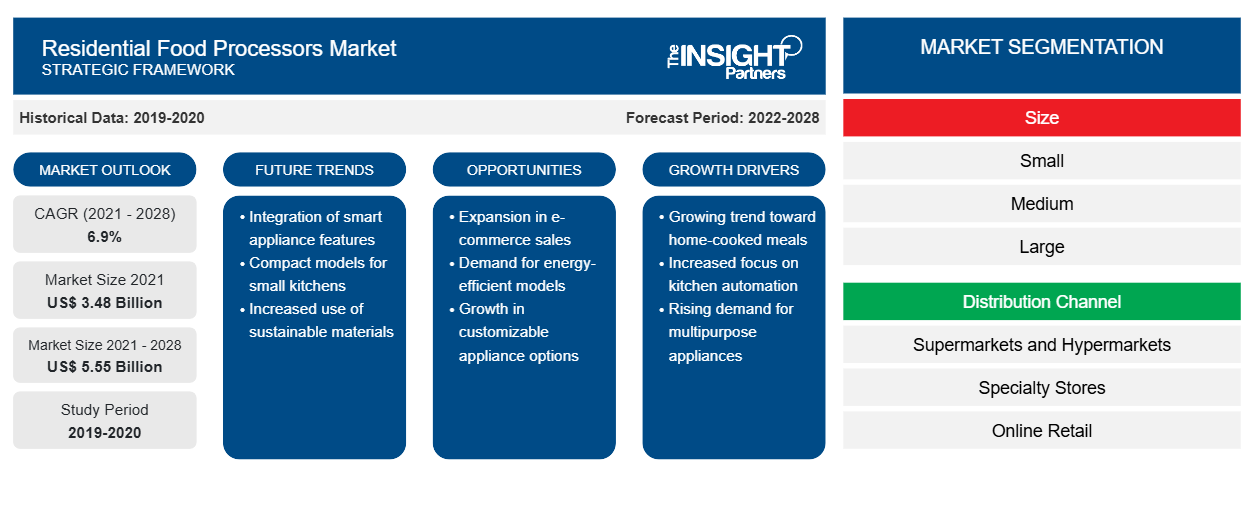

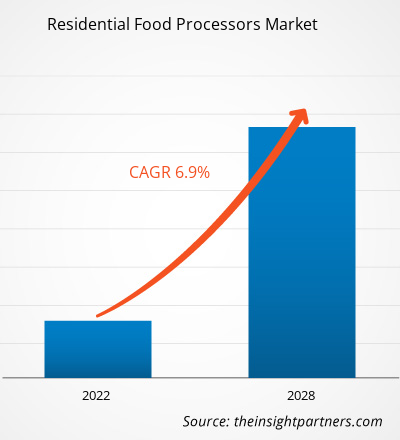

The residential food processors market was valued at US$ 3,475.21 million in 2021 and is projected to reach US$ 5,553.20 million by 2028; it is expected to grow at a CAGR of 6.9% from 2021 to 2028.

A residential food processor is basically a kitchen appliance used for easing out repetitive tasks during food preparation. The processors nowadays are mostly automated and provide ease while preparing food.

In 2020, Asia Pacific dominated the global residential food processors market and is expected to retain its dominance during the forecast period. The increase in the working population across the region has led to increasing demand for convenient household and kitchen appliances. These factors are expected to propel the demand for residential food processors across the region. In addition, the change in consumers’ lifestyles has led to increased adoption of modernized household and kitchen appliances. The rising population in countries such as China and India has led to increased construction of residential houses and complexes having limited kitchen space. Thus, this lead to an increased demand for small kitchen appliances, such as mini food processors.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Increasing Demand for Convenient Products

Consumer lifestyle has become hectic in recent years due to increased work pressure, making them feel exhausted after their regular working hours. Working professionals increasingly prefer convenient, automated, and smart household and kitchen appliances that can save their time and effort. The residential food processors are multifunctional and fast. These food processors work effectively and significantly to ease the cooking process even if a user is cooking for a large number of people.

Size Insights

Based on the size, the residential food processors market is segmented into small, medium, and large. In 2020, the medium segment dominated the market. The increased constraint of kitchen size and space in developing countries is one of the factors driving the demand for medium-size residential food processors. The medium residential food processor includes a medium slicing disc, a shredding disc, and a stainless steel chopping blade for processing.

