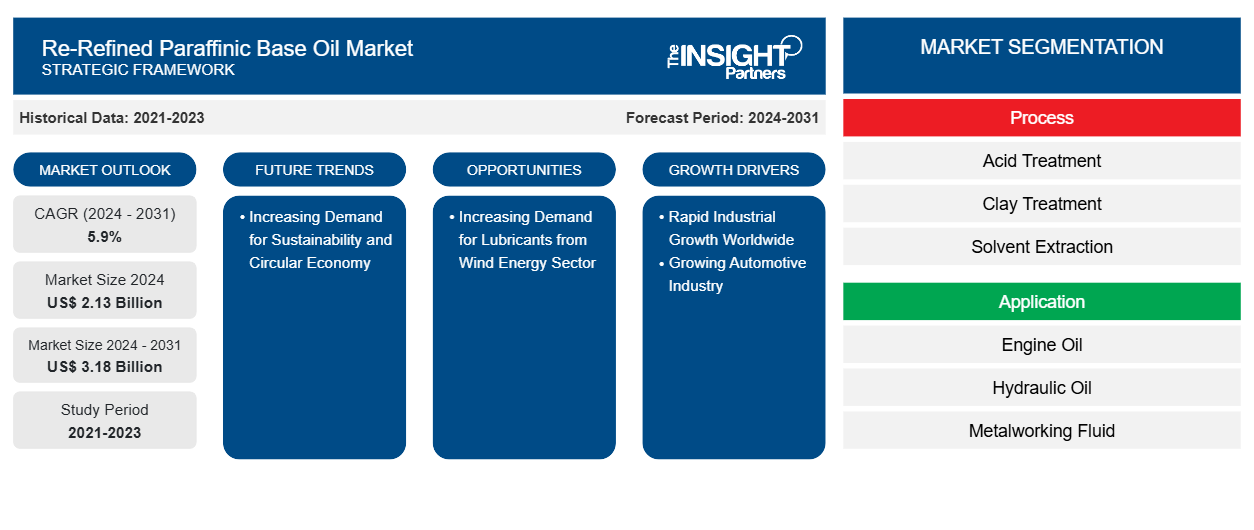

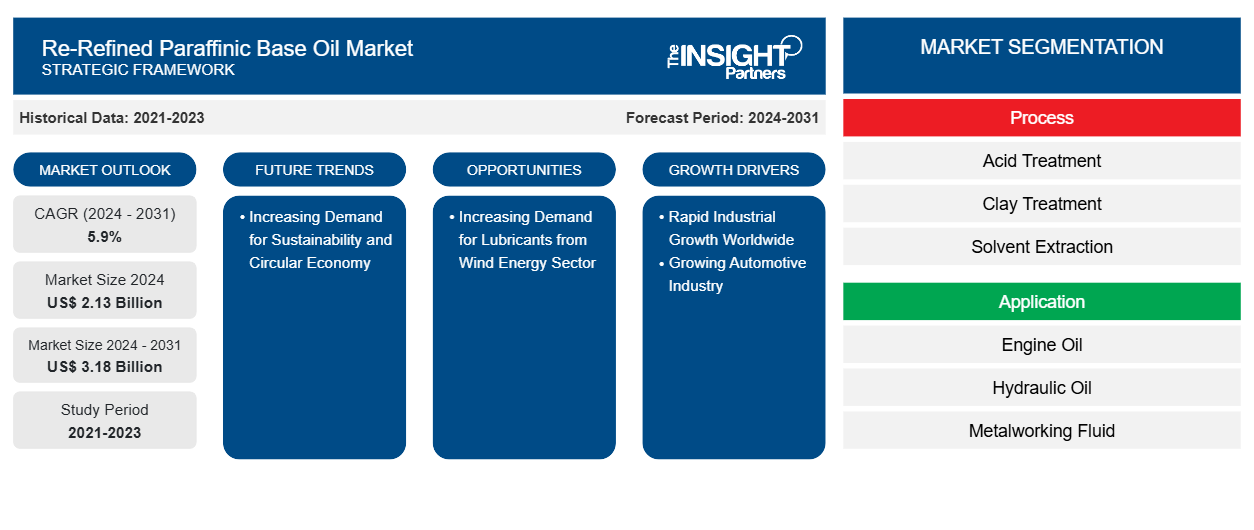

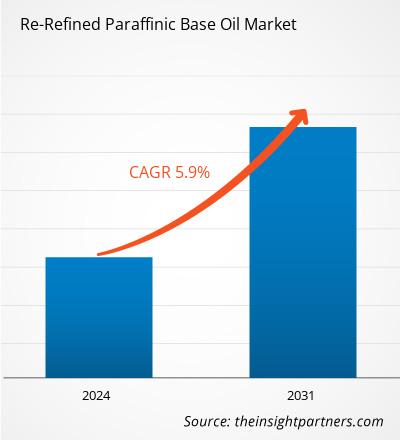

The re-refined paraffinic base oil market size is projected to reach US$ 3.18 billion by 2031 from US$ 2.13 billion in 2024; the market is expected to register a CAGR of 5.9% during 2024–2031. Increased demand for sustainability and circular economy is expected to be a key trend in the market.

