Innovations in Flavors Bolster Tonic Water Market Growth

According to our latest study on “Tonic Water Market Size and Forecast (2021–2031), Global and Regional Growth Opportunity Analysis – by Type, Category, and End Use,” the market size is expected to grow from US$ 2.01 billion in 2023 to US$ 3.47 billion by 2031; it is estimated to register a CAGR of 7.1% from 2023 to 2031. The report highlights key factors driving the market growth and prominent players along with their developments in the market.

Consumers are increasingly seeking premium and unique experiences in everyday beverages. In response to the evolving consumer expectations, tonic water manufacturers across the world engage in product development and innovation to attract a larger clientele and enhance their market position. Innovative flavors such as elderflower, cucumber, and grapefruit appeal to a wider range of consumers. In July 2023, Double Dutch, a UK-based premium tonic water and mixer brand, announced the launch of its new elderflower tonic water. With this launch, the company aimed to cater to the increasing consumer demand for innovative flavors. In addition, the demand for fresh and fruity citrus flavors is on the rise among consumers. For instance, in March 2022, The Coca-Cola Company introduced new grapefruit-flavored bottled tonic water to its Schweppes portfolio. The launch aimed to cater to the growing demand for fruity flavor tonic water.

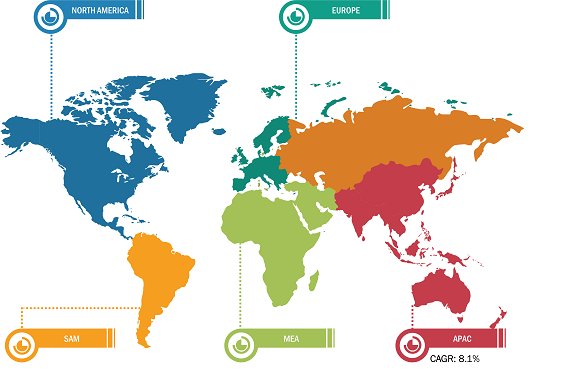

Tonic Water Market Breakdown – by Region

Tonic Water Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Plain and Flavored), Category (Low/No Sugar and Regular), End User (On-Trade and Off-Trade), and Geography

Tonic Water Market Size and Growth by 2031

Download Free Sample

With the burgeoning interest in natural and botanical-based products, in line with the growing trend of healthy eating and drinking, consumers seek beverages made with natural, high-quality ingredients. They are also looking for lighter and more floral tonic water varieties. In February 2022, BZZDEnergy announced the launch of a new energy tonic water powered by natural caffeine, pure blossom honey, and stevia. With this launch, the company has plans to expand its product portfolio and cater to growing consumer preferences. Thus, the introduction of innovative flavors fuels the growth of the tonic water market.

With the increasing popularity of online shopping, particularly in the food & beverages sector, tonic water brands can leverage e-commerce platforms to expand their market presence and reach an extended consumer base. By establishing the online presence, these brands can directly connect with consumers, offering a seamless shopping experience and convenient delivery options, which is especially appealing to busy urban residents. The launch of a dedicated online platform specifically offering alcoholic beverages and mixers creates growth opportunities for the tonic water market players. In July 2022, A1 Cuisines, a company that owns and manufactures the Malaki brand of tonic water, announced the launch of BeverageCart, India’s first mobile app-based beverage platform. The app aims to aid the smooth delivery of beverages to retailers, hotels, restaurants, and caterers, thereby fulfilling wholesale online orders.

The tonic water market analysis has been performed by considering the following segments: type, category, and end use. Based on type, the market is bifurcated into plain and flavored. The flavored segment is anticipated to hold a significant tonic water market share by 2031.

The tonic water market report emphasizes the key factors driving the market. The popularity of gin-based cocktails is on the rise in bars and restaurants, which indicates the spurred demand for tonic water in the hospitality sector. Mixologists and bartenders are continually innovating and experimenting with new gin and tonic combinations with different flavors, driving the need for various tonic water options to accommodate diverse tastes and preferences. As a result, manufacturers are expanding their product offerings to include different flavors, formulations, and packaging sizes to meet the demand of both retail consumers and the hospitality industry. Thus, owing to the popularity of gin and tonic combination, the increasing demand for gin benefits the tonic water market growth.

In terms of revenue, Europe dominated the tonic water market share in 2023. The UK is a major market for tonic water in Europe. The market growth in the UK is attributed to the increasing gin consumption, surging demand for premium tonic water, and consumer expectations for unique flavors and ingredients in tonic water. In recent years, the popularity of gin, particularly artisans and craft gins, has soared, driving the demand for tonic water as a key mixer. In addition, the key players in the country are involved in strategic initiatives such as product launches, mergers, acquisitions, and collaborations to strengthen their position in the tonic water market. For instance, in July 2023, Double Dutch—a UK-based premium tonic water and mixer brand—announced the launch of its new elderflower tonic water. The launch was aimed to cater to the growing consumer demand for unique flavors and premium products.

The tonic water market trends include the preference for low-sugar tonic water. As more consumers become health-conscious and seek to reduce their sugar intake, the demand for low-sugar or zero-sugar beverages has surged. Low-sugar tonic water offers consumers a lighter and healthier option without compromising flavor or quality. Key players in the tonic water market engage in adopting strategic initiatives such as product launches and development to cater to the growing demand for low-sugar tonic water. In August 2021, Nexba made the Nexba Sugar-Free Tonic Water available in two flavors: lime, cucumber, and mint; and classic tonic. The launch was aimed to cater to the growing demand for low-sugar tonic water.

The tonic water market forecast can help stakeholders plan their growth strategies. The Coca-Cola Co, Fevertree Drinks Plc, Three Cents Co, Thomas Henry GmbH, Q Tonic LLC, East Imperial Beverage Corp, Fentimans Ltd, Britvic Plc, Bickford & Sons Ltd, and White Rock Beverages Ltd are among the prominent players profiled in the tonic water market report. These market players are focusing on providing high-quality products to fulfill customer demand. They are also adopting strategies such as new product launches, capacity expansions, partnerships, and collaborations to stay competitive in the market. For Instance, in March 2024, Topo Chico introduced its latest Topo Chico Mixers, inspired by Topo Chico Mineral Water, in the US. These nonalcoholic drinks are available in three flavors—Ginger Beer, Tonic Water, and Club Soda. They are crafted with filtered sparkling water, premium ingredients, and herbal flavor notes, subtly complementing specialty cocktails with their delicious taste.

The tonic water market is segmented on the basis of type, category, end use, and geography. Based on type, the market is segmented into plain and flavored. Based on category, the market is segmented into low/no sugar and regular. By end use, the market is segmented into on-trade and off-trade. By geography, the tonic water market is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The North America market is further segmented into the US, Canada, and Mexico. The market in Europe is subsegmented into Germany, France, the UK, Italy, Russia, and the Rest of Europe. The Asia Pacific market is further segmented into China, India, Japan, Australia, South Korea, and the Rest of Asia Pacific. The tonic water market in the Middle East & Africa is further segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The market in South & Central America is further segmented into Brazil, Argentina, and the Rest of South & Central America.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com