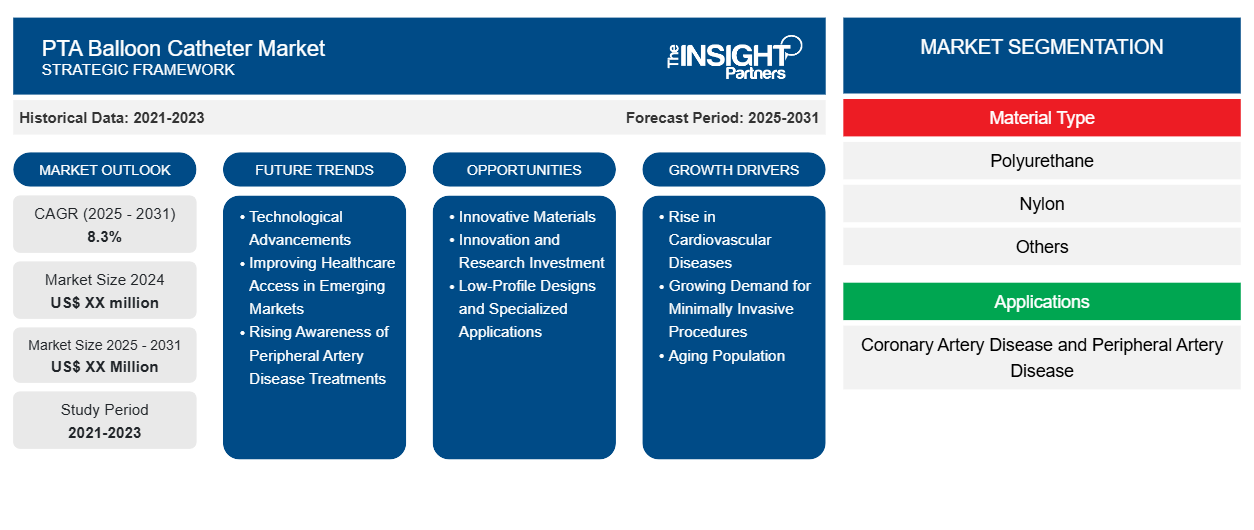

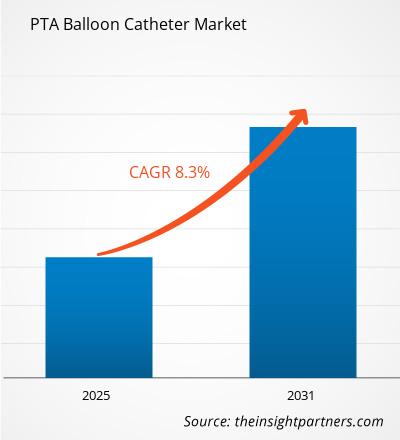

The PTA Balloon Catheter Market is expected to register a CAGR of 8.3% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by PTA Balloon Catheter Market By Material Type (Polyurethane, Nylon, and Others), Applications (Coronary Artery Disease and Peripheral Artery Disease), End-user (Hospitals, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America). The global analysis is further broken-down at regional level and major countries. The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report PTA Balloon Catheter Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

PTA Balloon Catheter Market Segmentation

Material Type

- Polyurethane

- Nylon

- Others

Applications

- Coronary Artery Disease and Peripheral Artery Disease

End-user

- Hospitals

- Ambulatory Surgical Centers

- Others

Geography

- North America

- Europe

- Asia-Pacific

- South and Central America

- Middle East and Africa

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

PTA Balloon Catheter Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

PTA Balloon Catheter Market Growth Drivers

- Rise in Cardiovascular Diseases: One of the main causes is the increase in cardiovascular conditions including peripheral artery disease and coronary artery disease. This tendency is especially noticeable in North America and Europe, where the prevalence of these conditions makes PTA balloon catheters and other efficient treatment options necessary.

- Growing Demand for Minimally Invasive Procedures: Because of their benefits over traditional surgery, such as shorter recovery periods and fewer complications, there is a noticeable trend toward minimally invasive surgical techniques. PTA balloon catheters are becoming more widely used in a variety of medical procedures as a result of this trend.

- Aging Population: The need for PTA balloon catheters is increased by the growing number of older people worldwide, which is correlated with an increased incidence of cardiovascular disorders. Conditions needing angioplasty procedures are more common in the elderly. Such a factor has assisted the overall market growth in the recent past and is expected to continue a similar trend during the forecast period.

PTA Balloon Catheter Market Future Trends

- Technological Advancements: The effectiveness and safety of PTA operations are being improved by advancements in catheter design and materials. Healthcare practitioners are drawn to newer goods that have better deliverability, tractability, and inflation capabilities.Such a factor has assisted the overall market growth in the recent past and is expected to continue a similar trend during the forecast period.

- Improving Healthcare Access in Emerging Markets: More patients are getting prompt treatments for cardiovascular ailments as healthcare infrastructures in areas like Asia-Pacific improve. Government programs that attempt to improve healthcare delivery systems further support this. Such a factor has assisted the overall market growth in the recent past and is expected to continue a similar trend during the forecast period.