Re-Refined Paraffinic Base Oil Market Analysis

The re-refined paraffinic base oil market is witnessing significant growth due to wide application scope. The booming electric vehicle market is fueling the demand for lubricants worldwide. Re-refined paraffinic base oil is used in engine oil, gear oil, and transmission fluids, which are essential for the smooth operation of modern vehicles. In addition, various governments are implementing more stringent environmental regulations, pushing the automotive industry to adopt more sustainable and eco-friendly solutions. Thus, the growing automotive industry in various countries is driving the demand for re-refined paraffinic base oil. Furthermore, the growing demand from wind energy sector to ensure smooth functioning of the wind turbines contributes to its market growth.

Re-Refined Paraffinic Base Oil Market Overview

The re-refined is a vital segment of the lubricants industry. It involves the production and distribution of high-quality base oils derived from re-refined petroleum products. These base oils are essential in manufacturing a wide range of lubricants, including motor oils, transmission fluids, and industrial lubricants. One of the significant driving factors for the re-refined is the growing demand for environmentally friendly and sustainable lubricants across end-use industries. The increasing focus on reducing carbon footprint and minimizing waste has led to a surge in demand for re-refined paraffinic base oils, which offer a more sustainable alternative to traditional base oils.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Re-Refined Paraffinic Base Oil Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Re-Refined Paraffinic Base Oil Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Re-Refined Paraffinic Base Oil Market Drivers and Opportunities

Growing Automotive Industry

The global automotive industry is witnessing high growth due to the growing vehicle production and sales. The increase in population, rise in disposable income, and easy availability of credit and financing are a few key factors boosting automotive vehicle sales. Automotive manufacturers globally are investing in improving their supply chain to increase sales in developing regions. According to the Society of Indian Automobile Manufacturers (SIAM), in India, sales of passenger vehicles increased to 2,854,242 units in November 2023 from 2,409,535 units in November 2022. Similarly, according to the China Association of Automobile Manufacturers (CAAM), China's commercial vehicle sales soared 18.3% year-on-year to ~2.94 million units in the first three quarters of 2023. The automotive industry also paved its way in Brazil and South Africa. According to the National Economic Development and Labour Council (Nedlac), automobile production in South Africa reached 633,332 units in 2023. The South African automotive manufacturing industry ranks 22nd in the world in terms of the number of vehicles produced. It is the largest on the African continent, accounting for more than 54% of vehicles assembled in 2023. According to the International Organization of Motor Vehicle Manufacturers (OICA), Brazil was the largest manufacturer and exporter of light and commercial vehicles in South & Central America in 2023. The country reported production of 2.3 million vehicles in 2022. Globally, the automotive industry is the major consumer of lubricants, and engine oil is the most utilized product in passenger cars and light commercial vehicles. Thus, the growth in the automotive industry in various economies is driving the demand for lubricants.

Increased Demand for Lubricants from Wind Energy Sector

The renewable energy industry is one of the major consumers of industrial lubricants, especially turbine oil and transformer oil. Wind energy is one of the fastest-growing renewable energy technologies, which holds a potential share for consuming lubricants. As per the data published by WindEurope, in 2023, Europe installed 18.3 GW of new wind power capacity and is expected to install 260 GW of new wind power capacity during 2024–2030. As the countries in the region embrace renewable energy sources, particularly wind power, the need for specialized lubricants to ensure the smooth functioning of wind turbines becomes paramount. These lubricants play a crucial role in enhancing the operational efficiency and lifespan of the intricate machinery involved in harnessing wind energy. Moreover, the expanding wind energy sector requires a reliable and consistent supply of high-performance lubricants to mitigate wear and tear, reduce friction, and prevent corrosion in the mechanical components of wind turbines. This demand propels the market for lubricants and opens avenues for research and development, encouraging innovation in lubricant formulations tailored to the unique challenges posed by the wind energy environment.

Re-Refined Report Segmentation Analysis

Key segments that contributed to the derivation of the re-refined analysis are process, application, and end use.

- Based on process, the market is segmented into acid treatment, clay treatment, solvent extraction, and hydrotreating.

- In terms of application, the market is segmented into engine oil, hydraulic oil, metalworking fluid, compressor oil, grease, turbine oil, and others.

- Based on end use, the market is segmented into automotive, construction, mining and metallurgy, marine, energy and power, oil and gas, and others.

Re-Refined Paraffinic Base Oil Market Share Analysis by Geography

The geographic scope of the re-refined paraffinic base oil market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific is expected to record the highest CAGR over the forecast period. The re-refined paraffinic base oil market in Asia Pacific is poised for significant growth, driven by the region's thriving automotive and construction industries. According to the International OICA, Asia-Oceania's vehicle production increased from 50 million in 2022 to 55.1 million in 2023, highlighting the escalating demand for high-quality base oils in manufacturing lubricants. Furthermore, the Government of India's ambitious plans to revamp the country's infrastructure and construction services are expected to bolster the demand for petrochemical-derived products, including re-refined paraffinic base oils. As per the report by the Department for Promotion of Industry and Internal Trade (DPIIT), the Government of India has announced its plans to boost the country's infrastructure and construction services through several policies such as large budget allocation to the infrastructure sector, open FDI norms, and smart cities mission. The real estate industry in India is projected to account for US$ 1 trillion by 2030, along with an increased year-on-year infrastructure Capex by 34% to reach US$ 6.7 million.

