The 3D Scanner Market is expected to register a CAGR of 11.6% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Offering (Hardware, Software); Type (Optical Scanners, Laser Scanner, Structured Light Scanner); Range (Short Range, Medium Range, Long Range); End User (Industrial, Aerospace and Defense, Automotive, Architecture and Construction, Healthcare, Others). The global analysis is further broken-down at regional level and major countries. The report offers the value in USD for the above analysis and segments

Purpose of the Report

The report 3D Scanner Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

3D Scanner Market Segmentation

Offering

- Hardware

- Software

Type

- Optical Scanners

- Laser Scanner

- Structured Light Scanner

Range

- Short Range

- Medium Range

- Long Range

End User

- Industrial

- Aerospace and Defense

- Automotive

- Architecture and Construction

- Healthcare

- Others

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

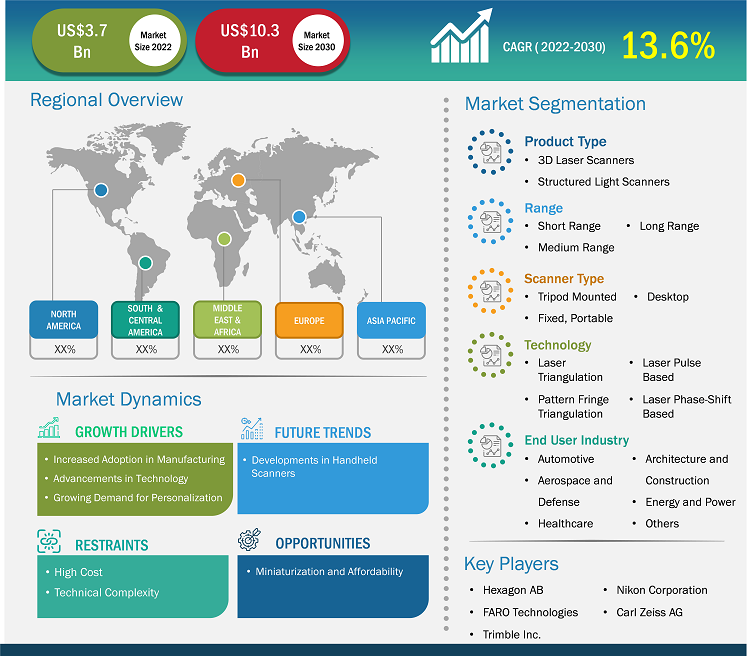

3D Scanner Market: Strategic Insights

| Market Size Value in | US$ 3.7 billion in 2022 |

| Market Size Value by | US$ 10.3 billion by 2030 |

| Growth rate | CAGR of 13.6% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

3D Scanner Market Growth Drivers

- Growing Adoption of 3D Printing Technologies: The rise of 3D printing is a significant driver for the 3D scanner market. As industries like manufacturing, healthcare, and aerospace increasingly adopt additive manufacturing, the demand for accurate and efficient 3D scanning solutions grows. 3D scanners enable precise digital modeling of objects, which is essential for creating high-quality prototypes and parts. This synergy between 3D scanning and printing technologies enhances productivity, speeds up product development, and reduces costs, thereby driving the overall growth of the 3D scanner market.

- Advancements in Scanning Technology: Continuous advancements in scanning technologies, such as laser scanning, structured light scanning, and photogrammetry, are propelling the 3D scanner market. These innovations improve the accuracy, speed, and versatility of 3D scanners, making them suitable for various applications across industries. Enhanced scanning capabilities allow for capturing complex geometries and intricate details, which are crucial for sectors like architecture, archaeology, and product design. As technology evolves, it offers new opportunities for more efficient and effective 3D scanning solutions, contributing to market expansion.

- Increasing Demand for Quality Control and Inspection: The need for quality control and inspection in manufacturing processes is a key driver for the 3D scanner market. Industries are increasingly recognizing the importance of precise measurements and dimensional accuracy to ensure product quality and compliance with standards. 3D scanners facilitate real-time inspection and analysis, allowing manufacturers to identify defects and inconsistencies early in the production process. This capability reduces waste, minimizes rework, and enhances overall operational efficiency, driving the adoption of 3D scanning technologies in quality assurance applications.

3D Scanner Market Future Trends

- Shift Towards Portable and User-Friendly Scanners: A notable trend in the 3D scanner market is the shift towards portable and user-friendly devices. As the demand for on-site scanning increases, manufacturers are developing lightweight, compact scanners that can be easily transported and operated by users with minimal training. These innovations make 3D scanning accessible to a broader audience, including small businesses and individual professionals. This trend enhances convenience and flexibility in various applications, driving the growth of portable 3D scanning solutions.

