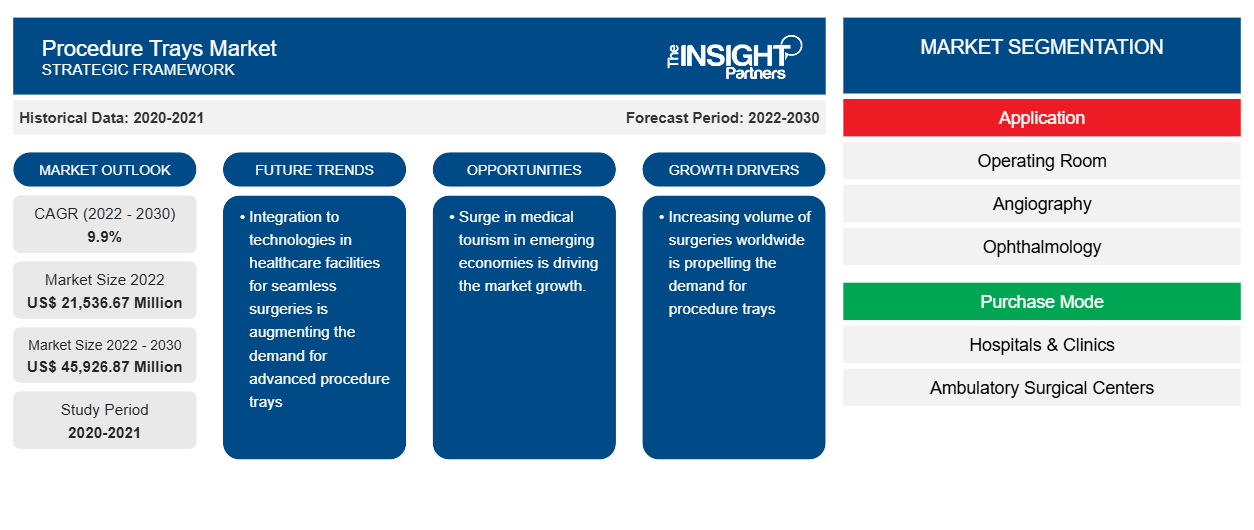

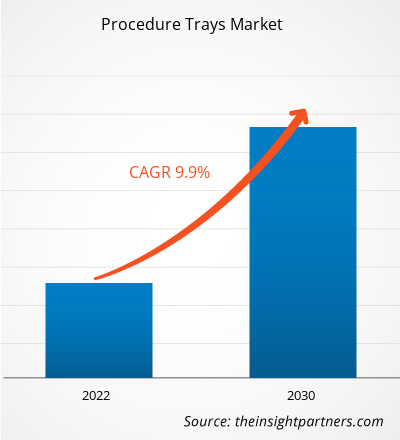

The procedure trays market was valued at US$ 21,536.67 million in 2022 and is expected to reach US$ 45,926.87 million by 2030. It is estimated to register a CAGR of 9.9% during 2022–2030. With the growing need for cost-effective products by hospitals and surgical centers, customized procedure trays are likely to remain a key trend in the market.

Procedure Trays Market Analysis

The increasing number of surgeries and surge in medical tourism are the key driving factors behind the market development. Furthermore, the integration of procedure trays with cloud platforms and data analytics has created growth opportunities for the market over the upcoming forecast period.

Procedure Trays Market Overview

The prevalence of health conditions such as cardiovascular diseases, obstructed labor, injuries, and malignancies trigger the need for surgical procedures. According to research by the World Health Organization (WHO), the number of cesarean sections continues to increase worldwide, accounting for more than one in five (21%) births. This number is expected to rise over the coming decade, with almost a third (29%) of all births likely to be by cesarean section by 2030. Advances in surgical, anesthetic, and critical care techniques have resulted in more of the growing elderly population undergoing surgical procedures. According to the US Census Board, about 13% of the total population in the US is over 65 years old, and it is estimated that this percentage will reach 20% by 2030. According to WHO, the world geriatric population is expected to reach 1.5 billion by 2050.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Procedure Trays Market Drivers and Opportunities

Surge in Medical Tourism

Many countries are becoming popular destinations for health seekers. According to the Medical Tourism Association (MTA), ~14 million people travel to other countries for medical care yearly. Advancements in medical devices and non-invasive surgical procedures are the major factors responsible for increased medical tourism. According to the Centers for Disease Control and Prevention (CDC), millions of Americans travel abroad yearly for medical care. Medical tourism destinations for US citizens include Argentina, Brazil, Canada, Colombia, Costa Rica, Cuba, Dominican Republic, Ecuador, Germany, India, Malaysia, Mexico, Nicaragua, Peru, Singapore, and Thailand. The treatment categories pursued by US medical tourists include cancer treatment, dental care, fertility treatments, organ and tissue transplants, and various forms of surgery, including bariatric, cosmetic, and non-cosmetic (e.g., orthopedic) surgery. Further, cheaper treatments available for various medical conditions, such as knee replacements, dentistry, and cosmetics, in countries including Singapore, Thailand, and Dubai increase the potential of medical travel market value in these countries. According to the ASEAN Briefing, Singapore attracts 500,000 medical tourists annually, accounting for nearly 4% of total tourism revenue (US$ 1 billion), and 60% of those tourists come from Indonesia.

