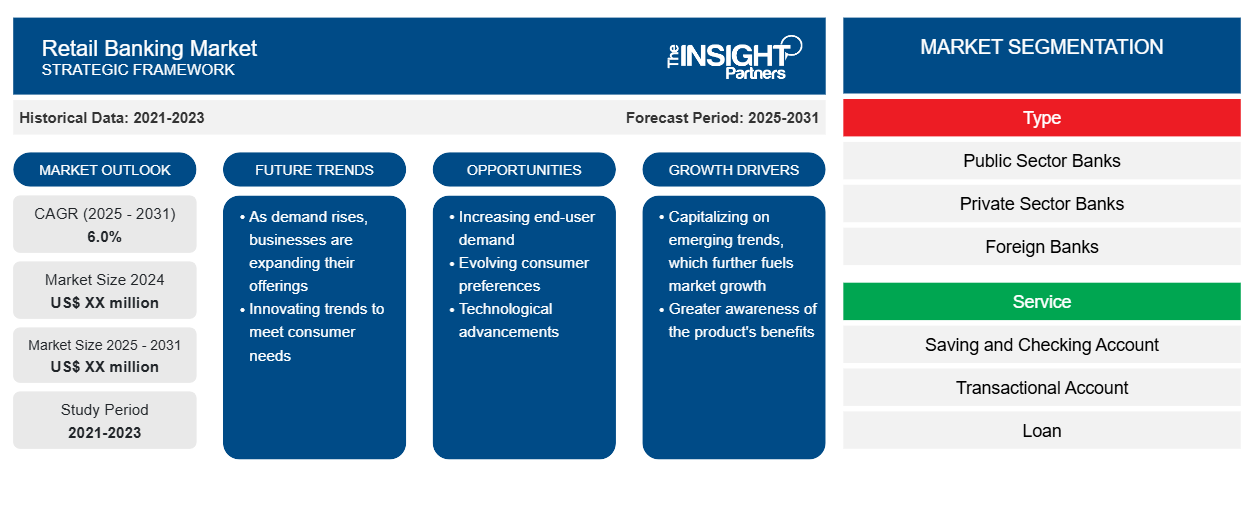

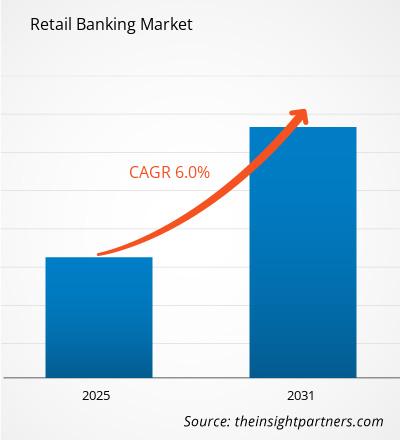

The Retail Banking Market size is anticipated to expand at a CAGR of 6.0% from 2025 to 2031. Rising demand for personalized consulting services to drive the retail banking market growth.

Retail Banking Market Analysis

The retail banking market has experienced significant growth in recent years, driven by various factors such as technological advancements, changing customer preferences, regulatory reforms, and evolving market dynamics. This growth trend is expected to continue in the foreseeable future, propelled by several key drivers and trends. One of the primary drivers of growth in the retail banking market is technological innovation. The adoption of digital banking solutions, such as mobile banking apps, online account management platforms, and contactless payment options, has transformed the way customers interact with banks. These technologies have not only enhanced convenience for customers but have also enabled banks to streamline their operations, reduce costs, and improve efficiency. Furthermore, the rise of fintech companies and their innovative solutions has introduced new competition into the retail banking landscape. Fintech startups often specialize in niche areas such as peer-to-peer lending, robo-advisory services, and digital wallets, offering consumers alternative options to traditional banking services. As a result, traditional banks are under pressure to innovate and adapt to meet changing customer demands, driving further growth and evolution in the market.

