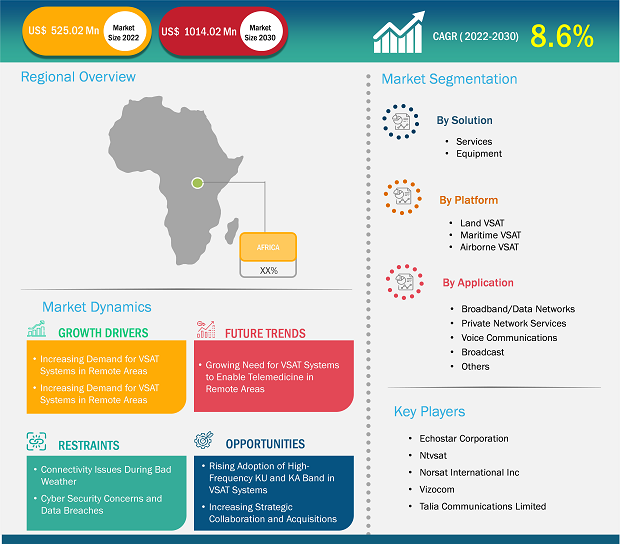

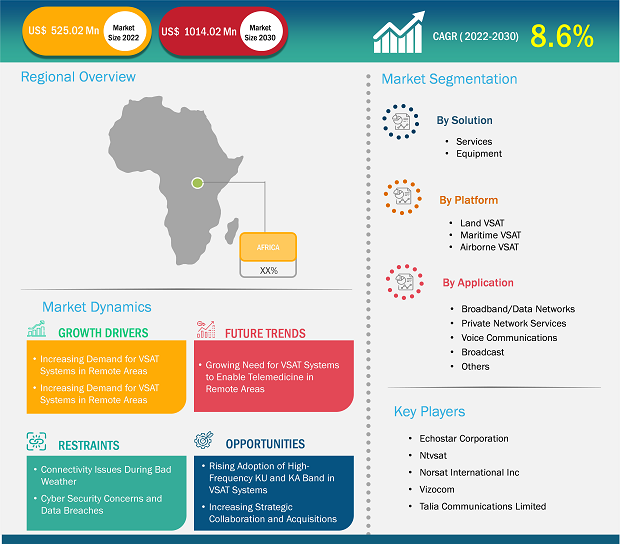

The Africa Very Small Aperture Terminal (VSAT) market size was valued at US$ 525.02 million in 2022 and is expected to reach US$ 1014.02 million by 2030; it is estimated to record a CAGR of 8.6% from 2022 to 2030.

Analyst Perspective:

A very small aperture terminal (VSAT) technology offers value-added satellite access that can transmit data for Internet/intranet applications, video, voice over IP, and public or private networks. VSAT technology is increasingly being utilized to create networks for private, public/governmental, and business applications due to its flexibility, rapid deployment, and low setup and operational costs. The Africa VSAT market forecast can aid internet service providers in evaluating broadband internet facilities to extend coverage in remote areas of the world.

Africa VSAT Market Overview:

The study predicts noticeable growth of the Africa VSAT market size by recording a CAGR of 8.6% during 2022–2030. A VSAT is a compact ground station utilized to transmit and receive data, voice, and video signals via a satellite communication network. It comprises two primary components: an outdoor transceiver that must have an unobstructed line of sight to the satellite and an indoor device that connects the transceiver to the end user's communication equipment, such as a PC.

The transceiver establishes communication with a satellite transponder located in space. In contrast, the satellite serves as a relay for signals between the transceiver and a central ground station computer, which acts as a central hub for the system. This network configuration forms a star topology, with each end user being connected to the hub station via the satellite. The VSAT technology offers flexible, dependable, and cost-effective connectivity solutions for broadband internet access, point-of-sale transactions, remote access, and various other communication requirements. Despite challenges such as cybersecurity concerns, the Africa VSAT market is predicted to flourish owing to expanding applications in remote industries and government sectors. Moreover, the Africa VSAT market players are constantly upgrading their strategies to stay competitive as the demand for satellite internet access expands in remote areas.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Africa VSAT (Very Small Aperture Terminal) Market: Strategic Insights

