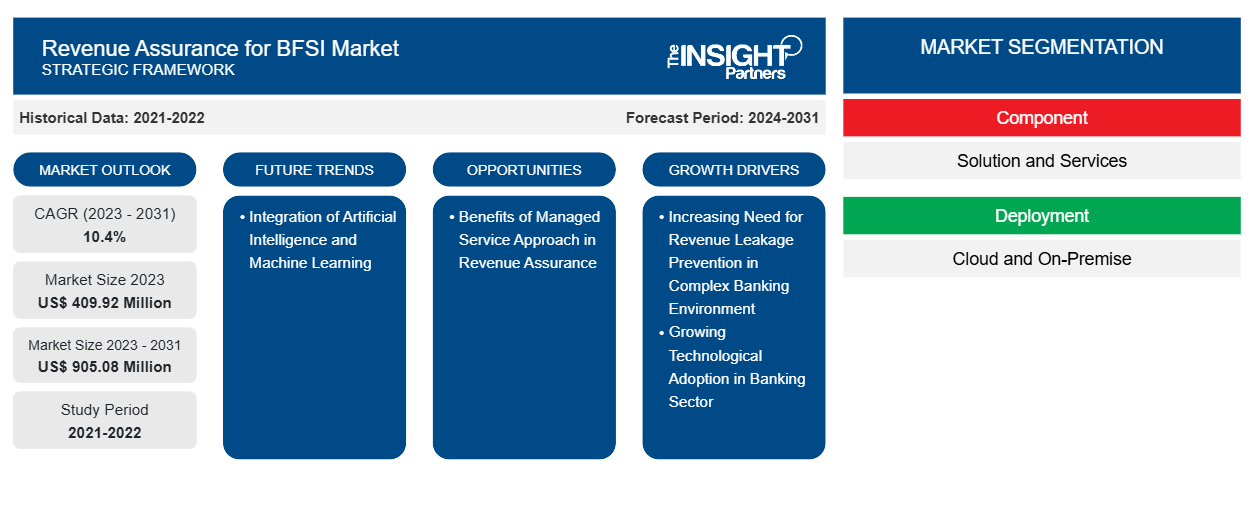

The revenue assurance for BFSI market size is projected to reach US$ 905.08 million by 2031 from US$ 409.92 million in 2023. The market is expected to register a CAGR of 10.4% in 2023–2031. Integration of artificial intelligence and machine learning is likely to remain one of the key revenue assurance for BFSI market trends.

Revenue Assurance for BFSI Market Analysis

Revenue assurance is a crucial process used by businesses to identify, analyze, mitigate, and prevent revenue leakage through various measures. It aims to reduce the risks of financial losses due to errors, inaccuracies, or inefficiencies in revenue-related activities. Revenue assurance encompasses multiple internal and external activities, including auditing, reconciliation, budgeting, and reporting, to ensure that the income generated from business operations is accurate, secure, and compliant.

Revenue Assurance for BFSI Market Overview

Several factors fuel the growth of the revenue assurance market for BFSI sector, including the rising complexity of banking operations. Financial services businesses prioritize customer-centricity by developing novel products and pricing strategies, generating new income streams, and optimizing digital channels. They also prioritize risk management, operational agility, and margin controls. A comprehensive revenue management and business assurance solution can help achieve these goals. With the rising complexity of business operations in the BFSI sector, revenue assurance solutions and services allow organizations to monitor their revenue streams and avoid revenue leakage.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Revenue Assurance for BFSI Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Revenue Assurance for BFSI Market Drivers and Opportunities

Growing Technological Adoption in Banking Sector by Electronic Manufacturers to Favor Market

Digital adoption in banking is the process of integrating and using digital technology and solutions to improve client experiences, streamline operations, and increase overall efficiency in the banking business.

As more banking transactions move online and via digital channels such as mobile banking and online payments, the number and complexity of transactions rise. Revenue assurance solutions assist banks in resolving and verifying these transactions, assuring proper revenue recognition and reducing revenue loss due to errors or fraud. For instance, according to 2021 data released by the World Bank, two-thirds of adults worldwide now make or receive digital payments, with developing economies accounting for 57% in 2021, up from 35% in 2014. In developing countries, 71% hold an account with a bank, another financial institution, or a mobile money provider, an increase from 63% in 2017 and 42% in 2011. Digitalization has raised client expectations for consistent, tailored banking services across all channels. Revenue assurance solutions help banks improve the customer experience by optimizing revenue streams, recognizing cross-selling and upselling opportunities, and delivering targeted marketing campaigns based on customer data. According to a 2023 survey by Astera Software, with more than 70% of customers underlining the importance of personalized offers in banking, it is clear that individuals place great value on individualized experiences from their financial institutions. Also, a 2023 study by Genesys stated that 72% of business leaders believe that customer loyalty is achieved majorly by offering personalized products and services.

