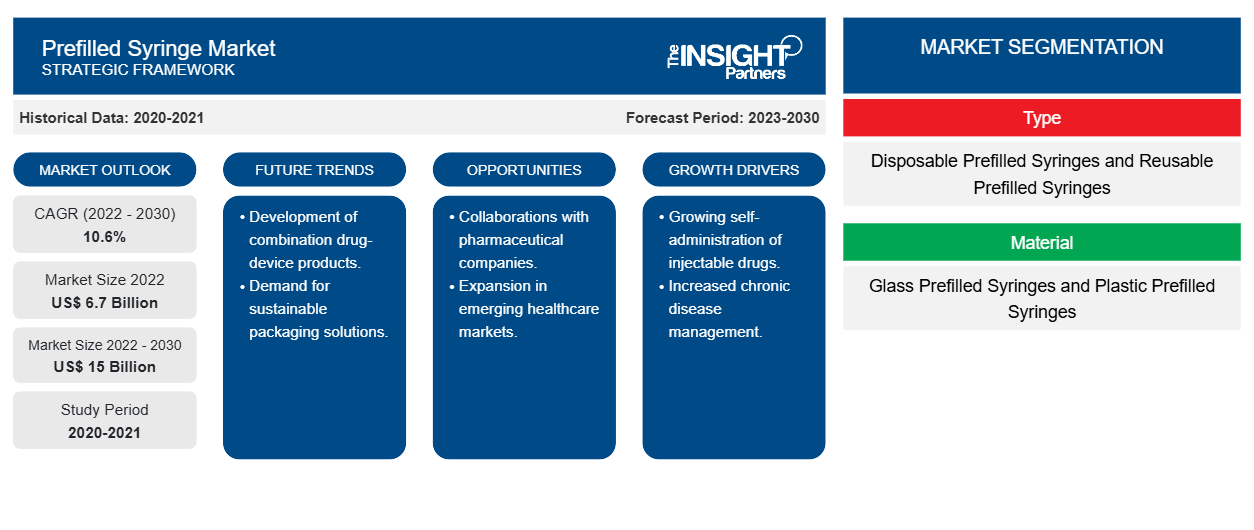

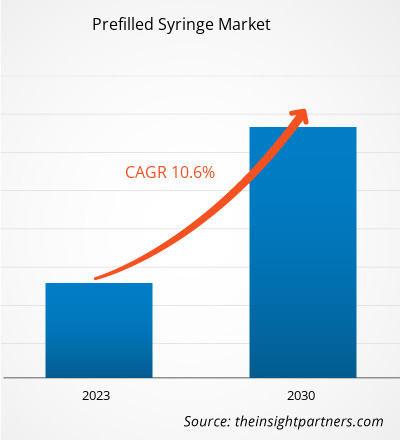

[Research Report] The prefilled syringe market size is projected to reach US$ 15,003.68 million by 2030 from US$ 6,698.94 million in 2022; the market is estimated to record a CAGR of 10.6% from 2022 to 2030.

Market Insights and Analyst View:

Prefilled syringes (PFS) are the most recent aids for administering injectable medicines. Both pharmaceutical and biotech companies deliver products such as vaccines and protein medicines in PFS. In the past few decades, PFS has become a popular method of drug delivery. With a PFS, the process of administering a drug product can be quicker, safer, and easier for nurses and patients. Factors such as the increasing prevalence of chronic disorders and growing adoption of self-injecting parenteral devices are driving the market growth. On the other hand, the increasing product recalls hinder the prefilled syringe market growth.

Growth Drivers:

Increasing Prevalence of Chronic Disorders Propels Prefilled Syringe Market Growth

The growing aging population and changes in social behavior and lifestyle contribute to some of the common long-term health conditions. As per the World Health Organization (WHO), the prevalence of chronic lifestyle diseases is expected to increase by 57% by the end of 2026. The emerging markets will be hit hardest as a population explosion is expected in developing countries. With increasing urbanization, people are more inclined toward a sedentary lifestyle, which results in rheumatoid arthritis, diabetes, and others. Diabetes is one of the major global health issues of the 21st century. According to the International Diabetes Federation (IDF), the number of people with diabetes in North America was about 46 million in 2019 and is projected to reach 62 million by 2045. The increase in disease prevalence is approximated to be 35% during the projection period.

