HPMC Segment, by Product, to Bolster Vegetarian Capsules Market Size During 2023–2031

According to our latest study on "Vegetarian Capsules Market Forecast to 2031 – Global Analysis – Product, Application, Functionality, and End User," the market is expected to reach US$ 3.5 billion by 2031 from US$ 1.8 billion in 2023 at a CAGR of 8.4%. The market report emphasizes the key factors driving the market and showcases the developments of prominent players. The rising preference for vegan capsules over gelatin-based capsules is a crucial factor propelling the vegetarian capsules market growth. However, product recalls impede the market growth.

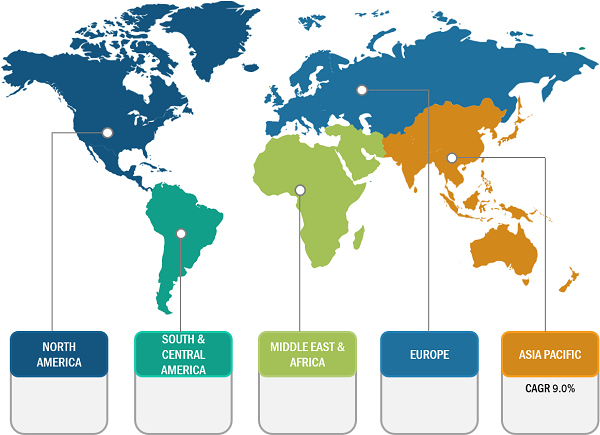

Regional Overview

Based on region, the vegetarian capsules market is primarily segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The market in Asia Pacific held the largest share in 2023. India dominates the market in Asia Pacific, whereas China holds the second-largest share of the regional market. According to the China-Britain Business Council 2020 report, China is facing issues associated with aging, social stress, and environmental problems, including air and water pollution. To prevent such consequences, the population of China is taking several measures to shift toward the consumption of health supplements. Also, consumers in China tend to trust traditional medicines and prefer to consume natural dietary supplements. Further, during and post-COVID-19 pandemic, older adults have shown a high risk of developing serious health complications. As a result, the consumption of dietary supplements surged across the country, particularly among older adults, with a rise in awareness about measures associated with good health among the population. This is creating a lucrative opportunity for natural dietary supplement manufacturers to address the health needs of the aging population with their products. Thus, the demand for proper dietary supplement products is increasing as the composition is filled with micronutrients, which are highly required by the aging population to maintain optimal health and immune support.

Vegetarian Capsules Market

Vegetarian Capsules Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product [Hydroxypropyl Methyl Cellulose (HPMC), Pullulan, and Others], Application (Antibiotic and Antibacterial Drugs, Vitamin and Dietary Supplements, Anti-inflammatory, Cardiovascular Therapy, Antacid and Antiaffluent, and Others), Functionality (Immediate-Release, Sustained-Release, and Delayed-Release), End User (Pharmaceutical Industry, Nutraceutical Industry, Contract Manufacturing Organizations, and Cosmetic Industry), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Vegetarian Capsules Market Size and CAGR by 2031

Download Free Sample

The purchasing of natural dietary supplements for the geriatric population in China through e-commerce platforms is high. These supplements include multivitamins, calcium, iron, and zinc supplements. Additionally, nutrient supplements such as "Coenzyme Q10," which play an antioxidant role in the cardiovascular system, are widely consumed by the middle-aged and elderly populations. Therefore, the demand for nutraceutical products is rapidly growing in China as consumers are becoming more mature in terms of maintaining health, with traditional distribution channels changing to e-commerce platforms, creating new opportunities for dietary supplement manufacturers.

North America holds the second-largest share of the global vegetarian capsules market. In North America, the US holds the largest share. According to data published in the American Osteopathic Association (AOA) report in 2024, in the US, more than 4 in 5 American adults (86%) consume vitamins or dietary supplements. The report reveals that American adults consume vitamins or nutraceuticals due to personal needs or recommendations by physicians, friends, or family members. Also, with the rising prevalence of vitamin deficiency, the consumption of nutraceutical supplements such as capsules is high among the US population. The 2023 CRN Consumer Survey on Dietary Supplements shows that almost 74% of adults in the US consume dietary supplements, among which 55% are regular consumers. Some US population is shifting toward vegan diet. Health-conscious vegan consumers look for the “Vegan Trademark” while purchasing nutraceuticals and other dietary supplement products.

