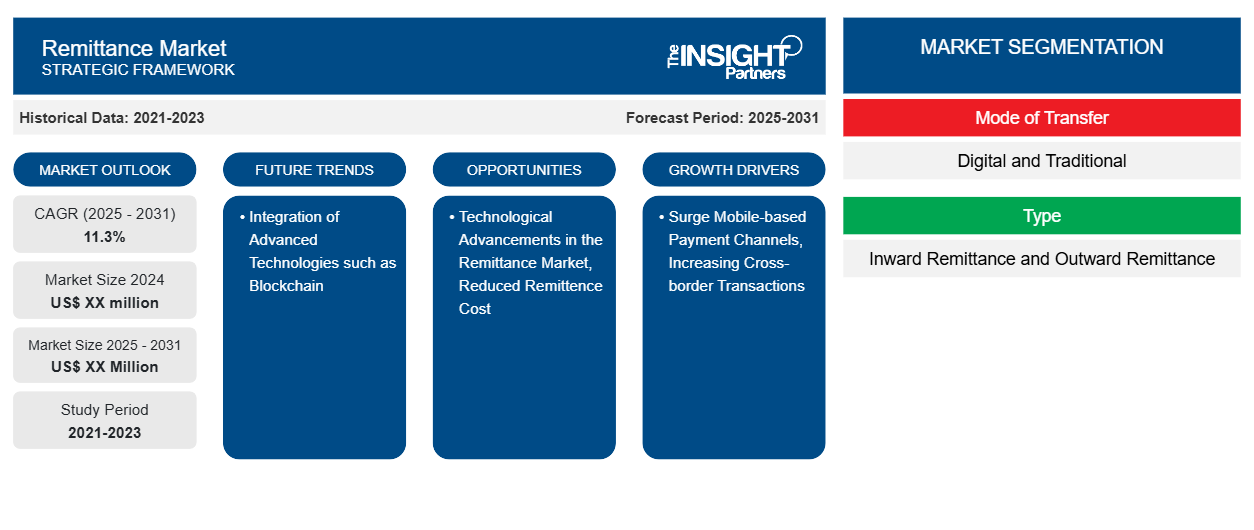

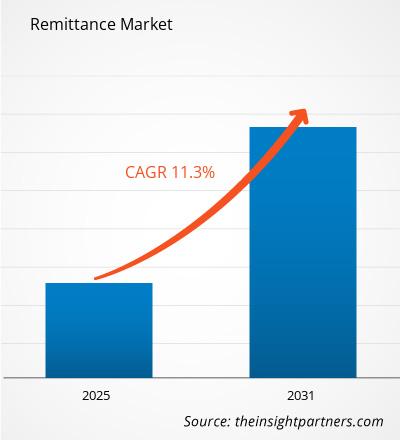

The remittance market size is expected to grow at a CAGR of 11.3% from 2023 to 2031. The market's growth is driven by an increase in cross-border transactions and mobile payment channels, as well as decreasing remittance costs and money transfer times. Furthermore, the increased use of banking and financial sectors around the world drives market growth. Furthermore, ongoing technology advances in the digital remittance business, as well as increased internet and mobile usage, are likely to create attractive potential for remittance market expansion.

Remittance Market Analysis

Remittance is the cross-border transfer of money by a foreign migrant to another individual using electronic payments, drafts, or checks. Furthermore, the bulk of remittance service providers are focused on digital remittance to grow their business and provide clients with better and faster-transferring options. Multiple advantages of using digital channels for money transfer, including fast speed, 24-hour availability, transparency, ease of use, high security, and others, generate multiple potential for the remittance sector.

Remittance Market Industry Overview

- Cross-border remittances have several economic benefits, including greater financial inclusion and economic development. Migrants and their families rely heavily on remittances. The majority of migrant households' income comes from money obtained in their home countries, which is often spent on needs like medication, education, food, and housing.

- Sending money abroad has always been time-consuming and expensive, as indicated by endless networks of intermediaries, hidden fees, and tedious procedures. Fortunately, industry improvements in recent years have resulted in cheaper, faster, and value-added overseas fund transfer services for individuals and small-to-medium-sized organizations alike.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Remittance Market Driver and Opportunities

Surge Mobile-based Payment Channels and Cross-border Transactions to Drive the Remittance Market

- Market players are focusing on delivering services for cross-border transactions. For instance, in December 2019, Mastercard entered into a strategic alliance with a provider of real-time payment solutions, ProgressSoft, to enable the integration of Mastercard Cross-Border Services and accelerate international remittances throughout the Middle East and Africa (MEA) region.

