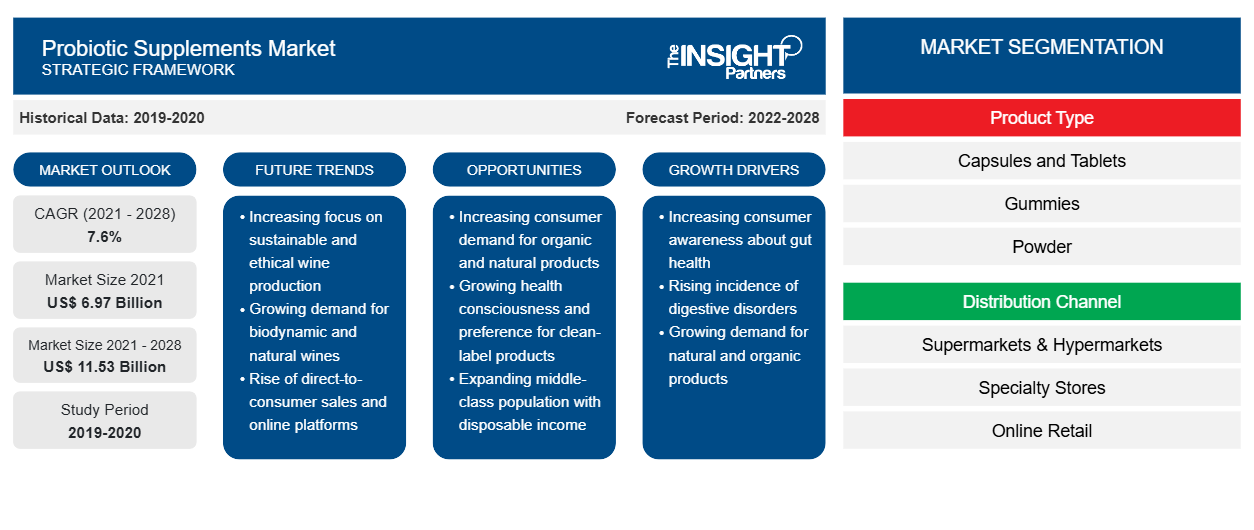

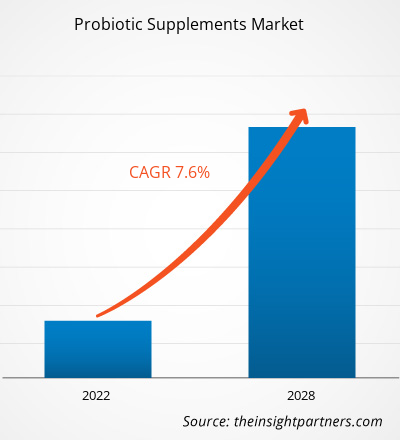

The probiotic supplements market is valued US$ 6,970.10 million in 2021; It is estimated to grow at a CAGR of 7.6% from 2022 to 2028.

Probiotic supplements are live microorganisms available in the form of powders, tablets, capsules, etc.; these supplements are consumed to restore or improve gut flora. Global probiotic supplement consumption is growing at a high pace due to the rising prevalence of digestive disorders and the increased availability of products for children. Further, the preference for nutritional supplements in the form of gummies and the elevating popularity of non-GMO and vegan probiotic supplements are among the major trends contributing to the growth of the probiotic supplements market

