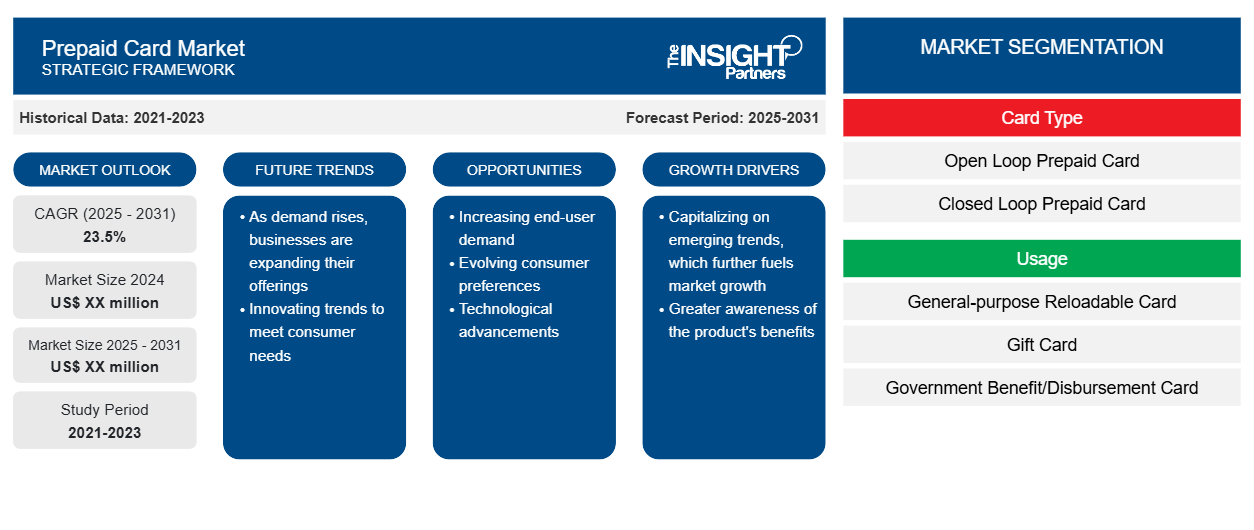

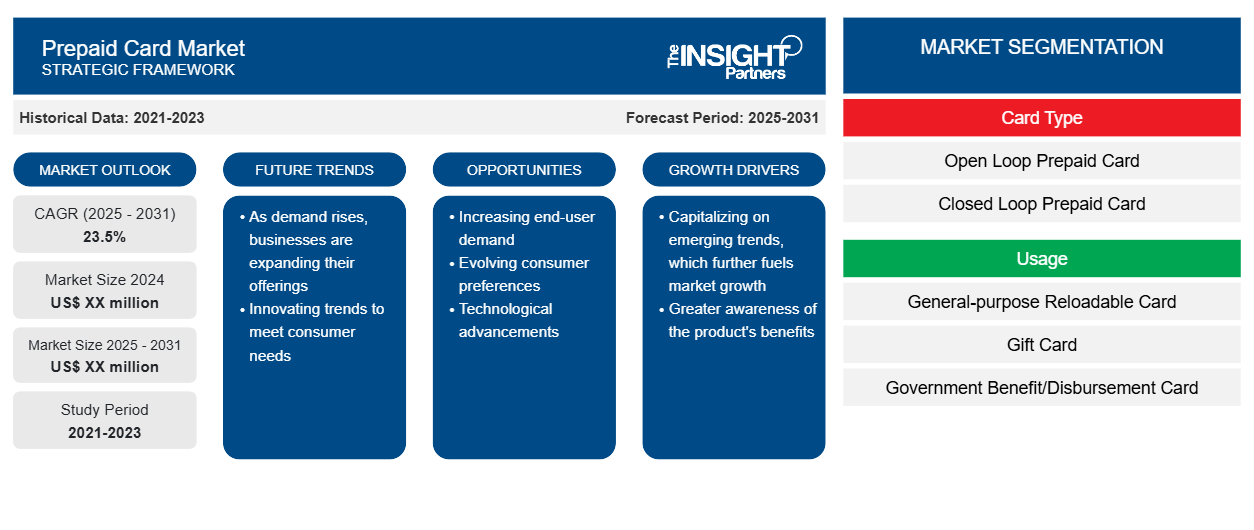

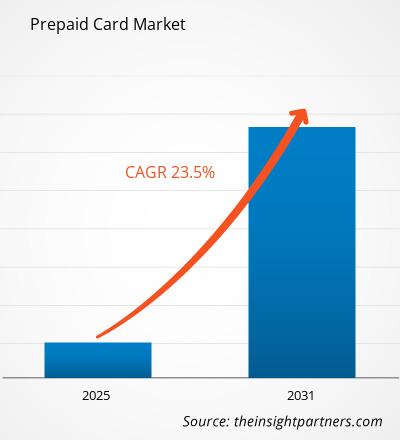

The prepaid card market is anticipated to expand at a CAGR of 23.5% from 2025 to 2031.

Prepaid cards have replaced cash, checks, and other payment cards in situations where consumers or businesses want to use an electronic method of payment.

Prepaid Card Market Analysis

The prepaid card market is predicted to grow rapidly during the forecast period, owing to the convenience offered, which is similar to that of a credit or debit card, as well as the option for the end user to determine the spending limit based on their budget. Prepaid cards have replaced cash, checks, and other payment cards in situations where consumers or businesses want to use an electronic method of payment without tying it to a credit or debit account. Furthermore, prepaid cards are a valuable alternative to traditional banking products for persons who do not have bank accounts or desire more control over their spending because they are used to budgeting, travel, and others. The prepaid card market is influenced by factors such as the rise in demand for prepaid cards in remittances and the diversification of financial institutions are among the factors contributing to the growing prepaid cards market size.

Prepaid Card Industry Overview

- Prepaid cards are sometimes known as prepaid debit cards or stored value cards. These prepaid cards can be loaded easily using several platforms, including bank account transfers, direct deposit, and cash, both online and in-person.

- Furthermore, the market is expected to see significant expansion due to the Growth of the E-commerce Industry and diversification of financial institutions. The prepaid cards market size is likely to surge by 2031 owing to the demand for prepaid cards in remittances.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Prepaid Card Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Prepaid Card Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Prepaid Card Market Drivers and Opportunities

