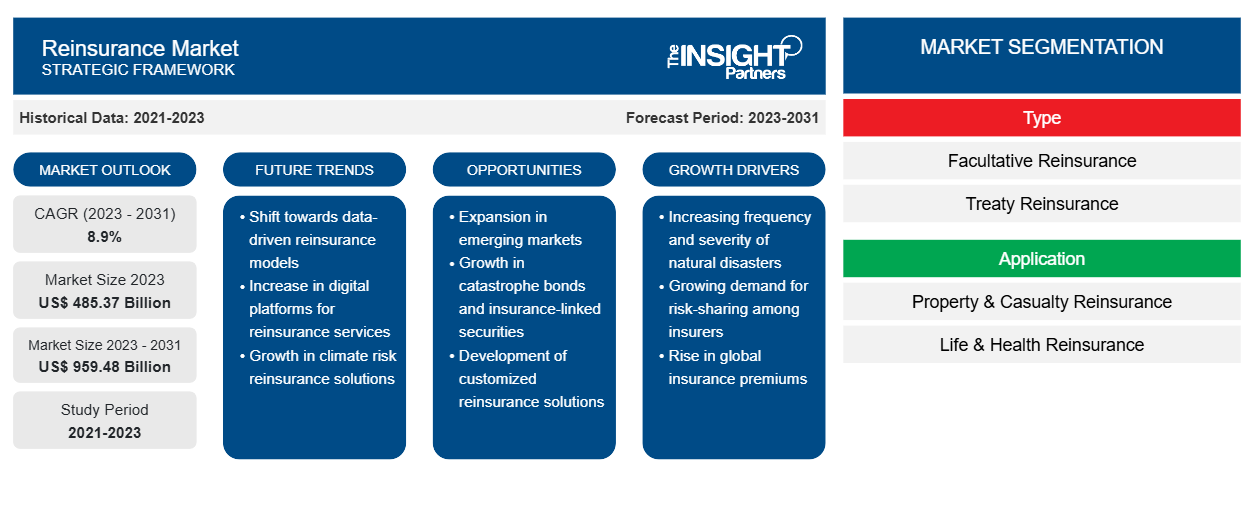

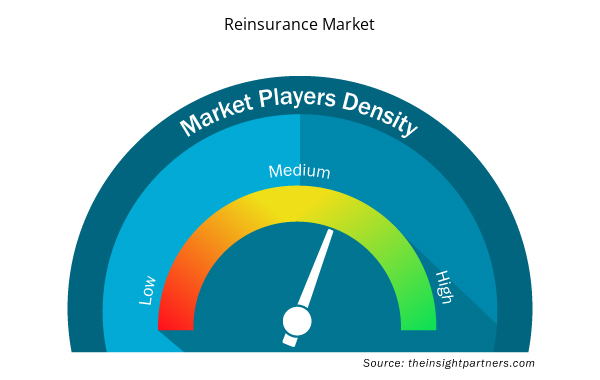

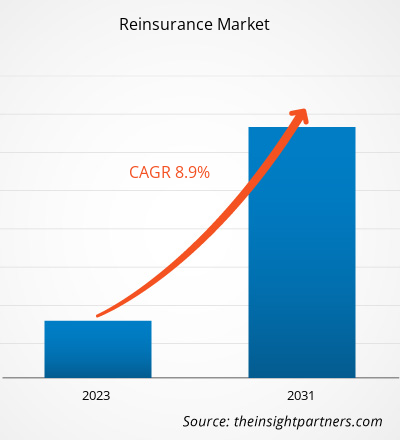

The reinsurance market size is expected to grow from US$ 485.37 billion in 2023 to US$ 959.48 billion by 2031; it is anticipated to expand at a CAGR of 8.9% from 2023 to 2031. The reinsurance market includes growth prospects owing to the current reinsurance market trends and their foreseeable impact during the forecast period. Insurance companies commonly want financial protection offered to their customers, which can be fulfilled by reinsurance solutions. Insurance companies frequently desire these protections. Reinsurance providers safeguard other insurance companies from losses, particularly those resulting from catastrophic events like hurricanes. This has pushed enterprises across the globe to adopt solutions to mitigate financial risks. In such a scenario, the reinsurance industry has also been evolving to support the risks entailing such changes in enterprises and consumer behavior.

Reinsurance Market Analysis

Reinsurance is referred to as insurance for insurance companies. It is a contract between a reinsurer and an insurer. Reinsurance helps insurers stay in business by recouping all or part of the money they have paid to claimants. Reinsurance lowers the net liability for specific risks and provides disaster protection against significant or numerous losses. Insurers buy reinsurance for four reasons: to boost capacity, to stabilize loss experience, to protect themselves and the insured against disasters, and to limit liability on a particular risk. Reinsurance increases the insurer's capacity to bear the financial burden in the event of uncommon, significant events by protecting it from accumulated liabilities. This provides the insurer with more assurance of its equity and solvency. In order to maintain the solvency margins, insurers can underwrite policies that cover a greater amount of risk without unnecessarily increasing administrative expenses by the use of reinsurance. Furthermore, reinsurance provides insurers with significant liquid assets in the event of extraordinary losses.

