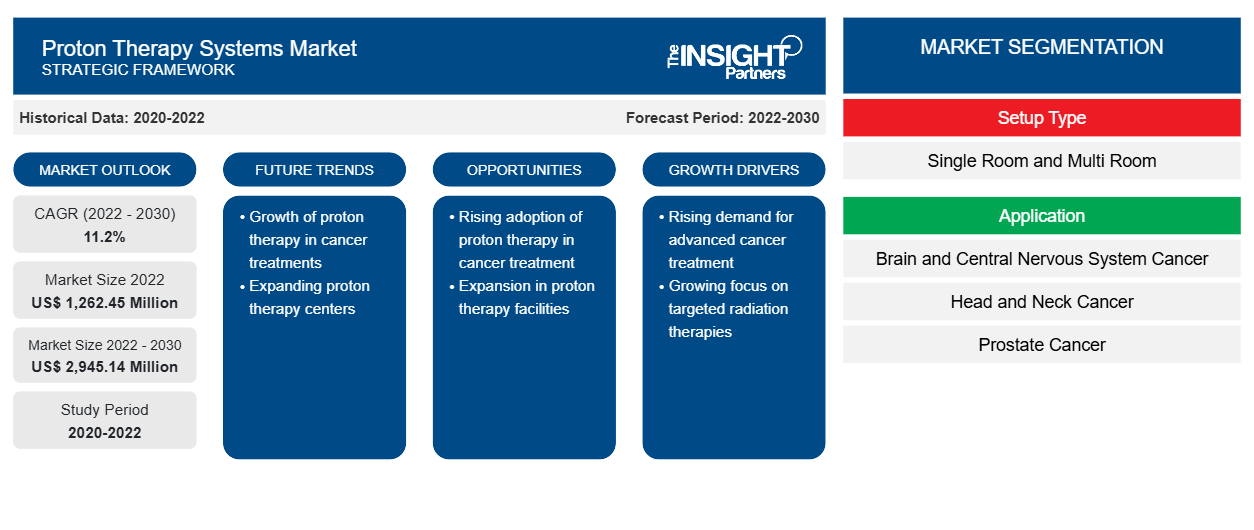

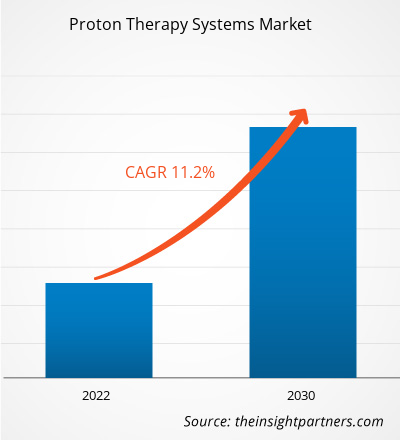

[Research Report] The proton therapy systems market is projected to grow from US$ 1,262.45 million in 2022 to US$ 2,945.14 million by 2030; it is estimated to record a CAGR of 11.2% during 2022–2030.

Market Insights and Analyst View:

The proton therapy systems market forecast can help stakeholders in this marketplace outline their growth strategies.

A proton therapy system is an advanced medical device employed to provide a highly precise radiation treatment for tumors. These systems are huge in size, and they consist of an accelerator (cyclotron), beam transport system, energy selection system, and rotating gantry irradiation equipment. Due to its effectiveness in treating certain types of cancer, there has been a growing demand for proton therapy worldwide. Factors such as rising demand for advanced treatments with the surging cancer incidence, and increasing government support for proton therapy centers propel the proton therapy systems market growth. However, the high cost and large area of proton therapy systems hamper the growth of the market. Further, the growing adoption of personalized treatment approaches with technological advancements is expected to bring new proton therapy systems market trends in the coming years.

Growth Drivers:

Rising Demand for Advanced Treatments with Surging Cancer Incidence Drives Market Growth

As per the International Agency for Research on Cancer (IARC), lung, breast, and prostate cancer types had the highest incidence rate in 2022. These diseases have an age-standardized rate of 23.6, 47.1, and 29.4 cases per 100,000 population, respectively. According to the estimates by IARC, the number of total cancer cases is expected to jump from 19.98 million in 2022 to 23.71 million by 2030 and 30.97 million by 2045. Various cancer conditions, such as head and neck cancers (nasal, oral, eye, and larynx) and brain cancers have precise treatment requirements, which results in a high demand for advanced treatment approaches such as intensity-modulated proton therapy (IMPT). In traditional radiation therapies, such as X-ray radiation therapy, the healthy tissue around the tumor also receives a dose of radiation, which leads to side effects and may cause secondary cancers. However, proton therapy aids in the effective treatment of complicated tumors in the brain, and head and neck region while minimizing the collateral damage to nearby tissues. Thus, the high prevalence of cancer and demand for advanced treatments boost the demand for proton-based radiotherapy, fueling the proton therapy systems market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Proton Therapy Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Proton Therapy Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Restraint:

High Cost and Large Area of Proton Therapy Systems

A proton therapy system is an advanced medical device used in highly precise radiation treatment for tumors. It is a huge medical device that consists of an accelerator (cyclotron), beam transport system, energy selection system, and rotating gantry irradiation equipment, which results in large surface areas and high cost of equipment. According to the University of Pennsylvania (Oncolink), cyclotrons of the proton therapy systems weigh up to 200 tons and have 6–12 feet of diameter. The gantry can be 100 tons in weight and 40 feet in diameter. According to a study published (2021) in IOPscience, even the compact design (single-room setup) entails an area of 100 sq. m., while multi-room proton therapy systems occupy 200–400 sq. m. of area.

