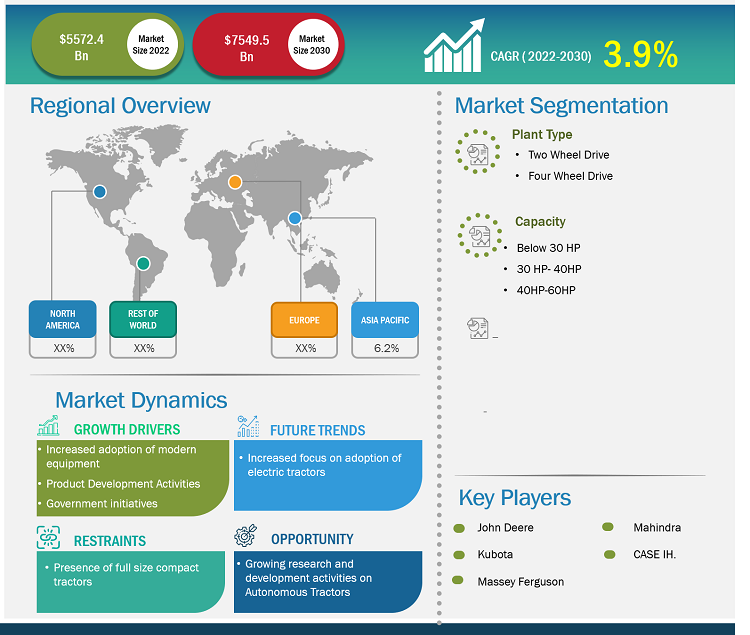

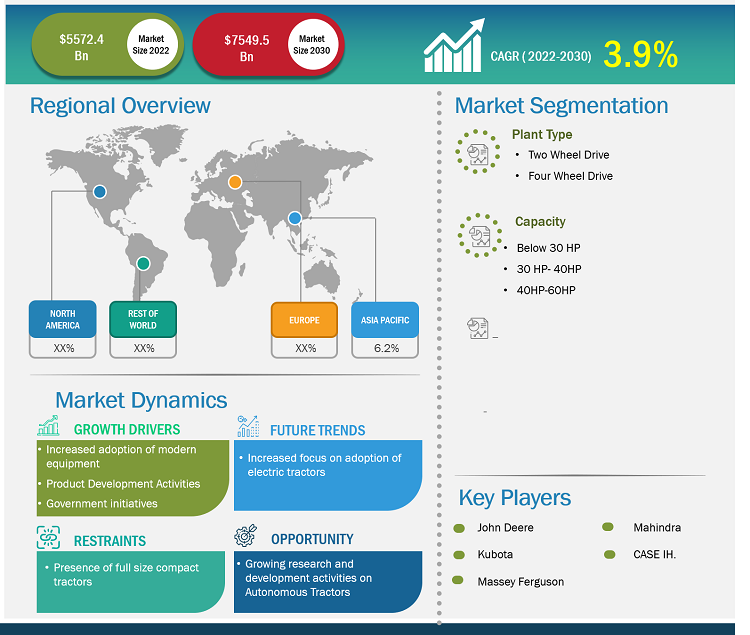

[Research Report] The agriculture compact tractors market size is estimated to grow from US$ 5,572.4 million in 2022 to US$ 7,549.5 million by 2030; the market is expected to register a CAGR of 3.9% from 2022 to 2030.

Analyst Perspective:

The continuously growing agriculture sector, along with an increasing preference for modern equipment, drives the global agriculture compact tractors market growth. The demand for food is increasing with a continuously growing population. As per the recent forecasts offered by the United Nations, the world population is anticipated to reach 8.5 billion by 2030 and expand further to 9.7 billion by 2050. As a result, the demand for agricultural produce is increasing rapidly, which burdens farmers to enhance the yields of their farms. Hence, the increasing scale of agriculture activities propels the demand for agriculture compact tractors.