Other chronic conditions such as Crohn’s disease, multiple sclerosis, and cardiovascular disorders require frequent drug administration for disease management and treatment. As per the WHO, cardiovascular disorders are the leading cause of death—nearly 17.9 million deaths are reported every year due to cardiovascular disorders. It has become a new standard for injectable drug delivery among large patient populations globally. Moreover, these prefilled syringes can be used by a large patient population with minimal training and do not require constant assistance from healthcare professionals, owing to which prefilled syringes are adopted largely in professional healthcare environments as well as home healthcare settings, thereby driving the prefilled syringes market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Prefilled Syringe Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Prefilled Syringe Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The prefilled syringe market is segmented on the basis of type, material, product type, application, distribution channel, and geography.

The prefilled syringe market, by type, is bifurcated into disposable prefilled syringes and reusable prefilled syringes. In 2022, the disposable prefilled syringes segment held a larger market share and is estimated to register a faster CAGR during 2022–2030. Based on material, the prefilled syringe market is bifurcated into glass prefilled syringes and plastic prefilled syringes. In 2022, the glass prefilled syringes segment held a larger market share, and the plastic prefilled syringes segment is estimated to register a faster CAGR during 2022–2030. Based on product type, the prefilled syringe market is bifurcated into single chamber and multi-chamber. In 2022, the single chamber segment held a larger market share, and the multi-chamber segment is estimated to register a faster CAGR during 2022–2030. Based on application, the prefilled syringe market is segmented into cancer, diabetes, autoimmune disease, infectious diseases, and others. In 2022, the others segment held the largest market share, and the infectious diseases segment is estimated to register the fastest CAGR during 2022–2030. Based on distribution channel, the prefilled syringe market is segmented into hospital pharmacy, retail pharmacy, and online channel. In 2022, the hospital pharmacy segment held the largest market share and is estimated to register the fastest CAGR during 2022–2030.

Segmental Analysis:

The prefilled syringe market, by type, is bifurcated into disposable prefilled syringes and reusable prefilled syringes. In 2022, the disposable prefilled syringes segment held a larger market share and is estimated to register a faster CAGR during 2022–2030.

Prefilled disposable syringes are designed to be used once, after which they are discarded to reduce the risk of contamination and infections. These syringes are used in healthcare settings for the administration of medications, vaccines, and other injectables. They can also be used in home healthcare settings for the self-administration of injectables at regular intervals. Prefilled disposable syringes are available in different types such as insulin syringes, allergy syringes, and tuberculin syringes, with varying sizes. Moreover, the increased use of prefilled autoinjectors has generated the demand for disposable prefilled syringes as they are sold as a single dose. Moreover, increasing cases of allergies and infections among large populations, coupled with stringent safety guidelines from health ministries and other regulatory bodies worldwide, is expected to fuel the growth of disposable prefilled syringes.

Based on material, the prefilled syringe market is bifurcated into glass prefilled syringes and plastic prefilled syringes. In 2022, the glass prefilled syringes segment held a larger market share, and the plastic prefilled syringes segment is estimated to register a faster CAGR during 2022–2030. Glass is widely used for storage as it is stable and nonreactive; however, the main drawback is its fragility. Glass used in manufacturing prefilled syringes should be made up of borosilicate glass of hydrolytic class I, which has a transformation temperature of 565°C.

Glass prefilled syringes are of two types.

- Oil siliconized syringes: In this type of prefilled syringe system, there is direct contact of rubber to a glass surface, leading over time to higher breakout forces and chances of contamination.

- Baked-on silicone syringes: These backed-on silicone syringes provide a consistent coating of the glass barrel Wales. Breakout forces stay low during storage.

Based on product type, the prefilled syringe market is bifurcated into single chamber and multi-chamber. In 2022, the single chamber segment held a larger market share, and the multi-chamber segment is estimated to register a faster CAGR during 2022–2030.

Single-chamber prefilled syringes are used for injecting vaccines, pharmaceuticals, and biological products. These syringes are designed for the specified dosage of a medication and are easily available through different sales channels. They are easy to handle and use as compared to the multi-chamber prefilled syringes. Manufacturers are focused on bringing further technological developments in single-chamber prefilled syringes to enhance patient safety by using retractable needles and RFID or NFC systems, in turn preventing needlestick injuries. These types of syringes are mainly used for medications administered in liquid form, and they are associated with a lower risk of infections and contamination risk as they consist of a single dose of medicine.