Further, proton therapy systems are highly capital-intensive. For instance, a single-room system may cost nearly US$ 30–50 million. The cost of multi-gantry proton systems may start from US$ 300 million onwards, and they are usually installed only in large hospitals and university systems. Therefore, high capital investment requirements and large installation areas are among the factors hindering the growth of the proton therapy systems market.

Report Segmentation and Scope:

The proton therapy systems market analysis has been carried out by considering the following segments: setup type and application.

By setup type, the market is bifurcated into single room and multi room. The multi room segment held a larger proton therapy systems market share in 2022. Further, the single room segment is anticipated to register a faster CAGR during the forecast period.

The market, by application, is categorized into brain and central nervous system cancer, head and neck cancer, prostate cancer, breast cancer, lung cancer, gastrointestinal cancer, and others. The brain and central nervous system cancer segment held the largest proton therapy systems market share in 2022, and it is anticipated to register the highest CAGR during the forecast period.

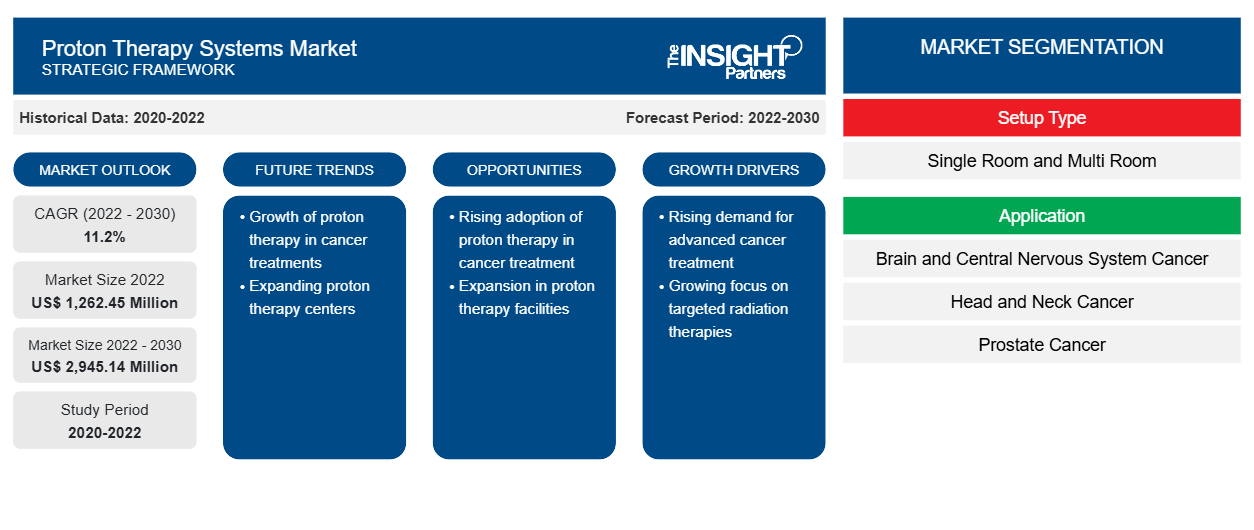

Regional Analysis:

In terms of geography, the scope of the proton therapy systems market report includes North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In 2022, North America accounted for the largest market share. The growing acceptance and adoption of the latest medical devices, the high prevalence of cancer, and product innovations by key players contribute to the expansion of the proton therapy systems market size in North America. According to the American Cancer Society estimates, the US recorded ~1.95 million new cancer cases and ~0.61 million mortalities related to the disease in 2023, exhibiting a significant increase from 1.60 million cancer cases and 0.60 million deaths reported in 2020. As per the Particle Therapy Co-Operative Group, at the end of 2023, the US had the highest number of proton therapy systems globally, with 46 proton therapy treatment facilities.

Proton Therapy Systems Market Regional Insights

Proton Therapy Systems Market Regional Insights

The regional trends and factors influencing the Proton Therapy Systems Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Proton Therapy Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Proton Therapy Systems Market

Proton Therapy Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,262.45 Million |

| Market Size by 2030 | US$ 2,945.14 Million |

| Global CAGR (2022 - 2030) | 11.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Setup Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