In January 2024, LS Mtron Co., a South Korean manufacturer of heavy machinery and electronic components, introduced the new MT2·MT2E small tractor series in North America. The two models from this series—the premium MT2 and the budget MT2E—are designed to improve operational convenience in restricted places and are appropriate for small-scale farming. This product lineup was designed for various jobs, including an easy-to-use shuttle for smooth forward and reverse operations, and dual pedals suited for transferring soil or gravel. Such product development activities by agriculture compact tractor manufacturers fuel the agriculture compact tractors market growth.

Market Overview:

Compact tractors, usually known as compact utility tractors, are primarily used for small farm activities such as plowing, mowing, planting, tilling, and hauling. They are smaller in size and capacity, and more beneficial for small-scale farms, fruit and nut yards, vineyards, gardens, and lawns. Compact tractors consume less fuel and have low maintenance requirements, which results in low operational costs.

Asia Pacific dominates the agriculture compact tractors market owing to the large scale of farming activities in countries such as China and India. However, North America and Europe are expected to register strong CAGR values during the forecast period. The US is one of the major producers of nuts and fruits. As per the data published by the US Department of Agriculture in 2022, small family farms accounted for 88% of the total farms in the US. Thus, the presence of a large number of small farms in the US is a key factor that benefits the agriculture compact tractors market in this country.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Agriculture Compact Tractors Market: Strategic Insights

Market Size Value in US$ 5,572.4 million in 2022 Market Size Value by US$ 7,549.5 million by 2030 Growth rate CAGR of 3.9% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Agriculture Compact Tractors Market: Strategic Insights

| Market Size Value in | US$ 5,572.4 million in 2022 |

| Market Size Value by | US$ 7,549.5 million by 2030 |

| Growth rate | CAGR of 3.9% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Driver:

Government Initiatives to Support Small-Scale Farmers

Government policies and supportive initiatives such as funding boost the number of small-scale farms in different countries. For instance, the US Department of Agriculture offers a Microloan Program to small-scale and beginner farmers that enables them to get up to US$ 35,000 in loans through simple applications. Further, in 2023, the government of Guyana announced an initiative through its National Pathway for Food Systems program. As part of this project, farm input supplies and a one-time cash grant were provided to smallholder farmers and participants in continuing socioeconomic empowerment programs around the nation. Such government initiatives are empowering small-scale farmers to adopt farming equipment, including compact tractors. Moreover, these programs and initiatives create a conducive environment for small-scale agricultural farms in developing and developed nations, ultimately resulting in the expansion of the agriculture compact tractors market size.

Segmental Analysis:

The agriculture compact tractors market analysis has been carried out by considering the following segments: Type, Capacity, and Application. On the basis of capacity, the market is segmented into below 30HP, 30HP-40HP, and 40HP-60HP. The 40HP-60HP and 30HP-40HP segments collectively account for more than 50% of the agriculture compact tractors market share. These tractors are suitable for medium-sized farms for tasks such as plowing, tilling, planting, and harvesting. For instance, Farmtrac launched its new Farmtrac 60 Powermaxx tractor in 2024. This tractor has a 55 HP engine and offers several features.

Regional Analysis:

The geographic scope of the agriculture compact tractors market report entails North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America) Asia Pacific accounted for the largest agriculture compact tractors market share in 2022.

The North American agriculture compact tractors market is segmented into the US, Canada, and Mexico. The agriculture sector in North America, particularly in countries such as the US, Canada, and Mexico, majorly drives the demand for agriculture compact tractors. The expansion of the agriculture sector and continuous product developments would continue to boost the market in this region in the future. As per the data published by the US Department of Agriculture in 2021, the agriculture sector contributed approximately US$ 1.264 trillion to the US GDP in 2021, accounting for 5.4% of the national GDP. As per the data published by the Canadian Government in 2022, the agriculture and agri-food sector makes a significant contribution to the Canadian economy. Canadian agricultural commodity sales, growing at an annual rate of 5.6%, totaled US$ 87.7 billion in 2022. The rising number of small land farms results in a greater demand for compact tractors, which provides new growth avenues for vendors. Further, many key players in the United States are now focusing on developing fully automated compact tractors, and such developments are expected to bring new agriculture compact tractors market trends in North America in the coming years.

