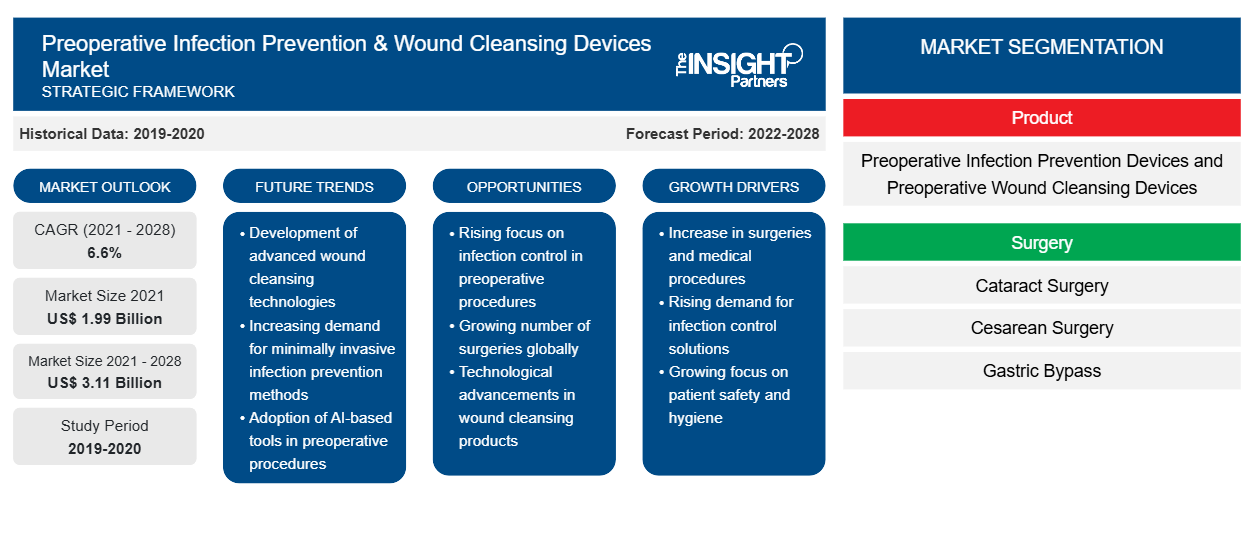

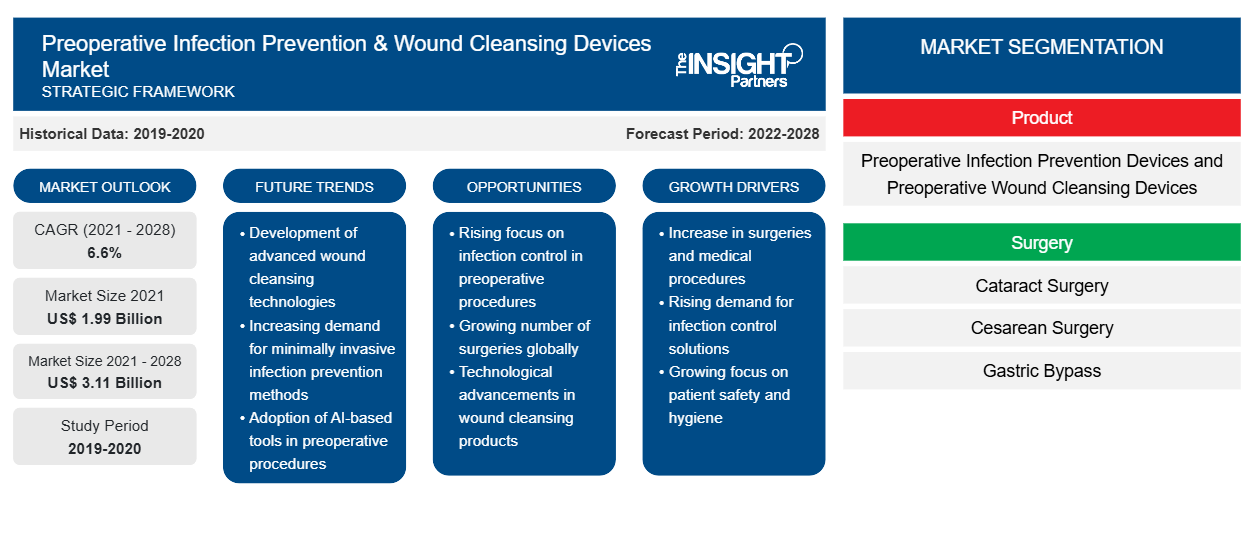

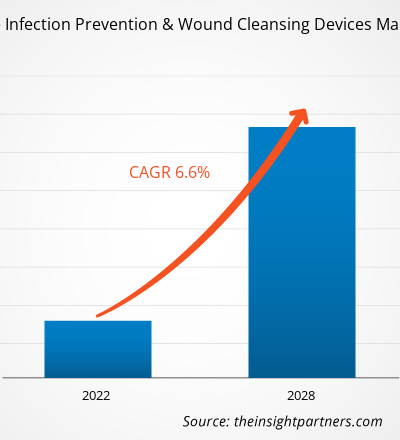

The preoperative infection prevention & wound cleansing devices market is expected to grow from US$ 1,994.75 million in 2021 to US$ 3,112.36 million by 2028; it is estimated to grow at a CAGR of 6.6% from 2022 to 2028.

The preoperative infection prevention & wound cleansing devices market is segmented on the basis of product, surgery, application, and regions. The report offers insights and in-depth analysis of the market, emphasizing various parameters such as dynamics, trends, and opportunities in the market and competitive landscape analysis of leading market players across various regions. It also includes the impact analysis of COVID–19 pandemic across the regions.

Market Insights

Increasing Incidence of Hospital Acquired Infections Drives Market Growth

Healthcare facilities in various developing countries such as India and Japan pose a risk of infection to patients. In hospitals, infections cause unnecessary suffering and the death of millions of patients every year. Asia-Pacific is a source of emerging infectious diseases, including multidrug-resistant organisms (MDROs) and pathogens with pandemic potential. Risks for emerging infectious diseases in the region are complex and believed to involve environmental, socioeconomic, and technological processes favoring the dynamics of microbial transmission. According to the National Institutes of Health estimates, the risk of hospital-acquired infections (HAIs) in Asia-Pacific is 2–20 times higher than in developed countries, with up to 25% of hospitalized patients reporting infections. According to the Centers for Disease Control and Prevention (CDC), in the US, ~1 in 31 patients in hospitals suffers from at least one HAIs on any given day. According to the data provided by PatientCareLink, in American Hospitals alone, HAIs account for an estimated 1.7 million infection cases and 99,000 associated diseases each year, out of which 22% are surgical site infections.

