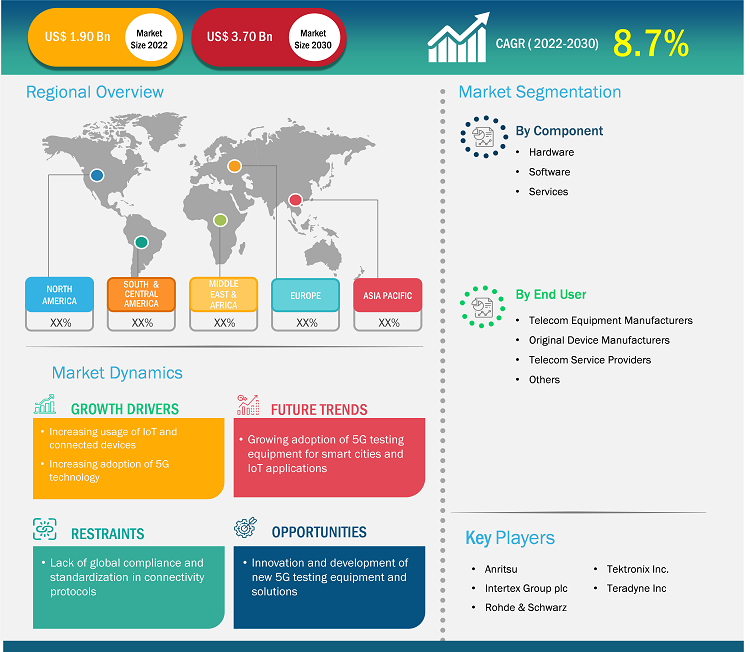

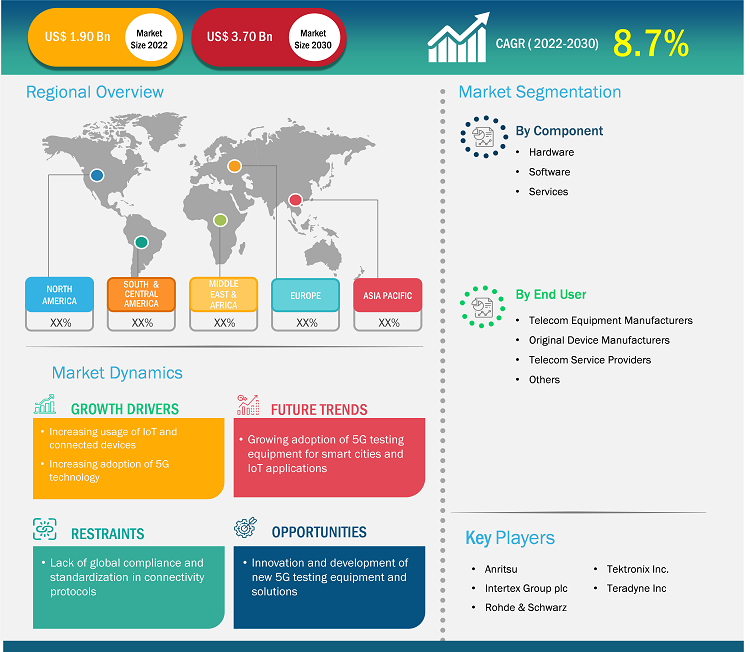

[Research Report] The 5G device testing market size is expected to grow from US$ 1.90 billion in 2022 to US$ 3.70 billion by 2030; it is anticipated to expand at a CAGR of 8.7% from 2022 to 2030.

Analyst Perspective:

The 5G device testing market offers several opportunities and trends, such as the rising demand for 5G testing equipment to validate virtualized network functions, the growing adoption of 5G testing equipment for smart cities and IoT applications, and the innovation and development of new 5G testing equipment and solutions. These factors may create new market segments and enhance market competitiveness and differentiation. The market is also driven by factors such as the increasing usage of IoT and connected devices, the need for high-speed and low-latency connectivity, the emergence of new use cases, and the increasing adoption of 5G technology across various industries.

