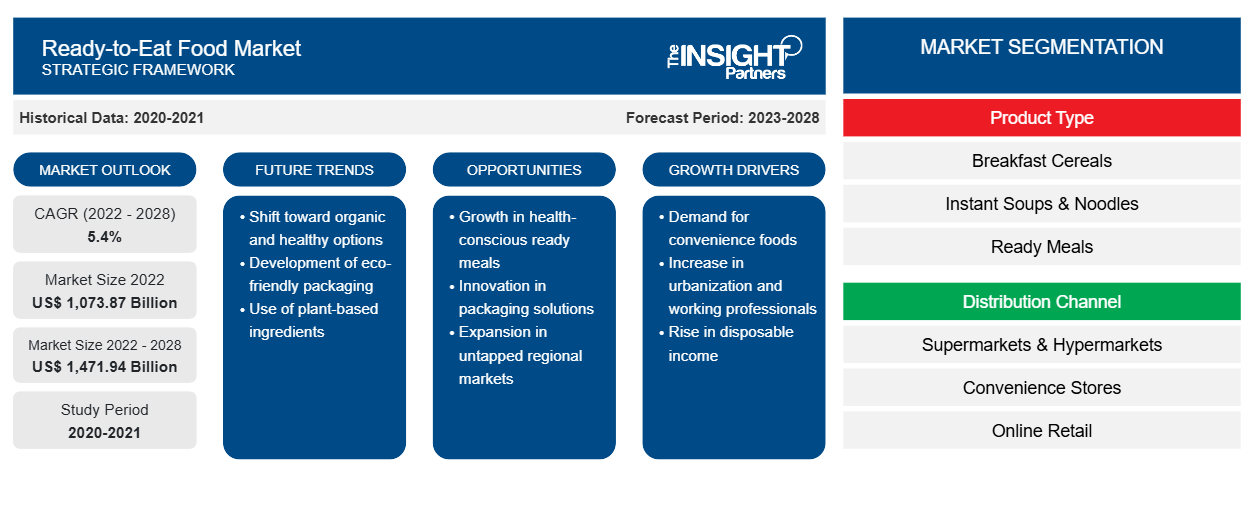

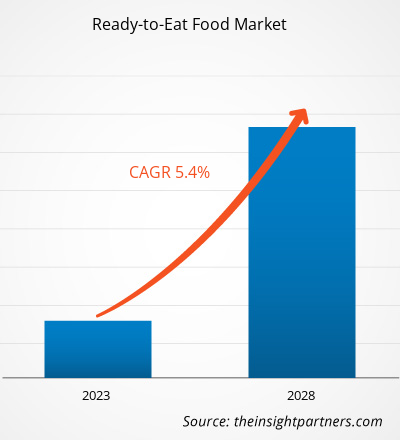

[Research Report] The ready-to-eat food market is projected to reach US$ 1,471.94 billion by 2028 from US$ 1,073.87 billion in 2022. It is expected to grow at a CAGR of 5.4% from 2022 to 2028.

Ready-to-eat food consists of various processed and packaged foods that can be consumed without further preparation. Ingredients are washed, cooked, processed, and packed in containers for direct consumption. Some common types of RTE foods include instant soups, baked goods, desserts, and ready meals. These products are enriched with various extracts, acids, flavors, sweeteners, antioxidants, and preservatives. They offer immense convenience to the consumer while assisting in reducing the meal preparation time and providing a longer shelf-life of products, cost-efficiency, and minimal spoilage.

