Pharmacies Segment to Lead US Hearing Aids Market Based on Distribution Channel During 2023–2031

According to our new research study on “Hearing Aids Market Forecast To 2031 – Country Analysis – by Type, Product Type, Technology, Type of Hearing Loss, Patient Type, and Distribution Channel,” the US hearing aids market size is expected to grow from US$ 9.66 billion in 2023 to 14.66 billion by 2031; it is estimated to register a CAGR of 5.3% during 2023–2031. Key factors driving the US hearing aids market growth include the increasing incidence of hearing loss among the US population and the surge in strategic initiatives by the market players.

Driven by changing consumer perceptions and preferences, the hearing aids market in the US is increasingly focusing on aesthetics and customization. Historically, hearing aids were often viewed as unattractive medical devices, leading many individuals to avoid using them due to stigma. However, as societal attitudes began shifting and technological advancements were made, manufacturers prioritized design and personalization, transforming hearing aids into stylish and appealing accessories. Manufacturers are evolving hearing aids into fashionable items that seamlessly blend with modern aesthetics while delivering improved hearing and understanding. These modern devices include Signia Styletto AX, Phonak Lumity Slim, Phonak Virto Paradise Titanium, and Widex Moment Sheer.

US Hearing Aids Market

US Hearing Aids Market Size and Forecast (2021 - 2031), Country Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (OTC Hearing Aids and Prescription Hearing Aids), Product Type (Hearing Aid Devices and Hearing Implants), Technology (Digital Hearing Aids and Conventional Hearing Aids), Type of Hearing Loss (Sensorineural Hearing Loss and Conductive Hearing Loss), Patient Type (Adults and Pediatrics), and Distribution Channel (Pharmacies, Retail Stores, and Online)

US Hearing Aids Market SWOT Analysis by 2031

Download Free Sample

Customization is a significant trend that is currently gaining attention. Many companies now offer various customizable options, allowing users to choose colors, shapes, and styles that reflect their preferences. The level of personalization enhances user satisfaction and empowers individuals to embrace their hearing aids as part of their identity. As more people seek hearing solutions that align with their lifestyle and aesthetic choices, the demand for customizable hearing aids is expected to increase. For instance, Lexie OTC Hearing Aids offers a range of options to suit various styles and hearing needs. Their devices, which feature a discreet behind-the-ear (BTE) design, are available in five colors: beige, bronze, light gray, metallic black, and silver.

Another critical aspect of the trend is the growing influence of fashion in the US hearing aid market. Collaborations between hearing aid manufacturers and fashion designers are becoming more common, resulting in stylish designs that appeal to a broader audience. These partnerships help reposition hearing aids in consumers' minds, making them functional devices and fashionable accessories that enhance personal style.

Furthermore, social media is crucial in shaping perceptions about hearing aids. Influencers and public figures who openly share their experiences with hearing loss and showcase stylish hearing aids help normalize their use. Such visibility encourages others to consider hearing aids and emphasizes the importance of self-expression through personal choices, including hearing devices. Thus, by offering personalized options, promoting discreet designs, and embracing fashion collaborations, manufacturers can attract a wider audience and foster a positive image of hearing aids. As societal attitudes continue to evolve, this trend will likely lead to increased adoption and satisfaction among users, ultimately improving their quality of life.

Based on distribution channel, the US hearing aids market is categorized into pharmacies, retail stores, and online. The pharmacies segment held the largest share of the market in 2023. Pharmacies are an essential part of the healthcare system and a key distribution center of healthcare prescription products over a long period. The pharmacies provide hearing aids based on the prescription given by an audiologist or healthcare provider, along with convenience and accessibility for individuals. Pharmacies have a wide range of hearing aids and brands, which allows individuals to compare and choose the best option based on their requirements.

Pharmacies may also offer financing options, making prescription hearing aids more affordable to a large population. In August 2022, the FDA passed the OTC Hearing Aid Act to provide hearing aids for adults without any prescription for mild to moderate hearing loss. This will likely increase the demand for OTC hearing aids at pharmacies, promoting overall hearing aids market growth.