Globalization has evolved in recent decades as a result of the expansion of commercial and financial networks that cross national borders, making businesses and workers from other economies increasingly interconnected. Greater globalization creates more chances for international investments, resulting in more investment-linked programs. Moreover, industrialization also facilitates increased investments, cross-broader collaborations, partnerships and joint ventures, facilitating the reinsurance market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Reinsurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Reinsurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Reinsurance Industry Overview

- Reinsurance is a crucial tool used by insurance firms to control risk and the required capital holdings to sustain that risk.

- Insurers may use reinsurance to achieve an optimal targeted risk profile. In the insurance business, reinsurance transactions can be complicated.

- Businesses may employ numerous reinsurance transactions with different details. Reinsurance is frequently used for the following reasons: 1) increasing the capacity of the insurance company; 2) stabilizing underwriting results; 3) financing; 4) providing catastrophe protection; 5) exiting a particular line of business; 6) distributing risk; and 7) gaining knowledge.

- State insurance regulators have long understood that in order to meet the demands of the American market, both local and foreign reinsurance capacity is necessary, and the U.S. reinsurance sector remains a significant source of capacity for domestic insurers.

- As a result, the US has created a reinsurance regulatory framework that has fostered the growth of an accessible yet safe reinsurance market, with the majority of reinsurance premiums being reinsured outside of the nation.

Reinsurance Market Driver

Significant Growth In Intellectual Property (IP) Reinsurance And Mortgage Reinsurance to Drive the Reinsurance Market

- The expansion and innovation within the intellectual property reinsurance and mortgage reinsurance sectors are poised to be pivotal growth drivers within the reinsurance market.

- By leveraging advanced risk management strategies and tailored solutions, insurers can effectively mitigate risks associated with intellectual property assets and mortgage portfolios, thus unlocking new opportunities for revenue generation and market expansion.

- This strategic focus on intellectual property and mortgage reinsurance not only enhances insurers' ability to manage risk but also fosters a climate of stability and confidence within the industry, attracting increased investment and driving the reinsurance market growth.

Reinsurance Market Report Segmentation Analysis

- Based on type, the reinsurance market is segmented into facultative reinsurance and treaty reinsurance.

- The treaty reinsurance segment is expected to hold a substantial reinsurance market share in 2023.

- In a treaty reinsurance agreement, the reinsurer is required to accept all of the policies from the reinsured, including those that haven't yet been written or a certain class of policies.

- Facultative reinsurance can cover many sections with multiple policies pooled together, or it can cover a single policy individually, such as reinsuring the excess insurance on a business or large building.

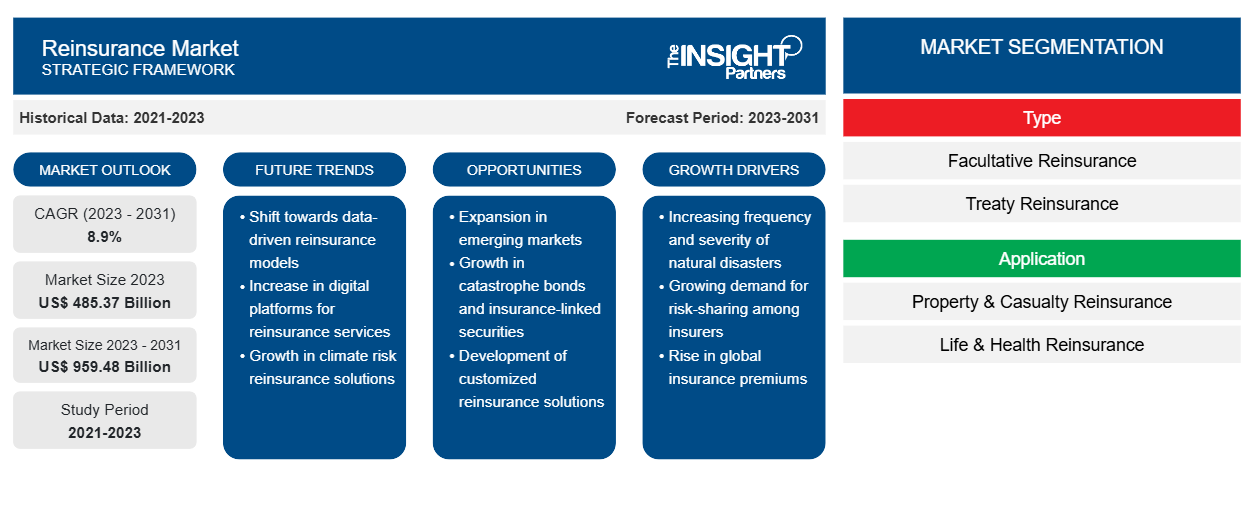

Reinsurance Market Share Analysis By Geography

The scope of the reinsurance market is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant reinsurance market share. The region's significant economic development, growing population, and increasing focus on risk management and reinsurance have contributed to the growth of the market.

