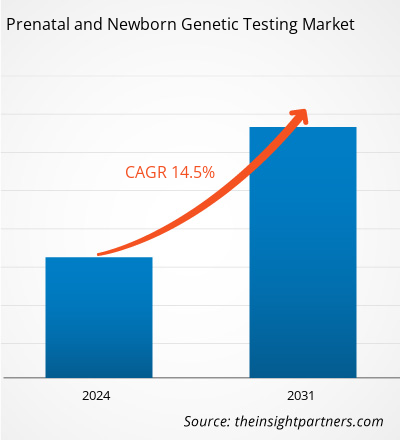

The prenatal and newborn genetic testing market size in 2021 stood at US$ 5.72 billion and is projected to reach US$ 21.44 billion by 2031. The market is expected to register a CAGR of 14.5% in 2023–2031. Digital microfluidics for newborn screening is likely to remain key prenatal and newborn genetic testing market trends.

Prenatal and Newborn Genetic Testing Market Analysis

Developing technology capabilities, rising acceptance and awareness of genetic testing for prenatal and neonatal screening, and an increased emphasis on individualized healthcare are some factors that are expanding the market growth. The future of the market is shaped by the crucial role that genetic testing solutions play in improving early diagnosis, well-informed decision-making, and better healthcare outcomes for both pregnant women and babies. Increasing numbers of diagnostic companies operating in the prenatal and newborn screening domain, along with rising public and private investments, are anticipated to augment the market's expansion during the forecast period.

Prenatal and Newborn Genetic Testing Market Overview

Prenatal genetic testing is performed during pregnancy to diagnose diseases or detect specific genetic abnormalities before 8 to 10 weeks of gestation. Most prenatal genetic tests use a blood sample from the mother for the conduction of various screens. Growing demand for prenatal & newborn genetic testing for identifying genetic abnormalities, as well as the presence of public and private-public organizations such as Genomic Health Inc. and the National Human Genome Research Institute, is supporting the growth of the market. The American Association for Clinical Chemistry (AACC) recognizes newborn screening as a critical factor for improving children’s health. As an effort toward the management of genetic diseases in infants, the AACC endorses public-private efforts to maintain, improve, and expand newborn screening programs. In addition, the increase in maternal age, leading to pregnancy complications, is fueling the demand for prenatal genetic testing globally.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Prenatal and Newborn Genetic Testing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Prenatal and Newborn Genetic Testing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Prenatal and Newborn Genetic Testing Market Drivers and Opportunities

High Prevalence of Genetic Diseases in Infants Drives the Market Growth

The fetuses in the womb are impacted by various genetic diseases. The way in which these genetic diseases are inherited helps to determine the risk that they pose on pregnancy and the risk of its recurrence. The risk of having genetic diseases in newborn is high in several cases, such as when the parents have another child with a genetic disease, a family history of a genetic disorder, or if either of a parent has a chromosomal abnormality. There is a substantial prevalence of genetic diseases among infants, and these diseases are also responsible for infant mortality globally. Down syndrome is the most common form of intellectual disability in the world. It remains the most common chromosomal condition diagnosed in the US, affecting about 1 in every 700 babies. According to the Centers for Disease Control and Prevention (CDC) data, ~6,000 babies born annually in the US have Down syndrome. The World Health Organization estimates that 240,000 newborns worldwide succumb to death yearly within 28 days of birth due to these diseases. An additional 170,000 children die between the ages of 1 month and 5 years due to congenital diseases. Thus, the prevalence of genetic diseases among infants increases the demand for prenatal and newborn genetic tests, thereby driving the growth of the market.

Government Support to Encourage Prenatal and Newborn Testing to Favor Market Growth

With the advancing field of genomic science, genetic and genomic tests are becoming more customary in various clinical and healthcare institutes. Governments and healthcare regulatory bodies across the world are comprehending the importance of genetic tests and the benefits that these tests offer. To ensure the health of newborns, various initiatives are taken by government worldwide that require babies to undergo newborn screening. The California Newborn Screening (NBS) Program is a public health program that screens all newborns for several serious but treatable genetic disorders. Similarly, in India, the Department of Biotechnology launched the UMMID Initiative (The Unique Methods of Management and Treatment of Inherited Disorders) in 2019. It is designed to promote the babies' genetic screening in the nation. Thus, the increase in support from the government to promote the use of prenatal and new genetic tests across the world is expected to contribute to the market's growth in the future.