- Rising Awareness of Peripheral Artery Disease Treatments: The market is expanding as a result of individuals' and healthcare professionals' growing knowledge of peripheral artery disease and its available treatments. The need for efficient treatments like PTA balloon catheterization is fueled by this awareness.Such a factor has assisted the overall market growth in the recent past and is expected to continue a similar trend during the forecast period.

PTA Balloon Catheter Market Opportunities

- Innovative Materials: The flexibility and longevity of PTA balloon catheters have increased with the advent of cutting-edge technologies like hydrophilic coatings and biocompatible polymers. By lowering friction during procedures, these materials facilitate easier passage through vascular systems and lessen blood vessel damage.

- Innovation and Research Investment: One significant development is the creation of drug-coated balloons, or DCBs. By releasing therapeutic chemicals that prevent cell growth, these devices dramatically lower the risk of restenosis, or re-narrowing of the arteries, following surgery. This two-pronged system makes angioplasty procedures more successful.

- Low-Profile Designs and Specialized Applications: The variety of disorders that can be treated with PTA procedures has expanded thanks to modern low-profile balloon designs that provide access to smaller vessels and intricate anatomies. When treating patients with different vascular issues, this flexibility is essential. For certain procedures, such balloon valvuloplasty and atrial septostomy, technological advancements have produced specialized balloon catheters that can be used on both adult and juvenile patients. This diversity raises demand overall and creates new market niches.

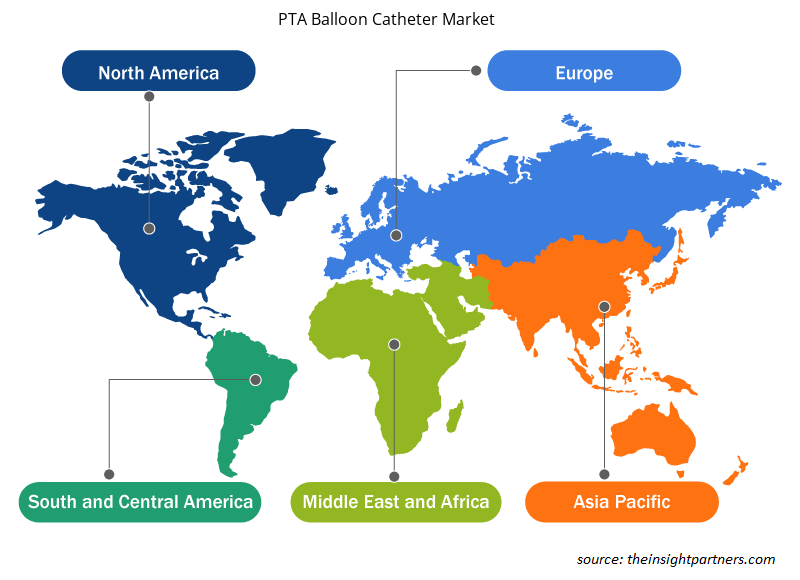

PTA Balloon Catheter Market Regional Insights

The regional trends and factors influencing the PTA Balloon Catheter Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses PTA Balloon Catheter Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for PTA Balloon Catheter Market

PTA Balloon Catheter Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 8.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Material Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

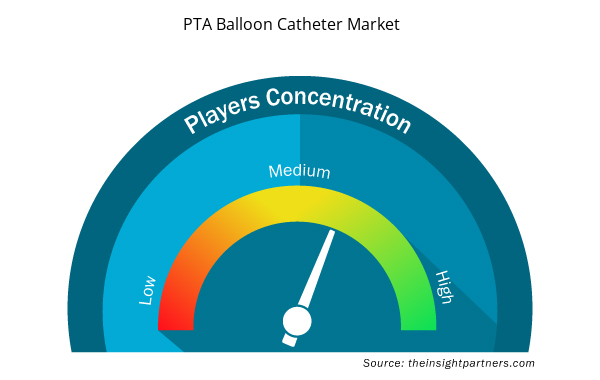

PTA Balloon Catheter Market Players Density: Understanding Its Impact on Business Dynamics

The PTA Balloon Catheter Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the PTA Balloon Catheter Market are:

- Medtronic plc

- Terumo Corporation

- Cardinal Health

- Boston Scientific Corporation

- Natec Medical and Surmodics, Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the PTA Balloon Catheter Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the PTA Balloon Catheter Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the PTA Balloon Catheter Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Budgetary Constraints

Innovative Materials

Asia Pacific region is expected to witness the highest growth during the forecast period

Europe region is expected to witness a high growth rate in terms of CAGR after Asia Pacific region during the forecast period

The PTA Balloon Catheter Market is estimated to witness a CAGR of 8.3% from 2023 to 2031

Rise in Cardiovascular Diseases

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies

1. Medtronic plc

2. Terumo Corporation

3. Cardinal Health

4. Boston Scientific Corporation

5. Natec Medical and Surmodics, Inc

6. Cook Medical

7. Biotronik

8. Andratec

9. Stron Medical.

10. Freudenberg Medical

Get Free Sample For

Get Free Sample For