Reinsurance Market Regional Insights

The regional trends and factors influencing the Reinsurance Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Reinsurance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Reinsurance Market

Reinsurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 485.37 Billion |

| Market Size by 2031 | US$ 959.48 Billion |

| Global CAGR (2023 - 2031) | 8.9% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

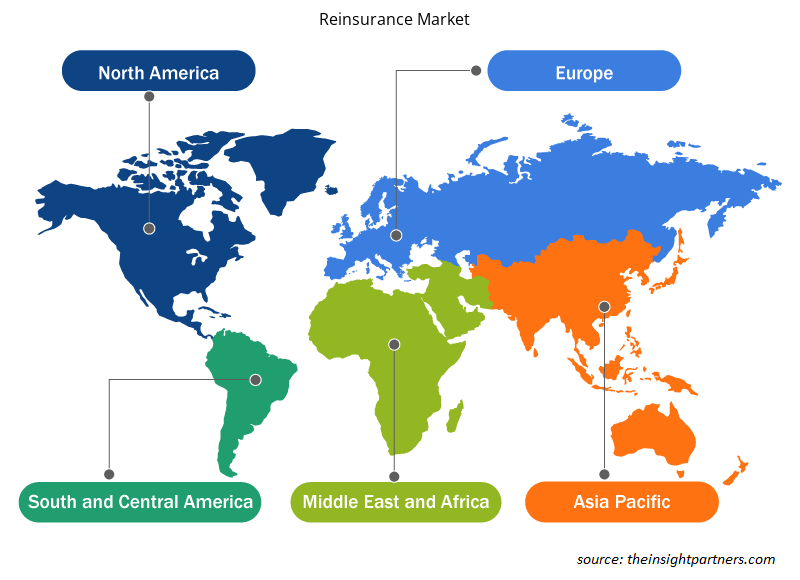

Reinsurance Market Players Density: Understanding Its Impact on Business Dynamics

The Reinsurance Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Reinsurance Market are:

- Munich Re

- Swiss Re Group

- Hannover Re Group

- Canada Life RE

- Berkshire Hathaway Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Reinsurance Market top key players overview

The "Reinsurance Market Analysis" was carried out based on type, application, mode, and geography. On the basis of type, the market is segmented into facultative reinsurance and treaty reinsurance. Based on application, the reinsurance market is segmented into property & casualty reinsurance and life & health reinsurance. Based on mode, the market is segmented into online and offline. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Reinsurance Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the reinsurance market. A few recent key market developments are listed below:

- In February 2024, Resolution Life announced that its Bermudian reinsurance platform, Resolution Re, has entered into a flow reinsurance agreement with a Japanese insurer. This agreement aims to provide increased capacity and greater product competitiveness, enhancing the offering to the cedent's fixed annuity policyholders.

[Source: Resolution Life, Company Website]

- In January 2024, Reinsurance Group of America, Incorporated announced a strategic investment and exclusive global life and health reinsurance partnership with insurance technology company DigitalOwl.

[Source: Reinsurance Group of America, Company Website]

- In January 2024, Guy Carpenter announced the launch of a new cyber reinsurance product, CatStop+. CatStop+ helps solve a range of issues that cyber reinsurers face, striking a balance between coverage from peak perils, tail protection, and cost-effectiveness while bringing clarity to the recovery of losses resulting from a severe cyber event.

[Source: Guy Carpenter, Company Website]

- In December 2023, Manulife Financial Corporation announced a US$13 billion reinsurance deal, including US$6 billion of long-term care, with Global Atlantic.

[Source: Global Atlantic, Company Website]

Reinsurance Market Report Coverage & Deliverables

The reinsurance market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Reinsurance Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Fill Finish Manufacturing Market

- MEMS Foundry Market

- Electronic Health Record Market

- Skin Tightening Market

- Electronic Data Interchange Market

- Vaginal Specula Market

- Power Bank Market

- Single-Use Negative Pressure Wound Therapy Devices Market

- Environmental Consulting Service Market

- Retinal Imaging Devices Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Application, Mode and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Digital transformation promoting online reinsurance is anticipated to play a significant role in the global reinsurance market in the coming years.

The global reinsurance market was estimated to be US$ 485.37 billion in 2023 and is expected to grow at a CAGR of 8.9% during the forecast period 2023 - 2031.

The increasing frequency and severity of natural disasters, increasing innovations in the insurance industry, and significant growth in intellectual property (IP) reinsurance and mortgage reinsurance are the major factors that propel the global reinsurance market.

The key players holding majority shares in the global reinsurance market are Munich Re; Swiss Re Group; Hannover Re Group; Canada Life RE; and Berkshire Hathaway Inc,

The global reinsurance market is expected to reach US$ 959.48 billion by 2031.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Munich Re

- Swiss Re Group

- Hannover Re Group

- Canada Life RE

- Berkshire Hathaway Inc

- China Reinsurance (Group)

- Lloyd’s

- BMS Group

- Markel Corporation

Get Free Sample For

Get Free Sample For