Koninklijke Philips N.V., Whirlpool Corporation, Breville Group Limited, De’Longhi Appliances S.r.l., Conair Corporation, Robert Bosch GmbH, MAGIMIX, SharkNinja Operating LLC, Groupe SEB, and Spectrum Brands Inc. are among the key players operating in the residential food processors market. The leading players adopt several strategies, such as mergers & acquisitions and product launches, to expand their geographic presence and consumer base.

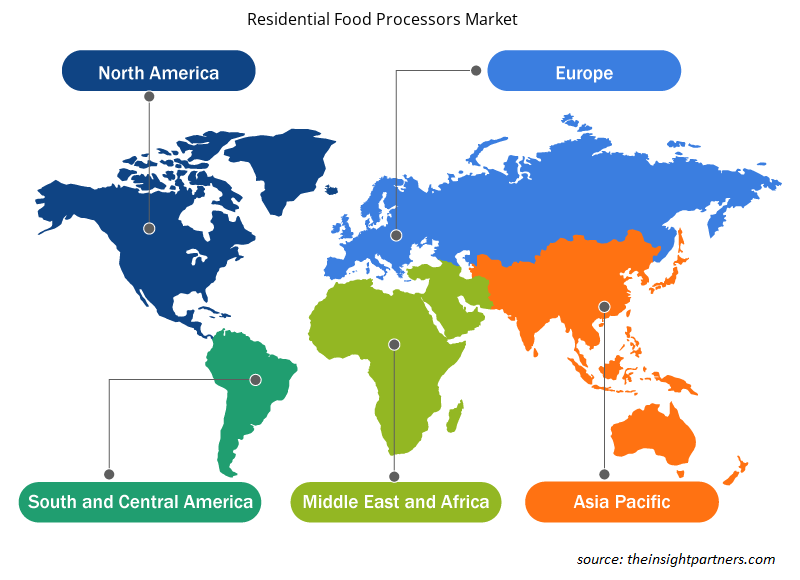

Residential Food Processors Market Regional Insights

Residential Food Processors Market Regional Insights

The regional trends and factors influencing the Residential Food Processors Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Residential Food Processors Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Residential Food Processors Market

Residential Food Processors Market Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 3.48 Billion |

| Market Size by 2028 | US$ 5.55 Billion |

| Global CAGR (2021 - 2028) | 6.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Size

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

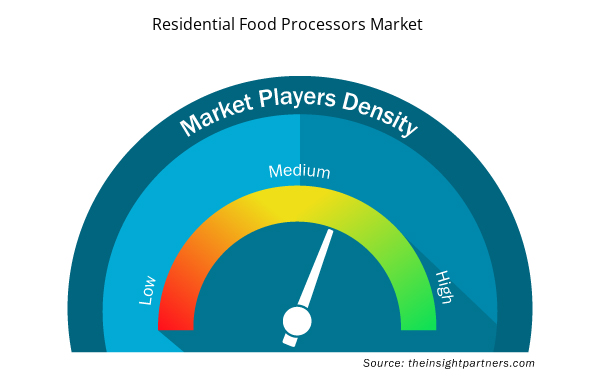

Market Players Density: Understanding Its Impact on Business Dynamics

The Residential Food Processors Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Residential Food Processors Market are:

- Koninklijke Philips N.V.

- Whirlpool Corporation

- Breville Group Limited

- De

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Residential Food Processors Market top key players overview

Report Spotlights

- Progressive trends in the residential food processors industry to help players develop effective long-term strategies

- Business growth strategies adopted by companies to secure growth in developed and developing markets

- Quantitative analysis of the global residential food processors market from 2019 to 2028

- Estimation of the demand for residential food processors across various industries

- PEST analysis to illustrate the efficacy of buyers and suppliers operating in the industry to predict the market growth

- Recent developments to understand the competitive market scenario and the demand for the residential food processors

- Market trends and outlook coupled with factors driving and restraining the growth of the residential food processors market

- Understanding regarding the strategies that underpin commercial interest with regard to the global residential food processors market growth, aiding in the decision-making process

- Residential food processors market size at various nodes of market

- Detailed overview and segmentation of the global residential food processors market as well as its industry dynamics

- Residential food processors market size in various regions with promising growth opportunities

The "Global Residential Food Processors Market Analysis to 2028" is a specialized and in-depth study of the consumer goods industry with a special focus on the global residential food processors market trend analysis. The report aims to provide an overview of the market with detailed market segmentation. The residential food processors market is segmented on the basis of size, distribution channel, and geography. Based on the size, the market is segmented into small, medium, and large. Based on distribution channel, the residential food processors market is segmented into supermarkets and hypermarkets, specialty stores, online retail, and others. Based on geography, the market is segmented into five main regions—North America, Europe, Asia Pacific, the Middle East and Africa, and South and Central America.

