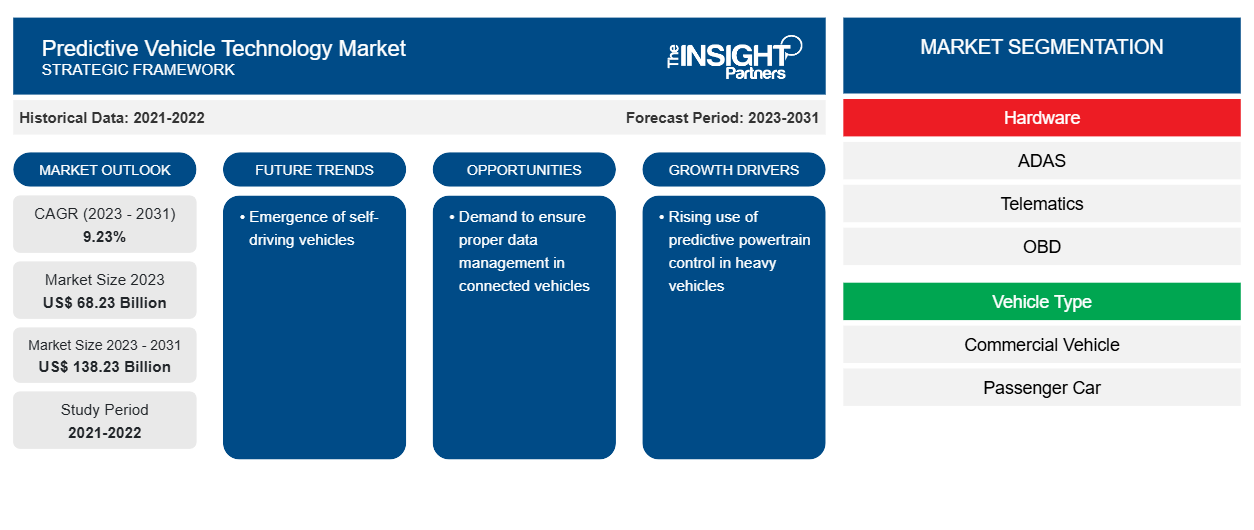

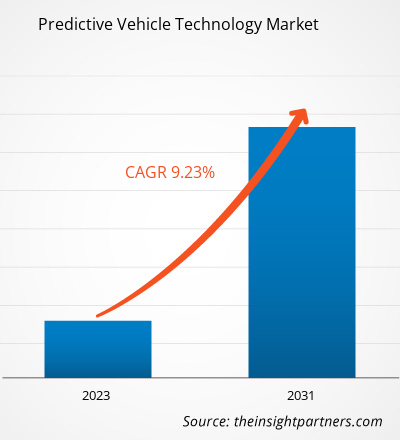

The predictive vehicle technology market size is projected to reach US$ 138.23 billion by 2031 from US$ 68.23 billion in 2023. The market is expected to register a CAGR of 9.23% in 2023–2031. The benefits of PPC have made the automakers, especially heavy commercial vehicle manufacturers, integrate PPC in their vehicles. The PPC can be retrofitted in nearly all types of trucks & heavy vehicles.

Predictive Vehicle Technology Market Analysis

The major stakeholders in the global predictive vehicle technology market ecosystem include technology providers, component providers, OEMs, and an end-user segment of the automotive industry. The technology providers offer Al, ML, and predictive technology to the automakers to integrate this technology into systems such as ADAS, OBD, telematics, V2X, and more. The component manufacturers of this mentioned system include sensors, cameras, displays, and more. Later, the system product integrated with technology is fitted into the vehicle to provide a hassle-free experience to the user by ensuring the safety and security of both driver and passenger. A distribution channel consisting of OEMs provides the finished end product to the category of end-users. Both passenger cars and commercial vehicles use predictive technology and integrated finished products in their vehicles. Predictive automobile technology finds its application in all types of vehicles, including cars, vans, SUVs, and trucks.

