Growing Demand from Automotive and Transportation Industry Drives US Injection Molded Plastics Market Growth

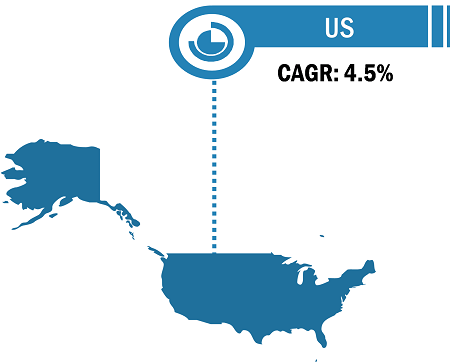

According to the latest market study on “US Injection Molded Plastics Market Forecast to 2031 – Country Share, Trend, and Growth Opportunity Analysis – by Material and End Use,” the market was valued at US$ 54.77 billion in 2023 and is projected to reach US$ 77.59 billion by 2031; it is anticipated to record a CAGR of 4.5% from 2023 to 2031. The report highlights key factors contributing to the US injection molded plastics market size and prominent players, along with their developments in the market.

The injection molded plastics demand in the US has been steadily increasing owing to the growing construction industry and surging infrastructure development. The construction industry strongly contributes to the US economy. Every year, US$ 1.4 trillion worth of structures are built nationwide. According to PwC’s Global Construction 2030 report, the global construction output value is expected to grow by 85% to US$ 15.5 trillion by 2030, dominated majorly by the US. According to a 2022 report by the USAFacts Institute, the federal government of the US passed the Infrastructure Investments and Jobs Act in 2021, allocating US$ 550 billion in new federal infrastructure, including the repair or rebuilding of bridges, roads, rail, and airports, for five years.

US Injection Molded Plastics Market Breakdown – by Country

US Injection Molded Plastics Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Material (Acrylonitrile Butadiene Styrene, Nylon, Polyethylene, Polypropylene, Polystyrene, Polycarbonate, Thermoplastic Polyurethane, and Others), and End Use [Residential Construction, Non-Residential Construction, Energy (Oil and Gas) and Mining, Retail Stores and Restaurants, Petrochemical and Chemical, Transportation Providers, Vehicle Aftermarket, HVAC, Vehicle Manufacturers, Consumer, Construction and Agricultural Equipment, Military, Aerospace, Food and Agriculture, Healthcare, and Others]

US Injection Molded Plastics Market Forecast, Trends, Scope by 2031

Download Free Sample

In automotive applications, injection molded plastics offer advantages over traditional materials such as glass and metal. Plastics are lightweight yet durable and they help to reduce vehicle weight and improve fuel efficiency, which is a crucial consideration for automakers determined to meet stringent regulations related to emissions. In addition, injection molding allows for the production of complex shapes and designs with tight tolerances, enabling the integration of functional features and aesthetic elements into automotive components such as interior trim, exterior panels, and under-the-hood parts.

The US is one of the most economically competitive countries in the world. According to the US Bureau of Economic Analysis projections, the US real gross domestic product (GDP) increased by 3.4% in the fourth quarter of 2023 and rose by 1.6% in the first quarter of 2024. Economic stability and growth spur the demand across various sectors such as construction, automotive, and consumer goods. The growing trend of electric and autonomous vehicles has further increased the demand for injection molded plastics in the automotive industry. Electric vehicles require lightweight materials to maximize driving range, while autonomous vehicles rely on sensors and electronic components that benefit from the insulating properties of plastic. Injection molding enables the mass production of precision-engineered plastic parts that meet the specific requirements of electric and autonomous vehicle manufacturers. Moreover, the increasing adoption of recycled plastics is expected to remain one of the key US injection molded plastics market trends.

The US is witnessing a significant rise in the electric vehicles market. As per the 2022 report by the International Energy Agency, the sales of electric cars in the country doubled in 2021; the sales share increased by 4.5%, with 6.6 million units sold that year. According to the International Organization of Motor Vehicle Manufacturers (OICA), commercial vehicle production in the US increased from 9.2 million in 2021 to 10.1 million vehicles in 2022, nearly 10% higher than in 2021. The growing demand from the automotive and transportation industries and rising demand from the packaging industry are projected to drive the US injection molded plastics market growth.

The US injection molded plastics market analysis is carried out by identifying and evaluating key players in the market across different countries. Wilbert Plastic Services Inc., Rodon Ltd, Texas Injection Molding LLC, Nicolet Plastics LLC, Britech Industries, Ironwood Plastics Inc., Jones Plastic & Engineering LLC, Hi-Tech Mold and Tool Inc., Valencia Plastics Inc., Abtec Inc., Mack Group Inc., Bemis Contract Group, Revere Plastics Systems LLC, Parkway Products LLC, Thomson Plastics Inc, and Baxter Enterprises LLC are among the key players profiled in the US injection molded plastics market report.

US Injection Molded Plastics Market Report Segmentation:

Based on material, the market is segmented into acrylonitrile butadiene styrene, nylon, polyethylene, polypropylene, polystyrene, polycarbonate, thermoplastic polyurethane, and others. The polypropylene segment held the largest US injection molded plastics market share in 2023. The demand for polypropylene is increasing in sectors such as packaging, automotive, and healthcare. Polypropylene has wide range of applications in the automotive industry, owing to its characteristics such as lightweight, and durability, aiding in the fuel efficiency and meeting stringent emission standards. In the packaging industry polypropylene is used increasingly owing to its strength, chemical resistance, and versatility. In 2019, Braskem launched its new “I'm green” recycled polypropylene in the US. In 2023, Lummus Technology and Citroniq Chemicals announced the licensing and engineering agreements for green polypropylene plants in the US. The first plant, scheduled for completion in 2027, is aimed at producing 400 kilotons per annum of bio-polypropylene. Thus, all these factors drive the US injection molded plastics market for the polypropylene segment.

Polyethylene is being increasingly used for the development of injection molded plastics, owing to its versatility, performance, and sustainability. Polyethylene is highly versatile, offering a broad range of grades with varying densities and properties, catering to diverse applications such as packaging, automotive, construction, and healthcare. Its lightweight nature, coupled with excellent chemical resistance and durability, makes it a preferred choice for packaging materials, automotive components, and consumer products.

Based on end use, the market is segmented into residential construction, non-residential construction, energy (oil and gas) and mining, retail stores and restaurants, petrochemical and chemical, transportation providers, vehicle aftermarket, HVAC, vehicle manufacturers, consumer, construction and agricultural equipment, military, aerospace, food and agriculture, healthcare, and others. The retail stores and restaurants segment held the largest US injection molded plastics market share in 2023. Retail stores and restaurants include businesses where merchandise, including food & beverages, is sold to end consumers. Walmart, Kroger, McDonald's, Home Depot, and Walgreens are a few examples of such retail stores and restaurants. The demand for injection molded plastics in this end use is increasing due to its various properties that appeal to consumers.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com