- Similarly, in August 2022, an open banking payments company named Trustly entered into a partnership with a Poland-based multi-currency company, Conotoxia, to deliver users with a fast, secure, and safe method to transfer money internationally through their bank accounts.

Technological Advancements in the Remittance Market to Create Lucrative Market Opportunities

- Two prominent trends in the global remittance industry include the disruption potential of small technology-driven startups and market consolidation by large players.

- Blockchain is one of the important underlying technologies that can transform the money transfer industry. Although the majority of large financial institutions are reluctant to waive traditional currency and cash for digital currency, acceptance among remittance startups has grown primarily as they use blockchain to deliver faster, better, and cheaper financial services. Thus, technological advancement in the remittance market is expected to create lucrative growth opportunities during the forecast period.

Remittance Market Report Segmentation Analysis

The key segment that contributed to the derivation of the Remittance market analysis is type.

- In 2023, the traditional (non-digital) category generated the major revenue. Cheques and ATMs are among the traditional methods of remitting cash. The consumer's sense of trust and safety when remitting payments via an offline channel is a crucial factor driving the segment's rise.

- In 2023, the outward remittances segment dominated the market. Most businesses are part of the global economy. An external remittance facilitates international commerce and capitalizes on commercial opportunities that would not have existed otherwise.

Remittance Market Share Analysis By Geography

- The scope of the Remittance market is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America.

- Asia-Pacific is predicted to have significant growth over the projection period. The growth is due to the fact that the biggest remittance recipient countries, such as India, the Philippines, and China, are in Asia-Pacific. Furthermore, several significant firms from around the world have made efforts to enter the thriving regional market. Thus, these elements are likely to drive regional growth during the predicted period.

Remittance Market Regional Insights

The regional trends and factors influencing the Remittance Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Remittance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Remittance Market

Remittance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ XX Million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2023 - 2031) | 11.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Mode of Transfer

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

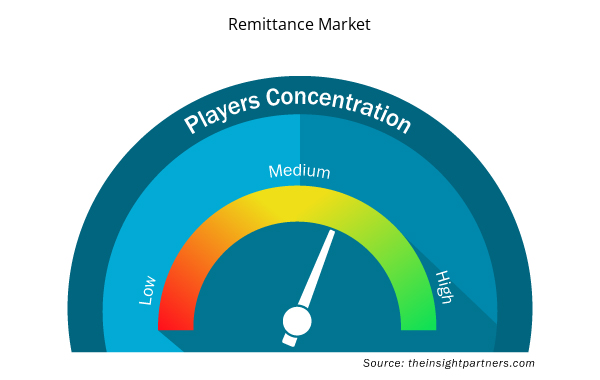

Remittance Market Players Density: Understanding Its Impact on Business Dynamics

The Remittance Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Remittance Market are:

- Bank of America Corporation

- ZEPZ

- Citigroup, Inc.

- Ria Financial Services, Inc.

- OFX

- Wells Fargo

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Remittance Market top key players overview

Remittance Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the Remittance market. Some of the recent key market developments are listed below:

- In 2022, Payments Enabler Currencycloud entered into a collaboration with Future FinTech (FTFT) Labs to launch the remittance application Tempo for US immigrants. FTFT Labs offers its customers a multi-currency wallet with beneficial fees over the competition through this partnership. [Source: Currencycloud, Company Website]

Remittance Market Report Coverage & Deliverables

The Remittance market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Remittance Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Asia Pacific is anticipated to grow with a high growth rate during the forecast period.

The major players holding majority shares are Bank of America Corporation, ZEPZ, Citigroup, Inc., Ria Financial Services, Inc., and OFX.

Technological innovations and a surge in demand for alternative lending options in the global remittance market in the coming years.

Less operating costs and a growing focus on serving underbanked individuals are the major factors that propel the global remittance market.

The global Remittance market was estimated to grow at a CAGR of 11.3% during 2023 - 2031.

Get Free Sample For

Get Free Sample For