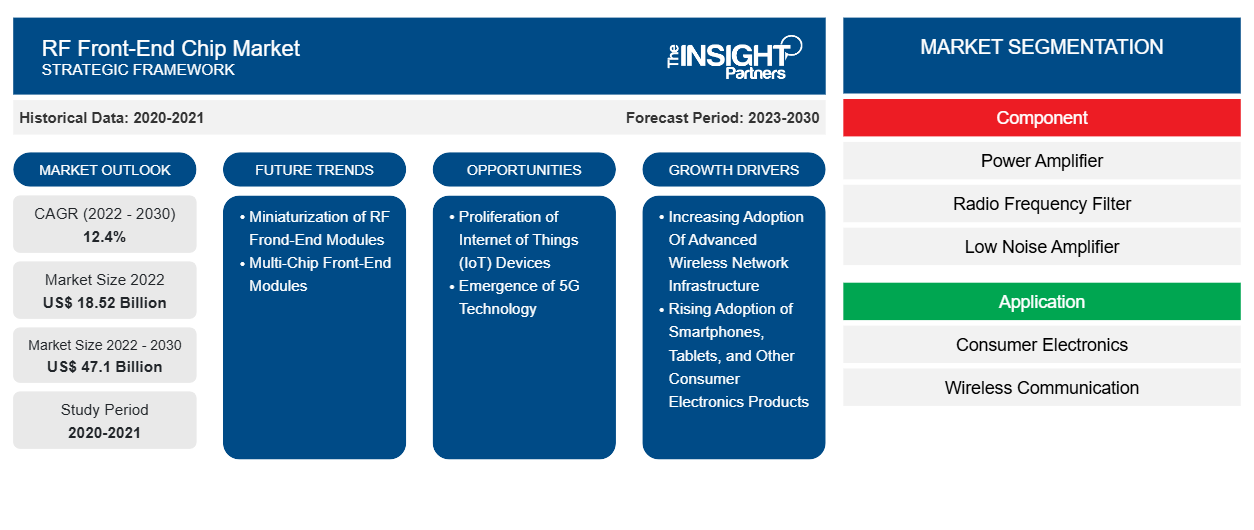

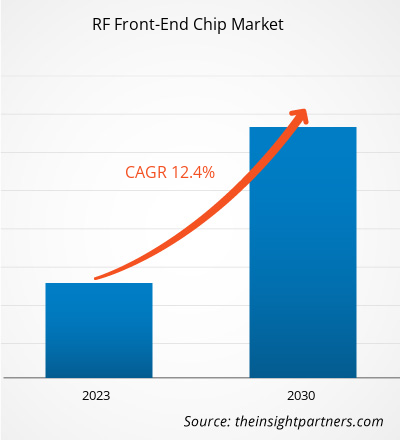

[Research Report] The RF front-end chip market was valued at US$ 18.52 billion in 2022 and is expected to reach US$ 47.10 billion by 2030; it is estimated to record a CAGR of 12.4% from 2022 to 2030.

Analyst Perspective:

The increased demand for smartphones, tablets, and other consumer electronics, combined with the global rollout of 5G networks, is propelling the RF front-end chip market growth. Furthermore, the development of wireless communication, IoT, and AI drives market growth. As an essential component for wireless communication devices and systems, radio frequency front-end chips handle the transmission and receipt of radio frequency signals. These chips serve an important role in boosting signal quality, increasing data transfer speeds, and lowering battery consumption in mobile devices such as smartphones, tablets, and IoT. The RF front-end chip market is expanding rapidly owing to the surge in demand for high-speed data transfer and the fast advancement of wireless communication technologies. With the growth of 5G networks, there is an increase in demand for RF front-end devices that can support multi-mode, multiband operations, resulting in better network connectivity and faster data rates. Moreover, the miniaturization of RF front-end modules and multi-chip front-end modules is expected to bring new RF front-end chip market trends in the coming years.

RF Front-End Chip Market Overview:

The RF front-end chip refers to everything between the antenna and the digital baseband system. For a receiver, this "between" area encompasses all of the filters, low-noise amplifiers (LNAs), and down-conversion mixer(s) required to convert the modulated signals received at the antenna into signals acceptable for input into the baseband analog-to-digital converter. An RF front end is a device or module containing all of the circuitry that connects the antenna to at least one mixing stage of a receiver and the transmitter's power amplifier. They are employed in a diverse range of RF goods and applications. Examples include Wi-Fi and FM radio systems.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

RF Front-End Chip Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

RF Front-End Chip Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

RF Front-End Chip Market Driver:

Rising Adoption of Smartphones, Tablets, and Other Consumer Electronics Products Contributes to Growing RF Front-End Chip Market Size