Market Size Value in US$ 525.02 million in 2022 Market Size Value by US$ 1014.02 million by 2030 Growth rate CAGR of 8.6% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Africa VSAT (Very Small Aperture Terminal) Market: Strategic Insights

| Market Size Value in | US$ 525.02 million in 2022 |

| Market Size Value by | US$ 1014.02 million by 2030 |

| Growth rate | CAGR of 8.6% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Africa VSAT Market Driver:

Growing Demand for Safe Communications for Maritime IoT Applications Drives Africa VSAT Market Growth

As IoT devices gain traction in maritime operations, secure and seamless communication between these devices and onshore systems becomes crucial. The VSAT technology has emerged as a valuable resource for maritime applications, enabling two-way satellite communication for the Internet, data, and telephony. VSAT systems offer a reliable and robust communication infrastructure that ensures the uninterrupted functioning of maritime IoT applications. The maritime sector heavily relies on essential functions such as real-time monitoring, remote management, and data exchange. The Africa VSAT market growth is, therefore, driven by the increasing demand for safe communication in maritime applications.

The companies operating in the Africa VSAT market are expanding their business across the region. In August 2020, Cobham Satcom, a renowned provider of radio and satellite communication solutions for the maritime and land sectors, expanded its SAILOR XTR portfolio. This expansion includes introducing two new Ka-band antenna systems designed specifically for Telenor Satellite's THOR 7 VSAT services. The one-meter SAILOR 1000 XTR Ka and the 65-centimeter SAILOR 600 XTR Ka are newly introduced systems incorporating Cobham Satcom's cutting-edge VSAT technology platform. These systems ensure high-speed broadband service on the THOR 7 satellite, which supports several network applications, including cloud-based big data management, thereby facilitating the expansion of the Africa VSAT market share.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Africa VSAT Market Report Segmentation:

Based on solution, the Africa VSAT market is segmented into services and equipment. VSAT services include shared bandwidth TDMA VSAT services; internet access C-band, Ku-band, and Ka-band; shared bandwidth services with 1:1, 1:4, and 1:10 contention ratios; iDirect, Newtec, and Hughes DVB platforms; dedicated bandwidth SCPC VSAT services (Comtech, Newtec, UHP Romantis modems); star (VSAT terminal to Hub Earth Station) and mesh configuration (from VSAT terminal to VSAT terminals); point-to-point or point-to-multipoint connectivity; power supply options: portable generator and solar panel technology; secured private VPNs; and installation services. Further, VSAT connections are usually billed monthly, just like a regular terrestrial-based internet provider; however, unusual arrangements can be made for usage only at certain times of the day/week or only to be used during emergency settings.

The internet service offered by VSATs is one of the cheaper satellite internet connections available in the Africa VSAT market. VSAT equipment encompasses a range of hardware components facilitating satellite communication, such as VSAT antenna; Block Upconverter (BUC) – BUC units convert low-energy signals into high-energy signals and are used to "send" the signal from the VSAT; Low-Noise Block Downconverter (LNB) – LNBs convert high energy signals to low-energy signals and are used to convert data received from the satellite into a signal for the modem; and Outdoor Unit (ODU), Indoor Unit (IDU), modem – proprietary hardware that decodes the signal from the satellite into usable data for a computer network or a computer hub, and network operations center (NOC). LNB, BUC, and modems all require some form of external power, though usually relatively low.

An organization or base that faces multiple power outages must consider battery backup for the VSAT if satellite-provided internet is required every time. Additionally, BUC and LNB units are placed outside and easily accessible. By platform, the market is divided into land VSAT, maritime VSAT, and airborne VSAT. In terms of application, the VSAT market in Africa is categorized into broadband/data networks, private network services, voice communications, broadcast, and others.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Africa VSAT Market Analysis by Region:

The Africa VSAT market is driven by factors such as increasing demand for high-speed internet connectivity, advancements in satellite communication technology, and the need for reliable communication networks in remote areas.

