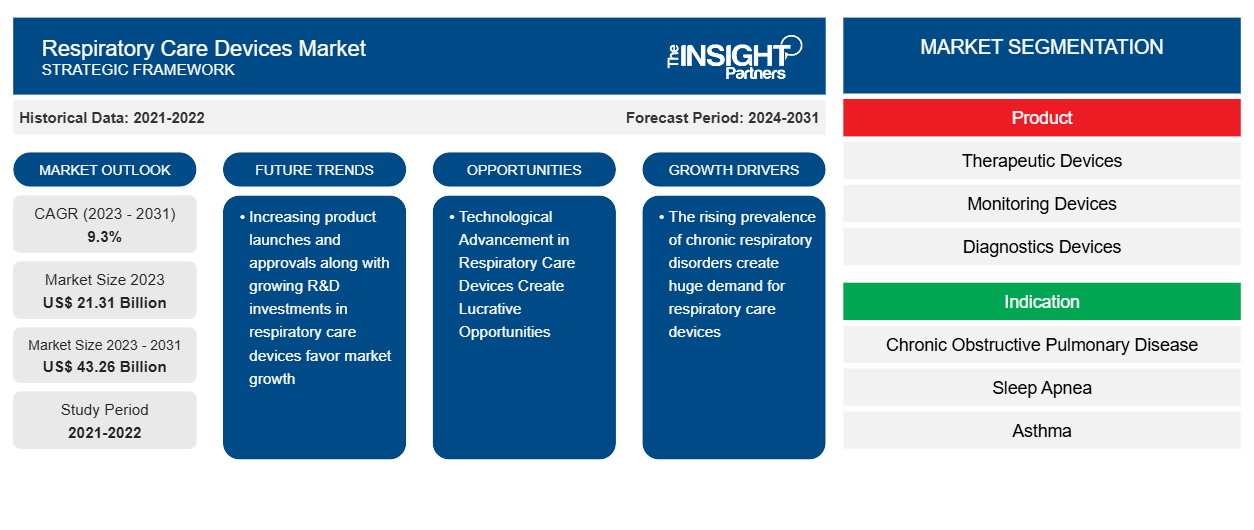

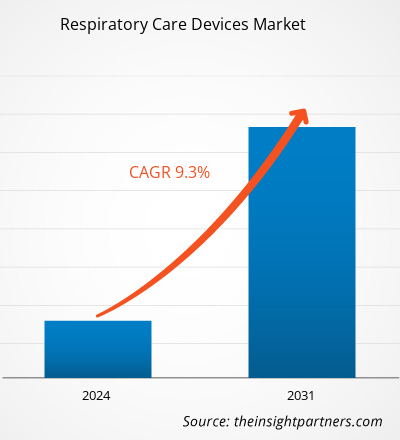

The Respiratory care devices market size is projected to reach US$ 43.26 billion by 2031 from US$ 21.31 billion in 2023. The market is expected to register a CAGR of 9.3% during 2023–2031. Growing adoption of mobile/digital respiratory care devices and paradigm shift towards value-based technology solutions are likely to remain key trends in the market.

Respiratory Care Devices Market Analysis

The rising prevalence of respiratory diosrders such as COPD, asthma, influenza, and others and increasing number of product launches and approvals along with suring R&D investments in respiratory care devices are the major factors driving the respiratory care devices market growth. Additionally, growing demand for hocare therapeutic devices and technological advancement in respirarory care devices are expected to create lucrative opportunities for the market growth. Moreover, growing adoption of mobile/digital respiratory care devices and paradigm shift towards value-based technology solutions are the trending factors contributing to the market growth.

Respiratory Care Devices Market Overview

Respiratory care devices market is driven by the rising prevalence of respiratory diosrders such as COPD, asthma, influenza, and others and increasing number of product launches and approvals along with suring R&D investments in respiratory care devices. Additionally, growing demand for hocare therapeutic devices and technological advancement in respirarory care devices are expected to create lucrative opportunities for the market growth. North America dominated the respiratory care devices market and the US leading the North America market. During the COVID-19 pandemic, the US Food and Drug Administration (FDA) undertook significant actions to increase the availability of respiratory equipment, including ventilators, pulse oximeter, oxygen concentrator and other devices and accessories. However, Asia Pacific is anticipated to register the significant growth rate owing to the growing investments from international players in China and India, improving government support in countries, surge in the geriatric population, growing pollution levels, and advancing healthcare infrastructure. Therefore, the region holds huge potential for the respiratory care devices market players to grow during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Respiratory Care Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Respiratory Care Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Respiratory Care Devices Market Drivers and Opportunities