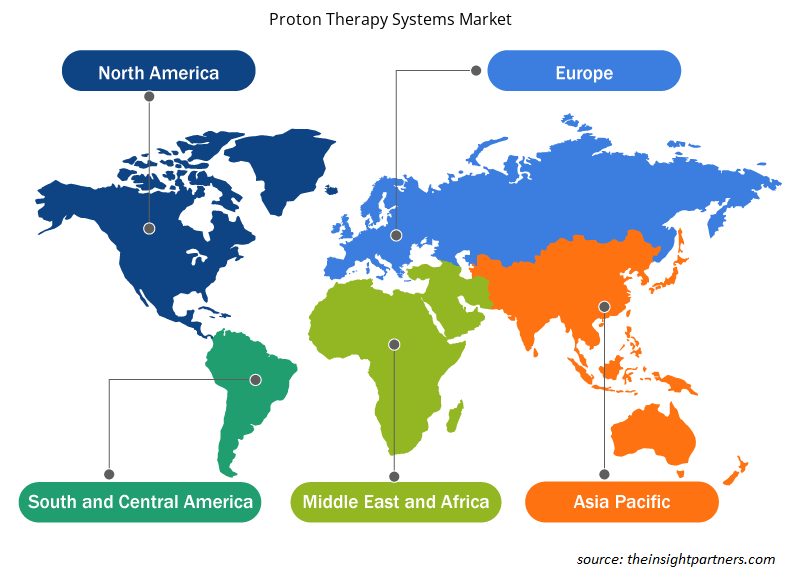

Proton Therapy Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Proton Therapy Systems Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Proton Therapy Systems Market are:

- Varian Medical Systems Inc

- Hitachi Ltd

- Sumitomo Heavy Industries Limited

- Ion Beam Applications SA

- Mevion Medical Systems

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Proton Therapy Systems Market top key players overview

Industry Developments and Future Opportunities:

A few strategic developments by leading players operating in the proton therapy systems market, as per the company press releases, are listed below:

- In January 2024, OncoRay launched the prototype for a whole-body MRI-guided proton therapy system for the real-time tracking of moving tumors using magnetic resonance imaging (MRI) during proton therapy. The MRI aids in the visualization of tumors in enhanced contrast, which is its major advantage over conventional imaging modalities. Better contrast makes it possible to better delineate the tumor from surrounding healthy tissue and to define the volume to be irradiated with greater accuracy.

- In December 2023, HKSH Medical Group opened a new proton therapy center at the HKSH Eastern Medical Centre in A Kung Ngam, Shau Kei Wan, Hong Kong. The new center features an advanced proton therapy system and two state-of-the-art treatment rooms. The system includes two half-rotating proton therapy gantries, the latest beam transport system, and a synchrotron-based accelerator.

Competitive Landscape and Key Companies:

Varian Medical Systems Inc, Sumitomo Heavy Industries Ltd, Hitachi Ltd, Ion Beam Applications SA, Mevion Medical Systems, Provision Healthcare LLC, ProTom International, Optivus Proton Therapy Inc, Advanced Oncotherapy plc, and B dot Medical Inc are among the prominent companies profiled in the proton therapy systems market report. These companies focus on developing new technologies, upgrading existing products, and expanding their geographic presence to meet the growing consumer demand worldwide.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Social Employee Recognition System Market

- Semiconductor Metrology and Inspection Market

- Dairy Flavors Market

- Rare Neurological Disease Treatment Market

- Transdermal Drug Delivery System Market

- Genetic Testing Services Market

- Diaper Packaging Machine Market

- Electronic Health Record Market

- Bioremediation Technology and Services Market

- Cell Line Development Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Setup Type, Application, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

A proton therapy system is an advanced medical device employed to provide a highly precise radiation treatment for tumors. These systems are huge in size, and they consist of an accelerator (cyclotron), beam transport system, energy selection system, and rotating gantry irradiation equipment. Due to its effectiveness in treating certain types of cancer, there has been a growing demand for proton therapy worldwide.

Factors such as rising demand for advanced treatments with the surging cancer incidence, and increasing government support for proton therapy centers propel the proton therapy systems market growth. However, the high cost and large area of proton therapy systems hamper the growth of the market.

The proton therapy systems market is expected to be valued at US$ 2,945.14 million in 2030.

The proton therapy systems market majorly consists of the players, including Varian Medical Systems Inc, Sumitomo Heavy Industries Ltd, Hitachi Ltd, Ion Beam Applications SA, Mevion Medical Systems, Provision Healthcare LLC, ProTom International, Optivus Proton Therapy Inc, Advanced Oncotherapy plc, and B dot Medical Inc

By setup type, the market is bifurcated into single room and multi room. The multi room segment held a larger proton therapy systems market share in 2022. Further, the single room segment is anticipated to register a faster CAGR during the forecast period.

The proton therapy systems market was valued at US$ 1,262.45 million in 2022.

The market, by application, is categorized into brain and central nervous system cancer, head and neck cancer, prostate cancer, breast cancer, lung cancer, gastrointestinal cancer, and others. The brain and central nervous system cancer segment held the largest proton therapy systems market share in 2022, and it is anticipated to register the highest CAGR during the forecast period.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Proton Therapy Systems Market

- Varian Medical Systems Inc

- Hitachi Ltd

- Sumitomo Heavy Industries Limited

- Ion Beam Applications SA

- Mevion Medical Systems

- Provision Healthcare LLC

- ProTom International

- Optivus Proton Therapy Inc

- Advanced Oncotherapy plc

- B dot Medical Inc

Get Free Sample For

Get Free Sample For