Ready-to-Eat Meals Market Dynamics and Trends by 2030

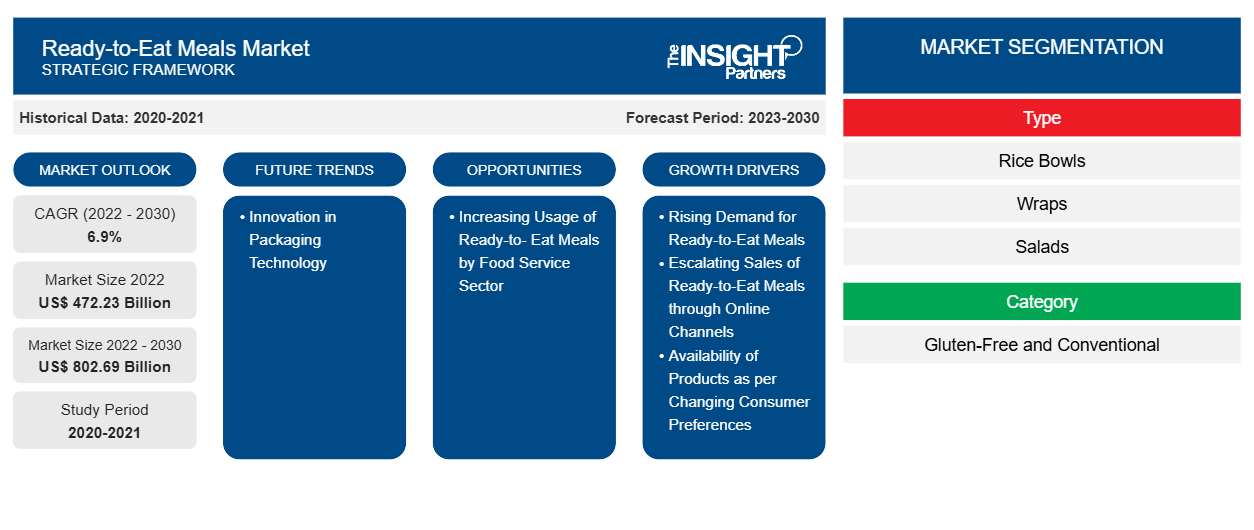

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030Ready-to-Eat Meals Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Rice Bowls, Wraps, Salads, Burritos, Gravies and Curries, Noodles and Pastas, Pizza, Soups and Stews, Meat Entrees, Burgers, Sandwiches, and Others), Category (Gluten-Free and Conventional), and End User (HoReCa, Institutions, Households, and Others)

- Report Date : Nov 2023

- Report Code : TIPRE00020200

- Category : Food and Beverages

- Status : Published

- Available Report Formats :

- No. of Pages : 180

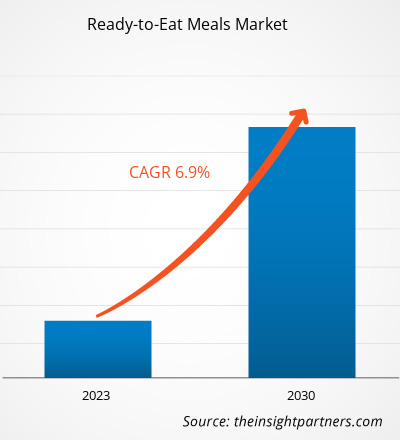

The ready-to-eat meals market is expected to grow from US$ 472,231.63 million in 2022 to US$ 802,689.21 million by 2030; it is expected to record a CAGR of 6.9% from 2022 to 2030.

Market Insights and Analyst View

Ready-to-eat meals are instant food items that can be consumed on-the-go and without any hassle. Sandwiches, wraps, pizzas, burgers, noodles and pasta, curries and gravies, burritos, and rice bowls are a few of the widely consumed ready-to-eat meals. The lifestyle of people around the globe has changed dramatically due to the growing corporate sector, the rising number of dual-income households, and extended working hours. People prefer ready-to-eat meals to avoid cooking time and effort. This factor has significantly contributed to the growth of the global ready-to-eat meals market.