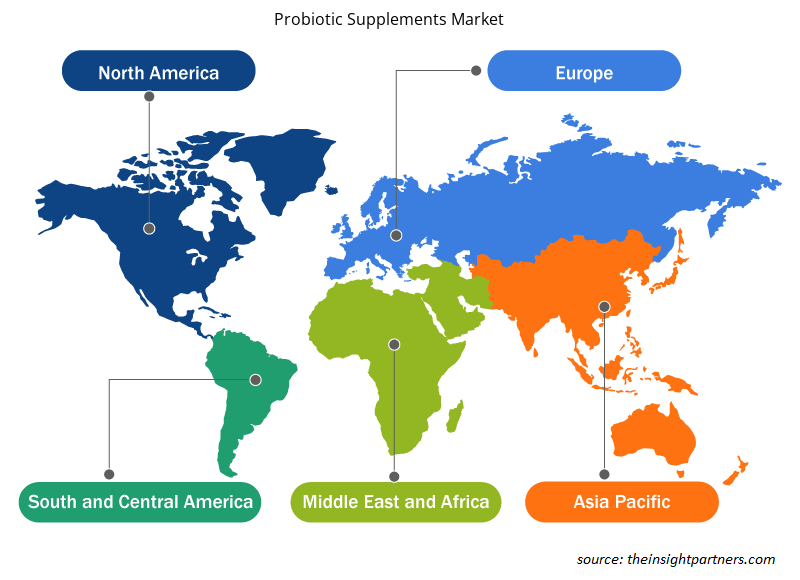

In 2021, North America held the largest revenue share of the probiotic supplements market. The consumption of probiotic supplements is gradually increasing in the region owing to the factors such as rising consumer awareness about digestive health, and probiotic strains and their health benefits. Probiotic supplements are available in the form of capsules and tablets, gummies, powder, etc., which are favorable for all age groups of the population. According to a report by the GI Alliance, published on January 23, 2021, 20 million North Americans are diagnosed with chronic digestive diseases. Digestive diseases, associated with distress and pain, represent one of the most severe health problems in North American countries. The prevalence of digestive diseases leads to a surge in personal treatment expenditures and a reduction in working hours. Probiotic supplements help maintain appropriate microflora in the gut and assist in curing gastrointestinal diseases.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Probiotic Supplements Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Probiotic Supplements Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Probiotic Supplements Market

In the pre-pandemic period, the probiotic supplements market was mainly driven by the consumption of functional food & beverages and dietary supplements, and the high demand for protein-rich products. However, many industries faced unprecedented challenges after the onset of the COVID-19 pandemic. The food and beverage manufacturers witnessed a slow growth in the initial phase of the pandemic due to the shutdown of manufacturing units and disruptions in supply chains. However, a shift in consumer lifestyle, a rise in preference for healthy dietary practices, and an increase in the health-conscious population have substantially promoted the demand for probiotic supplements. With increased consumer focus on immunity and wellness during the peak pandemic period, the demand for probiotics supplements also magnified. Many studies claim that the consumption of probiotic supplements can boost immunity, thereby reducing the risk of infections, including COVID-19. For instance, research conducted by experts from Sapienza University of Rome, Italy, identified that a mixture of probiotic strains—Streptococcus thermophilus DSM 32245 and Bifidobacterium lactis DSM 32246—is potent enough to reduce the risk of severe pneumonia. According to the same research, the high concentration of bacteria releases specific enzymes that modulate the immune responses of the host.

Market Insights

Rising Strategic Development Initiatives to Drive Probiotic Supplements Market Growth During Forecast Period

Manufacturers in the probiotic supplements market are making significant investments in research & development, partnerships, and collaborations to launch innovative products to tap into emerging market opportunities. For instance, in February 2021, Probi, a Swedish manufacturer of probiotic strains, and Perrigo—a manufacturer of health supplements—signed an agreement to jointly launch probiotic supplements that target digestive and immune health in 14 European countries, including Spain, Italy, and Belgium. Under this agreement, the companies launched three products: Probify Digestive Support, which helps to restore gut flora and supports digestive function; Probify Daily Balance, which supports everyday wellness and immune and gut health; and Probify Travel Protect, which supports gut flora while traveling. Similarly, Jarrow Formula launched probiotic gummy supplements in three variations—probiotic duo gummies, probiotic and prebiotic gummies, and probiotic and immune gummies. They are pectin-based, non-GMO (contain no genetically modified organisms/components), gluten-free, and vegetarian. They contain no artificial flavors, sweeteners, colors, or preservatives that address various consumer requirements. Such developments are expected to provide immense growth opportunities to the probiotic supplements market in the coming years.

Product Type Insights

Based on product type, the probiotic supplements market has been segmented into capsules and tablets, gummies, powder, and others. The capsules and tablets segment held the largest share in the market in 2021, and the gummies segment is expected to register the fastest CAGR during the forecast period. Capsules are more popular as they are less likely to have an unpleasant taste or odor. The probiotic supplements packed in capsule packages have higher bioavailability, which makes them more effective. Tablets are the most common type of supplement. Further, the growing popularity of nutritional supplements such as capsules and tablets owing to their convenient cost, easier dosing, and longer shelf life is expected to boost the market growth of the capsules and tablets segment during the forecast period.

Distribution Channel Insights

Based on category, the probiotic supplements market has been segmented into supermarkets and hypermarkets, specialty stores, online retail, and others. The specialty stores segment held the largest share in the market in 2021. Specialty stores are retail chains that sell a particular category of products. For example, probiotic supplements are easily available in specialty stores such as pharmacies and nutrition stores. Specialty stores display a large variety of products from different brands. These stores are widely preferred distribution channels for probiotic supplements due to their ability to exhibit an extensive range of flavors, offer attractive deals and discounts, and provide a high-end customer service.

A few of the players operating in the probiotic supplements market include Bayer AG; Pharmavite LLC; BioGaia AB; Nature's Way Products, LLC; Nestlé S.A.; SFI Health; GNC Holdings, LLC; Nature's Bounty; Church & Dwight Co., Inc.; and NOW Foods. Market players focus on product launch strategy to attract large consumer groups, acquire new customers, improve business revenues, and cater to changing consumer preferences. Moreover, these players are investing high amounts in product developments and innovations owing to rapidly emerging technological advancements in the industry and increasing competition.