In November 2019, Communication Services FZCO (InterSAT), a company that specializes in providing VSAT services in Africa, selected the Hughes Jupiter System to support its newly launched SkyFi satellite broadband service. This service is aimed at consumers and micro/small-to-medium enterprises (MSME/SME) in sub-Saharan Africa. As per the agreement, InterSAT is expected to deploy the latest-generation JUPITER gateway and numerous high-speed customer terminals to ensure efficient and fast connectivity for its users.

In August 2020, Paratus South Africa, a subsidiary of Paratus Africa (a prominent pan-African telecommunications service provider), announced its plans to make significant investments in the South African satellite market. These investments aim to provide high-quality connectivity to South Africa and the Rest of Africa. Paratus is leveraging satellite technology to offer Internet Service Providers (ISPs) and businesses a versatile, dependable, and cost-effective communication solution that caters to a wide range of needs. Thus, such initiatives are expected to benefit the overall Africa VSAT market size.

In terms of revenue, Nigeria dominated the Africa VSAT market share. The utilization of VSAT technology in Nigeria has garnered considerable attention and significance. In Nigeria, VSATs serve various purposes, encompassing satellite internet access, point-of-sale transactions, telemedicine, and video communication. Recognizing its value, the Nigerian government has implemented policies to equip citizens with the necessary digital skills for a globally competitive digital economy. Moreover, in a bid to enhance the widespread adoption of broadband connectivity in Nigeria, the federal government announced plans to provide training for 600 Nigerian youths in VSAT installations and essential skills in March 2021. The Minister of Communications and Digital Economy announced the official launch of the National Policy on installations of VSAT solutions in Abuja. The policy aims to facilitate the implementation of VSAT installation training programs for the youth across the country to empower them with the necessary expertise.

Africa VSAT Market Players: Competitive Landscape:

GlobalTT SaRL, NTvsat, Talia Communications Ltd, Afrikanet Oxford Consultech UK Ltd, Norsat International Inc, Sandstream Telecoms, VSATmena FZCO, Echostar Corp, and Link Communications Systems Ltd are among the prominent players profiled in the Africa VSAT market report. Mergers & acquisitions, partnerships, and R&D activities are key strategies adopted by players to mark their position in the market.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the Africa VSAT market. A few recent key market developments are listed below:

- In April 2020, Norsat International announced the launch of a new satellite antenna in its WAYFARER series of portable and easy-to-deploy commercial terminals.

- In January 2024, Es'hailSat, the Qatar Satellite Company, expanded its partnership with Viasat Energy Services for VSAT connectivity throughout the Middle East & North Africa (MENA). The agreement makes use of the capabilities of the Es'hail-1 satellite, which is located at 25.5 degrees east and is specifically targeted to diverse sectors such as government, maritime, oil & gas, and energy.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Solution, Platform, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The Africa VSAT (Very Small Aperture Terminal) market is expected to reach US$ 1014.02 million by 2030.

The rest of Africa held the largest market share in 2022, followed by Nigeria and South Africa.

The Africa VSAT (Very Small Aperture Terminal) market was valued at US$ 525.02 million in 2022 and is projected to reach US$ 1014.02 million by 2030; it is expected to grow at a CAGR of 8.6% during 2022–2030.

Factors such as increasing demand for VSAT systems in remote areas and growing demand for safe communications for maritime IoT applications are the driving the Africa VSAT (Very Small Aperture Terminal) market growth.

The key players, holding majority shares, in Africa VSAT (Very Small Aperture Terminal) market includes EchoStar Corporation, Ntvsat, Norsat International Inc, Vizocom, and Taila Communications Limited.

Growing need for VSAT systems to enable telemedicine in remote areas is the future trend of the Africa VSAT (Very Small Aperture Terminal) market.