Healthcare facilities in low and middle-income countries have exceptionally high HAI rates, possibly due to the additional challenges in achieving effective control of infection, lack of cleanliness in hospitals, and lack of awareness regarding infection control. Seriously ill patients are susceptible to HAIs in industrialized and developing countries. An increase in HAI cases has fueled the need for preoperative infection prevention devices, driving the preoperative infection prevention & wound cleansing devices market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Preoperative Infection Prevention & Wound Cleansing Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Preoperative Infection Prevention & Wound Cleansing Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Product-Based Insights

Based on product, the preoperative infection prevention & wound cleansing devices market is segmented into preoperative infection prevention devices and preoperative wound cleansing devices. The market for the preoperative infection prevention devices segment is further segmented into infection prevention supplies, medical waste disposable devices, and infection prevention equipment. In 2021, the preoperative infection prevention devices segment held a larger market share. Moreover, the same segment is anticipated to register a higher CAGR in the market during 2022–2028. The prevention of perioperative infections requires technical equipment, good surgical techniques, and proper hygiene. The basis for this is a well-structured and well-organized department with known generally practiced routine processes and a solid realistic schedule. Preventing postoperative surgical site infections (SSIs) is now more critical than ever. The Centers for Medicare & Medicaid Services (CMS) will no longer reimburse healthcare facilities for SSIs in multiple surgeries. Healthcare-Associated Infections (HAIs) are a significant and growing concerns for healthcare systems.