Growing Demand for Prepaid Cards in Remittances to Drive the Prepaid Card Market

- Prepaid payment cards have grown in popularity in both emerging and developed nations as a means of promoting financial inclusion and supplementing remittances. The prepaid card market includes a wide range of card kinds that enable cardholders to transfer payments to authorized family members in other countries.

- Furthermore, to use this feature, the customer can choose between two structures: dual card or subaccount holding. In the dual card system, the account holder is given two cards, one of which can be sent to a family member abroad to access funds from the sender's account.

- Factors such as the rise in demand for prepaid cards in remittances and diversification of financial institutions augment the prepaid cards market growth. However, security issues and privacy concerns impede the prepaid card market growth.

Prepaid Card Market Report Segmentation Analysis

- The “prepaid card market analysis” has been performed by considering the following segments: card type, usage, and end-use. Based on card type, the prepaid card market is segmented into open-loop prepaid cards and closed-loop prepaid cards.

- The closed-loop prepaid card segment is expected to hold a substantial prepaid card market share in 2023. This was ascribed to the fact that they are affiliated with certain stores or businesses, offering particular incentives, discounts, and brand loyalty benefits that entice customers seeking tailored and valuable experiences.

- On the other hand, open-loop prepaid cards are expected to be the fastest-growing segment. This is owing to their broader usage, as they function similarly to traditional debit or credit cards and allow for a variety of purchases online transactions.

- Based on end-users, the prepaid card market is segmented into retail establishments, corporate, and government. The retail establishment's plan is estimated to hold a significant prepaid card market share by 2031.

