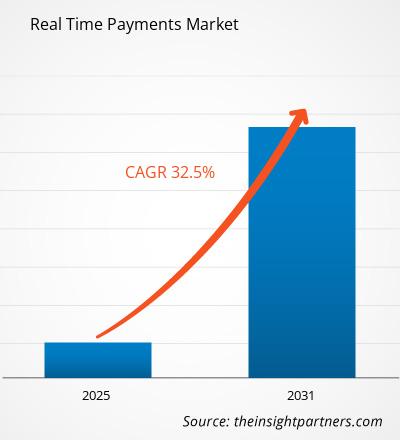

The global real time payments market size is expected to grow from US$ 19.62 billion in 2023 to US$ 186.39 billion by 2031; it is anticipated to expand at a CAGR of 32.5% from 2025 to 2031. The increasing utilization of AI and IoT is likely to remain a key real time payments market trends.

Real Time Payments Market Analysis

The market growth can be attributed to the widespread use of smartphones and the adoption of cloud-based solutions for faster payment processing. The increasing availability and usage of smartphones have led to a higher demand for products and services that cater to mobile users.

Real Time Payments Market Overview

Real Time Payments (RTP) is a cutting-edge financial system that enables businesses to conduct instant and seamless transactions. Unlike traditional payment methods, which often involve delays and manual processes, RTP allows for immediate transfer of funds, ensuring swift and efficient payment processing. With RTP, businesses can enjoy the benefits of instant settlements, eliminating the need for waiting periods and reducing the risk of delayed payments. This real-time capability empowers organizations to optimize their cash flow, enhance liquidity management, and improve overall financial performance. Furthermore, RTP offers enhanced security measures to protect businesses and their customers from fraudulent activities. The system utilizes advanced encryption techniques and authentication protocols, ensuring that each transaction is conducted securely and confidentially.

IMAGE

Real Time Payments Market Drivers and Opportunities

Growth of mobile-based transactions and e-commerce to Favor Real Time Payments Market Growth

The continuous growth of online shopping and e-commerce sales has been a significant driver for the development of the real-time payments market. The increasing popularity of mobile commerce and the convenience it offers are contributing to the growth of the market. The convenience of mobile shopping is a major factor driving the growth of mobile commerce. Three out of four consumers say they carry out purchases on their mobile devices because it saves time. However, there is still room for improvement, as 90% of shoppers believe their experiences with mobile commerce could be better. The share of mobile e-commerce sales in total e-commerce sales has been increasing. It is forecasted to reach a 60% market share in 2024, meaning that $3 out of every $5 spent on online purchases will be done through a mobile device.

Adoption of cloud-based solutions

The adoption of cloud-based solutions is driving the real-time payments market due to several key advantages. Cloud-based solutions offer scalability, flexibility, and cost-effectiveness, making them attractive options for businesses and financial institutions. Additionally, cloud-based solutions offer cost-effectiveness by providing a more cost-effective and scalable alternative to traditional on-premises solutions. Financial institutions can save costs by leveraging the scalability and flexibility of cloud-based solutions, allowing them to adapt to new market trends and customer demands more efficiently. Cloud-based solutions also enable financial institutions to innovate and adapt to changing demands. By leveraging cloud computing, banks can more easily put out new services and adapt to changing market conditions. This flexibility and scalability make cloud-based solutions helpful for driving innovation in payment systems.

Real Time Payments Market Report Segmentation Analysis

Key segments that contributed to the derivation of the real time payments market analysis component, payments type, deployment mode, and end user.

- Based on components, the market is divided into solutions and services. The solutions segment held a larger market share in 2023.

- Based on payment type, the market is divided into P2B, B2B, P2P, and Others. The P2B segment held a larger market share in 2023.

- Based on deployment mode, the market is divided into on-premises and cloud. The on-premises segment held a larger market share in 2023.

- Based on end user, the market is bifurcated into retail & e-commerce, BFSI, it & telecom, travel & tourism, government, healthcare, energy & utilities. The retail & e-commerce segment held a larger market share in 2023.

Real Time Payments Market Share Analysis by Geography

The geographic scope of the real time payments market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America. Asia Pacific dominated the real time payments market in 2023. The regional market is anticipated to experience rapid growth over the forecast period, with the highest compound annual growth rate (CAGR). The increasing adoption of real-time payment solutions by both large-scale and small- to medium-scale enterprises in the Asia Pacific region is predicted to propel the growth of the regional market. Numerous enterprises throughout the Asia Pacific are prioritizing the digitization of their business operations, which is expected to drive the demand for real-time payment solutions.

Real Time Payments Market Report Scope

Real Time Payments Market News and Recent Developments

The real time payments market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market:

- In June 2021, Mastercard Incorporated unveiled the introduction of PayPort+, an advanced real-time payment gateway service. This innovative solution aims to offer payment service providers and financial institutions convenient and adaptable access to the United Kingdom's real-time payment infrastructure. PayPort+ is developed in collaboration with Vocalink, a subsidiary of Mastercard, and Form3, a trusted technology partner.

(Source: Mastercard, Press Release, 2021)

Real Time Payments Market Report Coverage and Deliverables

The "Real Time Payments Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter's Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

Real Time Payments Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 26 billion |

| Market Size by 2031 | US$ 186.39 billion |

| Global CAGR (2025 - 2031) | 32.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Smart Grid Sensors Market

- Smart Parking Market

- Airline Ancillary Services Market

- Artificial Intelligence in Healthcare Diagnosis Market

- Dairy Flavors Market

- Aerospace Forging Market

- Truck Refrigeration Market

- Excimer & Femtosecond Ophthalmic Lasers Market

- Cling Films Market

- Cosmetic Bioactive Ingredients Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Nature of Payment Component Enterprise Size and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, UK, Canada, Germany, France, Italy, Australia, Russia, China, Japan, South Korea, Saudi Arabia, Brazil, Argentina

Frequently Asked Questions

The advent of IoT, big data, and machine learning are impacting real-time payments, which are anticipated to play a significant role in the global real-time payments market in the coming years.

Rising adoption of smartphones and access to high-speed internet to drive the real-time payments market growth.

The key players holding majority shares in the global real-time payments market are ACI Worldwide; FIS; Fiserv, Inc.; and Mastercard.; Worldline S.A.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- ACI Worldwide

- FIS

- Fiserv, Inc.

- Mastercard.

- Worldline S.A.

- PayPal

- Visa

- Apple Inc.

- Ant Group CO., Ltd.

- Temenos SA

Get Free Sample For

Get Free Sample For