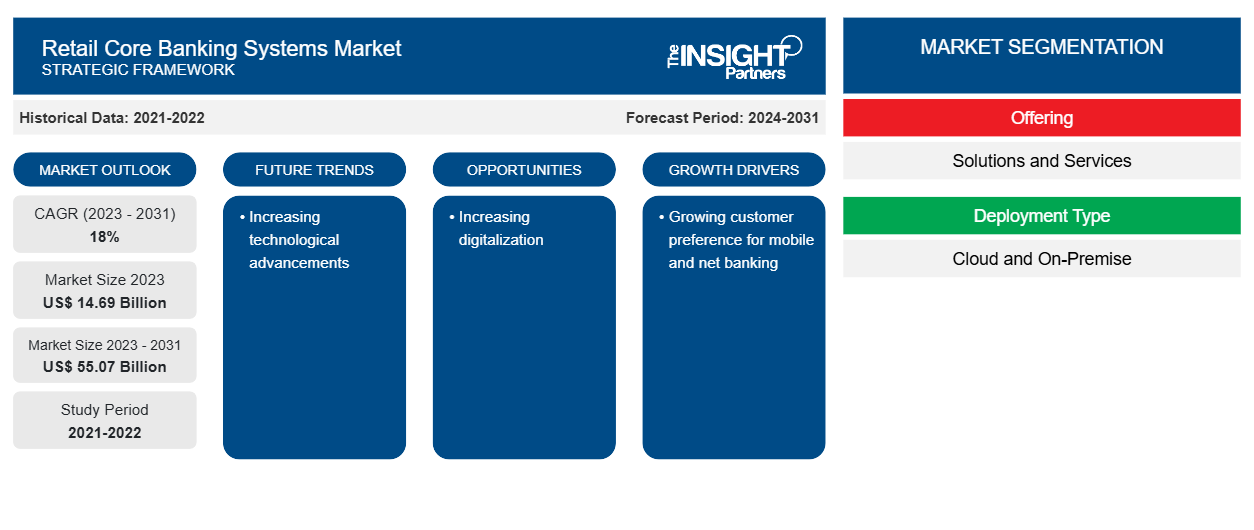

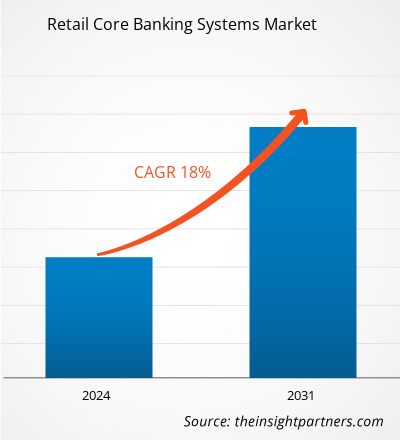

The Retail Core Banking Systems Market size is projected to reach US$ 55.07 billion by 2031 from US$ 14.69 billion in 2023. The market is expected to register a CAGR of 18% in 2023–2031. Increasing technological advancements are likely to remain key retail core banking systems market trends.

Retail Core Banking Systems Market Analysis

Due to the banking system's quick adoption of cutting-edge technology, the global market for retail core banking solutions is growing significantly and is predicted to do so in the future. A core banking system is a network of bank branches that enables customers to access a variety of financial services and keep an eye on their accounts from any location in the world.

Moreover, information technology (IT) is being applied by banks and FinTech companies to enhance the sustainability and growth of their respective businesses. Core banking technology offers ways to satisfy customers, enhance bank transaction performance, and adapt quickly to changing business needs. Technology also enables banks to streamline processes, cut down on delays, improve reporting and compliance, and provide client’s simple access.

Retail Core Banking Systems Market Overview

Retail core banking systems give banks the tools they need to better service their clients via digital channels for personal or consumer banking. By allowing clients to access credit and move money safely, these technologies improve customer money management. The use of retail banking systems helps banks to raise capital at cheap costs, establish a stable clientele, and maintain effective customer relationship management (CRM), all of which are anticipated to drive the market for retail core banking systems. Additionally, the growing consumer demand for mobile and net banking is supporting the market's expansion.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Retail Core Banking Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Retail Core Banking Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Retail Core Banking Systems Market Drivers and Opportunities

Growing Customer Preference for Mobile and Net Banking

Future growth in the retail core banking solutions market will be largely attributed to the growing demand from customers for mobile and net banking. With the help of mobile banking, customers may access and manage their bank accounts as well as carry out other financial tasks using their portable devices, such as smartphones or tablets. A banking service known as "net banking" enables users to access a variety of banking resources and carry out financial transactions via the Internet. In order to guarantee more seamless channel operations, the retail core banking solution is utilized to link net banking services with the bank's conventional operating channels.