In the US, the nutraceutical industry provides innovative vegan products to meet rising consumer demand and diverse consumer intake shift toward animal-free dietary supplements. In April 2023, IFF announced the launch of "VERDIGEL SC". The introduction of "VERDIGEL SC" enables manufacturers of vegan soft gels to offer carrageenan-free products that are in high demand in several markets. Softgels are gaining high popularity in the nutritional and supplement sectors, and this new product developed by the IFF offers manufacturers a suitable option to switch to plant-based, carrageenan-free alternatives without disrupting existing production processes and compromising performance and quality.

Market Trend:

Outsourcing of Vegetarian Capsules to Accelerate Vegetarian Capsules Market Growth in Coming Years

Vegetarian capsule manufacturers have limited production facilities, no specialized equipment to process specialized raw materials, and a limited marketing strategy. However, contract manufacturers production throughput is high, match demand and supply, and have experienced teams and effective product testing capabilities at the manufacturing unit. For instance, Vitaquest, a contract manufacturer, has a facility to procure premium product development capability to produce nearly 3 billion doses annually. Vitaquest provides numerous custom capsule options that accommodate a specific formulation and consumer preferences. The following list contains a few customized options:

- Gelatin, vegetarian, kosher, halal, and organic options

- Acid resistant delayed release vegetarian capsules and probiotics

- Capsule size option for multiple formulation type and easy consumption

- Color, design, packaging, and labeling design to reflect brand identity

In October 2020, Lonza announced an investment of US$ 93.23 million in its Capsules and Health Ingredients (CHI) Division, a delivery/contract partner to the biopharma and health nutrition industry. Such investments will enable the company to expand its overall production capacity of capsules within CHI's Capsugel portfolio by procuring 30 billion capsules annually and maintaining high-quality standards with Lonza's Sigma Series. Also, the company mentioned that this investment of procuring 30 billion capsules will address the high growth across CHI's gelatin, vegetarian, and specialty polymers product portfolio as well as the liquid-filled hard capsules sold under the "Licaps" brand. Therefore, the outsourcing of vegetarian capsules is expected to emerge as a trend in the vegetarian capsules market in the coming years.

Vegetarian Capsules Market, by Product:

Based on product, the vegetarian capsules market analysis is carried out by considering the following subsegments: Hydroxypropyl Methyl Cellulose (HPMC), pullulan, and others. The HPMC segment held the largest market share in 2023. The pullulan segment is anticipated to register the highest CAGR of 9.0% during the forecast period.

Vegetarian Capsules Market, by Application:

By application, the vegetarian capsules market is segmented into antibiotic & antibacterial drugs, vitamin and dietary supplements, anti-inflammatory, cardiovascular therapy, antacid & antiaffluent, and others. The antibiotic & antibacterial drugs segment held the largest vegetarian capsules market share in 2023. The vitamin and dietary supplements segment is anticipated to register the highest CAGR of 9.3% during the forecast period.

Vegetarian Capsules Market, by Functionality:

The vegetarian capsules market, based on functionality, is segmented into immediate-release, sustained-release, and delayed-release. The immediate-release segment held the largest market share in 2023. The sustained-release segment is anticipated to register the highest CAGR of 9.2% during the forecast period.

Vegetarian Capsules Market, by End User:

By end user, the vegetarian capsules market is segmented into pharmaceutical industry, nutraceutical industry, contract manufacturing organizations, and cosmetic industry. The pharmaceutical industry segment held the largest vegetarian capsules market share in 2023 and is anticipated to register the highest CAGR of 8.8% during the forecast period.

Industry Developments and Future Opportunities:

In October 2023, Roquette, a global leader in plant-based ingredients and pharmaceutical excipients, announced the acquisition of Qualicaps from the Mitsubishi Chemical Group. The acquisition aims to offer high-quality, high regarded products and services and technical capabilities through a single point of contact for expanded offerings.

Vegetarian Capsules Market, by Geography:

The geographic scope of the vegetarian capsules market report encompasses North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America). Developments and launch of new drugs by several market players, along with approvals by regulatory authorities, help in the market expansion.

Apart from factors driving the market, the vegetarian capsules market report emphasizes prominent players' developments. Shanxi Guangsheng Medicinal Capsules (GS Capsules); Lefancaps; SUHEUNG; ACG; Capsugel, Inc. (Subsidary of Lonza Group AG); HealthCaps India; NATURAL CAPSULES LIMITED; Sunil Healthcare Limited; QUALICAPS; Zhejiang Honghui Capsule Co., Ltd.; BrightCaps GmbH; CapsCanada; Zhejiang Huili Capsules Co., Ltd.; and Yasin are among the prominent players operating in the market.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com