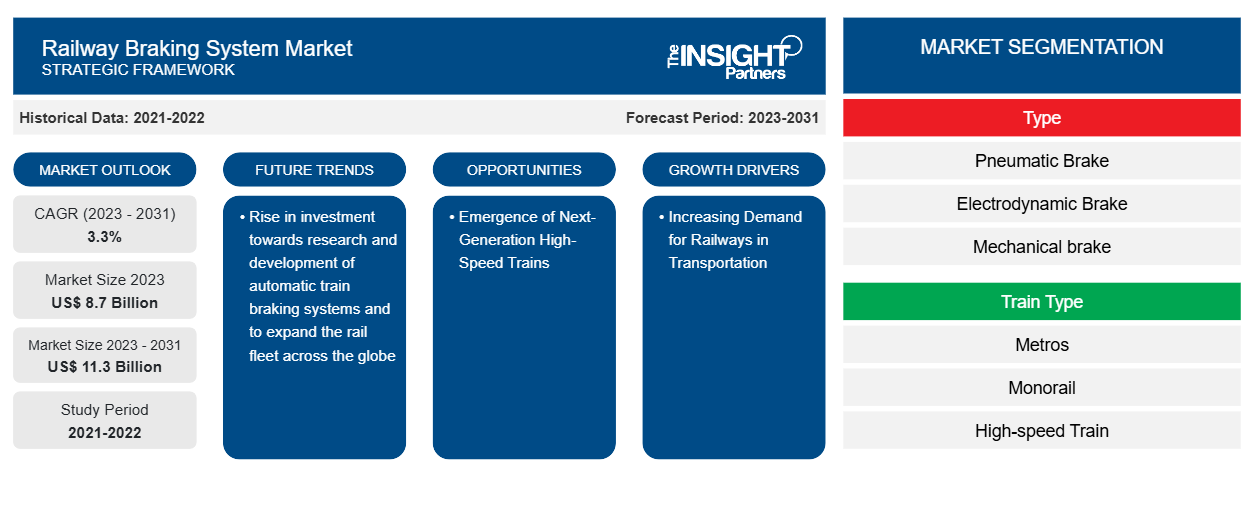

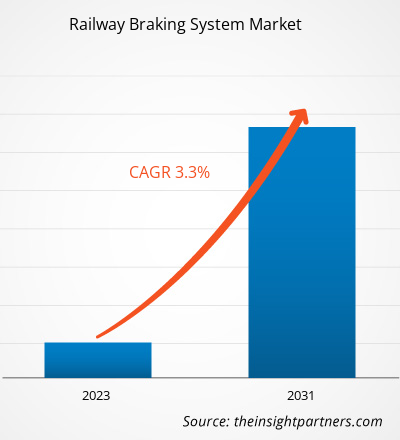

The railway braking system market size is projected to reach US$ 11.3 billion by 2031 from US$ 8.7 billion in 2023. The market is expected to register a CAGR of 3.3% in 2023–2031. Rise in investment towards research and development of automatic train braking systems and to expand the rail fleet across the globe are among the key trends driving the railway braking system market.

Railway Braking System Market Analysis

Factors such as increasing demand for rail transit among individuals as a mode of transportation and growing railway projects for building new rail and lines in metro, monorail, and high-speed rail. Projects coupled with rising government investment for expanding their railway sector are continuing towards strengthening of railway sector. With the rising railway sector, the scope of integrating safety systems, including brakes, is receiving high momentum. In addition, the arrival of automatic train braking systems, automatic train operations, and next-generation high-speed trains in emerging economies is another factor drawing market growth of braking systems. Moreover, the rising number of volume packages and trade in nations is impacting the use of railways, as it is the cheapest mode of transportation compared to airways. Therefore, booming freight business, the development cycle of freight rail has also increased. With the growing development of light rail, the integration of braking systems will also increase.

