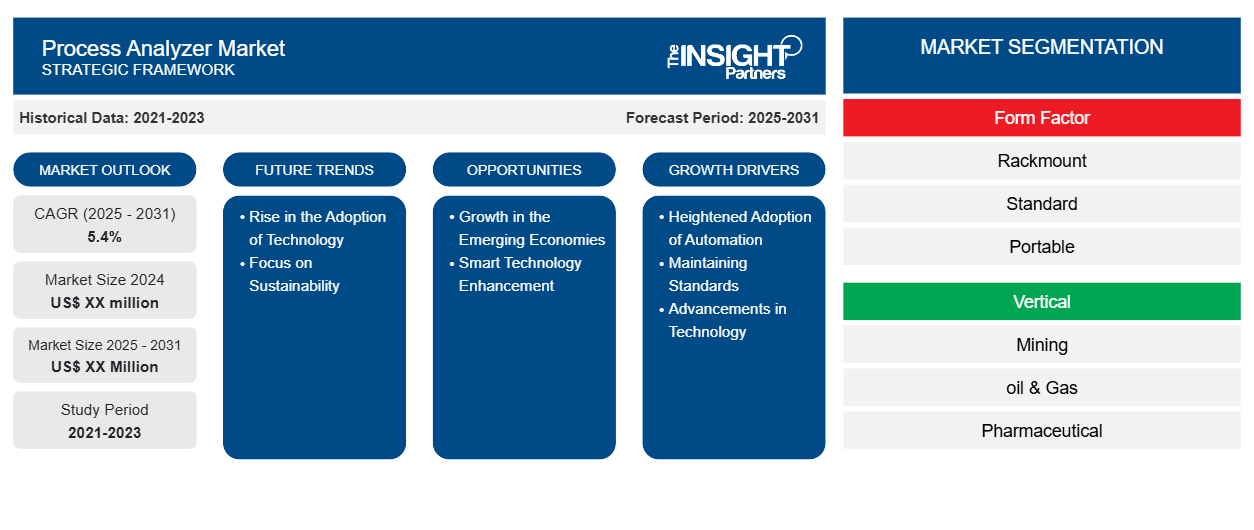

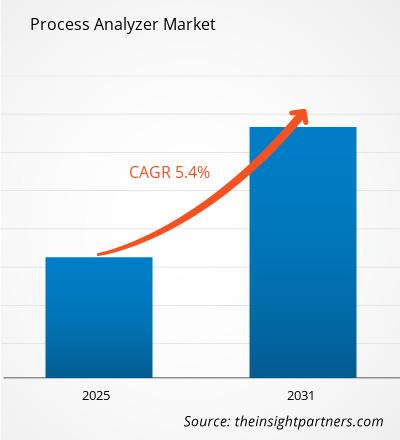

The Process Analyzer Market is expected to register a CAGR of 5.4% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Form Factor (Rackmount, Standard, and Portable) and Vertical (Mining, oil & Gas, Pharmaceutical, Food & Beverage, Power Generation & Transmission, and Others). The global analysis is further broken-down at regional level and major countries. The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report Process Analyzer Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Process Analyzer Market Segmentation

Form Factor

- Rackmount

- Standard

- Portable

Vertical

- Mining

- oil & Gas

- Pharmaceutical

- Food & Beverage

- Power Generation & Transmission

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Process Analyzer Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Process Analyzer Market Growth Drivers

- Heightened Adoption of Automation: The increasing trend toward automation in sectors such as oil and gas, pharmaceuticals, and food processing, among others, is fueling the need for process analyzers. These devices save time, minimize human error, and help maintain the standards of production, which makes them a must-have tool in today's world of manufacturing.

- Maintaining Standards: Due to ever more strict safety and environmental regulations, industries have no choice but to upgrade and install new and high-performance process analyzers. These devices essentially assist in overcoming challenges of adherence to regulations by the provision of precise information and constant monitoring; hence, risks of non-adherence are reduced.

- Advancements in Technology: The process of analyzers has been made better through revolutionized sensor technologies and analytic data. The incorporation of features like real-time data and linked IoT systems enhances the efficiency of the machines and the sectors where they are applied.

Process Analyzer Market Future Trends

- Rise in the Adoption of Technology: There is a growing tendency to gravitate toward the digitization of manufacturing processes, which is altering the process analyzer economy. Firms are turning to more and more automated and computerized means of gathering information for production management and other purposes.