Agriculture Compact Tractors Market Report Scope

Key Player Analysis:

AGCO GmbH, Yamaha Tractors, Solis, Bobcat Company, Mahindra Tractors, Kubota, John Deere, Massey Ferguson, and New Holland are among the prominent players profiled in the agriculture compact tractors market report. In addition to these players, several other important companies were studied and analyzed during this study to get a holistic overview of the global utility compact tractors market.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the global agriculture compact tractors market. A few recent developments by key agriculture compact tractors market players, as per press releases, are listed below:

|

|

|

August 2023 | Case IH launched its new Farmall Subcompact 25SC tractors. This newly launched model is the smallest tractor in the Case IH’s portfolio. The new tractor has an engine range from 25 HP to 115 HP. | APAC |

February 2023 | Bobcat introduced a new compact tractor line-up, namedthe 1000, 2000 and 4000 series. The series has nine compact tractors models that are differentiated on the basis of the engine power. These tractors have a power range between 25 to 85 HP. | Europe |

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Capacity, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Continuous adoption of electric vehicles owing to increased focus on sustainability is one of the trends that is expected to drive the demand of the electric agriculture compact tractors market.

AGCO GmbH, Yamaha Tractors, Solis, Bobcat Company, Mahindra Tractors, Kubota, John Deere, Massey Ferguson, and New Holland are the key market players operating in the global agriculture compact tractors market.

Regions such as Europe, North America and Asia-Pacific will boost the growth of the agriculture compact tractors market during the forecast period. This growth is owing to the rise in investment for the adoption of the modern agriculture equipment and vineyards in the regions.

Many compact tractor manufacturers are focusing on developing fully automated compact tractors. Such development is projected to generate lucrative opportunities for the agriculture compact tractors market during the forecast period.

High customization options and low cost of compact tractors are a few of the factors contributing to the expansion of the agriculture compact tractors market size. Farming requires a wide range of agricultural equipment, and tractors form an unintegral part of this set of equipment. Purchasing various farm equipment can be expensive, whereas low prices of a small tractor provide some relief to agriculturists and farm owners. Lower price is especially a primary factor driving the adoption of agriculture compact tractors in in agriculture-dominating economies such as China and India, which are home to numerous small and low-margin farmers.

