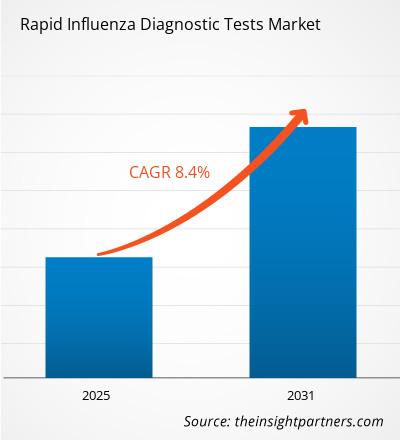

The Rapid Influenza Diagnostic Tests Market is expected to register a CAGR of 8.4% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Type (Hydraulic, Manual, Electronic). The report further presents analysis based on the Application (Dental Laboratory, Hospital, Others). The global analysis is further broken-down at regional level and major countries. The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report Rapid Influenza Diagnostic Tests Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Rapid Influenza Diagnostic Tests Market Segmentation

Test Type

- Influenza A Tests

- Influenza B Test

- Influenza A+B Test

Sample Type

- Nasal Swab

- Throat Swab

- Nasopharyngeal Swab

- Others

Technology

- Immunochromatographic Assays

- Immunofluorescence Assays

- Nucleic Acid Amplification Test

End User

- Hospitals and Clinics

- Diagnostic Centers

- Nursing Homes

- Others

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Rapid Influenza Diagnostic Tests Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Rapid Influenza Diagnostic Tests Market Growth Drivers

- Rising cases of influenza: The growing prevalence of influenza infections, especially the seasonal outbreaks contribute to the increasing demand for its rapid diagnostic tests. Early and effective treatments of the infection are also needed; accordingly, rapid influenza diagnostic tests have become a key tool that healthcare providers have adopted to improve patient outcomes and improve clinical workflows.

- Technological Advancements: Development in the field of diagnostics, for example, improved, and user-friendly rapid influenza tests, are helping enhance the growth of the market. The advancement leads to quicker results, it is more sensitive, and thus a must-have in clinical and point-of-care settings, with more and more healthcare professionals being on board.

- Increased Awareness and Access: More patient and provider awareness about the importance of early diagnosis of influenza-the primary reason for market growth. More access through retail pharmacies and clinics, ensuring rapid testing, makes their use more likely and enhances public health responses during flu seasons.

Rapid Influenza Diagnostic Tests Market Future Trends

- Point-of-Care Testing: The rapid influenza diagnostic tests market goes forward with point-of-care testing. Convenience and speed have been driving healthcare providers to adopt POC tests so that results obtained instantly help them make treatment decisions immediately and can improve patient care as well as resource management in a clinical setting.

- Integration into the Digital Health Trend: Rapid diagnostic tests are increasingly being introduced with digital health technologies, such as mobile applications and telemedicine. It addresses better management of data; remote consultations are taken care of through the integration of medical consultations with patients; it is efficient in monitoring cases of influenza; and overall, it enhances healthcare delivery and engages patients.

- The role of increased government initiative: Increased governmental activities in funding and awareness campaigns boost the usage of rapid influenza diagnostic tests. Such increased initiatives enhance surveillance and control over outbreaks of the flu, hence encouraging the development and delivery of these tests in all public and private facilities.

Rapid Influenza Diagnostic Tests Market Opportunities

- Emerging Markets: Rapidly growing healthcare infrastructure in the emerging markets opens vast opportunities for rapid influenza diagnostic tests. More investments by regions in improving healthcare create rising demand for such effective diagnostic tools, opening scope for manufacturers to tap into new markets and customers.

- Combination Tests Development: The combination tests would enable manufacturers to devise tests which can detect more than one agent responsible for respiratory illness, such as influenza, at the same time. Therefore, this innovation would solve a problem for healthcare providers of having broad and comprehensive testing solutions most desired in an outbreak of respiratory illness.

- Investment on R&D: Newer advanced technologies meant for diagnostics research will attract more investments in R&D. Thus, they can open up new avenues in the rapid influenza diagnostic tests market, focusing more on the precision, quick detection, and easy handling of tests results for the attraction of healthcare providers to provide better public health management at the time of flu seasons.