Based on application, the prefilled syringe market is segmented into cancer, diabetes, autoimmune disease, cardiovascular disease, infectious disease, and others. In 2022, the others segment held the largest market share, and the infectious diseases segment is estimated to register the fastest CAGR during 2022–2030.

There is a high prevalence of infectious diseases, including human immunodeficiency virus (HIV), hepatitis, malaria, tuberculosis (TB), and other infectious diseases, across the world. HIV remains a significant public health issue worldwide. In 2021, ~38.4 million people worldwide had HIV, as per the Joint United Nations Programme on HIV/AIDS (UNAIDS). Besides, hepatitis is another major factor driving the prefilled syringe market. According to the World Health Organization (WHO), about 58 million individuals across the world suffer from chronic hepatitis C infection, with 1.5 million new conditions occurring yearly. Furthermore, about 3.2 million adolescents and children have hepatitis C infection.

Market players are launching prefilled syringes for the treatment of infectious diseases as a simple, convenient drug delivery method. In April 2023, CSL Behring received the US Food and Drug Administration (FDA) approval for a 50 ml/10 gm prefilled syringe for Hizentra (Immune Globulin Subcutaneous [Human] 20% Liquid). The company provides a full range of prefilled syringe sizes to meet the requirements of people with chronic inflammatory demyelinating polyneuropathy (CIDP) or primary immunodeficiency (PI).

In April 2021, Novartis received FDA approval for Xolair (omalizumab) self-injection with a prefilled syringe across all indications for appropriate patients. Xolair is the FDA-approved biologic to target and block immunoglobulin E (IgE) to treat severe and moderate persistent allergic asthma, chronic idiopathic urticaria (CIU) and nasal polyps.

Based on distribution channel, the prefilled syringe market is segmented into hospital pharmacy, retail pharmacy, and online channel. In 2022, the hospital pharmacy segment held the largest market share and is estimated to register the fastest CAGR during 2022–2030. Hospital pharmacies are an essential part of healthcare systems. Located within hospital premises, these pharmacies operate as key distribution centers of prescription products. They provide medications and other pharmaceutical products to patients receiving treatment or care in corresponding hospitals. These pharmacies are responsible for ensuring that medications are stored, prepared, and dispensed safely and accurately for hospital usage. They are also responsible for providing clinical pharmacy services to support patient care. Further, hospital pharmacies may engage in medication management, drug utilization review, and medication education for patients and healthcare providers. Hospital pharmacies are one of the most common channels of distribution for prefilled syringes as it is easy for the patient to buy prescribed medication in prefilled syringes after every visit.

Regional Analysis – Prefilled Syringe Market:

