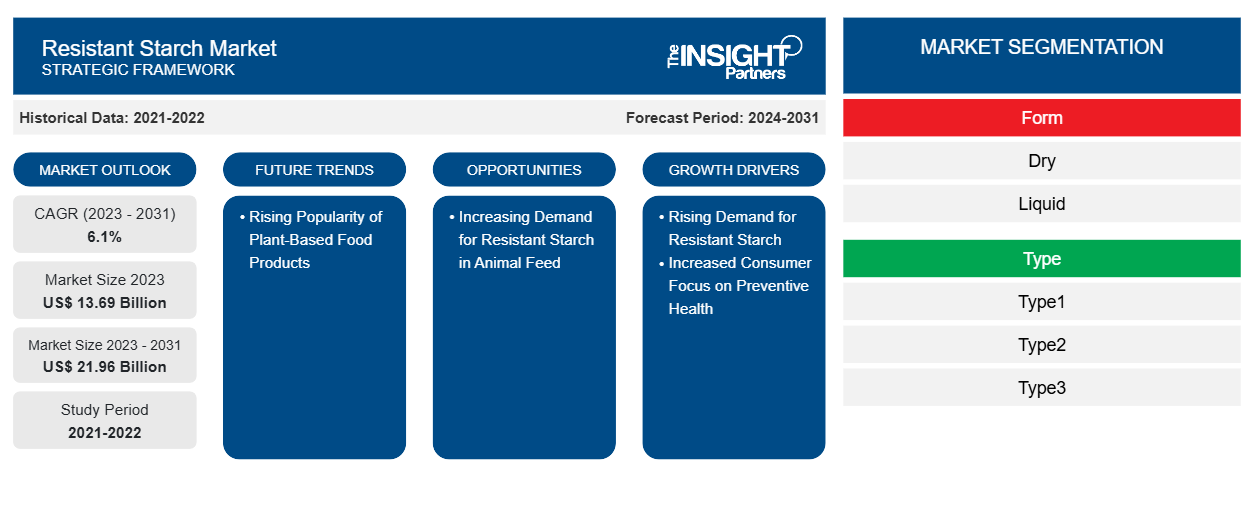

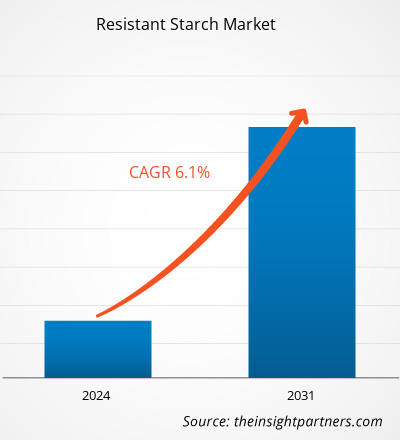

The resistant starch market size is projected to reach US$ 13.69 billion in 2023 and is projected to reach US$ 21.96 billion by 2031; it is estimated to register a CAGR of 6.1% during 2023–2031. Rising demand for resistant starch from the food and beverage industry contributes to the market growth of the resistant starch market.

Resistant Starch Market Analysis

The growing population worldwide is increasing the demand for food and beverages. According to the United Nations, the global population is projected to reach 8.5 billion by 2030. There has been a substantial increase in demand for ready-to-eat or convenience food and beverage products due to increasingly busy lifestyles and a surge in the working population in developing countries such as India and China. Further, the increasing demand from animal feeds is propelling the resistant starch market. Animal feed consisting of resistant starch acts as an additive and is responsible for increasing the yield. It is used in poultry feed as an alternative to antibiotics. The rising incidences of digestive disorders in livestock, such as enteric infections and acidosis, further strengthen the scope of resistant starch. Resistant starch positively impacts animal health by triggering growth rate and milk and egg yield. Thus, the increasing demand for resistant starch in animal feed is anticipated to create lucrative opportunities for the resistant starch market growth during the forecast period.