Predictive Vehicle Technology Market Overview

At present, the automotive industry is experiencing significant incorporation of various advanced technologies in cars to improve the safety and efficiency of the occupants. The automakers are leveraging artificial intelligence (AI) and machine learning (ML) to realize the patterns and trends of the driver and improve the safety of the vehicle. Both technologies are ready to become a vital part of upcoming vehicles and the automotive industry. In the race for connected cars and self-driving vehicles, predictive vehicle technologies are gaining acceptance among all auto types, which offers notable convenience to the driver and passengers. Therefore, the automakers are concentrating on adopting connected gadgets and loT in vehicles that support voice commands. The integration of IoT in connected cars is the next big digital development that persists in the automotive industry. This fact will result in bringing another revolution via the introduction of autonomous vehicles. The self-driving cars/autonomous vehicles include a sensor management system that makes loT vehicle-to-vehicle communication possible and a reality. The aforementioned factors of connected cars are projected to contribute towards the use of predictive technology by introducing a predictive collision avoidance system, predictive maintenance system, and more.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Predictive Vehicle Technology Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Predictive Vehicle Technology Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Predictive Vehicle Technology Market Drivers and Opportunities

Rising use of predictive powertrain control in heavy vehicles

The Predictive Powertrain Control (PPC) arrived a few years ago to gain momentum in current times. The adoption of PPC assists in lowering fuel consumption by up to 5% in long-distance traffic. This is a distinct cruise control system that saves monetary resources through intelligent predictions. The PPC uses 3D maps and GPS data to scan a road ahead. Later, the system automatically adjusts the speed while rolling accordingly. Improvements in PPC retrofit are well-suited with FleetBoard telematics services, as these are already used in trucks. The heavy truck manufacturers are approaching complementary business units to improve their product portfolio and acquire additional expertise in PPC trends. For instance, Mercedes-Benz PPC technology is available for retrofitting in Actros, Arcos, and Antos by Mercedes-Benz partners across Europe. PPC in Mercedes-Benz has ordered an average of 64% of heavy vehicles in long-distance traveling. Rising demand for heavy commercial vehicles is projected to grow the adoption of predictive technology in heavy vehicles.

Demand to ensure proper data management in connected vehicles

The prevalent opportunity in pursuing in a connected car arena is data management. The connected cars are streaming huge amounts of data into the cloud, and thus, to utilize enormous data, the need for predictive analysis and data analysis is growing. Predictive collision avoidance, predictive maintenance, automotive marketing, automotive marketing, and data management of connected vehicle are some of the growing concepts responsible for the growth of the market. Another feature is boosting the use of predictive technology in vehicles. Nissan has developed a predictive collision avoidance system with the help of big data, advanced sensors, and vehicle-to-vehicle connectivity. This system enables us to judge the distance and speed of the vehicle in front of a car and of the preceding two vehicles. Also, a video and an audible signal will be sent to the driver in case of any unusual behavior. Therefore, with the huge benefit of a predictive collision avoidance system, the automotive industry might witness a sophisticated and effective collision avoidance system based on predictive driver behavior as the developers are working ahead to create apps for improving communication between the connected vehicles.

Predictive Vehicle Technology Market Report Segmentation Analysis

Key segments that contributed to the derivation of the predictive vehicle technology market analysis are hardware, vehicle type, and application.

- Based on hardware, the market has been divided into ADAS, telematics, OBD. The golf carts segment held a larger market share in 2023.

- Based on vehicle type, the predictive vehicle technology market is segmented into commercial vehicle, passenger car. The passenger car segment held the largest share of the market in 2023.

- Based on application, the predictive vehicle technology market is segmented into proactive alerts, safety and security. The safety and security segment held the largest share of the market in 2023.