Market Overview:

5G device testing is the process of evaluating, validating, and optimizing the performance, functionality, and compatibility of devices that operate on 5G wireless networks and technologies. 5G device testing involves various types of tests, such as radio frequency (RF) tests, protocol tests, application tests, and conformance tests, that cover different aspects of the device's behavior and interaction with the network. 5G device testing requires specialized testing and measurement tools, devices, and solutions that can simulate and emulate 5G networks and scenarios, as well as measure and analyze the device's parameters and performance. 5G device testing is essential for ensuring that devices and networks meet the necessary standards and regulatory requirements, as well as the quality of service, reliability, and security expectations of the end users. 5G device testing is applicable to various end users, such as telecom equipment manufacturers, original device manufacturers, and telecom service providers.

The increasing adoption of 5G network deployment and the implementation of software-defined testing are also driving the growth of the 5G device testing market. Furthermore, the emergence of a hyper-connected world is expected to increase the demand for 5G test equipment. Countries such as India and China, as well as other developing countries, are accompanying an increase in the use of connected devices, resulting in increased data traffic within networks. This necessitates the construction of secure, dependable, and efficient networks. For instance, Cavli, an IoT hardware solution provider platform, launched a significant 5G test network in India in February 2020, demonstrating the transformative impact of 5G technology, particularly in the domains of smart cities and industries globally.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

5G Device Testing Market: Strategic Insights

Market Size Value in US$ 1.90 billion in 2022 Market Size Value by US$ 3.70 billion by 2030 Growth rate CAGR of 8.7% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

5G Device Testing Market: Strategic Insights

| Market Size Value in | US$ 1.90 billion in 2022 |

| Market Size Value by | US$ 3.70 billion by 2030 |

| Growth rate | CAGR of 8.7% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Driver:

Increasing Usage of IoT and Connected Devices Drives Market Growth

5G applications are expanding at a significant rate due to the mounting usage of IoT and linked devices. The demand for 5G device testing is expected to increase as 5G becomes more widely available in various industries such as construction, security, entertainment, and automobiles. The rise of new applications and business models, combined with lower device costs, has facilitated Internet of Things (IoT) adoption and, as a result, a proliferation of connected devices. This includes connected automobiles, wearables, machinery, meters, and consumer electronics, all of which have contributed significantly to market growth. The introduction of IoT and machine-to-machine connections, which have been instrumental in driving the market, aligns with the ongoing Industrial Revolution 4.0, fostering cellular connectivity advancements across various industries. As a result, the growing telecommunications user base and global R&D activities are expected to drive the demand for 5G device testing, thereby propelling the 5G device testing market throughout the forecast period.

Segmentation and Scope:

The "5G Device Testing Market" is segmented on the basis of component, end user, and geography. In terms of component, the market is segmented into hardware, software, and services. Based on end user, the market is segmented into telecom equipment manufacturers, original device manufacturers, telecom service providers, and others. Based on geography, it is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Segmental Analysis:

Based on components, the market is segmented into hardware, software, and services. The hardware segment is expected to grow at a significant CAGR during the forecast period. This is due to the increasing complexity of 5G networks, which require sophisticated testing equipment. Hardware is further divided into network analyzers, signal generators, spectrum analyzers, oscilloscopes, and others. Network analyzers are useful for evaluating the signal and data transmission quality in 5G devices. They aid in the detection and resolution of signal distortions, interference, and anomalies, ensuring that devices meet stringent quality standards. The signal generators segment is expected to grow at the fastest CAGR during the forecast period. This is due to the increasing demand for 5G devices and the need to test them for performance and compliance with standards. A spectrum analyzer assesses the magnitude of an input signal versus frequency over the instrument's entire frequency range. The primary application is to determine the strength of the spectrum of known and unknown signals. An oscilloscope, also known as an oscillograph, is a device that graphically displays electrical signals and shows how they change over time. Engineers use oscilloscopes to test, verify, and debug their circuit designs by measuring electrical phenomena. Its primary function is to measure voltage waves. These waves are displayed on a graph, which can disclose a lot about a signal.