Increasing Prevalence of Infectious Respiratory Diseases to Favor Market

Infectious respiratory diseases are creating a rising burden on the healthcare system worldwide. Infectious respiratory disease can be induced due to several factors associated with immune deficiency. Most infectious respiratory diseases are spread from person to person through mucus and saliva and are caused by microorganisms that can infect the respiratory system. The severity of contagious respiratory diseases ranges from mild to severe. Infectious respiratory diseases consist of an exhaustive list of diseases, such as tuberculosis (TB), COVID-19, influenza, diphtheria, measles, pneumonia, pertussis, respiratory syncytial virus (RSV), etc. In recent years, the COVID-19 recorded the highest mortality rate globally. Among the above-mentioned infectious respiratory diseases, TB was on the top of the list for high prevalence before the COVID-19 pandemic. For instance, According to the World Health Organization (WHO), TB is the 13th leading cause of death and the 2nd leading infectious disease after COVID-19. In October 2021, the WHO stated that in 2022, approximately 10.6 million people were infected with TB worldwide, including 5.8 million men, 3.5 million women, and 1.3 million children.

Technological Advancement in Respiratory Care Devices Create Lucrative Opportunities

Technological advancements make it easier for specialists to diagnose and patients to administer self-care. For instance, inhalers dispense nearly 90% of the medications prescribed for respiratory illness. Smart inhalers are the newest tool to help respiratory disease patients get their drugs and relay vital information back to doctors. Smart inhalers are embedded with AI technology to collect data and monitor a patient's condition. Technology is being tested to alert users to potential environmental triggers and a reminder to take their medication on time. Clinicians and doctors can use the data collected by these smart inhalers to understand each patient's needs better. Also, market participants can focus on the following trends to tap into these growth opportunities:

- Smart inhaler capable of providing feedback and support: Pharmaceutical companies can collaborate or partner with innovative start-ups which offer real-time feedback on the inhaler technique and use acoustic technology for drug delivery to the patients.

- Innovative and durable oxygen concentrators: Health technology companies and innovators can partner to explore opportunities to produce improved, stable, and easy-to-operate oxygen concentrators for hospital and home purposes.

Respiratory Care Devices Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Respiratory care devices market analysis are product, indication, and end user.

- Based on product, the Respiratory care devices market is segmented into therapeutic devices, monitoring devices, diagnostics devices, and consumables and accessories. Therapeutic devices are further segmented into positive Airway Pressure (PAP) Devices, Oxygen Concentrators, Ventilators, Inhalers, Nebulizers, Humidifiers, and Others. The therapeutic devices segment held the largest market share in 2023.

- By indication, the market is segmented into neurogenerative chronic obstructive pulmonary disease (COPD), sleep apnea, asthma, infectious diseases, and others. The chronic obstructive pulmonary disease (COPD)segment held the largest share of the market in 2023.

- In terms of end user, the market is classified into hospitals, home care, and ambulatory care.. The hospitals segment held a significant share of the market in 2023.