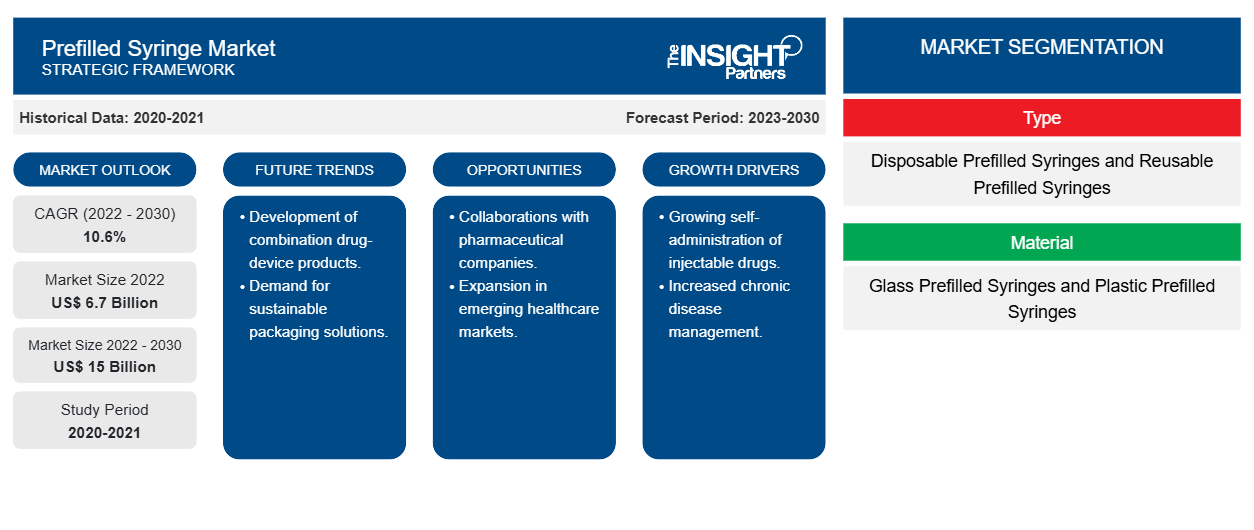

Based on geography, the prefilled syringe market is segmented into five key regions: North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In 2022, North America accounted for the largest share of the prefilled syringe market. Asia Pacific is expected to register the highest CAGR in the global prefilled syringe market during 2022–2030.

The North America prefilled syringes market is segmented into the US, Canada, and Mexico. The growth of the prefilled syringes market in the region is mainly due to the increased adoption of self-injecting parenteral devices and a surge in home healthcare to treat chronic diseases in the region.

According to the Diabetes Research Institute, the number of people with diabetes in the US was ~37.3 million (11.3% of the population) in 2022. Nearly 28.7 million people in the US were diagnosed with diabetes, and approximately 8.6 million people have undiagnosed diabetes. Further, ~1.4 million diabetes cases are diagnosed each year in the US. According to the Centers for Disease Control and Prevention, in 2020, ~88 million adults had prediabetes, which is 34.5% of the US adult population. According to Yale researchers, in 2022, ~30 million people in the US have diabetes, and about 7 million require daily insulin.

There is an increase in the demand for infertility treatment in the US. According to the CDC, in 2022, ~22% married couples, with women aged above 30 years, have problems in conceiving their first child. To overcome with infertility issues, various treatments are available in the market through prefilled syringes. In July 2023, Fresenius Kabi launched Ganirelix Acetate Injection, a generic fertility drug, in 250 mcg/0.5 ml prefilled syringes as part of the company’s expansion in women’s health. Therefore, the increasing prevalence of diabetes and other disorders, along with surge in product launches, is expected to drive the growth of prefilled syringes market in the US.

Industry Developments and Future Opportunities – Prefilled Syringe Market:

Various initiatives taken by leading players operating in the prefilled syringe market are listed below:

- In April 2023, Delta Med Group partnered with DBM, a leading manufacturer of prefilled syringes. Delta Med Group and DBM will expand their portfolio, profiting from highly complementary products and R&D capabilities, improving their ability to serve customers. The partnership will generate significant synergies and boost the growth trajectory of the combined entity.

- In October 2022, Hikma Pharmaceuticals PLC (Hikma) launched Succinylcholine Chloride Injection, USP, in prefilled syringe (PFS) form in the US. The 100 mg/5 ml PFS is the first FDA-approved PFS to be released in the market.

- In June 2022, WuXi Biologics launched a drug product facility in China for prefilled syringes. The new facility has PFS capacity of 17 million units per year. The maximum filling speed can reach 400 PFS/min to support the manufacturing of 17 million syringes of drug products every year.

- In February 2022, Takeda received US Food and Drug Administration (FDA) approval for TAKHZYRO (lanadelumab-flyo) injection single-dose prefilled syringe (PFS) used for the prevention of hereditary angioedema (HAE) attacks patients aged 12 years and above. The PFS is ready to use and requires less preparation than the current TAKHZYRO vial injection, along with reducing supplies and waste.

- In January 2022, Owen Mumford Pharmaceutical Services, a division of Owen Mumford Ltd., received approval for UniSafe 1 ml safety device for prefilled syringes as a combination product in Asia. In Europe, regulatory approval has been granted for UniSafe 1 ml, and the product is commercially available as a combination product with a drug for treating rheumatoid arthritis

In March 2021, SK bioscience launched a new shingles vaccine called ´SKYZoster® Ini.’ The newly introduced prefilled syringe type SKYZoster can be administered more conveniently than the current intramuscular injection type in which water for injection and freeze-dried vaccine are mixed and then transferred back into the syringe.

