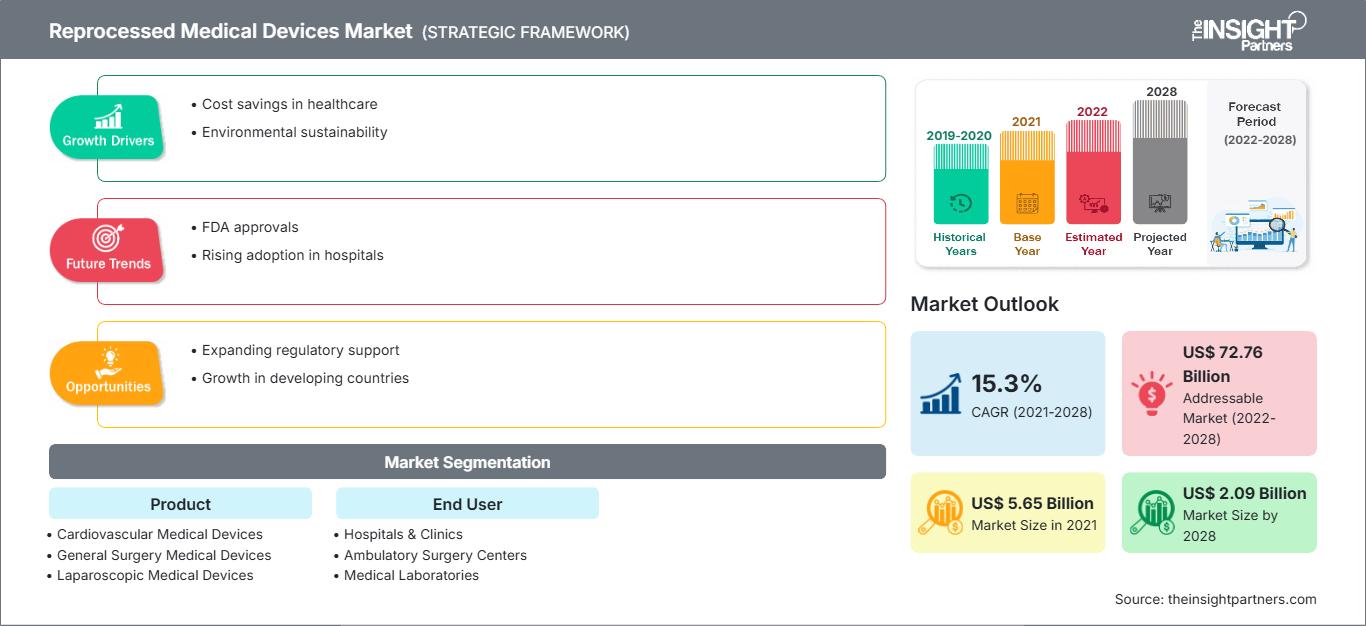

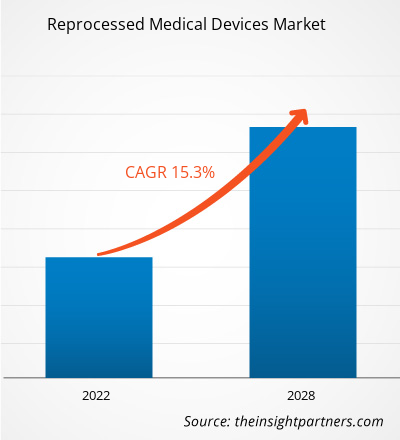

The reprocessed medical devices market is projected to reach US$ 5,653.87 million by 2028 from US$ 2,087.36 million in 2021; it is expected to grow at a CAGR of 15.3% from 2021 to 2028.

Reprocessing is an important part of the medical device life cycle. Reprocessing of the medical device is a process of cleaning, sterilizing, testing, remanufacturing, disinfecting, and wrapping as well as labeling a used, expired, and undamaged medical device to make it patient-ready at a much-reduced cost. It is a special process or treatment in preparation for the reuse of medical devices. Increasing hospital expenditures on healthcare devices and a high amount of medical wastage are driving the growth of the reprocessed medical device market.

The report offers insights and in-depth analysis of the reprocessed medical devices market, emphasizing various parameters such as market trends, technological advancements, remanufactured medical device market dynamics, and competitive landscape analysis of leading reprocessed medical devices market players worldwide. It also includes the impact of the COVID-19 pandemic on the market across all the regions. The pandemic has disrupted the socioeconomic conditions of various countries across the world. Presently, the US is the world's worst-affected country due to the COVID-19 outbreak with the highest number of confirmed cases and deaths, as per the recent WHO statistics. The high number of COVID-19 positive cases has negatively impacted the global economies. There has been a decline in overall business activities and growth of various industries operating all around the world.