Prenatal and Newborn Genetic Testing Market Report Segmentation Analysis

Key segments that contributed to the derivation of the prenatal and newborn genetic testing market analysis are product, disease indication, and end user.

- Based on product, the prenatal and newborn genetic testing market is divided into diagnostic and screening. The screening segment held the largest market share in 2023 and is anticipated to register the highest CAGR during the forecast period.

- By disease indication, the market is segmented into cystic fibrosis, sickle cell anaemia, down syndrome, phenylketonuria, and other diseases. The down syndrome segment held the largest share of the market in 2023. In addition, cystic fibrosis segment is projected to register the highest CAGR during the forecast period.

- Based on end user, the prenatal and newborn genetic testing market is divided into hospitals & clinics, diagnostic centers, and other end users. The hospitals & clinics segment held the largest market share in 2023. In addition, the diagnostic centers segment is anticipated to register the highest CAGR during the forecast period.

Prenatal and Newborn Genetic Testing Market Share Analysis by Geography

The geographic scope of the prenatal and newborn genetic testing market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the prenatal and newborn genetic testing market. North America market is expanding due to a number of factors, including the increase in the prevalence of genetic diseases among infants, supportive government initiatives as well as initiatives undertaken by various organizations to facilitate the use of prenatal and newborn testing, and increasing birth rate. As per the CDC, birth defects affect one in every 33 babies born annually in the US. Moreover, the demand for the market in the region is anticipated to grow significantly during the forecast period owing to regulatory mandates for performance of prenatal and newborn tests, increasing focus on advanced method integration in healthcare, and the launch of non-invasive tests for diagnosis of prenatal and genetic tests in the region. Asia Pacific is anticipated to grow with the highest CAGR in the coming years.

Prenatal and Newborn Genetic Testing Market Regional Insights

Prenatal and Newborn Genetic Testing Market Regional Insights

The regional trends and factors influencing the Prenatal and Newborn Genetic Testing Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Prenatal and Newborn Genetic Testing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Prenatal and Newborn Genetic Testing Market

Prenatal and Newborn Genetic Testing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 5.72 Billion |

| Market Size by 2031 | US$ 21.44 Billion |

| Global CAGR (2023 - 2031) | 14.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

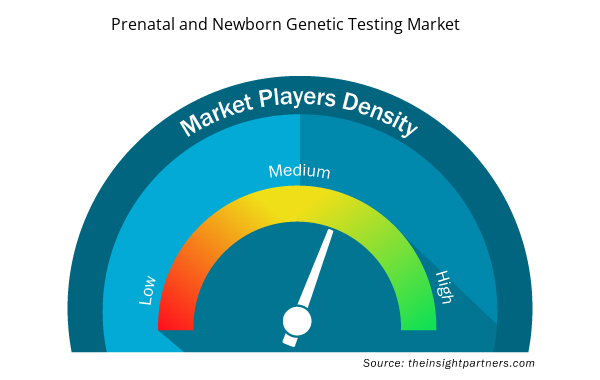

Prenatal and Newborn Genetic Testing Market Players Density: Understanding Its Impact on Business Dynamics

The Prenatal and Newborn Genetic Testing Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Prenatal and Newborn Genetic Testing Market are:

- Abbott

- Quest Diagnostics Inc.

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- F. Hoffmann La-Roche Ltd.

- Qiagen

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Prenatal and Newborn Genetic Testing Market top key players overview

Prenatal and Newborn Genetic Testing Market News and Recent Developments

The prenatal and newborn genetic testing market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for prenatal and newborn genetic testing and strategies:

- PerkinElmer Inc. received the US Food and Drug Administration authorization for the marketing of the EONIS SCID-SMA assay kit for in vitro diagnostic (IVD) use by certified laboratories for the simultaneous detection of spinal muscular atrophy (SMA) and severe combined immunodeficiency (SCID) in newborns. This is the first FDA-authorized assay for SMA screening in newborns in the US, and it is part of the company’s broader EONIS Platform. (Source: PerkinElmer Inc., Press Release, 2022)

- LifeCell International launched 'Genome-Scope' - a premier Genetic Diagnostic Test for newborns that assesses for thousands of early childhood onset disorders. (Source: LifeCell International Private Limited, Press Release, 2020)

Prenatal and Newborn Genetic Testing Market Report Coverage and Deliverables

The “Prenatal and Newborn Genetic Testing Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product , Disease , End User and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Get Free Sample For

Get Free Sample For