The services segment held largest market share in 2022 and it is expected to grow with the highest CAGR during the forecast period 2023-2030.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. VSAT (Very Small Aperture Terminal) Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Ecosystem Analysis

4.3.1 List of Vendors in Value Chain

5. VSAT (Very Small Aperture Terminal) Market - Key Industry Dynamics

5.1 VSAT (Very Small Aperture Terminal) Market - Key Industry Dynamics

5.2 Market Drivers

5.2.1 Increasing Demand for VSAT Systems in Remote Areas

5.2.2 Growing Demand for Safe Communications for Maritime IoT Applications

5.3 Market Restraints

5.3.1 Connectivity Issues During Bad Weather

5.3.2 Cyber Security Concerns and Data Breaches

5.4 Market Opportunities

5.4.1 Rising Adoption of High-Frequency KU and KA Band in VSAT Systems

5.4.2 Increasing Strategic Collaboration and Acquisitions

5.5 Future Trends

5.5.1 Growing Need for VSAT Systems to Enable Telemedicine in Remote Areas

5.6 Impact of Drivers and Restraints:

6. VSAT (Very Small Aperture Terminal) Market - Africa Market Analysis

6.1 VSAT (Very Small Aperture Terminal) Market Revenue (US$ Million), 2022 – 2030

6.2 VSAT (Very Small Aperture Terminal) Market Forecast and Analysis

7. VSAT (Very Small Aperture Terminal) Market Analysis – Solution

7.1 Services

7.1.1 Overview

7.1.2 Services Market, Revenue and Forecast to 2030 (US$ Million)

7.2 Equipment

7.2.1 Overview

7.2.2 Equipment Market, Revenue and Forecast to 2030 (US$ Million)

8. VSAT (Very Small Aperture Terminal) Market Analysis - Platform

8.1 Land VSAT

8.1.1 Overview

8.1.2 Land VSAT Market Revenue, and Forecast to 2030 (US$ Million)

8.2 Maritime VSAT

8.2.1 Overview

8.2.2 Maritime VSAT Market Revenue, and Forecast to 2030 (US$ Million)

8.3 Airborne VSAT

8.3.1 Overview

8.3.2 Airborne VSAT Market Revenue, and Forecast to 2030 (US$ Million)

9. VSAT (Very Small Aperture Terminal) Market Analysis - Application

9.1 Broadband/Data Networks

9.1.1 Overview

9.1.2 Broadband/Data Networks Market Revenue, and Forecast to 2030 (US$ Million)

9.2 Private Network Services

9.2.1 Overview

9.2.2 Private Network Services Market Revenue, and Forecast to 2030 (US$ Million)

9.3 Voice Communications

9.3.1 Overview

9.3.2 Voice Communications Market Revenue, and Forecast to 2030 (US$ Million)

9.4 Broadcast

9.4.1 Overview

9.4.2 Broadcast Market Revenue, and Forecast to 2030 (US$ Million)

9.5 Others

9.5.1 Overview

9.5.2 Others Market Revenue, and Forecast to 2030 (US$ Million)

10. VSAT (Very Small Aperture Terminal) Market - Country Analysis

10.1 Africa

10.1.1 Africa VSAT (Very Small Aperture Terminal) Market Overview

10.1.2 Africa VSAT (Very Small Aperture Terminal) Market Revenue and Forecasts and Analysis - By Country

10.1.2.1 Africa VSAT (Very Small Aperture Terminal) Market Revenue and Forecasts and Analysis - By Country

10.1.2.2 Nigeria VSAT (Very Small Aperture Terminal) Market Revenue and Forecasts to 2030 (US$ Mn)

10.1.2.2.1 Nigeria VSAT (Very Small Aperture Terminal) Market Breakdown by Solution

10.1.2.2.2 Nigeria VSAT (Very Small Aperture Terminal) Market Breakdown by Platform

10.1.2.2.3 Nigeria VSAT (Very Small Aperture Terminal) Market Breakdown by Application

10.1.2.3 South Africa VSAT (Very Small Aperture Terminal) Market Revenue and Forecasts to 2030 (US$ Mn)

10.1.2.3.1 South Africa VSAT (Very Small Aperture Terminal) Market Breakdown by Solution

10.1.2.3.2 South Africa VSAT (Very Small Aperture Terminal) Market Breakdown by Platform