Resistant Starch Market Overview

Resistant starch is used in food and beverages, dietary supplements, and animal feed. In the food & beverages industry, resistant starch is used as an ingredient in bread and bakery products, nutrition bars, biscuits and cookies, breakfast cereals, pasta and noodles, soups and ready meal components, and thickened beverages. There are various types of resistant starch, such as type1, type2, type3, and type4. Resistant starch has a granular structure that resists digestion due to the molecules being tightly packed in crystalline forms, making it difficult for enzymes to break down.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Resistant Starch Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Resistant Starch Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Resistant Starch Market Opportunities and Drivers

Increasing Demand for Resistant Starch in Animal Feed

Antibiotics, a feed additive, have been widely used in livestock diets for several decades owing to their therapeutic effects. However, a few countries limit the use of certain types of antibiotics due to growing concerns about surging bacterial antibiotic resistance. Furthermore, in 2006, the European Union (EU) prohibited using antibiotics as feed additives. Such limitations on using antibiotics as growth promoters are directing livestock owners' attention to plant-based growth promoters. As a result of customer inclination toward safe food and regulatory concerns regarding the use of antibiotics, growth-promoting additive providers seek natural strategies to modulate gut development and health. For instance, resistant starch has been suggested as an alternative to antibiotics, as prebiotics are live microbial feed supplements that beneficially affect the host by improving intestinal microbial balance. The use of resistant starch as a possible alternative to antibiotics has received renewed interest owing to the legislation prohibiting the consumption of subtherapeutic amounts of antibiotics.

Animal feed consisting of resistant starch acts as an additive and is responsible for increasing the yield. It is used in poultry feed as an alternative to antibiotics. The rising incidences of digestive disorders in livestock, such as enteric infections and acidosis, further strengthen the scope of resistant starch. Resistant starch positively impacts animal health by triggering growth rate and milk and egg yield. Thus, the increasing demand for resistant starch in animal feed is anticipated to create lucrative opportunities for the resistant starch market growth during the forecast period.

Increasing Consumer Focus on Preventive Health

Hectic work schedules and extended working hours have led people to pay less attention to their daily diet, health, and fitness. The lack of a proper diet might lead to various health issues, such as obesity, diabetes, and digestive problems. As a result, people are becoming more focused on preventive health and dietary supplements that offer health benefits without harmful effects. Prebiotics-infused supplements nourish human gut flora and significantly boost their metabolic activity, thereby improving digestion, nutrition absorption, and immune systems while inhibiting harmful microbe growth. Resistant starch as a prebiotic ingredient helps prevent obesity by positively stimulating fermentation by gut microbiota. Resistant starch enhances the body's ability to respond to insulin, enabling the body to manage high blood sugar and reducing the risk of type 2 diabetes, Alzheimer's disease, and heart disease.

Resistant starch used in dietary supplements creates good bacteria after fermentation in the large intestine. This leads to less constipation, lower cholesterol levels, and lower risk of colon cancer. According to a survey conducted by the International Food Information Council (IFIC) in 2022, 66% of Americans were concerned about digestive health, with many people seeking foods that can improve gut health. After the onset of the COVID-19 pandemic, there has been a sharp rise in the popularity of functional foods and dietary supplements, as people have been prioritizing their health and actively searching for healthy alternatives. Dietary supplements formulated with resistant starch improve digestion and nutrient absorption and help lower the risk of digestive diseases. Further, consistent and adequate intake of prebiotics lowers the risk of cardiovascular diseases, including coronary heart disease, by reducing low-density lipoprotein (LDL) levels. Thus, rising awareness about preventive health among consumers fuels the resistant starch market growth.

Resistant Starch Market Report Segmentation Analysis

Key segments that contributed to the derivation of the resistant starch market analysis are form, type, and application.