Prefilled Syringe Market Regional Insights

The regional trends and factors influencing the Prefilled Syringe Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Prefilled Syringe Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Prefilled Syringe Market

Prefilled Syringe Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 6.7 Billion |

| Market Size by 2030 | US$ 15 Billion |

| Global CAGR (2022 - 2030) | 10.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

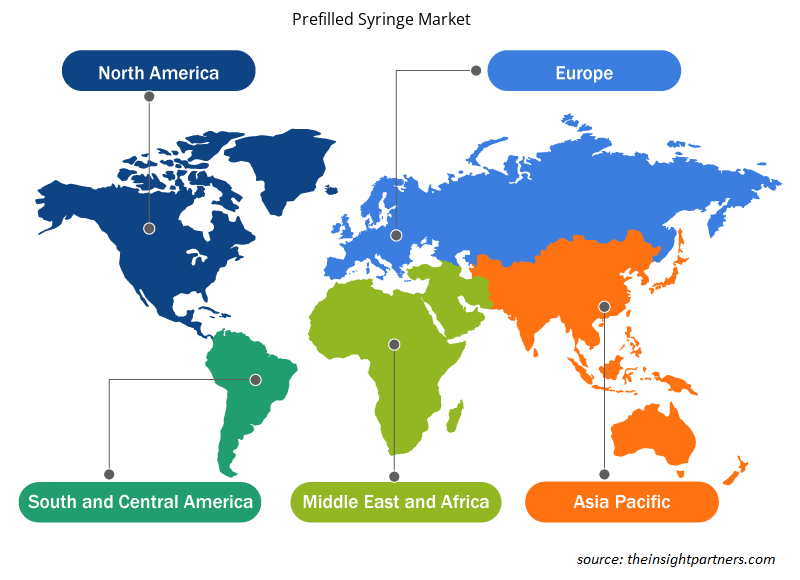

Prefilled Syringe Market Players Density: Understanding Its Impact on Business Dynamics

The Prefilled Syringe Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Prefilled Syringe Market are:

- Gerresheimer AG

- Schott Group

- Nipro Medical Corporation

- BD

- Baxter International Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Prefilled Syringe Market top key players overview

Competitive Landscape and Key Companies – Prefilled Syringe Market:

Gerresheimer AG, Schott Group, Nipro Medical Corporation, BD, Baxter International Inc., Terumo, YPSOMED, Weigao group, B Barun , and Deltamed are the prominent companies operating in the prefilled syringe market. These companies focus on new technologies, existing product advancements, and geographic expansions to meet the growing consumer demand worldwide.

A few major primary and secondary sources referred to while preparing the prefilled syringe market report on the World Health Organization (WHO), International Diabetes Federation (IDF), National Institute of Health (NIH), Dubai Health Authority, National Library of Medicine (NLM), Health Research Policy and Systems in 2020, American Cancer Society in 2021, Globocan, and Centers for Disease Control and Prevention (CDC).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Material, Product Type, Application, Distribution Channel, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Prefilled syringes (PFS) are the most recent aids for administering injectable medicines. Both pharmaceutical and biotech companies deliver products such as vaccines and protein medicines in PFS. In the past few decades, PFS has become a very popular method of drug delivery. With a PFS, the process of administering a drug product can be quicker, safer, and easier for nurses and patients.

The North American region dominates the prefilled syringe market share. Asia Pacific is anticipated to register the highest CAGR during the forecast period.

The growth of the global prefilled syringe market is attributed to a few key factors, such as the increasing prevalence of chronic disorders and growing adoption of self-injecting parenteral devices.

The prefilled syringe market majorly consists of the players such as Gerresheimer AG, Schott Group, Nipro Medical Corporation, BD, Baxter International Inc., Terumo, YPSOMED, Weigao group, B Barun , Deltamed.

The prefilled syringe market is analyzed based on type, material, product type, application, distribution cahnnel.

The prefilled syringe market, by type, is bifurcated into disposable prefilled syringes and reusable prefilled syringes. Based on material, the prefilled syringe market is bifurcated into glass prefilled syringes and plastic prefilled syringes. Based on product type, the prefilled syringe market is bifurcated into single chamber and multi-chamber. Based on application, the prefilled syringe market is segmented into cancer, diabetes, autoimmune disease, infectious diseases, and others. Based on end user, the prefilled syringe market is segmented into hospital pharmacy, retail pharmacy, and online channel

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Prefilled Syringe Market

- Gerresheimer AG

- Schott Group

- Nipro Medical Corporation

- BD

- Baxter International Inc.

- Terumo

- YPSOMED

- Weigao group

- B Barun

- Deltamed

Get Free Sample For

Get Free Sample For