1. INTRODUCTION

1.1. SCOPE OF THE STUDY

1.2. THE INSIGHT PARTNERS RESEARCH REPORT GUIDANCE

1.3. MARKET SEGMENTATION

1.3.1 Agriculture Compact Tractors Market - By Type

1.3.2 Agriculture Compact Tractors Market - By Capacity

1.3.3 Agriculture Compact Tractors Market - By Application

1.3.4 Agriculture Compact Tractors Market - By Region

1.3.4.1 By Country

2. KEY TAKEAWAYS

3. RESEARCH METHODOLOGY

4. AGRICULTURE COMPACT TRACTORS MARKET LANDSCAPE

4.1. OVERVIEW

4.2. PEST ANALYSIS

4.2.1 North America - Pest Analysis

4.2.2 Europe - Pest Analysis

4.2.3 Asia-Pacific - Pest Analysis

4.2.4 Middle East and Africa - Pest Analysis

4.2.5 South and Central America - Pest Analysis

4.3. ECOSYSTEM ANALYSIS

4.4. EXPERT OPINIONS

5. AGRICULTURE COMPACT TRACTORS MARKET - KEY MARKET DYNAMICS

5.1. KEY MARKET DRIVERS

5.2. KEY MARKET RESTRAINTS

5.3. KEY MARKET OPPORTUNITIES

5.4. FUTURE TRENDS

5.5. IMPACT ANALYSIS OF DRIVERS AND RESTRAINTS

6. AGRICULTURE COMPACT TRACTORS MARKET - GLOBAL MARKET ANALYSIS

6.1. AGRICULTURE COMPACT TRACTORS - GLOBAL MARKET OVERVIEW

6.2. AGRICULTURE COMPACT TRACTORS - GLOBAL MARKET AND FORECAST TO 2031

6.3. MARKET POSITIONING

7. AGRICULTURE COMPACT TRACTORS MARKET - REVENUE AND FORECASTS TO 2031 – TYPE

7.1. OVERVIEW

7.2. TYPE MARKET FORECASTS AND ANALYSIS

7.3. TWO WHEEL DRIVE

7.3.1. Overview

7.3.2. Two Wheel Drive Market Forecast and Analysis

7.4. FOUR WHEEL DRIVE

7.4.1. Overview

7.4.2. Four Wheel Drive Market Forecast and Analysis

8. AGRICULTURE COMPACT TRACTORS MARKET - REVENUE AND FORECASTS TO 2031 – CAPACITY

8.1. OVERVIEW

8.2. CAPACITY MARKET FORECASTS AND ANALYSIS

8.3. BELOW 30 HP

8.3.1. Overview

8.3.2. Below 30 HP Market Forecast and Analysis

8.4. 30 HP- 40 HP

8.4.1. Overview

8.4.2. 30 HP- 40 HP Market Forecast and Analysis

8.5. 40 HP- 60 HP

8.5.1. Overview

8.5.2. 40 HP- 60 HP Market Forecast and Analysis

9. AGRICULTURE COMPACT TRACTORS MARKET - REVENUE AND FORECASTS TO 2031 – APPLICATION

9.1. OVERVIEW

9.2. APPLICATION MARKET FORECASTS AND ANALYSIS

9.3. AGRICULTURE

9.3.1. Overview

9.3.2. Agriculture Market Forecast and Analysis

9.4. FORESTRY

9.4.1. Overview

9.4.2. Forestry Market Forecast and Analysis

10. AGRICULTURE COMPACT TRACTORS MARKET REVENUE AND FORECASTS TO 2031 – GEOGRAPHICAL ANALYSIS

10.1. NORTH AMERICA

- 10.1.1 North America Agriculture Compact Tractors Market Overview

- 10.1.2 North America Agriculture Compact Tractors Market Forecasts and Analysis

- 10.1.3 North America Agriculture Compact Tractors Market Forecasts and Analysis - By Type

- 10.1.4 North America Agriculture Compact Tractors Market Forecasts and Analysis - By Capacity

- 10.1.5 North America Agriculture Compact Tractors Market Forecasts and Analysis - By Application

- 10.1.6 North America Agriculture Compact Tractors Market Forecasts and Analysis - By Countries

10.1.6.1 United States Agriculture Compact Tractors Market

- 10.1.6.1.1 United States Agriculture Compact Tractors Market by Type

- 10.1.6.1.2 United States Agriculture Compact Tractors Market by Capacity

- 10.1.6.1.3 United States Agriculture Compact Tractors Market by Application

10.1.6.2 Canada Agriculture Compact Tractors Market

- 10.1.6.2.1 Canada Agriculture Compact Tractors Market by Type

- 10.1.6.2.2 Canada Agriculture Compact Tractors Market by Capacity

- 10.1.6.2.3 Canada Agriculture Compact Tractors Market by Application

10.1.6.3 Mexico Agriculture Compact Tractors Market

- 10.1.6.3.1 Mexico Agriculture Compact Tractors Market by Type

- 10.1.6.3.2 Mexico Agriculture Compact Tractors Market by Capacity

- 10.1.6.3.3 Mexico Agriculture Compact Tractors Market by Application

10.2. EUROPE

- 10.2.1 Europe Agriculture Compact Tractors Market Overview

- 10.2.2 Europe Agriculture Compact Tractors Market Forecasts and Analysis

- 10.2.3 Europe Agriculture Compact Tractors Market Forecasts and Analysis - By Type

- 10.2.4 Europe Agriculture Compact Tractors Market Forecasts and Analysis - By Capacity

- 10.2.5 Europe Agriculture Compact Tractors Market Forecasts and Analysis - By Application