- Based on form, the market is divided into dry and liquid. The dry segment held the largest share of the market in 2023.

- In terms of type, the market is segmented into type1, type2, type3, and type4. The type 2 segment held a significant share of the market in 2023.

- Based on application, the market is segmented into food and beverages, dietary supplements, and animal feed. The food and beverages segment dominated the market in 2023.

Resistant Starch Market Share Analysis by Geography

The geographic scope of the resistant starch market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific is expected to grow at the fastest CAGR during 2023-2031. China, as one of the largest producers of agricultural products, particularly corn, has leveraged its agricultural resources to manufacture resistant starch at scale. China plays a pivotal role in this expansion owing to rising awareness regarding digestive health benefits and obesity management. According to NIH, in China, the obesity rate in men was approximately 10%, and in women, it was ~8% in 2023. The Government of China has also promoted healthier dietary habits through initiatives that encourage the consumption of low-glycemic index foods, further boosting the demand for resistant starch. In 2023, the use of resistant starch in bakery products and snacks was notably high, especially among urban consumers seeking healthier alternatives. The growing interest in clean-label ingredients and dietary fibers is also propelling the market, with companies in China investing in research and development to expand their product portfolios. Further, the imports of resistant starch into China are also growing, reflecting a reliance on this ingredient in various food applications. This contributes to the growth of the resistant starch market share in the region.

Resistant Starch Market Regional Insights

The regional trends and factors influencing the Resistant Starch Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Resistant Starch Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Resistant Starch Market

Resistant Starch Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 13.69 Billion |

| Market Size by 2031 | US$ 21.96 Billion |

| Global CAGR (2023 - 2031) | 6.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Form

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Resistant Starch Market Players Density: Understanding Its Impact on Business Dynamics

The Resistant Starch Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Resistant Starch Market are:

- Tate & Lyle Plc

- Archer-Daniels-Midland Co

- Cargill Inc

- Ingredion Inc

- Arcadia Biosciences Inc

- Roquette Freres SA

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Resistant Starch Market top key players overview

Resistant Starch Market News and Recent Developments

The resistant starch market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A recent key development in the resistant starch market is mentioned below:

- MSP Starch Products Inc. secured a Master File acceptance from Health Canada, establishing Solnul as a prebiotic ingredient for Natural Health Products, a testament to its research on dose prebiotic starch. (Source: MSP Starch Products Inc, Company Website, 2024)

Resistant Starch Market Report Coverage and Deliverables

The "Resistant Starch Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Resistant starch market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Resistant starch market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- Resistant starch market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the resistant starch market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The resistant starch market size is projected to reach US$ 21.96 billion by 2031.

Increasing focus on preventive health is contributing to the growth of the market.

The rising popularity of plant-based products is likely to emerge as a key trend in the market in the future.

Archer-Daniels-Midland Co, Cargill Inc, Ingredion Inc, Arcadia Biosciences Inc, Roquette Freres SA, MGP Ingredients Inc, Crespel & Deiters GmbH & Co KG, American International Foods Inc, Agrana Beteiligungs AG, Lehmann Food Ingredients Ltd, KMC Amba, Emsland-Stärke GmbH, Kono Chem Co Ltd, and BS Starch Chemical Co Ltd are a few of the key players operating in the resistant starch market.

Asia Pacific accounted for the largest share of the market in 2023.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies - Resistant Starch Market

- Tate & Lyle Plc

- Archer-Daniels-Midland Co

- Cargill Inc

- Ingredion Inc

- Arcadia Biosciences Inc

- Roquette Freres SA

- MGP Ingredients Inc

- Crespel & Deiters GmbH & Co KG

- American International Foods Inc

- Agrana Beteiligungs AG

- Lehmann Food Ingredients Ltd

- KMC Amba

- Emsland-Stärke GmbH

- Kono Chem Co Ltd

- BS Starch Chemical Co Ltd

Get Free Sample For

Get Free Sample For