Surgery-Based Insights

Based on surgery, the preoperative infection prevention & wound cleansing devices market is segmented into cataract surgery, cesarean surgery, gastric bypass, appendectomy, colectomy and colostomy, esophagectomy, biopsy, cholecystectomy, mastectomy, cosmetic surgery, and others. In 2021, the cosmetic surgery segment held the largest market share. However, the market for the cataract surgery segment is expected to grow at the highest rate during the forecast period. Cosmetic surgery includes reconstructing facial and body defects resulting from childbirth, burns, disease, and trauma. In India, the popularity of cosmetic procedures has increased significantly due to the rising prevalence of obesity, surging aging population, and the increasing influence of Western culture. In addition, due to the country's tropical climate, the demand for antiaging treatments is increasing. South Korea is considered the capital of cosmetic surgery in Asia Pacific. Furthermore, it is expected to maintain dominance for the next few years. Over the years, an increase in the demand for facelifts, rise in spending on aesthetic enhancements, and the availability of advanced procedures have fueled the demand for cosmetic procedures across the South Kore. Wound infections are among the most common postoperative complications in patients undergoing cosmetic surgery. Proper preoperative counseling would help set the right expectations and ultimately improve patient outcomes and satisfaction.

Application-Based Insights

Based on application, the preoperative infection prevention & wound cleansing devices market is segmented into preoperative hair removal, preoperative skin preparation, intraoperative wound irrigation solution, and others. In 2021, the preoperative hair removal segment held the largest share of the market. Moreover, the market for the same segment is expected to grow at the highest rate during the forecast period. According to the World Health Organization (WHO) guidelines, hair should not be removed unless it interferes with surgery. According to The Cochrane Collaboration report, before surgical intervention, it is common to remove hair from the body area to have surgery. Hairs are removed to avoid problems during and after surgery. For example, while stitching up wounds or applying dressings, studies claim that removing hair could cause infections after surgery and should be avoided.

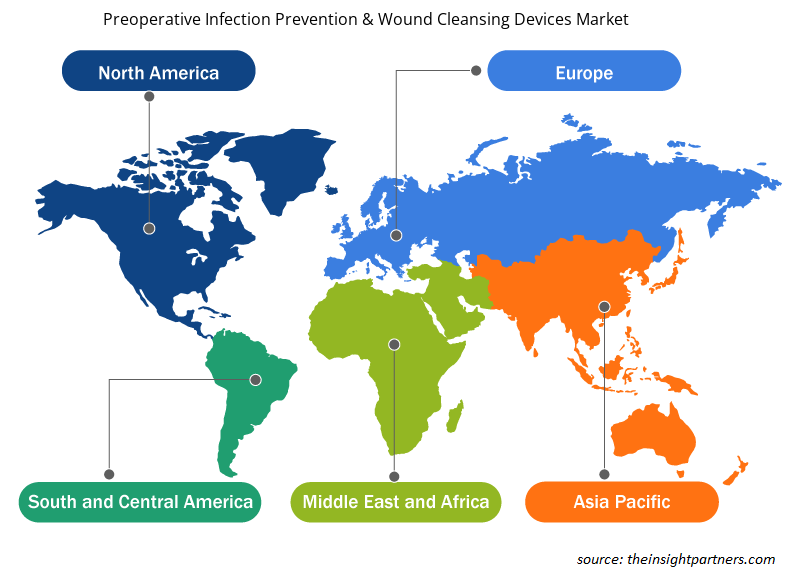

Preoperative Infection Prevention & Wound Cleansing Devices Preoperative Infection Prevention & Wound Cleansing Devices Market Regional Insights

The regional trends and factors influencing the Preoperative Infection Prevention & Wound Cleansing Devices Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Preoperative Infection Prevention & Wound Cleansing Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Preoperative Infection Prevention & Wound Cleansing Devices Market

Preoperative Infection Prevention & Wound Cleansing Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 1.99 Billion |

| Market Size by 2028 | US$ 3.11 Billion |

| Global CAGR (2021 - 2028) | 6.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

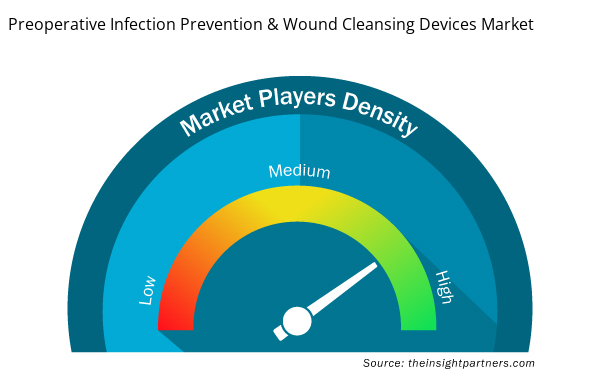

Preoperative Infection Prevention & Wound Cleansing Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Preoperative Infection Prevention & Wound Cleansing Devices Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Preoperative Infection Prevention & Wound Cleansing Devices Market are:

- Cardinal Health Inc

- 3M Co

- Bactiguard AB

- Becton Dickinson and Co

- Getinge AB

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Preoperative Infection Prevention & Wound Cleansing Devices Market top key players overview

The preoperative infection prevention & wound cleansing devices market players adopt organic strategies, such as product launch and expansion, to expand their footprint and product portfolio across the world and meet the growing demand. Inorganic growth strategies witnessed in the market are partnerships and collaborations. These growth strategies have allowed the market players to expand their businesses and enhance their geographic presence. Additionally, acquisitions, partnerships, and other growth strategies help strengthen the company’s customer base and increase its product portfolio.

- In May 2021, Medline announced that it has launched new product namely—ReadyPrep CHG cloths. This new product from launching holds 40% domestic market share within the span of two years.

- In October 2018, 3M announced advanced surgical skin preparation solution for benefitting in patient infection prevention. The new product leverages 3M's expertise in polymer and adhesive technology in the form of a proprietary "3M Prep Protection Film". It possesses high capability to stay on a patient's skin and can withstand the rigors of simulated surgical conditions, including repetitive wiping.

Company Profiles

- Cardinal Health Inc

- 3M Co

- Bactiguard AB

- Becton Dickinson and Co

- Getinge AB

- bioMerieux SA

- Medline Industries Inc

- Dynarex Corp

- Careon Healthcare Solutions Pvt Ltd

- Steris Plc

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Surgery, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

During COVID-19 outbreak, hospital admissions were on the rise. Regarding the total annual cost spent by healthcare facilities on these infections, SSIs are the largest contributor in the US. The most common types of hospital acquired infections (HAIs) cost around US$ 9.8 billion annually in the US, with SSIs contributing the largest share of 33.7% (US$ 3.3 billion). The reasons behind the high cost of SSIs are prolonged hospitalization of patients and associated diagnostic tests & treatments, which leads to an increase in additional cost burden. Hence, it is necessary to control infections during surgical procedures to reduce this burden, which is expected to drive the market for SSI control products in the coming years.

Global preoperative infection prevention & wound cleansing devices market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa and South & Central America. In The market growth in this region is attributed to the rise in surgical procedures, the increase in the R&D activities initiated by the government, and the rise in the geriatric population in this region. The surgical site infection control market has been dominated by North America, with the United States accounting for the largest share of regional revenue. During the forecast period, the region is expected to continue its dominance due to an increase in the prevalence of ulcers, traumatic wounds, surgeries, burn cases, and others, along with technological advancement in the region.

Becton Dickinson and Co and Bactiguard AB Corporation are the top two companies that hold huge market shares in the preoperative infection prevention & wound cleansing devices market.

The preoperative infection prevention & wound cleansing devices market majorly consists of the players such Cardinal Health, 3M, Bactiguard, BD, Getinge AB, bioMerieux SA, Medline Industries, Inc., Dynarex Corporation, Steris plc, and Careon Healthcare Solutions amongst others.

The preoperative hair removal segment dominated the global preoperative infection prevention & wound cleansing devices market and held the largest market share of 42.30% in 2021.

The CAGR value of the preoperative infection prevention & wound cleansing devices market during the forecasted period of 2022-2028 is 6.6%.

The preoperative infection prevention supplies segment held the largest share of the market in the global preoperative infection prevention & wound cleansing devices market and held the largest market share of 70.44% in 2021.

The cosmetic surgery segment dominated the global preoperative infection prevention & wound cleansing devices market and accounted for the largest market share of 22.11% in 2021.

Key factors that are driving the growth of this market are increasing incidence of hospital acquired infections and rising incidence of surgical site infections (SSIs) are expected to boost the market growth for the preoperative infection prevention & wound cleansing devices over the years.

Preoperative phase is essential for preventing surgical site infections (SSIs). Prophylactic antibiotics assist in reducing hospitalization time and cost. Therefore, wound cleansing devices are a cost-effective means for promoting wound healing by reducing the infection rate.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Preoperative Infection Prevention & Wound Cleansing Device Market

- Cardinal Health Inc

- 3M Co

- Bactiguard AB

- Becton Dickinson and Co

- Getinge AB

- bioMerieux SA

- Medline Industries Inc

- Dynarex Corp

- Careon Healthcare Solutions Pvt Ltd

- Steris Plc

Get Free Sample For

Get Free Sample For