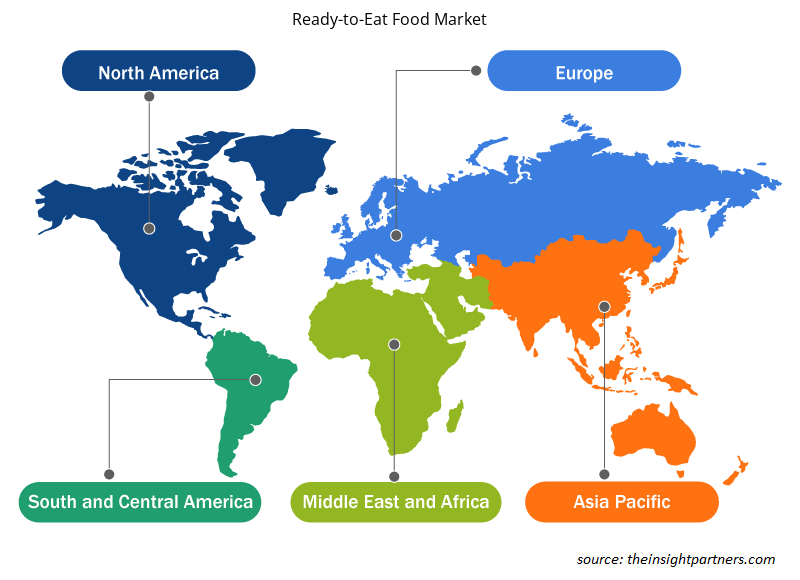

Asia Pacific held the largest share of the ready-to-eat food market in 2020, while other developing regions, such as the Middle East & Africa, are expected to grow significantly in the forecast period. Key players operating in the ready-to-eat food market are expanding their operations across Asia Pacific due to the rise in the working population and hectic lifestyles of people in developing countries. Individuals are increasingly opting to consume on the go or outside of home food.

Moreover, numerous studies have established that transnational food and beverage corporations (TFBCs) have shaped food systems and general consumption in ways, which change the availability, desirability, price, and ultimately consumption of processed foods. The growth of ready-to-eat food market has been prominently observed in middle-income countries.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Ready-to-Eat Food Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Ready-to-Eat Food Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Ready-to-Eat Food Market

The COVID-19 pandemic brought unprecedented challenges for many sectors in early 2020. Lockdowns, border restrictions, travel bans, manufacturing discontinuation, and other safety measures rolled out by governments as per the guidelines of the WHO, and national health ministries hampered the manufacturing operations. On the other hand, the COVID-19 outbreak positively impacted the ready-to-eat food market as consumers and retailers were stockpiling convenience food products with longer shelves. Also, consumers looking for healthier packaged food and beverage products to boost immunity were alarmed by the COVID-19 impact. Then, manufacturers of RTE products focused on healthy and nutritious products with enrichment of proteins and other nutritional values, which stimulated the demand for ready-to-eat food products during the pandemic.

Market Insights

Strong Preference for Convenience Food Among Millennials Drives Market Growth

Strong Preference for Convenience Food Among Millennials Drives Market Growth

The consumption of convenience food products of high quality is increasing, which is currently one of the biggest trends in the food industry. Convenience food, such as RTE products, allows consumers to save time and effort associated with meal preparation and cooking, consumption, and post-meal activities. The sources of development of this food segment are said to include the number of social changes, most notably the increasing number of smaller households and the rising millennial population across the globe. Because of the hectic work schedules of millennials, they prefer to be efficient with their time rather than wasting it on tedious tasks. They are more likely to spend their money on convenience. Thus, they increasingly prefer RTE products, such as baked products, snacks, and dairy products, further driving the ready-to-eat food market.

Product Type Insights

Based on product type, the ready-to-eat food market is segmented into breakfast cereals, instant soup & noodles, ready meals, snacks, baked goods & confectioneries, and others. The other ready-to-eat food segment is projected to register the largest share during the forecast period. Other types include dairy products, desserts, spreads, sauces, and dips. RTE dairy products include ice cream, yogurt, packaged flavored milk, and cheese. Health-conscious consumers mostly consume dairy products as regular dairy products improve bone and gut health and reduce the risks of cardiovascular diseases (CVDs) and type 2 diabetes. The popularity of processed and packaged sauces and dips grew as people switched from traditional ways of living and adopted a modern lifestyle, fueling the growth of ready-to-eat food market.

Ready-to-Eat Food Market Regional Insights

Ready-to-Eat Food Market Regional Insights

The regional trends and factors influencing the Ready-to-Eat Food Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Ready-to-Eat Food Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Ready-to-Eat Food Market

Ready-to-Eat Food Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,073.87 Billion |

| Market Size by 2028 | US$ 1,471.94 Billion |

| Global CAGR (2022 - 2028) | 5.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Ready-to-Eat Food Market Players Density: Understanding Its Impact on Business Dynamics

The Ready-to-Eat Food Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Ready-to-Eat Food Market are:

- Nestlé SA

- Conagra Brands Inc.

- The Kraft Heinz Company

- General Mills Inc.

- CAMPBELL SOUP COMPANY

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Ready-to-Eat Food Market top key players overview

Distribution Channel Insights

Based on distribution channel, the ready-to-eat food market has been segmented into supermarkets & hypermarkets, convenience stores, online retail, and others. The online retail segment is projected to register the highest CAGR in the ready-to-eat food market during the forecast period. Online retail offers a convenient shopping experience to users, followed by simplified product delivery. Online retail stores offer a wide range of products at heavy discounts; also, consumers can conveniently buy desirable products remotely.