Based on category, the ready-to-eat meals market is categorized into gluten-free and conventional. The rising prevalence of gluten intolerance in the region, coupled with increasing awareness of the health benefits of gluten-free products, are the key factors driving the demand for gluten-free ready-to-eat meals. Also, as consumers have more comprehensive access to a variety of gluten-free ready-to-eat meal brands, the category is expected to witness massive growth in the coming years.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Ready-to-Eat Meals Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Growth Drivers

The global ready-to-eat (RTE) meals market is experiencing significant expansion, driven by evolving consumer lifestyles, rising demand for convenience, and changing demographic patterns. The growing preference for high-quality, time-saving food options has made convenience food—including RTE meals, frozen products, and pre-packaged meals—one of the most prominent trends in the modern food industry. Consumers across all age groups are increasingly prioritizing ease of preparation and taste when selecting food products. According to the International Food Information Council (IFIC), convenience is a key purchasing driver for millennials, while taste remains a primary consideration for baby boomers.

The rising prevalence of smaller households, dual-income families, and time-constrained professionals is accelerating the demand for RTE solutions. These meals offer not only convenience in preparation but also advantages in terms of storage, shelf life, and transportation due to advances in food preservation and cold supply chain technologies. Meal kit delivery services like Blue Apron and grocery delivery platforms such as Amazon Fresh and Instacart have further supported this trend, ensuring wide accessibility and enhanced consumer reach.

North America, particularly the US and Canada, is witnessing strong momentum in the RTE meals market due to an increase in workforce participation. According to Employment and Social Development Canada (ESDC), labor force participation reached 88.142% in 2022, up from 87.075% in 2021, signaling a greater need for convenient meal solutions among working adults. Additionally, the Canadian retail food industry recorded sales of approximately US$29.5 billion in 2022, marking a 20.9% increase from the previous year, further underscoring the sector’s recovery and resilience.

The surge in online grocery shopping, catalyzed by the COVID-19 pandemic, has permanently reshaped consumer buying behavior, with digital platforms now serving as essential channels for RTE meal distribution. Well-established retail infrastructures—ranging from supermarkets and hypermarkets to online delivery services—are ensuring that RTE products are accessible, convenient, and increasingly integral to the daily lives of consumers. As a result, the RTE meals market is poised for continued growth, fueled by innovation, lifestyle alignment, and broader retail support.

Report Segmentation and Scope

The "Global Ready-to-Eat Meals Market" is segmented on the basis of type, category, end user, and geography.

- Based on type, the market is segmented into rice bowls, wraps, salads, burritos, gravies and curries, noodles and pasta, pizza, soups and stews, meat entrées, burgers, sandwiches, and others. The noodles and pasta segment held the largest share of the global ready-to-eat meals market.

- By category, the market is bifurcated into gluten-free and conventional.

- In terms of end user, the market is segmented into HoReCa, institutions, households, and others.

- Based on geography, the ready-to-eat meals market is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Chile, and the Rest of South & Central America).

Segmental Analysis

Based on type, the ready-to-eat meals market is segmented into rice bowls, wraps, salads, burritos, gravies and curries, noodles and pasta, pizza, soups and stews, meat entrées, burgers, and others. The noodles and pasta segment held the largest share of the ready-to-eat meals market in 2022. The salads segment is expected to register a higher CAGR during the forecast period. Ready-to-eat pasta meals are available in various types, such as spaghetti, penne, fettuccine, and macaroni. Pasta meals include protein sources such as shrimp, meatballs, chicken, and plant-based protein sources. Packaged pasta meals are designed for quick-serve and require minimal cooking. Ready-to-eat pasta meals are served in single-serving containers, thereby making portion control and reheating easier. Changing food consumption habits, busy lifestyles, exposure to diverse cultures, and increased demand for varied cuisine and convenience food are key factors driving the demand for ready-to-eat noodles. Manufacturers launch ready-to-eat noodles in several categories, such as vegan, gluten-free, or organic noodles, making it a more convenient meal option.

Regional Analysis

The ready-to-eat meals market is segmented into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. The global ready-to-eat meals market was dominated by Asia Pacific and was estimated to be ~US$ 150 billion in 2022. The ready-to-eat meals market in Asia Pacific is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. The growing urbanization and rising disposable income of the middle-class population propels the demand for ready-to-eat meals, including burgers, sandwiches, noodles, pasta, and pizza. According to the International Labor Organization (ILO), the total income of Asia Pacific countries increased by 3.5% in 2021, wherein China accounted for 0.3% in 2021 and 0.7% in the first half of 2022.

The total income grew by 12.4% in Central and Western Asia. Working professionals prefer convenient food options such as rice bowls, wraps, salads, rolls, gravies and curries, noodles and pasta, pizza, as well as soups and stews, owing to the rising disposable income, time constraints, and busy work schedules .