Regional Analysis:

The Europe 5G Device Testing Market holds the second-largest market share. Europe is poised to see a surge in demand for 5G services, driven by the increasing need for faster data speeds in both commercial and residential applications. As part of the Europe 2020 strategy, a concerted effort is being made to ensure that high-speed broadband of more than 100 Mbps is made available to a substantial number of European countries. The strategy also sets an ambitious goal of achieving ultra-fast broadband adoption by 50% of European households by 2020. According to European Commission estimates, substantial investments totaling US$ 64.5 billion in 5G technology are expected to yield substantial economic benefits totaling US$ 129.0 billion per year.

This investment is likely to provide enormous job prospects, with an estimated 2.3 billion jobs being created in Europe by 2025. This increased demand is likely to generate a sizable market for 5G testing equipment. Furthermore, the German 5G Device Testing Market held the biggest market share, while the UK 5G Device Testing Market was the fastest-growing market in Europe.

Key Player Analysis:

Anritsu, Artiza Networks Inc., Emite, Exfo Inc., GL Communications Inc., Intertek Group plc, Keysight Technologies, LitePoint, MACOM Technology Solutions, National Instruments Corp, Rohde & Schwarz, Spirent Communications, Tektronix Inc., Teradyne Inc, Trex Enterprise Corporation, and Viavi Solutions Inc. are among the key 5G device testing market players profiled in the report.

5G Device Testing Market Report Scope

Recent Developments:

Companies in the market highly adopt inorganic and organic strategies such as mergers and acquisitions. A few recent key 5G device testing market developments are listed below:

- In July 2023, with three transmit antennas, Samsung Electronics and MediaTek achieved an innovative 5G uplink breakthrough. Samsung Electronics and MediaTek have successfully tested 5G Standalone Uplink (UL) 2CC Carrier Aggregation (CA) with C-Band UL MIMO to achieve top uplink speeds, marking a breakthrough in wireless mobile capabilities. This method used three transmit (3Tx) antennas to improve upload experiences, ushering in a new era of global connectivity for consumers. With the rise of live streaming, multi-player gaming, and video conferences, the demands on uplink performance are increasing. Upload speeds govern how quickly your device can send data to gaming servers or send high-resolution videos to the cloud. As more customers seek to film and share their real-time experiences with the world, expanded uplink experiences allow them to use the network to improve how they map out their route home, check player stats online, and upload movies and pictures to share with friends and followers.

- In June 2023, Fibocom introduced the industry-first SC151-GL, which accelerates global 5G AIoT commercialization with a single highly integrated smart module. Fibocom, a global leader in IoT (Internet of Things) wireless solutions and wireless communication modules, will have SC151-GL available at MWC Shanghai 2023. Fibocom SC151-GL, based on the Qualcomm® QCM4490 Processor, is the industry's first 5G smart module that supports mainstream frequency bands under 5G network architecture globally, which is critical for customers who require global roaming on their devices to deploy the smart wireless solution faster and more efficiently than regional versions.

- In June 2023, HCLTech, a global technology company, announced the opening of a cutting-edge test lab in Chennai, India. This cutting-edge facility aims to empower global telecom infrastructure original equipment manufacturers (OEMs) by providing resources for testing and validating 5G solutions. The lab is the first of its kind in India due to its unique capabilities. Its advanced high-end scanners enable global OEMs to test large cellular base stations as well as small form factor antennas used in a variety of devices such as mobile phones, smart gadgets, health monitoring systems, and remote surveillance systems.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Components, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The rise in the adoption of 5G technologies is expected to drive the growth of the 5G device testing market in the coming years.

The key players holding majority shares in the 5G device testing market include Anritsu, Intertek Group plc, Keysight Technologies, Rohde & Schwarz, and Spirent Communications.

The hardware segment led the 5G device testing market with a significant share in 2022.

Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period.

Increasing demand for 5G networks across various sectors and increasing adoption of smartphones and mobile devices are driving factors in the 5G device testing market.

The 5G device testing market was estimated to be valued at US$ 1.90 billion in 2022 and is projected to reach US$ 3.70 billion by 2030; it is anticipated to grow at a CAGR of 8.7% over the forecast period.

The 5G device testing market is expected to reach US$ 3.70 billion by 2030.