Rapid Influenza Diagnostic Tests Market Regional Insights

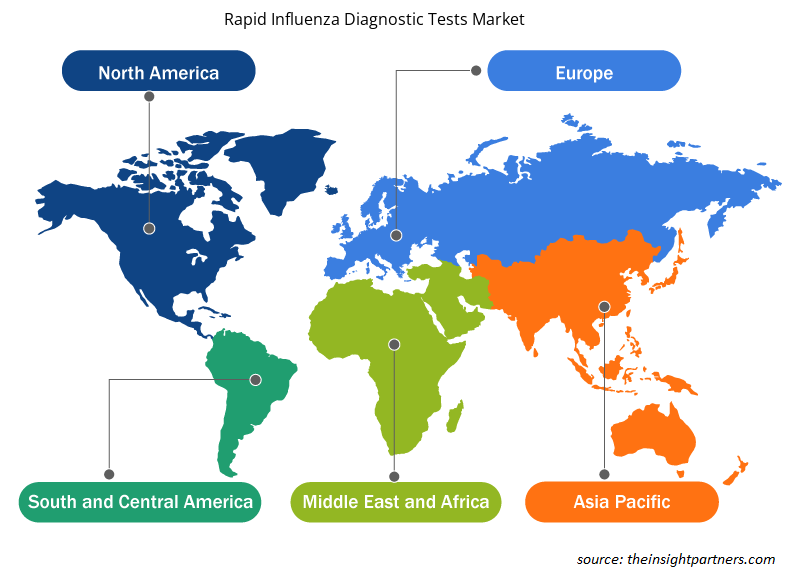

The regional trends and factors influencing the Rapid Influenza Diagnostic Tests Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Rapid Influenza Diagnostic Tests Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Rapid Influenza Diagnostic Tests Market

Rapid Influenza Diagnostic Tests Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 8.4% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Test Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

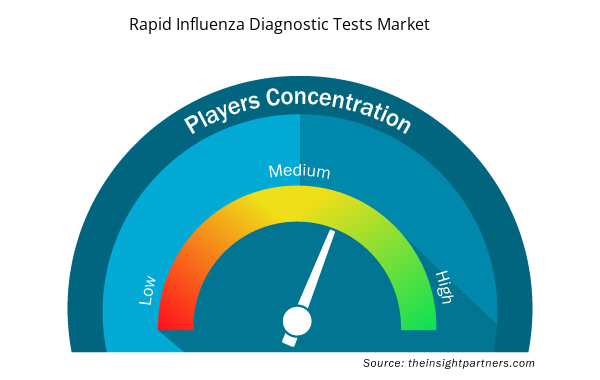

Rapid Influenza Diagnostic Tests Market Players Density: Understanding Its Impact on Business Dynamics

The Rapid Influenza Diagnostic Tests Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Rapid Influenza Diagnostic Tests Market are:

- DiaSorin S.p.A

- Becton Dickinson and Company

- SA Scientific

- CorisBioconcep

- Meridian Bioscience Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Rapid Influenza Diagnostic Tests Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Rapid Influenza Diagnostic Tests Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Rapid Influenza Diagnostic Tests Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The rapid influenza diagnostic tests market is estimated to grow with a CAGR of 8.4% from 2023 to 2031.

Asia-Pacific region is likely to witness the fastest growth rate during the forecast period

The market drivers include rising prevalence of influenza infections and innovations in diagnostic technology are driving the rapid influenza diagnostic tests market.

The rapid influenza diagnostic tests market majorly consists of players such as DiaSorin S.p.A, Becton Dickinson and Company, SA Scientific among others.

Shift towards point-of-care (POC) testing is a significant trend in the rapid influenza diagnostic tests market is likely to remain the key trend during the forecast period.

North America dominated the rapid influenza diagnostic tests market in 2023.

Trends and growth analysis reports related to Life Sciences : READ MORE..

1. DiaSorin S.p.A

2. Becton Dickinson and Company

3. SA Scientific

4. CorisBioconcep

5. Meridian Bioscience Inc.

6. Abbott

7. Analytik Jena

8. Roche

9. Quidel Corporation

10. Princeton BioMeditech Corporation

Get Free Sample For

Get Free Sample For