Retail Banking Industry Overview

- Retail banking, also known as consumer banking or personal banking, offers financial services to individual consumers rather than enterprises. Customers can manage their money, get credit, and deposit money safely and securely when via retail banking services.

- In the United States of America, commercial banks are also called retail banks, and investment banks can only invest money in market operations. Retail banks offer a wide range of services to the public, such as bank accounts, fixed deposits, credit and debit cards, loans, etc. These services help people efficiently manage their finances. Retail banking services, like deposits and withdrawals, can be done both online and at the bank branch.

- Online retail banking has made it easier for individual consumers to avail of home loans, personal loans, car loans, open fixed and recurring deposits, transfer money, etc. However, the range of services and products offered could vary from bank to bank.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Retail Banking Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Retail Banking Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Retail Banking Market Drivers and Opportunities

Rising Demand for Personalized Consulting Services to Drive the Retail Banking Market

- Retail banks can improve their market position by taking advantage of the expansion prospects created by the need for individualized consultancy services. Retail clients are looking for more individualized services and customized financial solutions that meet their requirements and objectives. The need for individualized consultancy services drives retail banks' ability to offer more thorough and specialized financial planning and assistance.

- Banks may set themselves apart from rivals and forge closer bonds with clients by providing individualized consultations. Personalized consulting services are a factor in maintaining long-term client retention and loyalty. Customers are more inclined to stick with the bank and keep utilizing its goods and services when they get insightful guidance and experience results from individualized consultations.

Retail Banking Market Report Segmentation Analysis

- Based on type, the retail banking market is segmented into public sector banks, private sector banks, foreign banks, community development banks, non-banking financial companies (NBFC), and rural banks.

- The private sector banks segment is expected to hold a substantial retail banking market share in 2023 owing to their innovative products, operational efficiency, and strong customer focus. By utilizing contemporary technology, private sector banks can differentiate themselves as innovators in meeting evolving customer needs and draw in tech-savvy customers.

- Effective banking solutions, such as retail banking, yield lower interest rates, faster loan processing, and more efficient services, all of which contribute to increased client satisfaction. Thus, by helping them to traverse the constantly shifting financial landscape with agility, this focus on operational excellence helps private sector banks to remain at the forefront of providing efficient and customer-focused solutions.