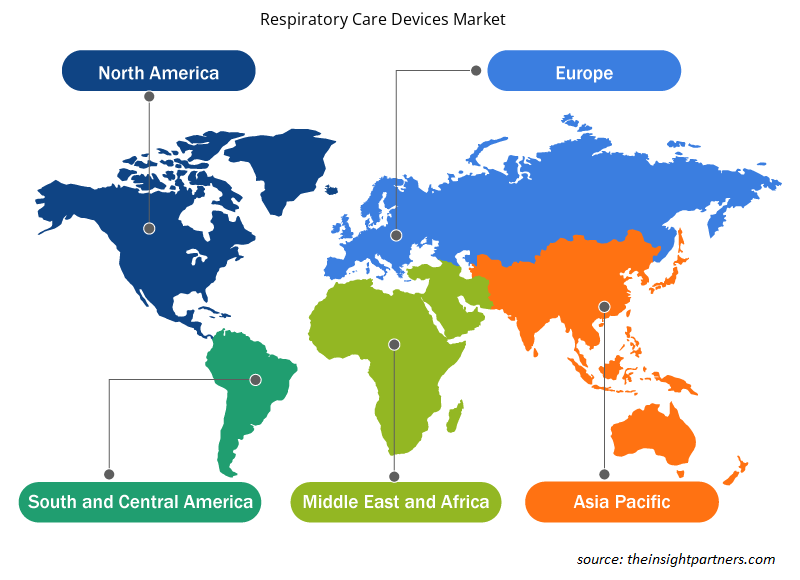

Respiratory Care Devices Market Share Analysis by Geography

The geographic scope of the Respiratory care devices market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the market owing to the rapid spread of COVID-19, rising prevalence of chronic obstructive pulmonary diseases (COPD) and asthma, increasing elderly population, and growing research & development of respiratory care devices are a few of the major factors responsible for boosting the market growth. In Canada and Mexico, the market is likely to experience growth opportunities due to growing respiratory disorder cases and the continuous launch of various respiratory care devices by leading organizations. Asia Pacific is anticipated to grow with the highest CAGR in the coming years.

Respiratory Care Devices Market Regional Insights

The regional trends and factors influencing the Respiratory Care Devices Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Respiratory Care Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Respiratory Care Devices Market

Respiratory Care Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 21.31 Billion |

| Market Size by 2031 | US$ 43.26 Billion |

| Global CAGR (2023 - 2031) | 9.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

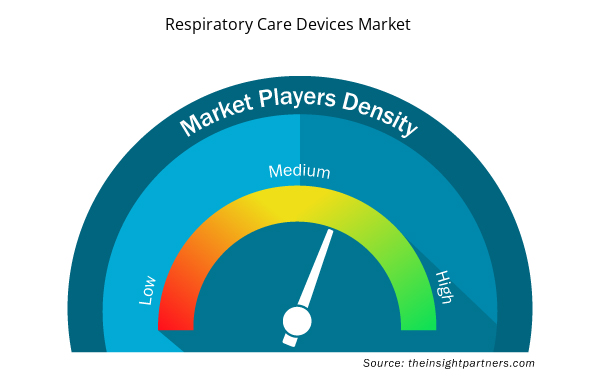

Respiratory Care Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Respiratory Care Devices Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Respiratory Care Devices Market are:

- Koninklijke Philips N.V.

- ResMed Inc

- Medtronic

- Masimo

- THERMO FISHER SCIENTIFIC INC.

- Dragerwerk AG & Co. KGaA

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Respiratory Care Devices Market top key players overview

Respiratory Care Devices Market News and Recent Developments

The Respiratory care devices market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Respiratory care devices market are listed below:

- ResMed launched its AirCurve 11 series bilevel positive airway pressure devices in the U.S. It uses inspiratory positive airway pressure (IPAP) and expiratory positive airway pressure (EPAP). Combined with digital technology, AirCurve 11 was designed to help providers treat sleep apnea while patients start and stay on therapy. (Source: ResMed, Newsletter, February 2024)

- Getinge launched its Servo-c mechanical ventilator in India. The Servo-c is designed to address patients’ respiratory needs, offering lung-protective therapeutic tools. Through this launch, the company wants to make healthcare solutions accessible and affordable to hospitals in India. (Source: Getinge, Newsletter, February 2024)

- Inspira Technologies OXY B.H.N Ltd. launched a single-use disposable blood oxygenation kit for its INSPIRA ART medical device series. The Kit is also intended to be compatible with various other life support machines, tapping into the disposable perfusion systems market. (Source: Inspira Technologies, Press Release, January 2024)

Respiratory Care Devices Market Report Coverage and Deliverables

The “Respiratory Care Devices Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Respiratory care devices market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Respiratory care devices market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Respiratory care devices market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Respiratory care devices market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Indication, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

North America region dominated the Respiratory care devices market in 2023

The rising prevalence of respiratory diosrders such as COPD, asthma, influenza, and others and increasing number of product launches and approvals along with suring R&D investments in respiratory care devices the driving factors impacting the Respiratory care devices market

Growing adoption of mobile/digital respiratory care devices and paradigm shift towards value-based technology solutions are the future trends of the Respiratory care devices market

The leading players operating in the Respiratory care devices market includes Koninklijke Philips N.V., ResMed Inc, Medtronic, Masimo, THERMO FISHER SCIENTIFIC INC., Dragerwerk AG & Co. KGaA, Invacare Corporation, Getinge AB., Nihon Kohden Corporation, Air Liquide, Teleflex Incorporated among others

The estimated value of the Respiratory care devices market by 2031 is US$ 43.26 Bn

The expected CAGR of the Respiratory care devices market is 9.3%

Get Free Sample For

Get Free Sample For