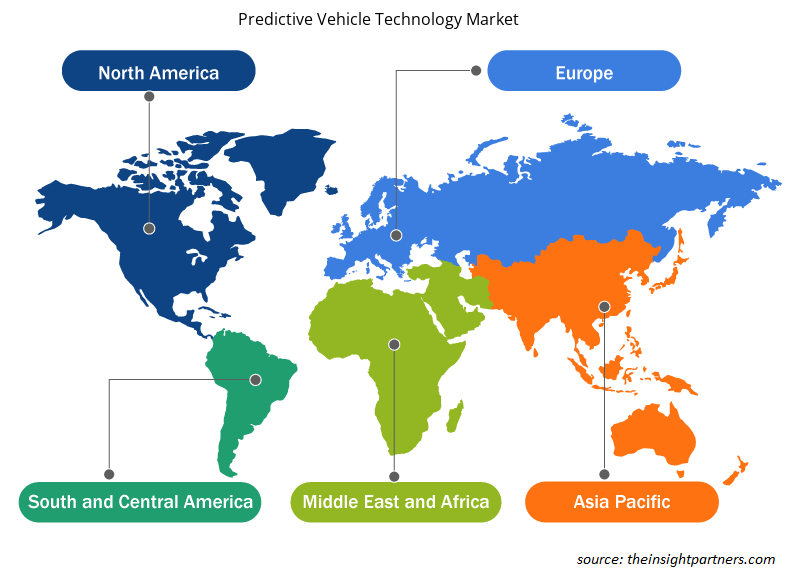

Predictive Vehicle Technology Market Analysis by Geography

The geographic scope of the predictive vehicle technology market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The US, Canada, and Mexico are major economies in North America. Owing to the higher technological advancements, the North American region remained a competitive market as the increasing populations attracted several technological developments due to high spending powers. Over the years, vehicles have become more like computers on wheels, which means that modern workshop technicians can only do their jobs with a professional predictive analytical tool. Predictive maintenance allows the auto manufacturer to fix things in any auto parts before they break. Using predictive maintenance enables manufacturers to change the manufacturing process and get rid of the problem for future products. As the region is highly advanced in terms of technology, various companies are integrating predictive maintenance tools in their passengers as well as commercial vehicles.

Predictive Vehicle Technology Market Regional Insights

The regional trends and factors influencing the Predictive Vehicle Technology Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Predictive Vehicle Technology Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Predictive Vehicle Technology Market

Predictive Vehicle Technology Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 68.23 Billion |

| Market Size by 2031 | US$ 138.23 Billion |

| Global CAGR (2023 - 2031) | 9.23% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Hardware

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

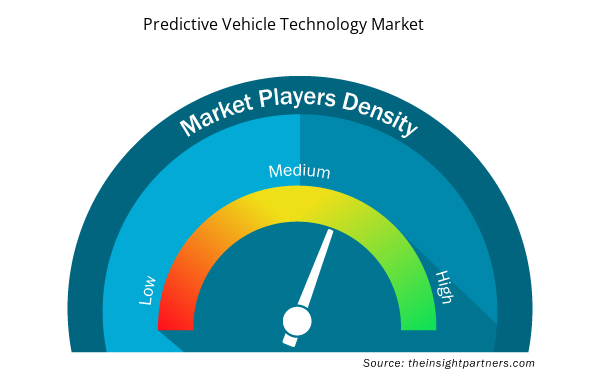

Predictive Vehicle Technology Market Players Density: Understanding Its Impact on Business Dynamics

The Predictive Vehicle Technology Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Predictive Vehicle Technology Market are:

- AISIN SEIKI Co.

- Ltd.

- Aptiv PLC

- Traffilog LTD

- Continental AG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Predictive Vehicle Technology Market top key players overview

Predictive Vehicle Technology Market News and Recent Developments

The predictive vehicle technology market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for predictive vehicle technology market and strategies:

- On November 2023, The City of New Orleans announced that they will use technology by Samsara Inc., the pioneer of the Connected Operations™ Cloud, to improve the safety, efficiency and sustainability of City fleet operations across 41 departments, including New Orleans Police Department (NOPD), New Orleans Fire Department (NOFD), Department of Public Works (DPW), Division of Code Enforcement, Department of Parks and Parkways (PPW), Department of Sanitation and more. The City is investing $75 million in its fleet and views the technology partnership with Samsara as critical for maintaining and protecting its vehicles. (Source: Samara Inc, Press Release/Company Website/Newsletter)

- On September 2023, M Group Services Plant & Fleet Solutions (MGSPFS) — the fleet management operating business of leading essential infrastructure services provider M Group Services — has been working with Samsara, the pioneer of the Connected Operations™ Cloud, and UK-based fleet safety solutions provider, Motormax to deliver the next generation of in-vehicle safety systems to protect drivers, road users and citizens. (Source: M Group Services Plant & Fleet Solutions, Press Release/Company Website/Newsletter)

Coverage and Deliverables

The “predictive vehicle technology market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Hardware ; Vehicle Type ; Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, South Africa, South Korea, United Kingdom, United States

Get Free Sample For

Get Free Sample For