UK Dominated US and Europe Pet Snacks and Treats Market During 2023–2031

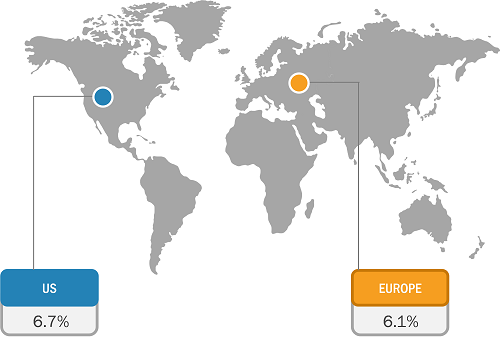

According to our new research study on “US and Europe Pet Snacks and Treats Market Forecast to 2031 – by Product Type, Flavor, and Distribution Channel,” the market was valued at US$ 20.24 billion in 2023 and is projected to reach US$ 33.09 billion by 2031; it is expected to register a CAGR of 6.3% during 2023–2031. The report highlights key factors propelling the market growth and prominent players along with their developments in the market. Apart from growth drivers, the report covers the US and Europe pet snacks and treats market trends and their foreseeable impact during the forecast period.

The scope of the US and Europe pet snacks and treats market report focuses on the US, Germany, France, Italy, Spain, the UK, and the Rest of Europe. The US dominated the market in 2023. The market in the US is significantly growing owing to a rising number of pet owners, the humanization of pets, and an increase in spending on pet health. As per the National Pet Owners Survey (2021–2022) conducted by the American Pet Food Association, pet ownership in US households grew from ~67% in 2021 to 70% in 2022. Further, millennials accounted for the largest group of pet owners (32% of total pet owners in the US), followed by baby boomers (27%) and Generation X (24%). People are willing to invest in premium quality pet food products, including snacks and treats. This trend is driven by a desire to provide pets with a variety of food options that not only cater to their dietary needs but also offer enjoyment and reward.

US and Europe Pet Snacks and Treats Market Growth

US and Europe Pet Snacks and Treats Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type [Dog Snacks (Biscuits and Cookies, Jerky, Sticks, Strips, Chew Bones, Ring Treats, and Others) and Cat Snacks (Crunchies, Lickable Treats, Jerky, Pillows, and Others)], Flavor (Chicken, Beef, Lamb, Seafood, Vegetables, Fruits, and Others), Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Retail, and Others), and Country

US and Europe Pet Snacks and Treats Market Overview by 2031

Download Free Sample

Italy accounted for a significant market share in 2023. As per the National Association of Manufacturers for Food and Care of Companion Animals (ASSALCO), approximately half of all Italian households include dogs or cats. In Italy, most pet owners consider pets as a part of their families. In addition, Italian pet owners are seeking functional snacks and treats that address specific health concerns such as dental hygiene, joint health, or digestion. Thus, the increasing pet adoption rate in the country contributes to the growing US and Europe pet snacks and treats market size.

US and Europe Pet Snacks and Treats Market: Trends

Pet owners increasingly seek nutritional pet snacks and treats that are manufactured, labeled, and distributed through eco-friendly techniques. This shift is evident in the rising demand for sustainably sourced ingredients and eco-friendly packaging. Companies responding to this trend by adopting sustainable practices and offering transparent information about their sourcing and production processes are experiencing increased customer loyalty and market share. Organic and premium pet snacks and treats are also gaining popularity as pet owner prioritize high-quality, natural ingredients for their pets. As a result, US and European manufacturers are developing new organic pet products. For instance, in February 2023, Healthy Paws Pet Company, Inc. launched a new line of functional dog treats—Pawmier. The Pawmier’s treats are formulated with organic superfoods, including pumpkin, carrots, sweet potato, and flaxseed. The low-calorie treats are also free from meat, grains, and peas.

The emphasis on organic products is a reflection of pet owners extending their dietary preferences to their pets. Organic pet snacks are perceived as healthier and safer, as these products are free from synthetic additives, pesticides, and genetically modified organisms. This perception drives pet owners to pay a premium price for such products. Premium pet treats, which often feature high-quality proteins, unique flavors, and functional ingredients targeting specific health benefits, cater to a market segment willing to invest more in their pets’ nutrition and overall well-being. This interest in premium, organic, and sustainable products is further fueled by the humanization of pets. Marketing strategies that highlight the health benefits, ethical sourcing, and superior quality of these products attract more pet owners. Additionally, innovation in flavors and formulations is another key trend in this market. Thus, the growing interest in sustainable, organic, and premium products with innovative flavors is expected to boost the US and Europe pet snacks and treats market growth during the forecast period.

US and Europe Pet Snacks And Treats Market: Segmental Overview

The US and Europe pet snacks and treats market analysis has been performed by considering the following segments: product type and distribution channel. By product type, the market is bifurcated into dog snacks and cat snacks. The dog snack segment accounted for a larger US and Europe pet snacks and treats market share in 2023. The dog snack segment is subsegmented into biscuits and cookies, jerky, sticks, strips, chew bones, ring treats, and others. The cat snack segment is further segmented into crunchies, lickable treats, jerky, pillows, and others. In recent years, there has been a significant increase in the variety and sophistication of available dog snacks. This segment encompasses a broad range of products, including training treats, dental chews, and functional snacks designed to provide specific health benefits related to joint health, digestion, and skin and coat conditions. As dog owners become more attentive to their pets' health and well-being, they are increasingly opting for pet snacks that offer nutritional value and are delicious to taste.

In terms of distribution channel, the market is segmented into supermarkets and hypermarkets, specialty stores, online retail, and others. The supermarkets and hypermarkets segment held the largest US and Europe pet snacks and treats market share in 2023. In the US and Europe pet snacks and treats market, supermarkets and hypermarkets play a key role in attracting a wide consumer base. Supermarkets, known for their extensive product offerings and accessibility, serve as primary retail outlets for pet snacks and treats. The convenience of finding these products alongside everyday items contributes to their widespread availability. Hypermarkets, with their larger size and diverse product range, provide a more expansive platform for the distribution of pet snacks and treats. The visibility of these products in hypermarket settings enhances consumer awareness and accessibility. Moreover, the ability of hypermarkets to negotiate bulk purchases with suppliers might influence pricing and promotions, making pet snacks and treats more appealing to a broader audience. These distribution channels offer a convenient and familiar environment for consumers to explore and purchase pet snacks and treats, aligning with the broader trend of making such products easily accessible to the general population. To increase their profit, supermarkets and hypermarkets concentrate on increasing product sales. Due to their large customer bases, pet snacks and treats manufacturers typically prefer to sell their goods through supermarkets and hypermarkets. Major supermarket chains such as Walmart and Tesco have partnered with pet snacks and treats manufacturing companies to maintain an uninterrupted supply of popular brands. All these factors boost the demand for pet snacks and treats through supermarkets and hypermarkets, contributing to the US and Europe pet snacks and treats market growth for the segment.

J M Smucker Co; Shameless Pets, LLC; Nestle SA; Nature’s Diet; General Mills Inc; Interquell Gmbh; VAFO Group; Purrform Limited; Scrumbles; Mars Inc; Colorado Pet Treats; mera—The Petfood Family; Schell & Kampeter, Inc; United Petfood; RUPP FOOD Austria GmbH; Irish Dog Foods Limited; Rondo Foods; Inspired Pet Nutrition Ltd; Ava's Pet Palace; Butcher’s Pet Care Limited; Scholtus Special Products B.V; Wellness Pet Company; Addiction Foods LLC; and Smart Cookie Dog Treats are among the leading companies profiled in the US and Europe pet snacks and treats market report.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com