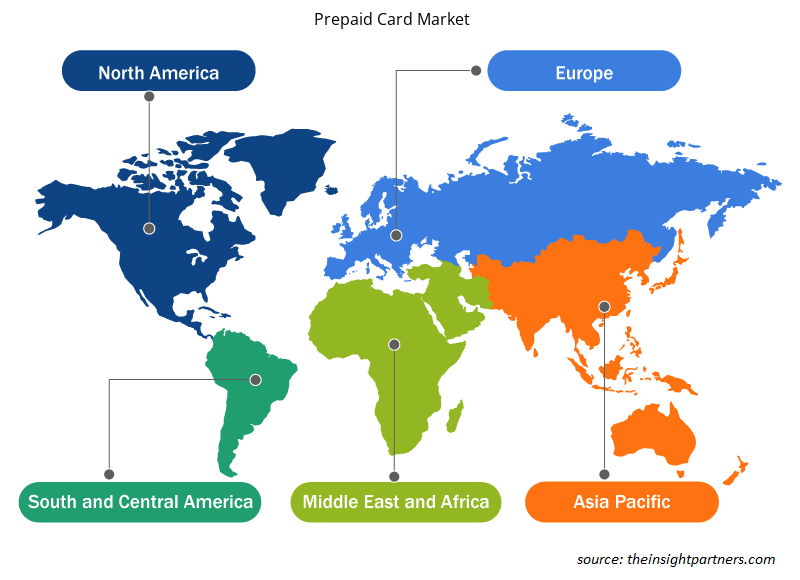

Prepaid Card Market Share Analysis By Geography

The scope of the prepaid card market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant prepaid card market share. The region's well-established digital payment usage, financial infrastructure, and technological advancements all contribute to the growing growth of prepaid cards. Furthermore, e-commerce, the popularity of online shopping, and mobile payment methods are consistent with the convenience and security that prepaid cards offer.

Prepaid Card Market Regional Insights

Prepaid Card Market Regional Insights

The regional trends and factors influencing the Prepaid Card Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Prepaid Card Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Prepaid Card Market

Prepaid Card Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX million |

| Global CAGR (2025 - 2031) | 23.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Card Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Prepaid Card Market Players Density: Understanding Its Impact on Business Dynamics

The Prepaid Card Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Prepaid Card Market are:

- Green Dot Corporation

- American Express Company

- JPMorgan Chase And Co.

- PayPal Holdings, Inc.

- Mastercard;

- Visa Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Prepaid Card Market top key players overview

The "Prepaid Card Market Analysis" was carried out based on provider, end-user, and geography. In terms of providers, the market is segmented into card types; the prepaid card market is segmented into open-loop prepaid cards and closed-loop prepaid cards. Based on usage, the prepaid card market is segmented into general-purpose reloadable cards, gift cards, government benefit/disbursement cards, payroll cards, and others. Based on end-users, the prepaid card market is segmented into retail establishments, corporate, and government. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Prepaid Card Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the prepaid cards market. A few recent key market developments are listed below:

- In November 2022, Visa increased its prepaid card services with trial payment innovations, such as instant-issue prepaid cards with animated card art and facial biometric payments. As consumers get more accustomed to obtaining items promptly, Visa is piloting a digital card issuance option for a small number of cardholders in Doha.

[Source: Visa Inc, Company Website]

- In July 2023, Giverly, a social impact fintech firm, has teamed with Transcorp International and Visa to create prepaid cards that combine shopping with charitable giving. These cards provide discounts and transform routine purchases into significant donations to important social causes. Giverly also offers an employee benefits solution, allowing businesses to distribute incentives and bonuses directly to employees' Giverly cards, fostering a culture of giving within firms.

[Source: Giverly, Company Website]

Prepaid Card Market Report Coverage & Deliverables

The market report on “Prepaid Card Market Size and Forecast (2021–2031)”, provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country- level for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Sandwich Panel Market

- 3D Audio Market

- Energy Recovery Ventilator Market

- Fertilizer Additives Market

- Radiopharmaceuticals Market

- Lyophilization Services for Biopharmaceuticals Market

- Aircraft MRO Market

- Artificial Intelligence in Healthcare Diagnosis Market

- Ceiling Fans Market

- Small Internal Combustion Engine Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Offerings, Card Type, End-User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The global prepaid card market is expected to grow at a CAGR of 23.5% during the forecast period 2023 - 2031.

The rise in demand for prepaid cards in remittances and the diversification of financial Institutions are the major factors that propel the global prepaid card market.

The key players holding majority shares in the global prepaid card market are Green Dot Corporation, American Express Company, JPMorgan Chase And Co., PayPal Holdings, Inc., and Mastercard.

Growing fintech companies and digital transformation, which is anticipated to play a significant role in the global prepaid card market in the coming years.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Green Dot Corporation

- American Express Company

- JPMorgan Chase And Co.

- PayPal Holdings, Inc.

- Mastercard;

- Visa Inc.

- NetSpend Corporation

- Mango Financial, Inc.

- Kaiku Finance LLC

- Travelex Foreign Coin Services Limited

Get Free Sample For

Get Free Sample For