- Focus on Cloud-Based Solutions and Data Sharing: The trend towards cloud-based solutions is transforming the 3D scanner market. Cloud technology enables users to store, process, and share 3D scan data efficiently. This shift facilitates collaborative workflows, allowing teams to access and analyze data from anywhere, enhancing productivity. Additionally, cloud-based platforms often integrate advanced analytics and machine learning, providing valuable insights and improving decision-making processes. As businesses increasingly embrace digital transformation, the demand for cloud-enabled 3D scanning solutions is expected to grow, driving market innovation.

3D Scanner Market Opportunities

- Emerging Applications in Healthcare: The healthcare sector presents significant opportunities for the 3D scanner market. Applications such as custom prosthetics, dental implants, and surgical planning require precise 3D models of patients' anatomy. 3D scanners can capture detailed impressions, enabling personalized solutions that enhance patient outcomes. As the demand for customized healthcare solutions continues to rise, companies can develop specialized 3D scanning technologies tailored to the medical field, thus expanding their market reach and fostering innovation in healthcare applications.

- Integration with Virtual and Augmented Reality: The integration of 3D scanning with virtual reality (VR) and augmented reality (AR) technologies offers new opportunities for market growth. As industries explore immersive experiences for training, design, and marketing, accurate 3D models generated from scans are essential. This synergy enhances user engagement and provides realistic simulations in sectors such as gaming, education, and real estate. Companies that develop solutions combining 3D scanning with VR and AR technologies can tap into this growing market and meet the evolving needs of various industries.

Market Report Scope

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the 3D Scanner Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the 3D Scanner Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Range, Technology, Scanner Type, End-User Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Some of the customization options available based on the request are an additional 3-5 company profiles and country-specific analysis of 3-5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation# as our team would review the same and check the feasibility

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request

Demand for real-time scanning and analysis is likely to remain a key trend in the market.

The 3D Scanner Market is estimated to witness a CAGR of 11.6% from 2023 to 2031

Growing adoption across industries and portability and accessibility of 3D scanners are the major factors driving the 3D scanner market.

