Polyaxial Pedicle Screw System Segment to Lead US Pedicle Screw Market During 2022–2030

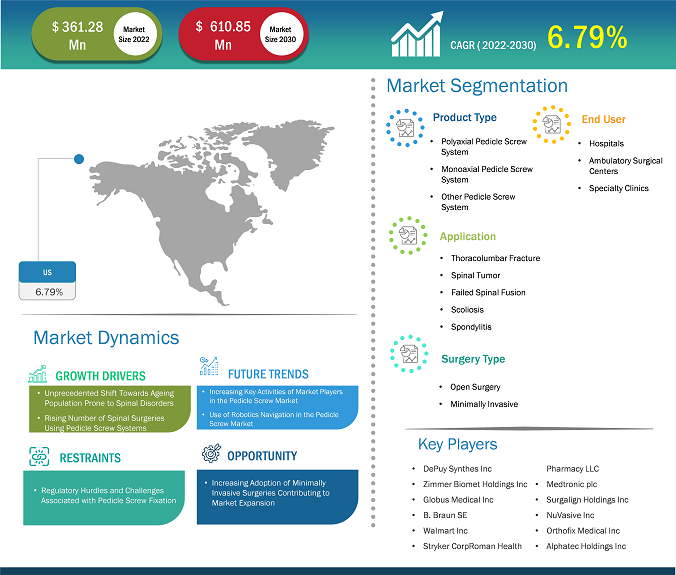

According to our new research study on “US Pedicle Screw Market Forecast to 2030 – Country Analysis – by Product Type, Application, Surgery Type, and End User,” the US pedicle screw market size was valued at US$ 361.28 million in 2022 and is expected to reach US$ 610.85 million by 2030; the market is estimated to register a CAGR of 6.79% from 2022 to 2030. Key factors driving the growth of the US pedicle screw market include the susceptibility of the aging population to spinal disorders and the rising number of spinal surgeries using the pedicle screw system.

Rising Number of Spinal Surgeries Using Pedicle Screw Systems

Pedicle screw systems are essential in increasing strength and supporting the damaged spinal cord. The escalating number of medical professionals specializing in spinal surgeries drives the pedicle screw market growth. According to data published in Health Central LLC in 2019, approximately 313 million surgeries are performed annually in the US, including ~1.62 million spinal procedures and 500,000 lumbar spine surgeries. Cost is an important factor in these types of surgeries. As per the data published in Health Trust-The Source Magazine in 2022, nearly 1.2 million surgeries are performed in the US, and a lumbar spinal fusion surgery costs ~US$ 80,000 on average.

US Pedicle Screw Market Size and Forecasts (2020 - 2030), Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product Type (Polyaxial Pedicle Screw Systems, Monoaxial Pedicle Screw Systems, and Other Pedicle Screw Systems), Application (Fracture, Spinal Tumor, Scoliosis, Failed Fusion, and Spondylitis), Surgery Type (Open Surgery and Minimally Invasive Surgery), End User (Hospitals, Ambulatory Surgical Centers, and Other End Users), and Country Analysis

US Pedicle Screw Market Trends and Top Players by 2030

Download Free Sample

Pedicle screw systems have developed significantly with the rising number of spinal surgeries. A significant development is incorporating a navigation system while placing the pedicle screw system. Moreover, robotics is used to augment accuracy and minimize surgical invasiveness while placing pedicle screws. Although robotics in elderly patients has not been studied at a larger scale, this population may benefit significantly from applying robotic techniques to perform minimally invasive procedures to decrease operative time, minimize blood loss, and reduce postoperative pain, ultimately resulting in decreased complications.

The rising adoption of pedicle screw systems in treating degenerative spinal disorders is another factor driving the pedicle screw market growth. Moreover, a steep rise in sports-related injuries and spinal cord injuries (SCIs) and accidental fractures require surgical procedures, bolsters pedicle screws’ demand and use. According to the data published by the National Spinal Cord Injury Statistical Center in 2022, the annual incidence of traumatic SCIs in 2021 was ~54 cases per 1 million people in the US, which is equivalent to the addition of 18,000 new SCI cases every year. Vehicle crashes are the major cause of these injuries, closely followed by falls. Moreover, acts of violence (primarily gunshot wounds) and sports/recreation activities are relatively common causes. Thus, the rising prevalence of spinal surgeries boosts the demand for pedicle screws, propelling overall market growth.

Key Market Opportunity

Increasing Adoption of Minimally Invasive Surgeries

Minimally invasive surgical procedures have become more feasible, popular, and efficient in managing spinal disorders in the last several years. As a result, spinal surgeries using pedicle screws are transitioning significantly into minimally invasive procedures. Navigated pedicle screw insertion is fundamental in minimally invasive spinal surgeries. Less damage to soft tissues and muscles, lower pain post-surgery, shorter hospital stays, and quicker recovery are among the major advantages of minimally invasive surgeries over open surgeries. Thus, the rising adoption of minimally invasive surgeries, coupled with technological advancements in robotic and image-guided (IG) surgeries, is anticipated to provide lucrative opportunities for the pedicle screw market players.

In January 2023, Orthofix Medical launched a fully commercial mariner deformity pedicle screw system. The innovation was carried out to advance reduction and correct instrumentation, specialized implant technologies, and for osteotomy tools for better surgical intervention. Similarly, in September 2021, Alphatec Holdings, Inc. expanded the spinal fixation platform with the launch of InVictus OsseoScrew. InVictus OsseScrew was the first commercially available pedicle screw technology designed to optimize fixation and address the clinical challenge of fixation failure in bone.

DePuy Synthes Inc, Zimmer Biomet Holdings Inc, Globus Medical Inc, B. Braun SE, Stryker Corp, Medtronic Plc, Surgalign Holdings Inc, NuVasive Inc, Orthofix Medical Inc, and Alphatec Holdings Inc. are among the leading companies operating in the US pedicle screw market.

The US pedicle screws market is segmented into product, application, surgery, and end users. Based on product type, the market is categorized into polyaxial pedicle screw system, monoaxial pedicle screw system, and other pedicle screw systems. In terms of application, the US pedicle screws market is segmented into thoracolumbar fracture, spinal tumor, failed spinal fusion, scoliosis, and spondylitis. The US pedicle screws market, by surgery type, is bifurcated into open surgery and minimally invasive surgery. The US pedicle screw market, by end user, is segmented into hospitals, ambulatory surgical centers, and specialty clinics.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com