According to GSMA's annual State of Mobile Internet Connectivity Report 2023 (SOMIC), in October 2023, over half (54%) of the global population—approximately 4.3 billion people—owned a smartphone. The number of smartphones is increasing significantly. For example, according to Ericsson & The Radicati Group, in 2020, there were 5.75 billion smartphones. In 2024, the number of smartphones is expected to increase to 6.93 billion, and in 2025, it is expected to reach 7.15 billion. Also, tablets have become increasingly popular in recent years due to the range of benefits they offer over traditional laptops and desktop computers. The rising popularity of connected devices, such as tablets, smartphones, headphones, and wearables, further fuels the demand for RF frond-end chips. Smartphones and tablets often support numerous wireless services, including FM radio and LTE, across many frequency bands. At the same time, a growing number of smartphones and tablets use several antennas to improve sensitivity and reduce crosstalk. Miniature RF solid-state switches play a vital part in RF front-end designs for smart mobile devices. Consumers expect seamless connectivity and high data speeds, pushing manufacturers to incorporate advanced RF technologies into their devices. Hence, various market players have launched RF frond-end solutions for smartphones. For example, in May 2020, NXP Semiconductors NV announced that its most recent radio frequency front-end (RFFE) solution, designed with Wi-Fi 6 standards, was integrated into the Xiaomi Mi 10 5G smartphone. Thus, the growing adoption of smartphones, tablets, and other consumer electronics is facilitating the expansion of the RF front-end chip market growth.

RF Front-End Chip Market Report Segmentation and Scope:

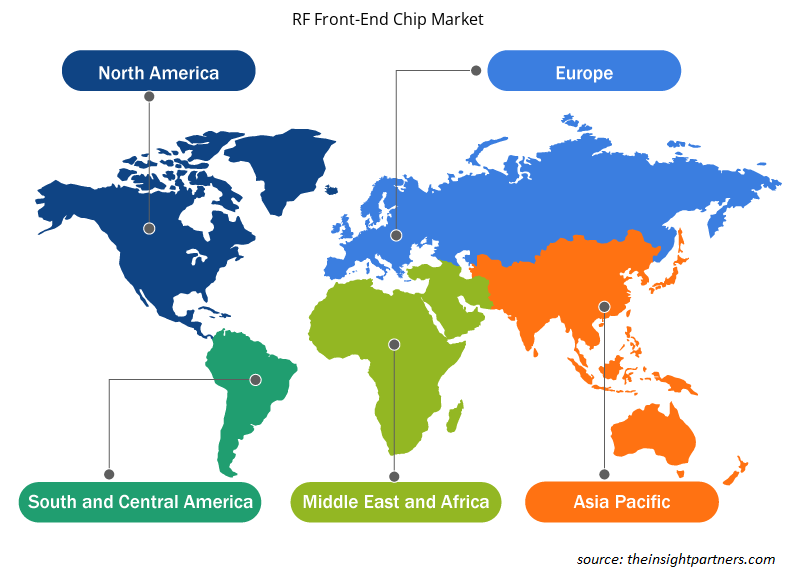

The RF front-end chip market is segmented on the basis of components and applications. Based on components, the RF front-end chip market is segmented into power amplifiers, RF switches, radio frequency filters, low-noise amplifiers, and others. Based on application, the RF front-end chip market is segmented into consumer electronics, wireless, communication, and others. The scope of the RF front-end chip market report covers North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

RF Front-End Chip Market Segmental Analysis:

Based on components, the RF front-end chip market is segmented into power amplifiers, RF switches, radio frequency filters, low noise amplifiers, and others. In terms of revenue, the power amplifier segment held the largest RF front-end chip market share in 2022. Power amplifiers are used to increase the power of RF signals. They play an important role in supplying sufficient power and range for wireless communication across multiple applications. Several players across the globe are indulging in the development of power amplifiers. For example, in September 2023, a new line of SDM GaN Hybrid Power Amplifier Modules for 4G LTE and 5G systems was released by RFHIC Corp. The SDM series, which uses RFHIC's GaN-on-SiC technology, was created for drive amplifier applications in massive MIMO systems, small cells, and low-power remote radio heads. The increase in product launches propels the growth of the power amplifier segment in the RF front-end chip market.

RF Front-End Chip Market Regional Analysis:

In terms of revenue, Asia Pacific dominated the RF front-end chip market share due to increased demand for high-speed data connectivity, expanding smartphone penetration, and the expansion of communication networks. The development of 5G networks primarily drives the Asia Pacific RF front-end chip market. Countries such as South Korea, China, and Japan are at the forefront of 5G adoption, increasing the demand for RF switches that can handle the complexities of high-frequency bands and advanced communication protocols. According to the Internet World Stats, in Asia Pacific, there are 2,934,186,678 Internet users and a 67.4% penetration rate as of July 2022. Also, as of November 2023, China has the world's first ultra-high-speed next-generation internet backbone. Such proliferation of high-speed internet connectivity is projected to drive the demand for RF front-end chips, as it helps to amplify, filter, and transmit the signal through the antenna. It also handles complex signals and higher frequencies associated with high-speed internet. Thus, all such factors propel the RF front-end chip market growth.

