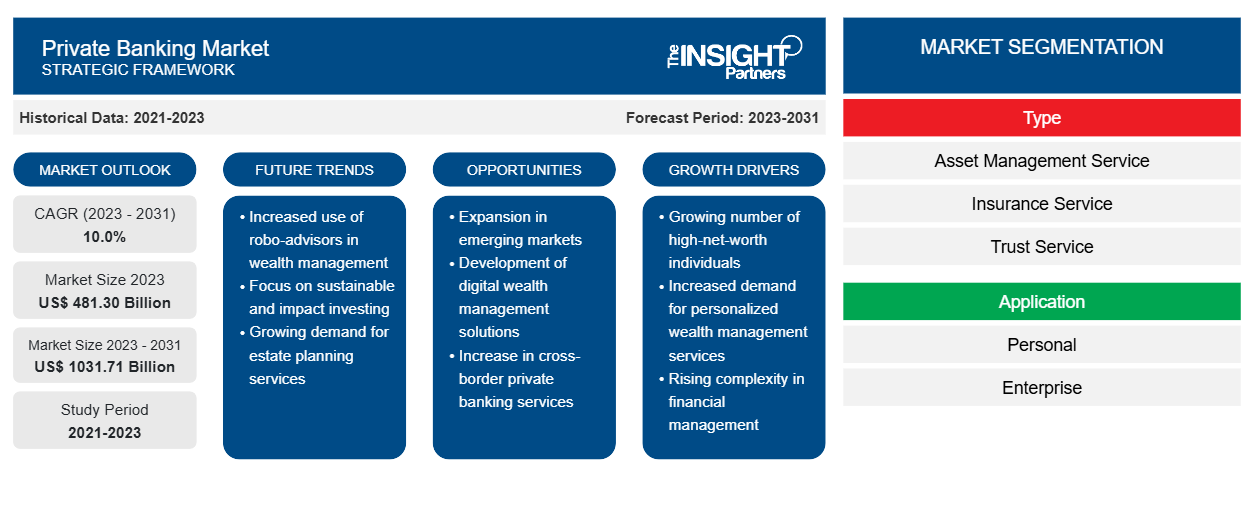

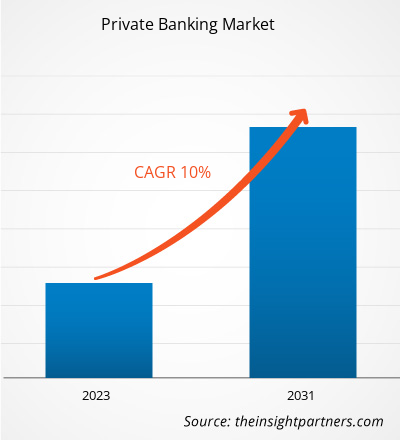

The private banking market size is expected to grow from US$ 481.30 billion in 2023 to US$ 1031.71 billion by 2031; it is anticipated to expand at a CAGR of 10.0% from 2023 to 2031. The market includes growth prospects owing to the current private banking market trends and their foreseeable impact during the forecast period. Private banking is the leading sector in the financial services landscape in terms of profitability.

Globalization has evolved in recent decades as a result of the expansion of commercial and financial networks that cross national borders, making businesses and workers from other economies increasingly interconnected. Greater globalization creates more chances for international investments, resulting in more investment-linked programs. Moreover, industrialization also facilitates increased investments, cross-broader collaborations, partnerships and joint ventures, facilitating the private banking market growth.

Private Banking Market Analysis

Private banking refers to the tailored financial services and products that retail banks and other financial institutions provide to their high-net-worth individual (HNWI) clientele. Private banking is provided by consumer banks and brokerages of all sizes, although it is targeted at a select group of customers. Typically, this service is provided by specialized departments known as "private banking" or "wealth management" divisions. Private banking offers a variety of wealth management services, all conveniently located under one roof. Trust and estate planning, insurance, tax services, and investment and portfolio management are some of the private banking offered. In the increasingly automated and digital banking environment, private banking provides customers with a range of benefits, privileges, and customized services, which is becoming a highly valued asset. Nonetheless, there are benefits for both the banks and their private customers.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Private Banking Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Private Banking Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Private Banking Industry Overview

- Common financial services like checking and savings accounts are included in private banking, but they are provided in a more individualized way.

- Each customer is given a "relationship manager" or "private banker" who is responsible for any issues. Everything is managed by the private banker, from complex jobs like setting up a jumbo mortgage to routine duties like bill payment.

- Private banking, on the other hand, handles a client's complete financial position in addition to CDs and safe deposit boxes.

- Advice on investment strategy and financial planning, portfolio management, specialized financing choices, retirement planning, and transferring money to future generations are examples of specialized services.

Private Banking Market Driver

Huge Demand For Wealth Management Solutions to Drive the Private Banking Market

- The soaring demand for wealth management solutions is expected to redefine the dynamics of the private banking market, catalyzing a profound pricing shift.

- As high-net-worth individuals increasingly seek sophisticated strategies to preserve and grow their assets, private banks are compelled to enhance their offerings and competitive positioning.

- As individuals accumulate more wealth, they seek sophisticated investment strategies, tax optimization, estate planning, and personalized advice, all of which private banking offers.

- Therefore, as demand for wealth management solutions grows, private banks will see increased business opportunities and expand their services to cater to the evolving needs of affluent clients.

- Moreover, the increasing complexity of financial markets and investment options further increases the need for expert guidance and tailored solutions, which private banks can fulfill.

- As global wealth continues to rise, particularly in emerging markets, the pool of potential clients for private banking services expands, further driving the private banking market growth.

Private Banking Market Report Segmentation Analysis

- Based on type, the private banking market is segmented into asset management service, insurance service, trust service, tax consulting, and real estate consulting.