1 Introduction

1.1 Scope of Study

1.2 The Insight Partners Research Report Guidance

2 Key Takeaways

3 3D Scanner Market Landscape

3.1 Market Overview

3.2 Market Segmentation

3.2.1 3D Scanner Market - By Type

3.2.2 3D Scanner Market - By Service

3.2.3 3D Scanner Market - By Range

3.2.4 3D Scanner Market - End-user Verticals

3.2.5 3D Scanner Market - By Region

3.2.5.1 By Countries

3.3 PEST Analysis

3.3.1 North America - PEST Analysis

3.3.2 Europe - PEST Analysis

3.3.3 Asia Pacific - PEST Analysis

3.3.4 Middle East and Africa - PEST Analysis

3.3.5 South America - PEST Analysis

4 3D Scanner Market - Key Industry Dynamics

4.1 Impact Analysis

4.2 Key Market Drivers

4.3 Key Market Restraints

4.4 Key Market Opportunities

4.5 Future Trends

5 3D Scanner Market Analysis- Global

5.1 Global 3D Scanner Market Overview

5.2 Global 3D Scanner Market Forecast and Analysis

6 3D Scanner Market Revenue and Forecasts to 2028 - Type

6.1 Overview

6.2 Technology market forecast and analysis

6.3 Optical Scanners Market

6.3.1 Overview

6.3.2 Optical Scanners market forecast and analysis

6.4 Laser Scanner Market

6.4.1 Overview

6.4.2 Laser Scanner market forecast and analysis

6.5 Structured Light Scanners Market

6.5.1 Overview

6.5.2 Structured Light Scanners market forecast and analysis

7 3D Scanner Market Revenue and Forecasts to 2028 - Range

7.1 Overview

7.2 Material market forecast and analysis

7.3 Short Range Market

7.3.1 Overview

7.3.2 Short Range market forecast and analysis

7.4 Medium Range Market

7.4.1 Overview

7.4.2 Medium Range market forecast and analysis

7.5 Long Range Market

7.5.1 Overview

7.5.2 Long Range market forecast and analysis

8 3D Scanner Market Revenue and Forecasts to 2028 - Service

8.1 Overview

8.2 Material market forecast and analysis

8.3 Quality Control & Inspection Market

8.3.1 Overview

8.3.2 Quality Control & Inspection market forecast and analysis

8.4 Reverse Engineering Market

8.4.1 Overview

8.4.2 Reverse Engineering market forecast and analysis

8.5 Rapid Prototyping Market

8.5.1 Overview

8.5.2 Rapid Prototyping market forecast and analysis

8.6 Virtual Simulation Market

8.6.1 Overview

8.6.2 Virtual Simulation market forecast and analysis

8.7 Others Market

8.7.1 Overview

8.7.2 Others market forecast and analysis

9 3D Scanner Market Revenue and Forecasts to 2028 - End-User Vertical

9.1 Overview

9.2 End-User Vertical market forecast and analysis

9.3 Industrial Market

9.3.1 Overview

9.3.2 Industrial market forecast and analysis

9.4 Aerospace and Defense Market

9.4.1 Overview

9.4.2 Aerospace and Defense market forecast and analysis

9.5 Automotive Market

9.5.1 Overview

9.5.2 Automotive market forecast and analysis

9.6 Architecture and Construction Market

9.6.1 Overview

9.6.2 Architecture and Construction market forecast and analysis

9.7 Healthcare Market

9.7.1 Overview

9.7.2 Healthcare market forecast and analysis

9.8 Others Market

9.8.1 Overview

9.8.2 Others market forecast and analysis

10 3D Scanner Market Revenue and Forecasts to 2028 - Geographical Analysis

10.1 North America

10.1.1 North America 3D Scanner market overview

10.1.2 North America 3D Scanner market forecast and analysis

10.1.2.1 North America market forecast and analysis - By Countries

10.1.2.1.1 US market

10.1.2.1.2 Canada market

10.1.2.1.3 Mexico market

10.1.3 North America market forecast and analysis -By Type

10.1.4 North America market forecast and analysis -By Service

10.1.5 North America market forecast and analysis -By Range

10.1.6 North America market forecast and analysis -By End-user Verticals

10.2 Europe

10.2.1 Europe 3D Scanner market overview

10.2.2 Europe 3D Scanner market forecast and analysis

10.2.2.1 Europe market forecast and analysis - By Countries

10.2.2.1.1 France market

10.2.2.1.2 Germany market

10.2.2.1.3 Italy market

10.2.2.1.4 Spain market

10.2.2.1.5 UK market

10.2.3 Europe market forecast and analysis -By Type

10.2.4 Europe market forecast and analysis -By Service

10.2.5 Europe market forecast and analysis -By Range

10.2.6 Europe market forecast and analysis -By End-user Verticals

10.3 Asia pacific (APAC)

10.3.1 Asia Pacific 3D Scanner market overview

10.3.2 Asia Pacific 3D Scanner market forecast and analysis

10.3.2.1 Asia Pacific market forecast and analysis - By Countries

10.3.2.1.1 Australia market

10.3.2.1.2 China market

10.3.2.1.3 India market

10.3.2.1.4 Japan market

10.3.3 Asia Pacific market forecast and analysis -By Type

10.3.4 Asia Pacific market forecast and analysis -By Service

10.3.5 Asia Pacific market forecast and analysis -By Range

10.3.6 Asia Pacific market forecast and analysis -By End-user Verticals

10.4 Middle East and Africa (MEA)

10.4.1 Middle East and Africa 3D Scanner market overview

10.4.2 Middle East and Africa 3D Scanner market forecast and analysis

10.4.2.1 Middle East and Africa market forecast and analysis - By Countries

10.4.2.1.1 South Africa market

10.4.2.1.2 Saudi Arabia market

10.4.2.1.3 UAE market

10.4.3 MEA market forecast and analysis -By Type

10.4.4 MEA market forecast and analysis -By Service

10.4.5 MEA market forecast and analysis -By Range

10.4.6 MEA market forecast and analysis -By End-user Verticals

10.5 South America (SAM)

10.5.1 South America 3D Scanner market overview

10.5.2 South America 3D Scanner market forecast and analysis

10.5.2.1 South America market forecast and analysis - By Countries

10.5.2.1.1 Brazil market

10.5.3 South America market forecast and analysis -By Type

10.5.4 South America market forecast and analysis -By Service

10.5.5 South America market forecast and analysis -By Range

10.5.6 South America market forecast and analysis -By End-user Verticals

11 Industry Landscape

11.1 Mergers & acquisitions

11.2 Market Initiatives

11.3 New developments

11.4 Investment scenarios

12 Competitive Landscape

12.1 Competitive Product mapping

12.2 Market positioning/ market share

13 3D Scanner Market, Key Company Profiles

13.1 3D Digital Corporation

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 3D Systems Corporation

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Autodesk, Inc.

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Creaform, Inc.

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Faro Technologies, Inc.

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 GOM mBH

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Hexagon AB

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Nikon Metrology NV

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Trimble Navigation Ltd.

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 Topcon Corporation

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

14 Appendix

14.1 About The Insight Partners

14.2 Glossary of Terms

14.3 Research Methodology

The List of Companies

- 3D Digital Corporation

- 3D Systems Corporation

- Autodesk, Inc.

- Creaform, Inc.

- Faro Technologies, Inc.

- GOM mBH

- Hexagon AB

- Nikon Metrology NV

- Trimble Navigation Ltd.

- Topcon Corporation

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For