Increasing Digitalization

Future growth in the retail core banking solutions market is largely attributed to the banking industry's increasing digitalization. In the banking, financial services, and insurance (BFSI) sector, "digital transformation" refers to the integration of digital technologies and tactics to improve client experiences, streamline business processes, and boost industry competitiveness. Multi-channel banking is supported by retail core banking solutions, giving users access to services via a variety of channels, including ATMs, mobile apps, online banking, and more. Thus, increasing digitalization is anticipated to present new opportunities for the retail core banking systems market players during the forecast period.

Retail Core Banking Systems Market Report Segmentation Analysis

Key segments that contributed to the derivation of the retail core banking systems market analysis are offering and deployment type.

Offering (Solutions and Services), and Deployment Type (Cloud and On-Premises) and Geography

- Based on the offering, the retail core banking systems market is bifurcated into solutions and services.

- By deployment type, the market is segmented into cloud and on-premises. The cloud segment held the largest share of the market in 2023.

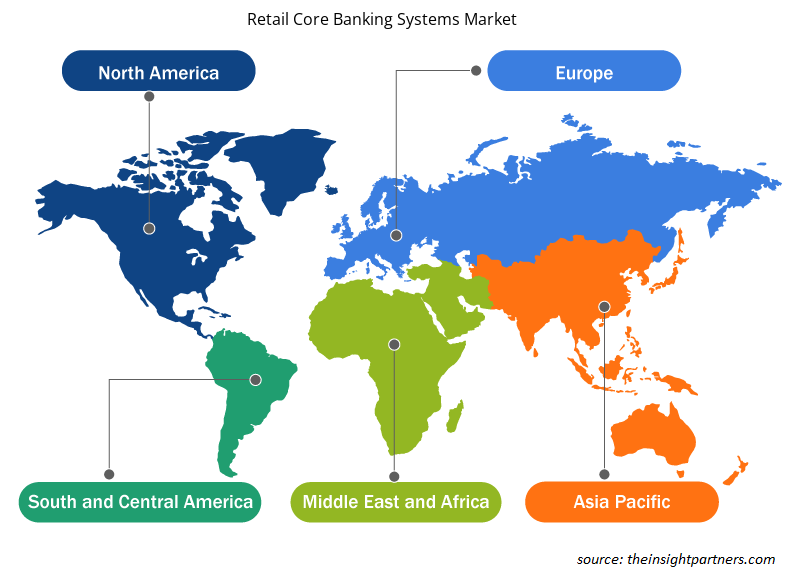

Retail Core Banking Systems Market Share Analysis by Geography

The geographic scope of the retail core banking systems market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America. In terms of revenue, North America accounted for the largest retail core banking systems market share. Because of major ongoing technological advancements in core banking solutions and adoption by major companies, such as Canadian Western Bank and HSBC Holdings plc, the dominance is expected to persist over the projected period.

Retail Core Banking Systems Market Regional Insights

The regional trends and factors influencing the Retail Core Banking Systems Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Retail Core Banking Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Retail Core Banking Systems Market

Retail Core Banking Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 14.69 Billion |

| Market Size by 2031 | US$ 55.07 Billion |

| Global CAGR (2023 - 2031) | 18% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Retail Core Banking Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Retail Core Banking Systems Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Retail Core Banking Systems Market are:

- Oracle Corporation

- SAP SE

- Tata Consultancy Services Limited

- Finastra International Limited

- Capital Banking Solutions

- EdgeVerve Systems Limited

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Retail Core Banking Systems Market top key players overview

Retail Core Banking Systems Market News and Recent Developments

The retail core banking systems market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for speech and language disorders and strategies:

- In April 2023, Oracle FS was updating the core banking software of Ethiopia-based OMO Bank in collaboration with Profinch, Oracle's FLEXCUBE implementation partner, and incorporating new anti-money laundering (AML) and fraud prevention technologies.

(Source: Oracle, Press Release)

- In Oct 2023, a fintech startup called Sopra Banking Software (SBS) introduced a cutting-edge Software-as-a-Service (SaaS) core banking platform. This platform is an Al-enabled, fully cloud-native solution that operates in real-time.

Retail Core Banking Systems Market Report Coverage and Deliverables

The “Retail Core Banking Systems Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Offering and Deployment Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The global retail core banking systems market was estimated to be US$ 14.69 billion in 2023 and is expected to grow at a CAGR of 18% during the forecast period 2023 - 2031.

Growing customer preference for mobile and net banking and increasing digitalization are the major factors that propel the global retail core banking systems market.

Increasing technological advancements are anticipated to play a significant role in the global retail core banking systems market in the coming years.

The key players holding majority shares in the global retail core banking systems market are Oracle Corporation, SAP SE, Tata Consultancy Services Limited, Finastra International Limited, and Capital Banking Solutions.

The global retail core banking systems market is expected to reach US$ 55.07 billion by 2031.

Get Free Sample For

Get Free Sample For