- Focus on Sustainability: Environmental initiatives are getting more attention and focus from industries and organizations alike. Consequently, waste processors, energy-consuming machinery, and other process analyzers that help in accomplishing green practices are being preferred more by the companies to achieve their sustainability targets.

Process Analyzer Market Opportunities

- Growth in the Emerging Economies: Industrialization economy-wide has been rapid in developing countries, and therefore, manufacturing process analyzers' growth potential lies in such regions. As these areas develop the existing infrastructures and use more sophisticated technologies, the need for such efficient systems is projected to grow.

- Smart Technology Enhancement: The other potential opportunity is the incorporation of process analyzers with smart technologies such as AI and machine learning. Such integrations present the opportunity for predictive maintenance as well as improving management, making it possible to optimize operations and lower downtime.

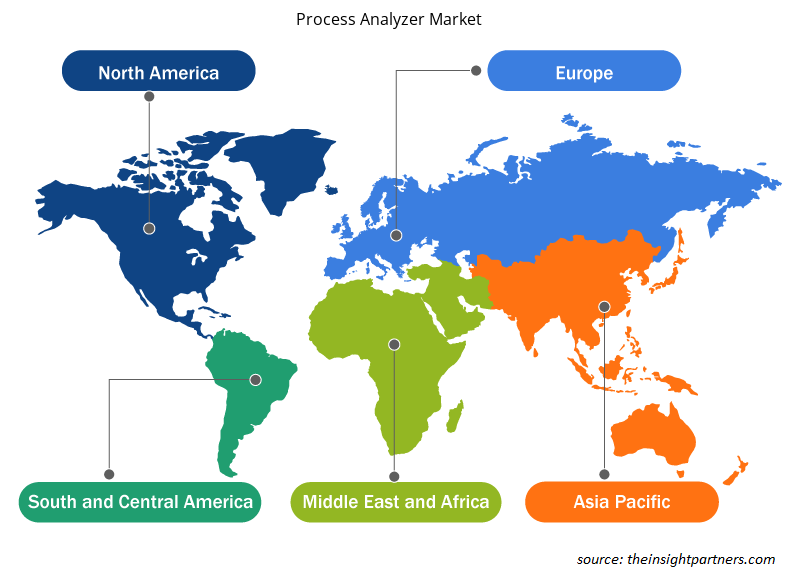

Process Analyzer Market Regional Insights

The regional trends and factors influencing the Process Analyzer Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Process Analyzer Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Process Analyzer Market

Process Analyzer Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 5.4% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Form Factor

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Process Analyzer Market Players Density: Understanding Its Impact on Business Dynamics

The Process Analyzer Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Process Analyzer Market are:

- ABB Ltd.

- Hach Lange GmbH

- Honeywell International, Inc.

- Teledyne Technologies, Inc.

- Endress+Hauser AG

- GE Analytical Instruments

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Process Analyzer Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Process Analyzer Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Process Analyzer Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Clinical Trial Supplies Market

- Aesthetic Medical Devices Market

- Flexible Garden Hoses Market

- Online Recruitment Market

- Electronic Signature Software Market

- Photo Printing Market

- Sexual Wellness Market

- Grant Management Software Market

- Wind Turbine Composites Market

- Cosmetic Bioactive Ingredients Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Some of the customization options available based on the request are an additional 3–5 company profiles and country-specific analysis of 3–5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation#as our team would review the same and check the feasibility

The Process Analyzer Market is estimated to witness a CAGR of 5.4% from 2024 to 2031

Heightened Adoption of Automation and Maintaining Standards are the major factors driving the process analyzer market.

Rise in the adoption of technology is likely to remain a key trend in the market.

Key players in the process analyzer market include ABB Ltd., Hach Lange GmbH, Honeywell International, Inc, Teledyne Technologies, Inc., Endress+Hauser AG, GE Analytical Instruments, Mettler-Toledo International Inc., The Emerson Electric Company, Thermo Fisher Scientific, Inc., and Yokogawa Electric Corp.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies

1. ABB Ltd.

2. Hach Lange GmbH

3. Honeywell International, Inc.

4. Teledyne Technologies, Inc.

5. Endress+Hauser AG

6. GE Analytical Instruments

7. Mettler-Toledo International Inc.

8. The Emerson Electric Company

9. Thermo Fisher Scientific, Inc.

10. Yokogawa Electric Corp.

Get Free Sample For

Get Free Sample For