Integration of Procedure Trays with Cloud Platform and Data Analytics

With rapid developments in the healthcare IT sector, companies manufacturing procedure trays focus on harnessing advanced technologies to enhance the experience of using procedure trays. Procedure trays carry various instruments used in surgical procedures; however, a few instruments may not be used during the procedure. Each procedure tray can typically cost more than US$ 350,000, and having every type of set on the shelf at each surgical facility is not feasible. Hence, manufacturers generally loan them to hospitals. Once a procedure is executed, the hospital returns the instrument tray to the manufacturer for storage and redistribution to other hospitals. Each time a hospital returns a tray, the manufacturer must check for missing instruments and ensure they are correctly placed, cleaned, and fit for use in the following procedure. As this checking may become hectic for manufacturers, they are focused on using data analytics tools and cloud-based platforms to maintain the record of the instruments used during surgery. For instance, BD and Johnson & Johnson MedTech are collaborating with cloud-based companies to engineer a scalable solution to improve the tracking and checking of instruments in procedure trays. Thus, using cloud-based platforms and data analytics to maintain and streamline the data collected when procedure trays are in use creates opportunities for the market players.

Procedure Trays Market Report Segmentation Analysis

Key segments that contributed to the derivation of the procedure trays market analysis are product and end user.

- Based on application, the procedure trays market is segmented operating room, angiography, ophthalmology, and others. The operating room segment held a largest market share in 2022.

- Based on purchase mode, the procedure trays market is segmented by hospitals & clinics, ambulatory surgical centers, and others. The hospitals & clinics segment held a largest market share in 2022.

Procedure Trays Market Share Analysis by Geography

The geographic scope of the procedure trays market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The presence of prominent market participants in the region is expected to help the region's growth. Moreover, an increasing aging population and the prevalence of chronic diseases, such as osteoporosis and heart-related problems, in the region, coupled with high awareness about healthcare and advanced surgical procedures, are likely to increase the demand for surgical procedures in North America. According to an article published by the International Osteoporosis Foundation, 44 million people in America above 50 will have osteoporosis by 2020. Regenexx says more than 7 million orthopedic surgeries were performed in 2021 in the US. According to the National Center for Health Statistics, more than 40 million surgeries are performed yearly, which is expected to grow exponentially. Furthermore, according to the American Psychological Association, the geriatric population in the country is currently at 46 million. It is supposed to double itself by 2060, which will increase the number of surgeries, coupled with technological advancements, and drive the procedure trays market growth.

Procedure Trays Market Regional Insights

The regional trends and factors influencing the Procedure Trays Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Procedure Trays Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Procedure Trays Market

Procedure Trays Market Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 21,536.67 Million |

| Market Size by 2030 | US$ 45,926.87 Million |

| Global CAGR (2022 - 2030) | 9.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

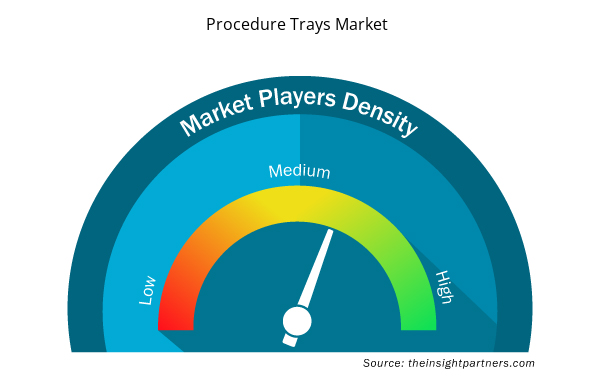

Market Players Density: Understanding Its Impact on Business Dynamics

The Procedure Trays Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Procedure Trays Market are:

- Biometrix

- Medica Europe BV

- BD

- 3M

- Owens & Minor Inc

- Molnlycke Health Care AB

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Procedure Trays Market top key players overview

Procedure Trays Market News and Recent Developments

The Procedure Trays Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the procedure trays market are listed below:

- HealthpointCapital acquired of a majority stake in SteriCUBE Holdings, Inc. (Source: HealthpointCapital, Company Website, April 2024)

- ICU Medical Inc. acquired Smiths Medical from Smiths Group plc. The Smiths Medical business includes syringe and ambulatory infusion devices, vascular access, and vital care products. Combined with ICU Medical’s existing businesses, the companies create a leading infusion therapy company with estimated pro forma combined revenues of approximately $2.5 billion. (Source: ICU Medical Inc, Company Website, January 2022)

Procedure Trays Market Report Coverage and Deliverables

The “Procedure Trays Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Procedure trays market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Procedure trays market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Procedure trays market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the procedure trays market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Social Employee Recognition System Market

- Latent TB Detection Market

- Automotive Fabric Market

- Microplate Reader Market

- Real-Time Location Systems Market

- Customer Care BPO Market

- Electronic Data Interchange Market

- Dropshipping Market

- Transdermal Drug Delivery System Market

- Analog-to-Digital Converter Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Application, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The market is expected to register a CAGR of 10.0% during 2023–2031.

Biometrix, Medica Europe BV, BD, 3M Owens & Minor Inc, Molnlycke Health Care AB, Nelipak Corporation, Cardinal Health Inc, Teleflex Inc, and ICU Medical Inc.

Growing need for cost-effective products by hospitals and surgical centers, customized procedure trays are trending is likely to remain a key trend in the market.

The increasing number of surgeries and surge in medical tourism are the key driving factors behind the market development. However, the concerns about the disposal and standardization of procedure trays are hampering the market growth.

North America dominated the procedure trays market in 2023

Get Free Sample For

Get Free Sample For