Thus, the digitization of the BFSI sector is driving the market for revenue assurance in banking. By employing modern technologies and data-driven insights, banks can improve revenue assurance methods, manage risks, and seize new income opportunities in the digital world.

Benefits of Managed Service Approach in Revenue Assurance

There is a rise in competition across the BFSI sector. Service providers are focusing on making their prices competitive and innovative in order to differentiate their offerings. To maintain the pace of innovation and lower prices while remaining profitable, firms must identify ways to improve operational efficiency. In this context, they are assessing all chances to reduce operational costs, including a review of all solutions, such as managed services. With income assurance managed services, BFSI firms may manage the complexity of their business, particularly control and support tasks, and focus their efforts on expansion and innovation initiatives that might generate additional income. A revenue assurance team should be equipped with business process experience and technological know-how to identify discrepancies and deviations during the implementation of a company strategy. Outsourcing revenue assurance activities, either partially or entirely, not only improves internal auditing skills but also allows for the expansion of responsibilities and talents within these teams without the need to hire additional workers. A revenue assurance managed services team should be adaptable and multidisciplinary, and they should work consistently to detect, investigate, and analyze the defined and implemented controls, proposing corrections and appropriate corrective actions to ensure the prevention (and avoidance) of inconsistencies. Thus, in order to realize reduced operational costs and provide the best expertise in revenue assurance, the focus on managed or outsourced services ought to increase.

Revenue Assurance for BFSI Market Report Segmentation Analysis

Key segments that contributed to the derivation of the revenue assurance for BFSI market analysis are component, deployment, and organization size.

- Based on component, the revenue assurance for BFSI market is segmented into solutions and services. The solutions segment held a larger market share in 2023.

- Based on deployment, the market is segmented into cloud and on-premise.

- By organization size, the market is bifurcated into large enterprises and SMEs.

Revenue Assurance for BFSI Market Share Analysis by Geography

The geographic scope of the revenue assurance for BFSI market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America dominated the revenue assurance for BFSI market share in 2023. The financial services sector in the US encompasses a variety of institutions, such as commercial banks, insurance companies, nonbanking financial companies, cooperatives, pension funds, mutual funds, and other smaller financial entities. Within the banking component of BFSI, there are different segments, including core banking, retail, private, wealth, corporate, investment, and cards, while financial services cover activities such as stock-broking, payment gateways, wallets, and mutual funds. Ensuring revenue assurance is vital in the BFSI industry to prevent loss of income or fees resulting from inconsistent practices, inadequate pricing controls, and the lack of attention to detail, all of which can lead to revenue leakages. In October 2023, a survey commissioned by the American Bankers Association and Morning Consult revealed that consumers are increasingly adopting digital banking channels. The survey found that 48% of bank customers preferred using mobile apps for managing their bank accounts, while 23% favored online banking via laptops or PCs over the past year. Additionally, visiting a physical branch (9%), ATMs (8%), and telephone calls (5%) are among the next most utilized banking methods. This trend reflects the ongoing digital transformation in the BFSI industry. The industry is embracing digitization and emerging technologies to improve operational efficiency, increase revenue, and provide a better customer experience, further boosting the demand for revenue assurance in BFSI.

Revenue Assurance for BFSI Market Regional Insights

The regional trends and factors influencing the Revenue Assurance for BFSI Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Revenue Assurance for BFSI Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Revenue Assurance for BFSI Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 409.92 Million |

| Market Size by 2031 | US$ 905.08 Million |

| Global CAGR (2023 - 2031) | 10.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Revenue Assurance for BFSI Market Players Density: Understanding Its Impact on Business Dynamics

The Revenue Assurance for BFSI Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Revenue Assurance for BFSI Market top key players overview

Revenue Assurance for BFSI Market News and Recent Developments

The revenue assurance for BFSI market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for revenue assurance for BFSI:

- Accelya, a leading global provider of technology solutions to the travel industry, announced that Spanish carrier Vueling renewed its long-standing commitment to the Accelya revenue management solution. The multi-year agreement with Accelya will ensure the Barcelona-based airline can quickly identify sales opportunities, closely control pricing, and constantly review the competitive environment for total revenue performance. (Source: Accelya, Press Release, 2022)

- Tecnotree, a global digital platform and services leader for 5G and cloud-native technologies, has been recognized again as a Representative Vendor in the Gartner Market Guide for complete (RM&M) Revenue Management and Monetization Solutions. (Source: Tecnotree, Press Release, 2022)

Revenue Assurance for BFSI Market Report Coverage and Deliverables

The "Revenue Assurance for BFSI Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market, covering the areas given below:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

Frequently Asked Questions

Which is the leading component segment in the revenue assurance for BFSI market?

Which key players hold the major market share of the revenue assurance for BFSI market?

What will be the revenue assurance for BFSI market size by 2031?

What is the estimated market size for the revenue assurance for BFSI market in 2023?

What are the future trends of the revenue assurance for BFSI market?

What are the driving factors impacting the revenue assurance for BFSI market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For