- 10.2.6 Europe Agriculture Compact Tractors Market Forecasts and Analysis - By Countries

10.2.6.1 Germany Agriculture Compact Tractors Market

- 10.2.6.1.1 Germany Agriculture Compact Tractors Market by Type

- 10.2.6.1.2 Germany Agriculture Compact Tractors Market by Capacity

- 10.2.6.1.3 Germany Agriculture Compact Tractors Market by Application

10.2.6.2 France Agriculture Compact Tractors Market

- 10.2.6.2.1 France Agriculture Compact Tractors Market by Type

- 10.2.6.2.2 France Agriculture Compact Tractors Market by Capacity

- 10.2.6.2.3 France Agriculture Compact Tractors Market by Application

10.2.6.3 Italy Agriculture Compact Tractors Market

- 10.2.6.3.1 Italy Agriculture Compact Tractors Market by Type

- 10.2.6.3.2 Italy Agriculture Compact Tractors Market by Capacity

- 10.2.6.3.3 Italy Agriculture Compact Tractors Market by Application

10.2.6.4 United Kingdom Agriculture Compact Tractors Market

- 10.2.6.4.1 United Kingdom Agriculture Compact Tractors Market by Type

- 10.2.6.4.2 United Kingdom Agriculture Compact Tractors Market by Capacity

- 10.2.6.4.3 United Kingdom Agriculture Compact Tractors Market by Application

10.2.6.5 Russia Agriculture Compact Tractors Market

- 10.2.6.5.1 Russia Agriculture Compact Tractors Market by Type

- 10.2.6.5.2 Russia Agriculture Compact Tractors Market by Capacity

- 10.2.6.5.3 Russia Agriculture Compact Tractors Market by Application

10.2.6.6 Rest of Europe Agriculture Compact Tractors Market

- 10.2.6.6.1 Rest of Europe Agriculture Compact Tractors Market by Type

- 10.2.6.6.2 Rest of Europe Agriculture Compact Tractors Market by Capacity

- 10.2.6.6.3 Rest of Europe Agriculture Compact Tractors Market by Application

10.3. ASIA-PACIFIC

- 10.3.1 Asia-Pacific Agriculture Compact Tractors Market Overview

- 10.3.2 Asia-Pacific Agriculture Compact Tractors Market Forecasts and Analysis

- 10.3.3 Asia-Pacific Agriculture Compact Tractors Market Forecasts and Analysis - By Type

- 10.3.4 Asia-Pacific Agriculture Compact Tractors Market Forecasts and Analysis - By Capacity

- 10.3.5 Asia-Pacific Agriculture Compact Tractors Market Forecasts and Analysis - By Application

- 10.3.6 Asia-Pacific Agriculture Compact Tractors Market Forecasts and Analysis - By Countries