RF Front-End Chip Market Regional Insights

RF Front-End Chip Market Regional Insights

The regional trends and factors influencing the RF Front-End Chip Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses RF Front-End Chip Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for RF Front-End Chip Market

RF Front-End Chip Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 18.52 Billion |

| Market Size by 2030 | US$ 47.1 Billion |

| Global CAGR (2022 - 2030) | 12.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

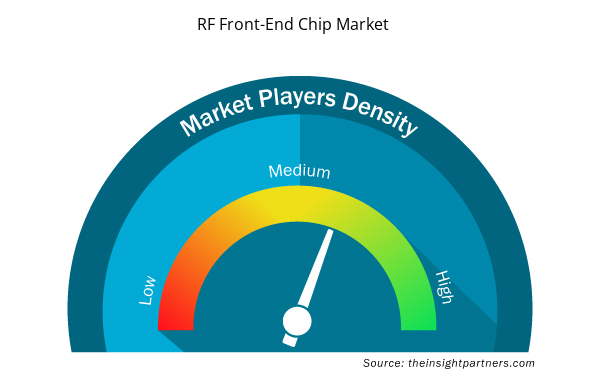

RF Front-End Chip Market Players Density: Understanding Its Impact on Business Dynamics

The RF Front-End Chip Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the RF Front-End Chip Market are:

- Infineon Technologies AG

- TDK Corp

- Texas Instruments Inc

- Broadcom Inc

- Qorvo Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the RF Front-End Chip Market top key players overview

Key Player Analysis:

Broadcom Corporation; Infineon Technologies AG; Microchip Technology Inc.; Murata Manufacturing Co., Ltd; NXP Semiconductors N.V.; Qorvo Inc.; Skyworks Solutions, Inc.; STMicroelectronics; TDK Corporation; and Texas Instruments Incorporated are among the key players profiled in the RF front-end chip market. Several other major market players were studied and analyzed during this market research study to get a holistic view of the market and its ecosystem. The RF front-end chip market analysis provides detailed market insights, which help the key players strategize their growth.

RF Front-End Chip Market Recent Developments:

The RF front-end chip market forecast can help stakeholders in this marketplace plan their growth strategies. Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the market. A few recent key market developments, as per company press releases, are listed below:

- In June 2023, Qorvo announced the availability of the QPQ3509, the first bulk acoustic wave (BAW) 280 MHz band pass filter for the new 5G C-band in North America, and the QPB9850, a compact, highly integrated front-end switch / low noise amplifier (LNA) module for 5G base station RF front-ends. The combination of the QPQ3509's C-band coverage and the QPB9850's high integration and compact design make the devices ideally suited for 5G small cell applications where size and weight are key metrics.

- In September 2023, Qorvo introduced two bulk acoustic wave (BAW) filters to support the ongoing global deployment of 5G base stations. The new QPQ3500 and QPQ3501 filters offer base station OEMs pin-compatible, 5G filter solutions that deliver lower insertion loss and superior out-of-band rejection than similar products. Pin compatibility allows the use of common printed circuit boards that support different frequency bands, eliminating costly board redesign and reducing time to market.

- In June 2023, Broadcom Inc introduced four RF front-end modules for powering routers using Wi-Fi 7, a new wireless networking standard. These modules can also be used to build Wi-Fi access points (APs), devices used by enterprises for wireless connectivity.

- In March 2021, Qorvo announced increased shipments of its RF Fusion20 portfolio, an expansion of its award-winning family of integrated 5G RF front-end (RFFE) modules, to all major 5G smartphone manufacturers. Fusion20 adds receive path integration and RF shielding to deliver full transmit and receive coverage in a complete suite of configurations to match varying regional market needs.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Power amplifier segment led the RF front-end chip market with a significant share in 2022 and low noise amplifier segment is expected to grow with the highest CAGR.

The RF front-end chip market is expected to reach US$ 47.10 billion by 2030.

Asia Pacific is anticipated to grow with the highest CAGR over the forecast period.

The key players holding majority shares in the RF front-end chip market include Qualcomm Technologies, Inc., Murata Manufacturing Co., Ltd, Qorvo, Inc, Broadcom., and STMicroelectronics.

Miniaturization of RF frond-end modules and multi-chip front-end modules is expected to set the future trend for the RF front-end chip market in the coming years.

Increasing adoption of wireless network infrastructure and rising adoption of smartphones, tablets, and other consumer electronics products are driving factors of RF front-end chip market.

The RF front-end chip market was estimated to be valued at US$ 18.52 billion in 2022 and is projected to reach US$ 47.10 billion by 2030; it is expected to grow at a CAGR of 12.4% during the forecast period.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - RF Front-End Chip Market

- Infineon Technologies AG

- TDK Corp

- Texas Instruments Inc

- Broadcom Inc

- Qorvo Inc

- Skyworks Solutions Inc

- STMicroelectronics NV

- Murata Manufacturing Co Ltd

- Microchip Technology Inc

- NXP Semiconductors NV

Get Free Sample For

Get Free Sample For