Railway Braking System Market Overview

In light of key megatrends like sustainability, urbanization, mobility vehicles, and digitalization, the transportation industry is witnessing huge growth. The trends mentioned above will benefit the railway sector by providing long-term sustainable growth opportunities for future mobility. In addition, owing to strict safety and quality standards involved in the railway sector, the integration of advanced systems and equipment is increasing. In the railway sector, the tracks with double elastic fastening, automated driving, overhead power cables/third rail, and communications-based train control signaling systems are among the few technologies, which are getting integrated into metro lines. Incorporation of such advanced technologies into the metro rails will play an essential role in increasing the scope for integrating rail-braking systems.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Railway Braking System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Railway Braking System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Railway Braking System Market Drivers and Opportunities

Increasing Demand for Railways in Transportation

Railway transportation is majorly considered a secure, safe, and economical mode of transportation when compared with road transportation. Pertaining to factors such as high precision and capability to cover a maximum geographic area, the demand among travelers is growing. To ensure the safety of trains, freight, and passengers, braking systems are among the systems used in rails. In addition, government projects like Dubai Route 2020 Metro for building new rail infrastructure and increasing investments to expand train connectivity are contributing towards the growth of the railway sector. The demand for railways for freight transport is rising as well. With the increasing volume of packages and goods transported through railways, the number of trains is increasing. Massive transportation of freight through railways is creating lucrative opportunities for both train and other train-related system manufacturers. Thus, this aspect of increasing freight transport and rail passengers is boosting the growth of the railways sector and motivating governments of countries to invest heavily in rail projects.

Emergence of Next-Generation High-Speed Trains

In the time of constant technological advancements, the railway industry worldwide is experiencing new technologies and systems that are playing a crucial role in transforming the entire sector. For instance, in April 2024, South Korea unveils a next-generation high-speed bullet train. This train has a maximum speed of 320 Kmph. In addition, in October 2023, France unveiled its next-generation high-speed TGV M trains, and is expected to be in service in 2025. Such technological advancement and the emergence of high-speed trains across the globe are projected to drive the demand for the railway braking system market during the forecast period.

Also, the advent of next-generation air disk brakes is making its path for transforming rails. In addition, in the direct braking system, the brake commands are transmitted quickly with a shorter time lag. Furthermore, Shift2Rail- a joint undertaking is working on a digital brake testing solution, which would allow the drivers to test brakes from their cabins through a tablet. This digital brake testing solution would help in saving time and labor costs while enhancing flexibility & safety. In the period of next-generation mobility, the emergence of high-speed trains, digital testing brake solutions, and next-generation brakes would help make the railway sector ready for the future. All mentioned aspects are projected to hold a significant position in the adoption of railway braking systems.

Railway Braking System Market Report Segmentation Analysis

Key segments that contributed to the derivation of the railway braking system market analysis are type and train type.

- Based on type, the railway braking system market has been divided into pneumatic brakes, electrodynamic brakes, mechanical brakes, and electromagnetic brakes. The pneumatic brake inches segment held a larger market share in 2023.

- Based on the train type, the railway braking system market has been divided into metros, monorail, high-speed trains, light rail/trams, and freight trains. The light rail/trams line segment held a larger market share in 2023.

Railway Braking System Market Share Analysis by Geography

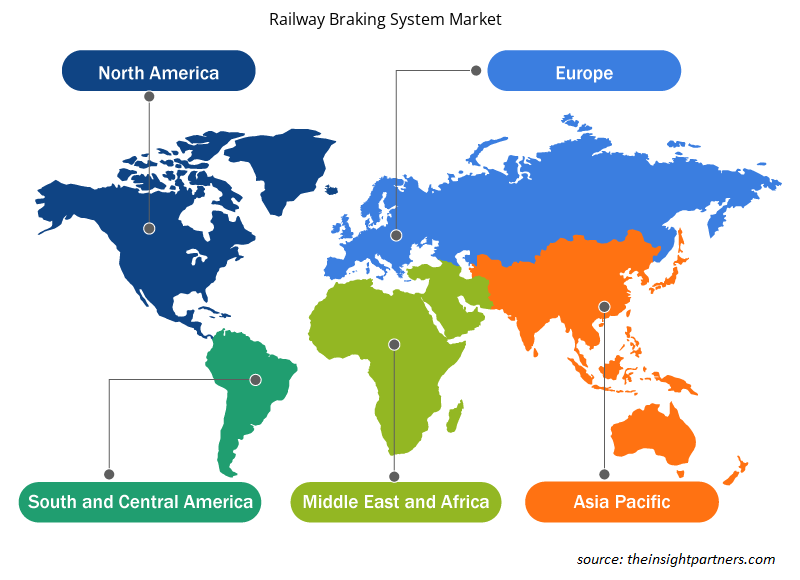

The geographic scope of the railway braking system market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East and Africa, and South America.