10.3.6.1 Australia Agriculture Compact Tractors Market

- 10.3.6.1.1 Australia Agriculture Compact Tractors Market by Type

- 10.3.6.1.2 Australia Agriculture Compact Tractors Market by Capacity

- 10.3.6.1.3 Australia Agriculture Compact Tractors Market by Application

10.3.6.2 China Agriculture Compact Tractors Market

- 10.3.6.2.1 China Agriculture Compact Tractors Market by Type

- 10.3.6.2.2 China Agriculture Compact Tractors Market by Capacity

- 10.3.6.2.3 China Agriculture Compact Tractors Market by Application

10.3.6.3 India Agriculture Compact Tractors Market

- 10.3.6.3.1 India Agriculture Compact Tractors Market by Type

- 10.3.6.3.2 India Agriculture Compact Tractors Market by Capacity

- 10.3.6.3.3 India Agriculture Compact Tractors Market by Application

10.3.6.4 Japan Agriculture Compact Tractors Market

- 10.3.6.4.1 Japan Agriculture Compact Tractors Market by Type

- 10.3.6.4.2 Japan Agriculture Compact Tractors Market by Capacity

- 10.3.6.4.3 Japan Agriculture Compact Tractors Market by Application

10.3.6.5 South Korea Agriculture Compact Tractors Market

- 10.3.6.5.1 South Korea Agriculture Compact Tractors Market by Type

- 10.3.6.5.2 South Korea Agriculture Compact Tractors Market by Capacity

- 10.3.6.5.3 South Korea Agriculture Compact Tractors Market by Application

10.3.6.6 Rest of Asia-Pacific Agriculture Compact Tractors Market

- 10.3.6.6.1 Rest of Asia-Pacific Agriculture Compact Tractors Market by Type

- 10.3.6.6.2 Rest of Asia-Pacific Agriculture Compact Tractors Market by Capacity

- 10.3.6.6.3 Rest of Asia-Pacific Agriculture Compact Tractors Market by Application

10.4. MIDDLE EAST AND AFRICA

- 10.4.1 Middle East and Africa Agriculture Compact Tractors Market Overview

- 10.4.2 Middle East and Africa Agriculture Compact Tractors Market Forecasts and Analysis

- 10.4.3 Middle East and Africa Agriculture Compact Tractors Market Forecasts and Analysis - By Type

- 10.4.4 Middle East and Africa Agriculture Compact Tractors Market Forecasts and Analysis - By Capacity

- 10.4.5 Middle East and Africa Agriculture Compact Tractors Market Forecasts and Analysis - By Application

- 10.4.6 Middle East and Africa Agriculture Compact Tractors Market Forecasts and Analysis - By Countries

10.4.6.1 South Africa Agriculture Compact Tractors Market

- 10.4.6.1.1 South Africa Agriculture Compact Tractors Market by Type

- 10.4.6.1.2 South Africa Agriculture Compact Tractors Market by Capacity

- 10.4.6.1.3 South Africa Agriculture Compact Tractors Market by Application

10.4.6.2 Saudi Arabia Agriculture Compact Tractors Market

- 10.4.6.2.1 Saudi Arabia Agriculture Compact Tractors Market by Type

- 10.4.6.2.2 Saudi Arabia Agriculture Compact Tractors Market by Capacity

- 10.4.6.2.3 Saudi Arabia Agriculture Compact Tractors Market by Application

10.4.6.3 U.A.E Agriculture Compact Tractors Market

- 10.4.6.3.1 U.A.E Agriculture Compact Tractors Market by Type

- 10.4.6.3.2 U.A.E Agriculture Compact Tractors Market by Capacity

- 10.4.6.3.3 U.A.E Agriculture Compact Tractors Market by Application

10.4.6.4 Rest of Middle East and Africa Agriculture Compact Tractors Market

- 10.4.6.4.1 Rest of Middle East and Africa Agriculture Compact Tractors Market by Type

- 10.4.6.4.2 Rest of Middle East and Africa Agriculture Compact Tractors Market by Capacity

- 10.4.6.4.3 Rest of Middle East and Africa Agriculture Compact Tractors Market by Application

10.5. SOUTH AND CENTRAL AMERICA

- 10.5.1 South and Central America Agriculture Compact Tractors Market Overview

- 10.5.2 South and Central America Agriculture Compact Tractors Market Forecasts and Analysis

- 10.5.3 South and Central America Agriculture Compact Tractors Market Forecasts and Analysis - By Type

- 10.5.4 South and Central America Agriculture Compact Tractors Market Forecasts and Analysis - By Capacity

- 10.5.5 South and Central America Agriculture Compact Tractors Market Forecasts and Analysis - By Application

- 10.5.6 South and Central America Agriculture Compact Tractors Market Forecasts and Analysis - By Countries