10.1.2.3.3 South Africa VSAT (Very Small Aperture Terminal) Market Breakdown by Application

10.1.2.4 Kenya VSAT (Very Small Aperture Terminal) Market Revenue and Forecasts to 2030 (US$ Mn)

10.1.2.4.1 Kenya VSAT (Very Small Aperture Terminal) Market Breakdown by Component

10.1.2.4.2 Kenya VSAT (Very Small Aperture Terminal) Market Breakdown by Platform

10.1.2.4.3 Kenya VSAT (Very Small Aperture Terminal) Market Breakdown by Application

10.1.2.5 Rest of Africa VSAT (Very Small Aperture Terminal) Market Revenue and Forecasts to 2030 (US$ Mn)

10.1.2.5.1 Rest of Africa VSAT (Very Small Aperture Terminal) Market Breakdown by Solution

10.1.2.5.2 Rest of Africa VSAT (Very Small Aperture Terminal) Market Breakdown by Platform

10.1.2.5.3 Rest of Africa VSAT (Very Small Aperture Terminal) Market Breakdown by Application

11. VSAT (Very Small Aperture Terminal) Market – Impact of COVID-19 Pandemic

11.1 Pre & Post Covid-19 Impact

12. Competitive Landscape

12.1 Heat Map Analysis by Key Players

12.2 Company Positioning & Concentration

13. Industry Landscape

13.1 Overview

13.2 Market Initiative

13.2 New Product Development

13.3 Merger and Acquisition

14. Company Profiles

14.1 GlobalTT SaRL

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

14.2 Vizocom ICT LLC

14.2.1 Key Facts

14.2.2 Business Description

14.2.3 Products and Services

14.2.4 Financial Overview

14.2.5 SWOT Analysis

14.2.6 Key Developments

14.3 NTvsat

14.3.1 Key Facts

14.3.2 Business Description

14.3.3 Products and Services

14.3.4 Financial Overview

14.3.5 SWOT Analysis

14.3.6 Key Developments

14.4 Talia Communications Ltd

14.4.1 Key Facts

14.4.2 Business Description

14.4.3 Products and Services

14.4.4 Financial Overview

14.4.5 SWOT Analysis

14.4.6 Key Developments

14.5 Afrikanet Oxford Consultech UK Ltd

14.5.1 Key Facts

14.5.2 Business Description

14.5.3 Products and Services

14.5.4 Financial Overview

14.5.5 SWOT Analysis

14.5.6 Key Developments

14.6 Norsat International Inc

14.6.1 Key Facts

14.6.2 Business Description

14.6.3 Products and Services

14.6.4 Financial Overview

14.6.5 SWOT Analysis

14.6.6 Key Developments

14.7 Sandstream Telecoms

14.7.1 Key Facts

14.7.2 Business Description

14.7.3 Products and Services

14.7.4 Financial Overview

14.7.5 SWOT Analysis

14.7.6 Key Developments

14.8 VSATmena FZCO

14.8.1 Key Facts

14.8.2 Business Description

14.8.3 Products and Services

14.8.4 Financial Overview

14.8.5 SWOT Analysis

14.8.6 Key Developments

14.9 Echostar Corp

14.9.1 Key Facts

14.9.2 Business Description

14.9.3 Products and Services

14.9.4 Financial Overview

14.9.5 SWOT Analysis

14.9.6 Key Developments

14.10 Link Communications Systems Ltd

14.10.1 Key Facts

14.10.2 Business Description

14.10.3 Products and Services

14.10.4 Financial Overview

14.10.5 SWOT Analysis

14.10.6 Key Developments

15. Appendix

15.1 About the Insight Partners

15.2 Word Index

List of Tables

Table 1. VSAT (Very Small Aperture Terminal) Market Segmentation

Table 2. VSAT (Very Small Aperture Terminal) Market Revenue and Forecasts To 2030 (US$ Million)

Table 3. VSAT (Very Small Aperture Terminal) Market Revenue and Forecasts To 2030 (US$ Million) – Solution

Table 4. VSAT (Very Small Aperture Terminal) Market Revenue and Forecasts To 2030 (US$ Million) - Platform

Table 5. VSAT (Very Small Aperture Terminal) Market Revenue and Forecasts To 2030 (US$ Million) - Application

Table 6. Africa VSAT (Very Small Aperture Terminal) Market Revenue and Forecasts To 2030 (US$ Mn) – By Country