Company Profiles

- Koninklijke Philips N.V.

- Whirlpool Corporation

- Breville Group Limited

- De’Longhi Appliances S.r.l.

- Conair Corporation

- Robert Bosch GmbH

- MAGIMIX

- SharkNinja Operating LLC

- Groupe SEB

- Spectrum Brands Inc.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Oxy-fuel Combustion Technology Market

- Social Employee Recognition System Market

- Photo Editing Software Market

- Extracellular Matrix Market

- Retinal Imaging Devices Market

- Aircraft Landing Gear Market

- Vessel Monitoring System Market

- Microplate Reader Market

- Explosion-Proof Equipment Market

- Pressure Vessel Composite Materials Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Size, Distribution Channel, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, Egypt, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Asia Pacific is expected to be the fastest growing region within the global residential food processors market. The rising population in countries such as China and India have led to an increase in the construction of residential houses and complexes having limited kitchen space. Thus, there is an increased demand for multifunctional and small kitchen appliances. Thus, mini residential food processor is preferred in such countries in terms of convenience because they are lightweight, multifunctional and require little space. Thus, the rapidly changing lifestyle of consumers, increasing awareness related to eco-friendly products, and the rising trend of automation in day-to-day activities to save time are providing lucrative opportunities for the residential food processors market in Asia-Pacific.

In 2020, specialty stores held the largest market share in the global residential food processors market. Specialty stores focus on the specific product category and have wide product varieties. The stores provide a personalized shopping experience and a positive retail environment to the customers. They offer value-added products to their customers and focus on customer satisfaction. Moreover, specialty stores usually have trained staff who can assist the customers in making the purchase decisions. For the residential food processors market, specialty stores are expected to maintain their market prominence amongst other distribution channels due to the availability of specific products under one roof, pleasant atmosphere of store, and the presence of skilled staff that can help the customer choose the right product.

In 2020, the medium-size segment accounted for the largest market share. Medium-size residential food processors have a capacity of 9 to 12 cups and are great for making four portions of food at a time. It is suitable for chopping, dicing, mincing, and slicing. It is used for shredding hard cheeses, carrots, sprouts, and potatoes and pureeing soups, sauces, desserts, and dips. These food processors are also available with the multi-purpose dough blade and reversible slicing or shredding disc for preparing a variety of shapes and sizes ideal for recipes.

On the basis of distribution channels, online retail is the fastest-growing segment. Ecommerce platforms offer many products of various categories to customers across the world. Consumers can buy any product online from their homes or offices. Online retail is the fastest-growing distribution channel for the residential food processors market owing to many factors, such as ease of accessibility, availability of a wide range of products, cashback, discount coupons, and attractive deals. Aided by the disruption of physical stores due to the Covid-19 pandemic and lockdowns, the market for the online retail segment is expected to grow rapidly in the next few years.

The major players operating in the global residential food processors market are Koninklijke Philips N.V.; Whirlpool Corporation; Breville Group Limited; De’Longhi Appliances S.r.l.; Conair Corporation; Robert Bosch GmbH; MAGIMIX; SharkNinja Operating LLC; Groupe SEB; and Spectrum Brands Inc.

In 2020, Asia Pacific accounted for the largest share of the global residential food processors market. The countries in the region, such as China, India, and South Korea, are witnessing an upsurge in the middle-class population and growth in urbanization. The changing lifestyle of the consumers and increasing working population are propelling the adoption of modernized household and kitchen appliances.

Trends and growth analysis reports related to Consumer Goods : READ MORE..

The List of Companies - Residential Food Processors Market

- Koninklijke Philips N.V.

- Whirlpool Corporation

- Breville Group Limited

- De’Longhi Appliances S.r.l.

- Conair Corporation

- Robert Bosch GmbH

- MAGIMIX

- SharkNinja Operating LLC

- Groupe SEB

- Spectrum Brands, Inc

Get Free Sample For

Get Free Sample For