In terms of opportunities, the ready-to-eat meals market in Asia Pacific has significant potential for innovation. Manufacturers focus on product development to introduce new flavors, ingredients, and cooking techniques to cater to consumers' diverse tastes and preferences. Moreover, targeting institutions such as schools, colleges, and corporate offices with customized meal solutions creates a new revenue stream for businesses operating in the Asia Pacific ready-to-eat meals market.

The influence of western lifestyles and cuisines is another major factor bolstering the demand for ready-to-eat meal products in Asia Pacific. However, price sensitivity among consumers presents a significant challenge to the progress of the ready-to-eat meals industry in Asia Pacific.

Industry Developments and Future Opportunities

Various initiatives taken by the key players operating in the global ready-to-eat meals market are listed below:

- In December 2020, Nestlé SA launched Harvest Gourmet's plant-based ready-to-eat meals product line in China. The product line includes burgers, sausages, nuggets, mince, and plant-based options such as kung pao chicken, braised meatballs, pork belly, and spicy wok.

- In June 2021, the US food processor "Tyson Foods, Inc." launched plant-based ready-to-eat meals in Asia Pacific.

- In December 2020, Nestle SA's subsidiary Freshly Inc., the ready-to-eat meals delivery service, launched ready-to-eat meal products. These offerings are gluten-free, clean-label, and are made with whole-food ingredients.

The regional trends and factors influencing the Ready-to-Eat Meals Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Ready-to-Eat Meals Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Ready-to-Eat Meals Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 472.23 Billion |

| Market Size by 2030 | US$ 802.69 Billion |

| Global CAGR (2022 - 2030) | 6.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Ready-to-Eat Meals Market Players Density: Understanding Its Impact on Business Dynamics

The Ready-to-Eat Meals Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Ready-to-Eat Meals Market top key players overview

COVID-19 Pandemic Impact

The COVID-19 pandemic affected economies and industries in various countries. Lockdowns, travel bans, and business shutdowns in leading countries in North America, Europe, Asia Pacific (APAC), South & Central America, and the Middle East & Africa (MEA) negatively affected the growth of various industries, including food & beverages. The shutdown of manufacturing units disturbed global supply chains, manufacturing activities, delivery schedules, and sales of various essential and nonessential products. Various companies announced possible delays in product deliveries and a slump in future sales of their products in 2020. In addition, the bans imposed by various governments in Europe, Asia Pacific, and North America on international travel forced the companies to put their collaboration and partnership plans on a temporary hold. Moreover, the closure of slaughterhouses due to the lockdown negatively impacted the market growth. All these factors hampered the food & beverages industry in 2020 and early 2021, thereby restraining the growth of the ready-to-eat meals market.

Competitive Landscape and Key Companies

Tyson Foods Inc., SK Chilled Foods, Fresh Grill Foods LLC, Dandee Sandwich Co., Taylor Farms, Calavo Growers Inc., Hearthside Food Solutions LLC, EA Sween, FreshRealm, and TripleSticks are among the prominent players operating in the global ready-to-eat-meals market. These ready-to-eat meal manufacturers offer cutting-edge extract solutions with innovative features to deliver a superior experience to consumers.

Frequently Asked Questions

What are the drivers for the growth of the global ready-to-eat meals market?

In 2022, which region held the largest share of the global ready-to-eat meals market?

Which product type segment is the fastest growing in the ready-to-eat meals globally?

Based on the category, which segment led the global ready-to-eat meals market in 2022?

Can you list some major players operating in the global ready-to-eat meals market?

What are the trends observed in the global ready-to-eat meals market?

Ready-to-eat meals are also offered in packages with resealable closures, ensuring appropriate storage of unused or remaining food. Smart packaging containing ready-to-eat meals features an RFID tag, allowing consumers to access cooking instructions, ingredient details, and other information. Meanwhile, the rising pressure upon manufacturers to offer products that are environment-friendly continues to shift the concept of packaged food boxes toward more vegan/plant-based ingredients and the use of sustainable packaging with less plastic and waste. For instance, in September 2021, Walki-a, a company specializing in consumer and industrial packaging, introduced a tray portfolio for frozen and packaged foods, and they are claimed to be recyclable in paper streams. These newly launched trays include the Walki Pack Tray PET, with a thin PET lining that is classified as mono-material, making it suitable for recycling in paper streams. Similarly, in 2023, Amcor partnered with Tyson Foods to launch a sustainable package for consumer products. Tyson Foods offers egg bites and frittatas packed in AmPrima recycled ready forming/non-forming flexible film, featuring a 70% carbon footprint and addressing sustainable needs.

Thus, innovation in packaging technology is expected to create a new trend in the ready-to-eat meals market during the forecast period.

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For