10.5.6.1 Brazil Agriculture Compact Tractors Market

- 10.5.6.1.1 Brazil Agriculture Compact Tractors Market by Type

- 10.5.6.1.2 Brazil Agriculture Compact Tractors Market by Capacity

- 10.5.6.1.3 Brazil Agriculture Compact Tractors Market by Application

10.5.6.2 Argentina Agriculture Compact Tractors Market

- 10.5.6.2.1 Argentina Agriculture Compact Tractors Market by Type

- 10.5.6.2.2 Argentina Agriculture Compact Tractors Market by Capacity

- 10.5.6.2.3 Argentina Agriculture Compact Tractors Market by Application

10.5.6.3 Rest of South and Central America Agriculture Compact Tractors Market

- 10.5.6.3.1 Rest of South and Central America Agriculture Compact Tractors Market by Type

- 10.5.6.3.2 Rest of South and Central America Agriculture Compact Tractors Market by Capacity

- 10.5.6.3.3 Rest of South and Central America Agriculture Compact Tractors Market by Application

11. IMPACT OF COVID-19 PANDEMIC ON GLOBAL AGRICULTURE COMPACT TRACTORS MARKET

11.1 North America

11.2 Europe

11.3 Asia-Pacific

11.4 Middle East and Africa

11.5 South and Central America

12. INDUSTRY LANDSCAPE

12.1. MERGERS AND ACQUISITIONS

12.2. AGREEMENTS, COLLABORATIONS AND JOINT VENTURES

12.3. NEW PRODUCT LAUNCHES

12.4. EXPANSIONS AND OTHER STRATEGIC DEVELOPMENTS

13. AGRICULTURE COMPACT TRACTORS MARKET, KEY COMPANY PROFILES

13.1. YANMAR TRACTOR

13.1.1. Key Facts

13.1.2. Business Description

13.1.3. Products and Services

13.1.4. Financial Overview

13.1.5. SWOT Analysis

13.1.6. Key Developments

13.2. MAHINDRA

13.2.1. Key Facts

13.2.2. Business Description

13.2.3. Products and Services

13.2.4. Financial Overview

13.2.5. SWOT Analysis

13.2.6. Key Developments

13.3. TYM CORPORATION

13.3.1. Key Facts

13.3.2. Business Description

13.3.3. Products and Services

13.3.4. Financial Overview

13.3.5. SWOT Analysis

13.3.6. Key Developments

13.4. SOLECTRAC

13.4.1. Key Facts

13.4.2. Business Description

13.4.3. Products and Services

13.4.4. Financial Overview

13.4.5. SWOT Analysis

13.4.6. Key Developments

13.5. JOHN DEERE

13.5.1. Key Facts

13.5.2. Business Description

13.5.3. Products and Services

13.5.4. Financial Overview

13.5.5. SWOT Analysis

13.5.6. Key Developments

13.6. AGCO GMBH

13.6.1. Key Facts

13.6.2. Business Description

13.6.3. Products and Services

13.6.4. Financial Overview

13.6.5. SWOT Analysis

13.6.6. Key Developments

13.7. NEW HOLLLAND

13.7.1. Key Facts

13.7.2. Business Description

13.7.3. Products and Services

13.7.4. Financial Overview

13.7.5. SWOT Analysis

13.7.6. Key Developments

13.8. MASSEY FERGUSON

13.8.1. Key Facts

13.8.2. Business Description

13.8.3. Products and Services

13.8.4. Financial Overview

13.8.5. SWOT Analysis

13.8.6. Key Developments

13.9. TAFE

13.9.1. Key Facts

13.9.2. Business Description

13.9.3. Products and Services

13.9.4. Financial Overview

13.9.5. SWOT Analysis

13.9.6. Key Developments

13.10. LANSU

13.10.1. Key Facts

13.10.2. Business Description

13.10.3. Products and Services

13.10.4. Financial Overview

13.10.5. SWOT Analysis

13.10.6. Key Developments

14. APPENDIX

14.1. ABOUT THE INSIGHT PARTNERS

14.2. GLOSSARY OF TERMS

The List of Companies - Agriculture Compact Tractors Market

- YANMAR Tractor

- Mahindra

- TYM CORPORATION

- Solectrac

- John Deere

- AGCO GmbH

- Bobcat Company

- New Hollland

- Massey Ferguson

- TAFE

- Jinma Tractor

- LANSU

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For