplastics with a high melt viscosity and require higher pressures for forming molded parts. Polyimides offer good chemical resistance, high mechanical strength, higher thermal stabilities, and exceptional electrical properties. For the IC packaging methods, polyimides are used as high-temperature adhesives, mechanical stress buffers, and as a film supporting the micro-sized circuitry. Polyimide is majorly used in all the flip-chip wafer bumping and WLP applications. The polyimide dielectric materials have been conventionally serving as Stress-Buffer Passivation Layers (SBP) on the ICs, which used to be wire-bonded and wrapped in a mold compound. All these factors are boosting the growth of the Southeast Asia redistribution layer material market for the polyimide (PI) segment.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com