Probiotic Supplements Market Regional Insights

Probiotic Supplements Market Regional Insights

The regional trends and factors influencing the Probiotic Supplements Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Probiotic Supplements Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Probiotic Supplements Market

Probiotic Supplements Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 6.97 Billion |

| Market Size by 2028 | US$ 11.53 Billion |

| Global CAGR (2021 - 2028) | 7.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

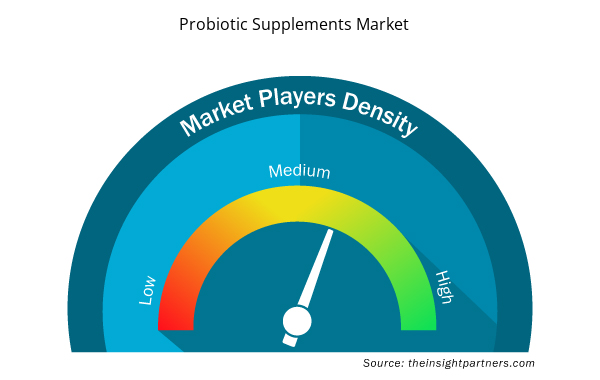

Probiotic Supplements Market Players Density: Understanding Its Impact on Business Dynamics

The Probiotic Supplements Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Probiotic Supplements Market are:

- Bayer AG

- Pharmavite LLC

- BioGaia AB

- Nature's Way Products, LLC

- Nestle SA

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Probiotic Supplements Market top key players overview

Report Spotlights

- Progressive industry trends in the probiotic supplements market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the probiotic supplements market from 2020 to 2028

- Estimation of global demand for probiotic supplements

- Porter’s Five Forces analysis to illustrate the efficacy of buyers and suppliers operating in the industry

- Recent developments to understand the competitive market scenario

- Market trends and outlook as well as factors driving and restraining the growth of the probiotic supplements market

- Assistance in decision-making process by highlighting market strategies that underpin commercial interest, leading to the market growth

- The size of the probiotic supplements market at various nodes

- Detailed overview and segmentation of the market, and the probiotic supplements industry dynamics

- Size of the probiotic supplements market in various regions with promising growth opportunities

Probiotic Supplements Market

The "Probiotic Supplements Market Analysis to 2028" is a specialized and in-depth study of the food & beverages industry, focusing on the probiotic supplements market trend analysis. The report aims to provide an overview of the market with detailed segmentation. The probiotic supplements market is segmented on the basis of product type, distribution channel, and geography. Based on product type, the market is segmented into capsules and tablets, gummies, powder, and others. Based on distribution channel, the market is segmented into supermarkets and hypermarkets, specialty stores, online retail, and others. Based on geography, the probiotic supplements market is segmented into 5 main regions—North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. In 2021, North America dominated the market, and Asia Pacific is expected to register the highest CAGR during the forecast period.

Company Profiles

- Bayer AG

- Pharmavite LLC

- BioGaia AB

- Nature's Way Products, LLC

- Nestlé S.A.

- SFI Health

- GNC Holdings, LLC

- Nature's Bounty

- Church & Dwight Co., Inc.

- NOW Foods

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Digital Language Learning Market

- Hydrogen Storage Alloys Market

- Microcatheters Market

- Portable Power Station Market

- Analog-to-Digital Converter Market

- Electronic Health Record Market

- Nuclear Decommissioning Services Market

- Excimer & Femtosecond Ophthalmic Lasers Market

- Helicopters Market

- Educational Furniture Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, and Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Increasing consumer focus on preventive health, rising demand for probiotic supplements for women’s health, and increasing awareness of the health benefits of probiotics for infants and kids are some of the key driving factors for the probiotic supplements market.

Based on distribution channels, online retail is the fastest-growing segment because consumers can conveniently buy desirable products remotely.

North America accounted for the largest share of the global probiotic supplements market owing to the factors such as increasing consumer awareness about probiotic strains with multiple health benefits and increased focus on digestive health across the region.

Based on the product type, the capsules and tablets segment accounted for the largest revenue share as owing to their convenient cost, easier dosing, and longer shelf life.

Manufacturers are making significant investments in research & development, partnerships, and collaborations to launch innovative products to tap into emerging market opportunities.

The major players operating in the global probiotic supplements market are Bayer AG; Pharmavite LLC; BioGaia AB; Nature's Way Products, LLC; Nestle SA; SFI Health; GNC Holdings, LLC; Nature's Bounty; Church & Dwight Co., Inc.; NOW Foods among few others.

Trends and growth analysis reports related to Consumer Goods : READ MORE..

The List of Companies - Probiotic Supplements Market

- Bayer AG

- Pharmavite LLC

- BioGaia AB

- Nature's Way Products, LLC

- Nestle SA

- SFI Health

- GNC Holdings, LLC

- Nature's Bounty

- Church & Dwight Co., Inc.

- NOW Foods

Get Free Sample For

Get Free Sample For