The rapid spread of the COVID-19 has provided significant momentum to the reprocessed medical device industry in 2020. Following a severe shortage of medical supplies, regulatory agencies such as the Association of Medical Device Reprocessors (AMDR) promoted the reprocessing of healthcare equipment. According to AMDR, the expansion of reprocessing programs could assist healthcare providers to manage COVID-19-related costs, better regulate supply chains, and better planning for future hazards. While the COVID-19 pandemic continues to disrupt economies around the world, the growing volume of medical waste is a huge worry. This emphasizes the need of efficient reprocessing, which can not only help meet supply shortages but also enhance healthcare sustainability. However, with the onset of the outbreak, physicians and patients became more concerned about their safety, hence, raising apprehensions about the reuse of medical devices. This negatively affected demand for reprocessed medical devices. Thus, to overcome these safety concerns, reassuring steps such as sterilization and microbial testing of reprocessed medical devices were made mandatory by various regulatory authorities in the region. Also, the risk of infection in surgeries and inappropriate sterilization of the medical devices can increase the potential outbreaks which hinder the reprocessed medical devices market growth. In addition, the R&D of reprocessing services has been put on hold due to the diversion of professionals to satisfy the demand of pandemic-related products. Thus, owing to the above–mentioned factors, the pandemic has shown a negative impact on the reprocessed medical devices market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Reprocessed Medical Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Reprocessed Medical Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Rising Importance of Medical Waste Minimization Drives Global Reprocessed Medical Devices Market

Reprocessing is a common practice in the US, where hospitals prefer to reprocess single-use devices to minimize medical waste. About 45% of hospitals have reprocessing agreements with third-party reprocessing medical devices companies in the US.

According to studies, reusing medical devices are a greener initiative, as it produces less medical waste, which is beneficial to the environment. Medical waste clogs landfills and gets expensive to avail bio waste disposal services. In comparison to the disposal of conventional solid waste, regulated medical waste (RMW) costs about 5–10 times higher, resulting in an increase in expenditure. Various health care practitioners have noted that reusable and single-use devices are nearly comparable and proper device reprocessing has no negative consequences for consumers.

RMW, often known as "red bag waste," is a waste expense that typically costs hospitals 6–10 times more than conventional solid waste to dispose of the waste material. With growing initiatives, 95% of the devices are reprocessed annually rather than sent to landfills at the end of their life cycle. Stainless steel, aluminum, titanium, gold, polycarbonate, and polyurethane are among the other re-processable raw materials that end up in a hospital's RMW. Some hospitals have diverted more than 8,000 pounds of RMW from landfills each year by reprocessing, while bigger systems can recycle more than 50,000 pounds. Therefore, the rising importance of medical waste minimization is driving the growth of the global reprocessed medical devices market.

Product - Based Insights

Based on product, the reprocessed medical devices market is segmented into cardiovascular medical devices, gastroenterology biopsy forceps, orthopedic external fixation devices, laparoscopic medical devices, general surgery medical devices, non-invasive devices, and others. In 2021, the cardiovascular medical device segment accounted for a larger share of the overall product market segment. Moreover, the cardiovascular device segment is anticipated to register the highest CAGR in the market during the forecast period, owing to the growing burden of various coronary heart disease for instance stroke and cardiomyopathy.

End User - Based Insights

Based on end user, the reprocessed medical devices market is segmented into hospitals and clinics, ambulatory surgical centers, medical laboratories, and others. The hospitals and clinics segment held the largest share of the end user market segment in 2021, and the same segment is anticipated to register the highest CAGR of 16.9% of the reprocessed medical device market during the forecast period.

The reprocessed medical devices market players adopt organic strategies such as product launch and expansion to expand their footprint and product portfolio worldwide and meet the growing demand.

Reprocessed Medical Devices Market Regional Insights

The regional trends and factors influencing the Reprocessed Medical Devices Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Reprocessed Medical Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Reprocessed Medical Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 5.65 Billion |

| Market Size by 2028 | US$ 2.09 Billion |

| Global CAGR (2021 - 2028) | 15.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

Reprocessed Medical Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Reprocessed Medical Devices Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Reprocessed Medical Devices Market top key players overview

By Product

- Cardiovascular Medical Devices

- Blood Pressure Cuffs/Tourniquet Cuffs

- Cardiac Stabilization and Positioning Devices

- Diagnostic Electrophysiology Catheters

- Electrophysiology Cables

- General Surgery Medical Devices

- Balloon Inflation Devices

- Infusion Pressure Bags

- Laparoscopic Medical Devices

- Endoscopic Trocars and Components

- Harmonic Scalpels

- Orthopedic External Fixation Devices

- Gastroenterology Biopsy Forceps

- Non-Invasive Devices

- DVT Garments

- ECG Leads

- Pulse Oximeter Probes

- Air Assisted Transfer Mats

- Ultrasonic Clothing

- Extraction Baloons and Baskets

- Circuit Acessories

- Optical Lens

- Other Non-Invasive Devices

- Others

By End User

- Hospitals and Clinics

- Ambulatory surgical centers

- Medical Laboratories

- Others

Company Profiles

- Medline Industries, Inc.

- Arjo Medical Devices

- Stryker Corporation

- Innovative Health

- Teleflex Incorporated

- Johnson and Johnson Services, Inc.

- 3M

- Currie Medical Specialities, Inc

- STERIS plc

- Cardinal Health Inc.

- Vanguard AG

Frequently Asked Questions

What is the regional market scenario of the reprocessed medical devices market?

Which end user led the market?

Who are the key players in the reprocessed medical devices market?

What is reprocessed medical devices?

What are the driving factors for the reprocessed medical devices market?

Which product type dominates the market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For