Retail Banking

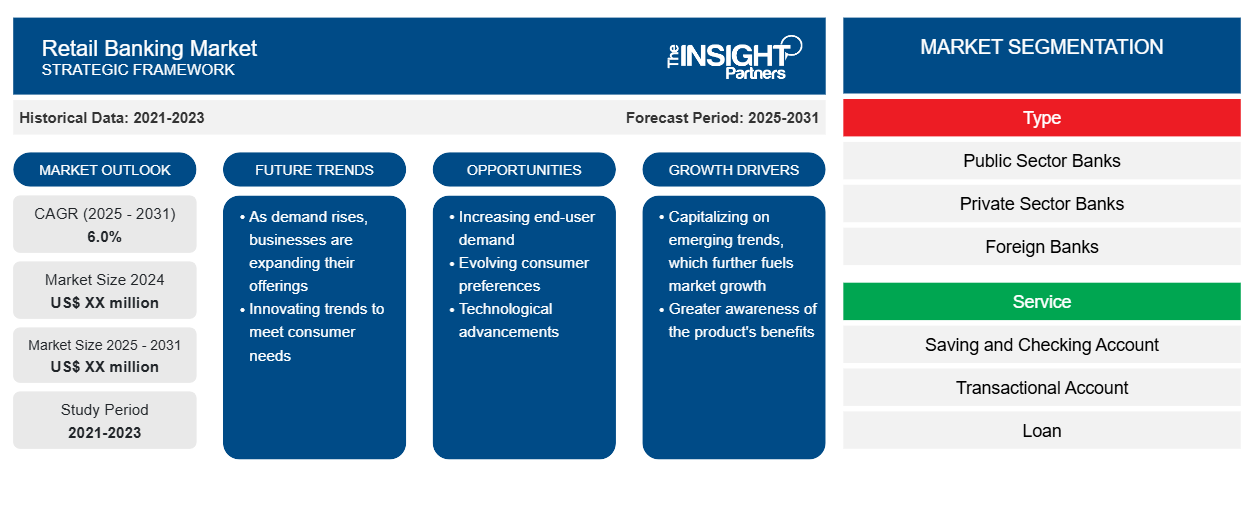

Market Share Analysis by Geography

The scope of the retail banking market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. Asia Pacific (APAC) is experiencing rapid growth and is anticipated to hold a significant retail banking market share. The population of the area is large and expanding quickly, and the middle class and disposable income of the populace are both rising. The demand for banking services, such as savings accounts, loans, and investment products, has increased as a result of this demographic shift. In addition, the area has seen notable urbanization and economic growth, which has stimulated corporate expansion and financial activity. As a result, more financial services are required to accommodate both personal and business activities.

Retail Banking

Retail Banking Market Regional Insights

Retail Banking Market Regional Insights

The regional trends and factors influencing the Retail Banking Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Retail Banking Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Retail Banking Market

Retail Banking Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX million |

| Global CAGR (2025 - 2031) | 6.0% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Retail Banking Market Players Density: Understanding Its Impact on Business Dynamics

The Retail Banking Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Retail Banking Market are:

- BNP Paribas

- Citigroup Inc.

- HSBC India

- JPMorgan Chase and Co.

- Bank of America Corporation

- Barclays

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Retail Banking Market top key players overview

The " Retail Banking Market Analysis" was carried out based on type, service, and geography. In terms of type, the market is segmented into public sector banks, private sector banks, foreign banks, community development banks, non-banking financial companies (NBFC), and rural banks. Based on service, the retail banking market is segmented into saving and checking accounts, transactional accounts, loans, mortgages, debit and credit cards, and others. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the retail banking market. A few recent key market developments are listed below:

- In February 2024, Barclays Bank UK PLC agreed to acquire the retail banking business of Tesco and enter into an exclusive long-term partnership to offer Tesco branded credit cards, personal loans and deposits. Tesco’s retail banking customer base is broadly similar to Barclays UK’s existing customers and will complement its current business, as well as build on our existing UK strategic partnerships with other leading retail, consumer electronics, and loyalty program brands.

(Source: Barclays, Company Website)

- In January 2023, Societe Generale Group announced that it had completed the legal merger of its two French Retail Banking networks, Societe Generale and Crédit du Nord Group. SG is now the Group’s new French Retail Banking. The completion of the merger is accompanied by the implementation of a new relationship model, which will improve the quality of service provided to individual, business, and corporate customers and establish itself as a leading player in the French market in terms of savings, insurance and excellent solutions for businesses and professionals.

(Source: Societe Generale, Company Website)

Retail Banking

Market Report Coverage & Deliverables

The market report on “Retail Banking Market Size and Forecast (2021–2031)”, provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country- level for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Semiconductor Metrology and Inspection Market

- Aerosol Paints Market

- USB Device Market

- Vertical Farming Crops Market

- Emergency Department Information System (EDIS) Market

- Sterilization Services Market

- Microcatheters Market

- Volumetric Video Market

- Nuclear Decommissioning Services Market

- Aesthetic Medical Devices Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The global retail banking market is expected to grow at a CAGR of 6.0 % during the forecast period 2024 - 2031.

Rising demand for digital banking service are the major factors that propel the global retail banking market.

Growing adoption of artificial intelligence and blockchain in retail banking, which is anticipated to play a significant role in the global retail banking market in the coming years.

The key players holding majority shares in the global retail banking market are BNP Paribas; Citigroup Inc.; HSBC India; JPMorgan Chase & Co. and Bank of America Corporation.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- BNP Paribas

- Citigroup Inc.

- HSBC India

- JPMorgan Chase and Co.

- Bank of America Corporation

- Barclays

- China Construction Bank

- Wells Fargo

- TD Bank Group

- The PNC Financial Services Group, Inc

Get Free Sample For

Get Free Sample For