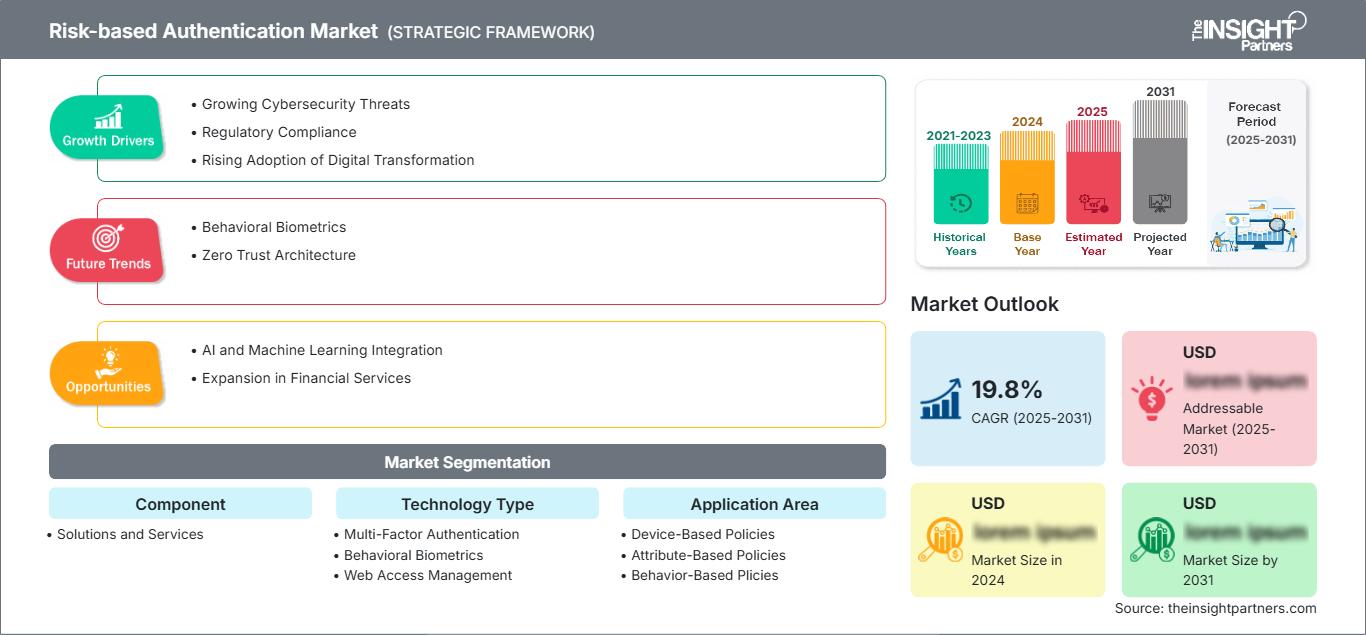

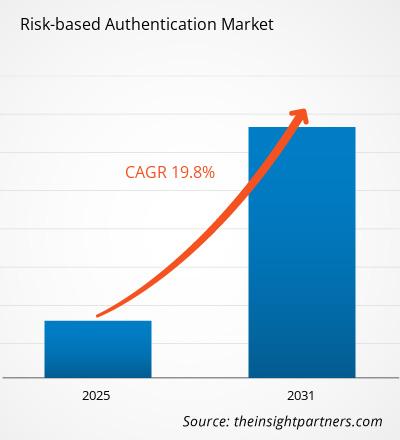

The Risk Based Authentication Market size is expected to reach US$ 13.67 Billion by 2031. The market is anticipated to register a CAGR of 14.3% during 2025-2031.

The report is segmented by Component (Solutions and Services), By Technology Type (Multi-Factor Authentication, Behavioral Biometrics, and Web Access Management), Application Area (Device-Based Policies, Attribute-Based Policies, Behavior-Based Plicies, and Network and Browser-Based Policies), By Deployment Mode (On-Premises and Cloud), By Industry Vertical (BFSI, Government, Healthcare, Manufacturing, Retail, Telecommunications, and Others). The global analysis is further broken-down at regional level and major countries. The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report Risk Based Authentication Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Risk Based Authentication Market Segmentation Component