Table 7. Nigeria VSAT (Very Small Aperture Terminal) Market Revenue and Forecasts To 2030 (US$ Mn) – By Solution

Table 8. Nigeria VSAT (Very Small Aperture Terminal) Market Revenue and Forecasts To 2030 (US$ Mn) – By Platform

Table 9. Nigeria VSAT (Very Small Aperture Terminal) Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 10. South Africa VSAT (Very Small Aperture Terminal) Market Revenue and Forecasts To 2030 (US$ Mn) – By Solution

Table 11. South Africa VSAT (Very Small Aperture Terminal) Market Revenue and Forecasts To 2030 (US$ Mn) – By Platform

Table 12. South Africa VSAT (Very Small Aperture Terminal) Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 13. Kenya VSAT (Very Small Aperture Terminal) Market Revenue and Forecasts To 2030 (US$ Mn) – By Component

Table 14. Kenya VSAT (Very Small Aperture Terminal) Market Revenue and Forecasts To 2030 (US$ Mn) – By Platform

Table 15. Kenya VSAT (Very Small Aperture Terminal) Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 16. Rest of Africa VSAT (Very Small Aperture Terminal) Market Revenue and Forecasts To 2030 (US$ Mn) – By Solution

Table 17. Rest of Africa VSAT (Very Small Aperture Terminal) Market Revenue and Forecasts To 2030 (US$ Mn) – By Platform

Table 18. Rest of Africa VSAT (Very Small Aperture Terminal) Market Revenue and Forecasts To 2030 (US$ Mn) – By Application

Table 19. Heat Map Analysis By Key Players

Table 20. List of Abbreviation

List of Figures

Figure 1. VSAT (Very Small Aperture Terminal) Market Segmentation, By Geography

Figure 2. PEST Analysis

Figure 3. Ecosystem: VSAT (Very Small Aperture Terminal) Market

Figure 4. Impact Analysis of Drivers and Restraints

Figure 5. VSAT (Very Small Aperture Terminal) Market Revenue (US$ Million), 2022 – 2030

Figure 6. VSAT (Very Small Aperture Terminal) Market Share (%) – Solution, 2022 and 2030

Figure 7. Services Market Revenue and Forecasts To 2030 (US$ Million)

Figure 8. Equipment Market Revenue and Forecasts To 2030 (US$ Million)

Figure 9. VSAT (Very Small Aperture Terminal) Market Share (%) Platform, 2022 and 2030

Figure 10. Land VSAT Market Revenue and Forecasts To 2030 (US$ Million)

Figure 11. Maritime VSAT Market Revenue and Forecasts To 2030 (US$ Million)

Figure 12. Airborne VSAT Market Revenue and Forecasts To 2030 (US$ Million)

Figure 13. VSAT (Very Small Aperture Terminal) Market Share (%) Application, 2022 and 2030

Figure 14. Broadband/Data Networks Market Revenue and Forecasts To 2030 (US$ Million)

Figure 15. Private Network Services Market Revenue and Forecasts To 2030 (US$ Million)

Figure 16. Voice Communications Market Revenue and Forecasts To 2030 (US$ Million)

Figure 17. Broadcast Market Revenue and Forecasts To 2030 (US$ Million)

Figure 18. Others Market Revenue and Forecasts To 2030 (US$ Million)

Figure 19. VSAT (Very Small Aperture Terminal) Market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 20. Nigeria VSAT (Very Small Aperture Terminal) Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 21. South Africa VSAT (Very Small Aperture Terminal) Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 22. Kenya VSAT (Very Small Aperture Terminal) Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 23. Rest of Africa VSAT (Very Small Aperture Terminal) Market Revenue and Forecasts To 2030 (US$ Mn)

Figure 24. Company Positioning & Concentration

The List of Companies - Africa VSAT (Very Small Aperture Terminal) Market

- GlobalTT SaRL

- Vizocom ICT LLC

- NTvsat

- Talia Communications Ltd

- Afrikanet Oxford Consultech UK Ltd

- Norsat International Inc

- Sandstream Telecoms

- VSATmena FZCO

- Echostar Corp

- Link Communications Systems Ltd

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For