Re-Refined Paraffinic Base Oil Market Regional Insights

Re-Refined Paraffinic Base Oil Market Regional Insights

The regional trends and factors influencing the Re-Refined Paraffinic Base Oil Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Re-Refined Paraffinic Base Oil Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Re-Refined Paraffinic Base Oil Market

Re-Refined Paraffinic Base Oil Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 2.13 Billion |

| Market Size by 2031 | US$ 3.18 Billion |

| Global CAGR (2024 - 2031) | 5.9% |

| Historical Data | 2021-2023 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Process

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

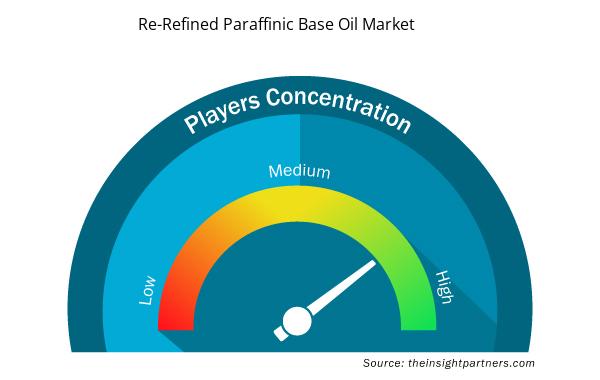

Re-Refined Paraffinic Base Oil Market Players Density: Understanding Its Impact on Business Dynamics

The Re-Refined Paraffinic Base Oil Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Re-Refined Paraffinic Base Oil Market are:

- AVISTA OIL Deutschland GmbH

- Heritage Crystal Clean Inc

- Clean Harbors Inc

- TotalEnergies SE

- Metalub

- Southern Oil

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Re-Refined Paraffinic Base Oil Market top key players overview

Re-Refined Paraffinic Base Oil Market News and Recent Developments

The re-refined paraffinic base oil market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the re-refined paraffinic base oil market are listed below:

- GFL Environmental Inc. announced that it had entered into a definitive agreement to sell its Environmental Services business for an enterprise value of US$ 8.0 billion. The transaction allows GFL Environmental Inc. to efficiently monetize the Environmental Services business tax. (GFL Environmental Inc, Company Website, January 2025)

- TotalEnergies SE acquired Tecoil, a Finnish company specializing in the production of re-refined base oils (RRBOs). This acquisition enabled TotalEnergies SE to strengthen its circular economy network for collecting used lubricants in Europe and supplying its plant. (TotalEnergies SE, Company Website, July 2024)

Re-Refined Paraffinic Base Oil Market Report Coverage and Deliverables

The " Re-Refined Paraffinic Base Oil Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Re-refined paraffinic base oil market size and forecast for all the key market segments covered under the scope

- Re-refined paraffinic base oil market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- Re-refined paraffinic base oil market analysis covering key market trends, country framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the re-refined paraffinic base oil market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Grant Management Software Market

- Single Pair Ethernet Market

- Neurovascular Devices Market

- Explosion-Proof Equipment Market

- Batter and Breader Premixes Market

- Lyophilization Services for Biopharmaceuticals Market

- Power Bank Market

- 3D Audio Market

- Vision Guided Robotics Software Market

- Print Management Software Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

In 2024, the solvent extraction process segment held the largest share of the global re-refined paraffinic base oil market.

The market is expected to register a CAGR of 5.9% during 2024–2031.

In 2024, Asia Pacific held the largest share of the global re-refined paraffinic base oil market owing to the increasing demand for re-refined paraffinic base oil in the region.

Key players in the re-refined paraffinic base oil market include AVISTA OIL Deutschland GmbH, Heritage Crystal Clean Inc, Clean Harbors Inc, TotalEnergies SE, Metalub, Southern Oil, EMERALD TRANSFORMER, GFL Environmental Inc, Hydrodec Group PLC, Nynas AB, PT Wiraswasta Gemilang Indonesia, ORLEN SA, Catalana de Tractament d'Olis Residuals SA, Aurea, and ITELYUM Regeneration SpA.

Rapid industrial growth worldwide and the growing automotive industry are driving the market.

Increased demand for sustainability and circular economy is expected to emerge as a future trend in the market.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Re-Refined Paraffinic Base Oil Marke

- AVISTA OIL Deutschland GmbH

- Heritage Crystal Clean Inc

- Clean Harbors Inc

- TotalEnergies SE

- Southern Oil

- EMERALD TRANSFORMER

- GFL Environmental Inc

- Hydrodec Group PLC

- Nynas AB

- Veolia

- Lwart Group

- PURAGLOBE

- DYM Resources

- Saudi Arabian Oil Co

- Universal Lubricants

Get Free Sample For

Get Free Sample For