The retail stores segment is anticipated to register the highest CAGR during 2023–2031. Retail stores include any independent pharmacy, chain pharmacy, supermarket pharmacy, or mass merchandiser pharmacy licensed by the State and distribute drugs and healthcare products to the public at retail pricing. Today, retail pharmacy clients are exploring how advanced analytics, artificial intelligence (AI), and other technologies (such as central fill, workload balancing via tele-pharmacy, and automation to improve dispensing and quality assurance) could be used to free up pharmacists' time so they can concentrate on customer experience. For instance, Best Buy offers 20 different hearing aids in nearly 300 stores in the US, with a price range between US$ 200 and US$ 3,000.

Starkey Laboratories Inc., Audina Hearing Instruments Inc., SeboTek Hearing Systems LLC, Earlens Corp, GN Store Nord AS, Cochlear Ltd, Amplifon Hearing Health Care Corp, WS Audiology AS, Sonova Holding AG, and Sonic Innovations Inc. are among the leading companies operating in the US hearing aids market.

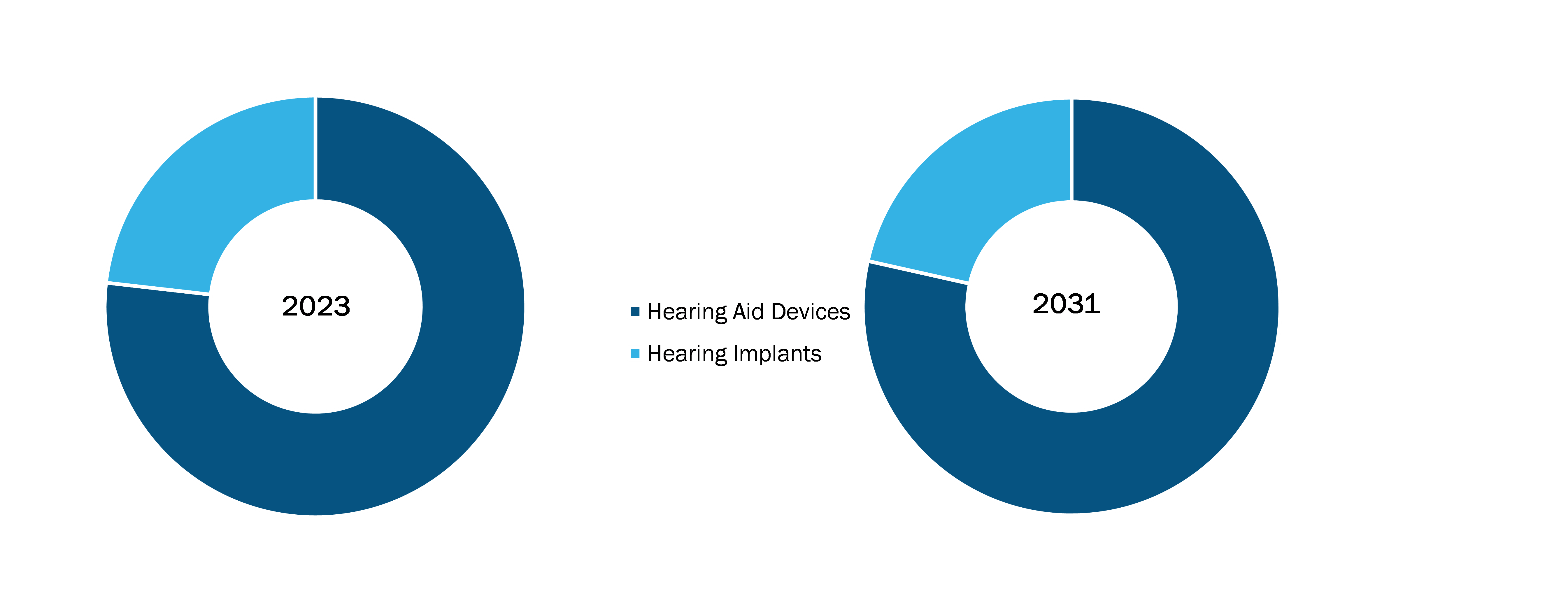

Based on type, the US hearing aids market is segmented into prescription hearing aids and OTC hearing aids. In terms of product type, the market is bifurcated into hearing aid devices and hearing implants. The US hearing aids market, by technology, is categorized into conventional hearing aids and digital hearing aids. By type of hearing loss, the market is bifurcated into sensorineural hearing loss and conductive hearing loss. In terms of patient type, the market is segmented into adults and pediatrics. The US hearing aids market, based on distribution channel, is segmented into pharmacies, retail stores, and online.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com