1. Introduction

1.1 Scope of the Study

1.2 Market Definition, Assumptions and Limitations

1.3 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness Analysis

3. Research Methodology

4. 5G Device Testing Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Ecosystem Analysis

4.3.1 List of Vendors in the Value Chain

5. 5G Device Testing Market - Key Market Dynamics

5.1 Key Market Drivers

5.2 Key Market Restraints

5.3 Key Market Opportunities

5.4 Future Trends

5.5 Impact Analysis of Drivers and Restraints

6. 5G Device Testing Market - Global Market Analysis

6.1 5G Device Testing - Global Market Overview

6.2 5G Device Testing - Global Market and Forecast to 2030

7. 5G Device Testing Market – Revenue Analysis (USD Million) – By Component, 2020-2030

7.1 Overview

7.2 Hardware

7.3 Software

7.4 Services

8. 5G Device Testing Market – Revenue Analysis (USD Million) – By End User, 2020-2030

8.1 Overview

8.2 Telecom Equipment Manufacturer

8.3 Original Device Manufacturer

8.4 Telecom Service Provider

8.5 Others

9. 5G Device Testing Market - Revenue Analysis (USD Million), 2020-2030 – Geographical Analysis

9.1 North America

9.1.1 North America 5G Device Testing Market Overview

9.1.2 North America 5G Device Testing Market Revenue and Forecasts to 2030

9.1.3 North America 5G Device Testing Market Revenue and Forecasts and Analysis - By Component

9.1.4 North America 5G Device Testing Market Revenue and Forecasts and Analysis - By End User

9.1.5 North America 5G Device Testing Market Revenue and Forecasts and Analysis - By Countries

9.1.5.1 United States 5G Device Testing Market

9.1.5.1.1 United States 5G Device Testing Market, by Component

9.1.5.1.2 United States 5G Device Testing Market, by End User

9.1.5.2 Canada 5G Device Testing Market

9.1.5.2.1 Canada 5G Device Testing Market, by Component

9.1.5.2.2 Canada 5G Device Testing Market, by End User

9.1.5.3 Mexico 5G Device Testing Market

9.1.5.3.1 Mexico 5G Device Testing Market, by Component

9.1.5.3.2 Mexico 5G Device Testing Market, by End User

Note - Similar analysis would be provided for below mentioned regions/countries

9.2 Europe

9.2.1 Germany

9.2.2 France

9.2.3 Italy

9.2.4 United Kingdom

9.2.5 Russia

9.2.6 Rest of Europe

9.3 Asia-Pacific

9.3.1 Australia

9.3.2 China

9.3.3 India

9.3.4 Japan

9.3.5 South Korea

9.3.6 Rest of Asia-Pacific

9.4 Middle East and Africa

9.4.1 South Africa

9.4.2 Saudi Arabia

9.4.3 U.A.E

9.4.4 Rest of Middle East and Africa

9.5 South and Central America

9.5.1 Brazil

9.5.2 Argentina

9.5.3 Rest of South and Central America

10. Pre and Post Covid-19 Impact

11. Industry Landscape

11.1 Mergers and Acquisitions

11.2 Agreements, Collaborations, Joint Ventures

11.3 New Product Launches

11.4 Expansions and Other Strategic Developments

12. Competitive Landscape

12.1 Heat Map Analysis by Key Players

12.2 Company Positioning and Concentration

13. 5G Device Testing Market - Key Company Profiles

13.1 Anritsu

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

Note - Similar information would be provided for below list of companies

13.2 Aritza Newtorks Inc.

13.3 Emite

13.4 Exfo Inc.

13.5 GL Communications

13.6 Intertek Group

13.7 Keysight Technologies

13.8 LitePoint

13.9 MACOM Technology Solutions

13.10 National Instrument Corporation

13.11 Rohde and Schwarz

13.12 Spirent Communications

14. Appendix

14.1 Glossary

14.2 About The Insight Partners

14.3 Market Intelligence Cloud

The List of Companies - 5G Device Testing Market

- Anritsu

- Artiza Networks Inc.

- Emite

- Exfo Inc.

- GL Communications Inc.

- Intertek Group plc

- Keysight Technologies

- LitePoint

- MACOM Technology Solutions

- National Instruments Corp

- Rohde & Schwarz

- Spirent Communications

- Tektronix Inc.

- Teradyne Inc

- Trex Enterprise Corporation

- Viavi Solutions Inc.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For