- Solutions and Services

Technology Type

- Multi-Factor Authentication

- Behavioral Biometrics

- Web Access Management

Application Area

- Device-Based Policies

- Attribute-Based Policies

- Behavior-Based Plicies

- Network and Browser-Based Policies

Deployment Mode

- On-Premises and Cloud

Industry Vertical

- BFSI

- Government

- Healthcare

- Manufacturing

- Retail

- Telecommunications

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Risk-based Authentication Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Risk Based Authentication Market Growth Drivers

- Growing Cybersecurity Threats: As cyber-attacks continue to evolve in sophistication, traditional security methods are proving inadequate. This creates a heightened demand for advanced authentication techniques, particularly risk-based authentication (RBA). By assessing factors like location, behavior, and device usage, RBA dynamically adjusts security measures, offering businesses more flexible protection against unauthorized access, thus enhancing overall cybersecurity defenses and protecting sensitive data in real time.

- Regulatory Compliance: Regulatory frameworks like GDPR, CCPA, and others are forcing organizations to adopt stricter security measures to safeguard user data. Non-compliance can result in hefty fines and reputational damage. Risk-based authentication helps companies meet these compliance requirements by offering granular, adaptive security controls that align with regulatory standards, ensuring data protection practices are both effective and up to date with ever-evolving legal demands.

- Rising Adoption of Digital Transformation: With businesses increasingly shifting towards digital platforms, the need for secure online environments has never been greater. The rise in cloud services, mobile workforces, and IoT devices presents new security challenges. Risk-based authentication (RBA) provides a solution by dynamically analyzing risk factors, allowing organizations to adjust their security posture based on user context, ensuring security without compromising user experience, even in highly digital environments.

Risk Based Authentication Market Future Trends

- Behavioral Biometrics: The integration of behavioral biometrics is a growing trend in the field of risk-based authentication. By continuously monitoring user actions, such as keystroke dynamics, mouse movements, and navigation patterns, RBA systems can detect and respond to potential security risks in real time. This non-intrusive approach enhances security while minimizing friction for users, offering a seamless authentication experience without compromising on protection against unauthorized access or identity theft.

- Zero Trust Architecture: The adoption of zero trust security models is expected to shape the future of risk-based authentication. In a zero trust environment, every access request is treated as potentially malicious, regardless of origin. Risk-based authentication complements this model by continuously evaluating the risk level associated with each request and enforcing adaptive security measures. This trend ensures that only authenticated, trusted users can access sensitive systems, even if internal network boundaries are no longer relevant.

Risk Based Authentication Market Opportunities

- AI and Machine Learning Integration: Artificial intelligence and machine learning technologies offer significant opportunities to enhance risk-based authentication systems. By leveraging AI to analyze user behavior patterns, anomalies, and transaction histories, organizations can improve the accuracy and efficiency of risk assessments in real-time. This allows for smarter, more adaptive security measures that provide a personalized user experience while ensuring heightened protection against fraud and unauthorized access

- Expansion in Financial Services: The financial services sector is under constant pressure to combat rising fraud and ensure the safety of digital transactions. As digital banking and online payment methods grow, thereReport Scope

Risk-based Authentication Market Regional Insights

The regional trends and factors influencing the Risk-based Authentication Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Risk-based Authentication Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Risk-based Authentication Market Report Scope

By Technology Type- Multi-Factor Authentication

- Behavioral Biometrics

- Web Access Management

- Device-Based Policies

- Attribute-Based Policies

- Behavior-Based Plicies

- Network and Browser-Based Policies

- On-Premises and Cloud

- UK

- Germany

- France

- Russia

- Italy

- Rest of Europe

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Brazil

- Argentina

- Rest of South and Central America

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Report Attribute Details Market size in 2024 US$ XX Billion Market Size by 2031 US$ 13.67 Billion Global CAGR (2025 - 2031) 14.3% Historical Data 2021-2023 Forecast period 2025-2031 Segments Covered By Component - Solutions and Services

Regions and Countries Covered North America - US

- Canada

- Mexico

Market leaders and key company profiles - IBM

- CA Technologies

- Micro Focus

- Okta

- Gemalto

- Vasco Data Security

- Secureauth

- Rsa Security

- Entrust Datacard

Risk-based Authentication Market Players Density: Understanding Its Impact on Business Dynamics

The Risk-based Authentication Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Risk-based Authentication Market top key players overview

Frequently Asked Questions

What are the deliverable formats of the report?

Which are the leading players operating in the Risk-based Authentication Market

What is the future trend of the Risk-based Authentication Market?

What are the growth opportunities impacting the global Risk-based Authentication Market?

What is the expected CAGR of the Risk-based Authentication Market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For