The key players operating in the ready-to-eat food market are Nestlé SA; Conagra Brands Inc.; The Kraft Heinz Company; General Mills Inc.; CAMPBELL SOUP COMPANY; MTR Foods Pvt Ltd.; Hormel Foods Corporation; Tyson Foods, Inc.; JBS S.A.; and The Kellogg Company. These players are engaged in developing products with reduced health risks to meet emerging consumer trends and abide by regulatory frameworks. They are involved in mergers and acquisitions, business expansions, and partnerships to expand their market share.

Report Spotlights

- Progressive industry trends in the ready-to-eat food market to help players develop effective long-term strategies

- Business growth strategies adopted to secure growth in developed and developing markets

- Quantitative analysis of the ready-to-eat food market from 2019 to 2028

- Estimation of global demand for ready-to-eat food

- Porter's Five Forces analysis to illustrate the efficacy of buyers and suppliers operating in the industry

- Recent developments to understand the competitive market scenario

- Market trends and outlook, and factors governing the growth of the ready-to-eat food market

- Assistance in the decision-making process by highlighting market strategies that underpin commercial interest, leading to the market growth

- Size of the ready-to-eat food market size at various nodes

- Detailed overview and segmentation of the market and the RTE products industry dynamics

- Size of the growth in various regions with promising growth opportunities

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Cell Line Development Market

- Ketogenic Diet Market

- Real-Time Location Systems Market

- Wheat Protein Market

- Small Molecule Drug Discovery Market

- Joint Pain Injection Market

- Military Rubber Tracks Market

- Aerosol Paints Market

- Volumetric Video Market

- Emergency Department Information System (EDIS) Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, and Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The major players operating in the global ready-to-eat food market are Nestlé SA; Conagra Brands Inc.; The Kraft Heinz Company; General Mills Inc.; CAMPBELL SOUP COMPANY; MTR Foods Pvt Ltd.; Hormel Foods Corporation; Tyson Foods, Inc.; JBS S.A.; The Kellogg Company.

In 2020, Asia Pacific accounted for the largest share of the global ready-to-eat food market. Many Asia Pacific countries, such as China and India, are among the world's fastest-growing populations. The food industry is anticipated to expand at a faster pace as a result of increasing population, rising urbanization, and rapid development of suburban areas. The growing middle class coupled with increasing disposable income in the developing countries of Asia Pacific is expected to result in high growth rate for the region over forecast period.

In 2020, the supermarkets and hypermarkets segment accounted for the largest market share. The penetration of supermarkets and hypermarkets is rapidly expanding globally with big retailers such as Walmart expanding into many developing countries in Asia Pacific. Supermarkets and hypermarkets are one stop shop for numerous ready-to-eat food and offers large discounts due to economies of scale. The convenience and discounts offered by supermarkets and hypermarkets has resulted in dominant share for the segment in the ready-to-eat food market.

On the basis of product type, ready meals is the fastest growing segment. The growing hectic schedules as well as evolving lifestyles has led consumers to increasingly seek ready meals. Moreover, the increasing working women population has led to working households, resulting in less time for meal preparation. Thus, ready meals are increasingly being consumed as they offer convenience.

Rise in working women population is a key driver of global ready-to-eat food market. In Asia, female labor force participation ranges from 16% in Afghanistan to 83% in Nepal, further growing in several other countries in the region. According to the “International Labor Organization,†the female employment rate in Germany was 42.50% in 1990 and has increased to 54.91% by 2020. Similarly, the female employment rates in other countries such as the US, France, Chile, and Mexico have surged in recent times.

Innovations in RTE products and strategic developments by manufacturers is expected to offer lucrative opportunities in the market. Major manufacturers are employing creative strategies such as new product releases and production capacity scaleup to better serve their customers and satisfy their growing demands. In May 2018, Del Monte Foods, Inc., a prominent processed food company, launched a canned Gold Pineapple line with a major focus on teenagers as a target consumer group. Major RTE product manufacturers are collaborating and partnering with other market players to launch innovative products in the market. The aforementioned factors have led to increased opportunities for ready-to-eat food market.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies - Ready-to-Eat Food Market

- Nestlé SA

- Conagra Brands Inc.

- The Kraft Heinz Company

- General Mills Inc.

- CAMPBELL SOUP COMPANY

- MTR Foods Pvt Ltd.

- Hormel Foods Corporation

- Tyson Foods, Inc.

- JBS S.A.

- The Kellogg Company

Get Free Sample For

Get Free Sample For