Asia Pacific will dominate the railway braking system market in 2023. The Asia Pacific region includes Australia, China, Japan, India, South Korea, & the Rest of Asia Pacific. Stable economies and technological advancements support the growth of a diversified range of industries and markets in the region. The regional railway network connectivity in the Southeast Asia region is becoming better due to the implementation of several projects to connect existing routes under the Pan Asia railway network. New rail projects supported and planned by the government of China would ensure connections between major cities in the Southeast Asia mainland—stretching from Kunming in China to Bangkok, Singapore, and Kuala Lumpur, with a central line from Vientiane in Laos to Bangkok; an eastern line through Hanoi City & Ho Chi Minh City in Vietnam and Phnom Penh City in Cambodia; and a western line through Yangon in Myanmar.

Indonesia and the Philippines also planned railway projects to connect key cities with their major islands. The railway sectors of the Philippines, Thailand, China, and India are making huge investments in their respective territories to strengthen rail transit by integrating advanced technologies. In addition, Japan is amongst the major countries that are into using high-speed rail to lower congestion on roads and help passengers save both time & money.

Railway Braking System Market Regional Insights

The regional trends and factors influencing the Railway Braking System Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Railway Braking System Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Railway Braking System Market

Railway Braking System Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 8.7 Billion |

| Market Size by 2031 | US$ 11.3 Billion |

| Global CAGR (2023 - 2031) | 3.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

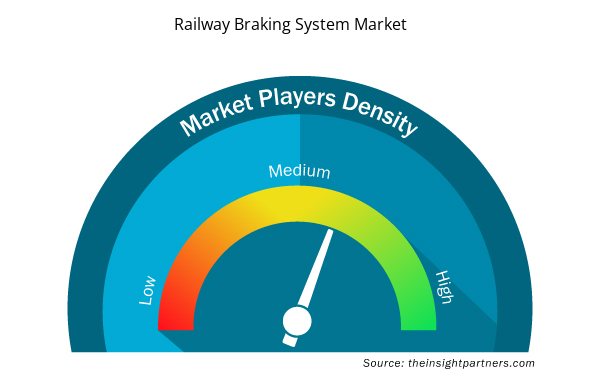

Railway Braking System Market Players Density: Understanding Its Impact on Business Dynamics

The Railway Braking System Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Railway Braking System Market are:

- DAKO-CZ

- Akebono Brake Industry Co., Ltd.

- Amsted Rail

- Knorr-Bremse AG

- Nabtesco Corporation

- Sabre Rail Services Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Railway Braking System Market top key players overview

Railway Braking System Market News and Recent Developments

The railway braking system market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for railway braking systems market and strategies:

- In January 2024, Wabtec Corporation ordered a US$ 157 million brake system from Siemens India Private Limited. Through this supply agreement, Siemens Limited will provide brake systems with improved operating performance, efficiency, and safety for the new line of 1,200 electric locomotives.

- In October 2023, Siemens Mobility launched a new air-free brake system. This new brake system enables full electric control of the friction brake in rail vehicles and strengthens the product portfolio of the company.

Railway Braking System Market Report Coverage and Deliverables

The “Railway Braking System Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, & country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Maritime Analytics Market

- Machine Condition Monitoring Market

- Fertilizer Additives Market

- Mail Order Pharmacy Market

- Arterial Blood Gas Kits Market

- Rare Neurological Disease Treatment Market

- Retinal Imaging Devices Market

- Medical Enzyme Technology Market

- Queue Management System Market

- Dry Eye Products Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type and Train Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For