- The asset management service segment is expected to hold a substantial private banking market share in 2023.

- Asset management service in private banking refers to the professional management of a client's investments and assets by a team of financial experts within a private banking institution. This service typically involves personalized investment strategies tailored to the client's financial goals, risk tolerance, and time horizon.

- Private bankers provide advice and guidance on asset allocation, portfolio diversification, and investment selection, aiming to maximize returns while managing risks effectively.

- They may also offer additional services such as estate planning, tax optimization, and wealth preservation strategies.

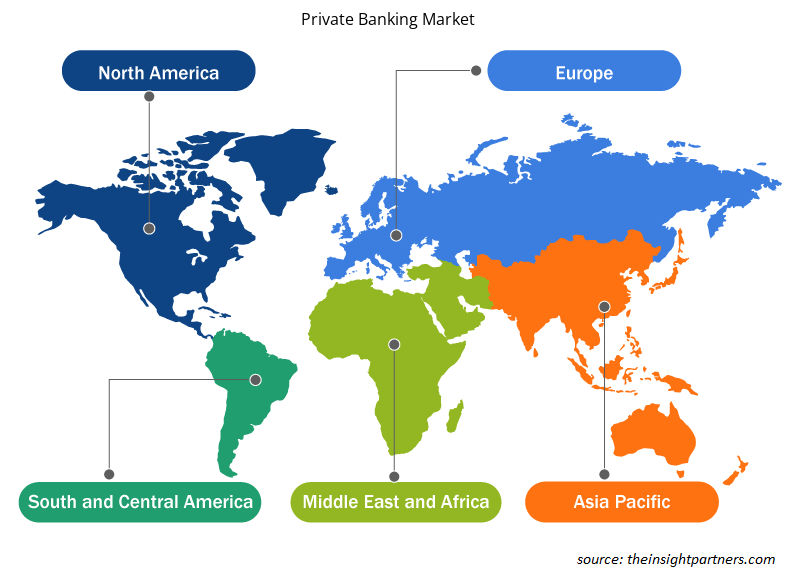

Private Banking Market Share Analysis By Geography

The scope of the private banking market is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant private banking market share. The region's significant economic development, growing population, and increasing focus on risk management and private banking have contributed to the growth of the market.

Private Banking Market Regional Insights

The regional trends and factors influencing the Private Banking Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Private Banking Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Private Banking Market

Private Banking Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 481.30 Billion |

| Market Size by 2031 | US$ 1031.71 Billion |

| Global CAGR (2023 - 2031) | 10.0% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

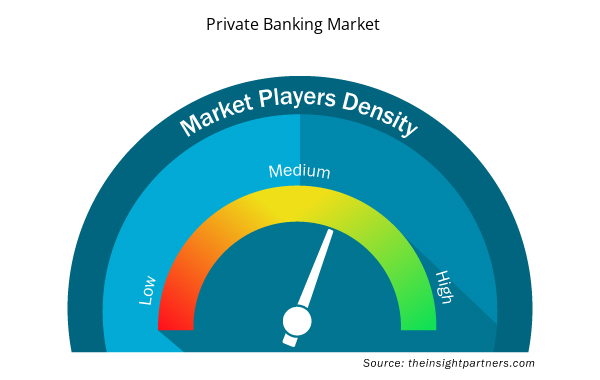

Private Banking Market Players Density: Understanding Its Impact on Business Dynamics

The Private Banking Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Private Banking Market are:

- CREDIT SUISSE GROUP.

- JPMorgan Chase & Co

- Morgan Stanley

- Royal Bank of Canada

- UBS

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Private Banking Market top key players overview

The "Private Banking Market Analysis" was carried out based on type and application. On the basis of type, the market is segmented into asset management service, insurance service, trust service, tax consulting, and real estate consulting. Based on application, the private banking market is segmented into personal and enterprise. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Private Banking Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the private banking market. A few recent key market developments are listed below:

- In July 2023, HSBC announced the launch of its global private banking (GPB) business in India to serve high-net-worth (HNW) and ultra-high-net-worth (UHNW) professionals, entrepreneurs, and their families. The new business is aimed at clients with investable assets of more than USD 2 million. The launch also demonstrates the Bank’s commitment to lead wealth management in Asia by offering world-class wealth solutions, global private banking expertise, an extensive international network, and access to commercial banking and global banking & markets capabilities.

[Source: HSBC, Company Website]

- In October 2022, HSBC Global Private Banking launched its business in the large Chinese cities of Chengdu and Hangzhou in a push to capture a bigger share of China's wealth market. The bank also planned to explore opportunities in China's Southwest region.

[Source: HSBC, Company Website]

Private Banking Market Report Coverage & Deliverables

The private banking market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Private Banking Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Application, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Huge demand for wealth management solutions and increasing demand for private equity are the major factors that propel the global private banking market.

The global private banking market was estimated to be US$ 481.30 billion in 2023 and is expected to grow at a CAGR of 10.0 % during the forecast period 2023 - 2031.

Digital transformation promoting online private banking is anticipated to play a significant role in the global private banking market in the coming years.

The key players holding majority shares in the global private banking market are CREDIT SUISSE GROUP.; JPMorgan Chase & Co; Morgan Stanley; Goldman Sachs; and Bank of America Corporation

The global private banking market is expected to reach US$ 1,031.71 billion by 2031.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- CREDIT SUISSE GROUP.

- JPMorgan Chase & Co

- Morgan Stanley

- Royal Bank of Canada

- UBS

- JuliusBaer Group

- Charles Schwab & Co

- Citigroup Inc

- Goldman Sachs

- Bank of America Corporation

Get Free Sample For

Get Free Sample For