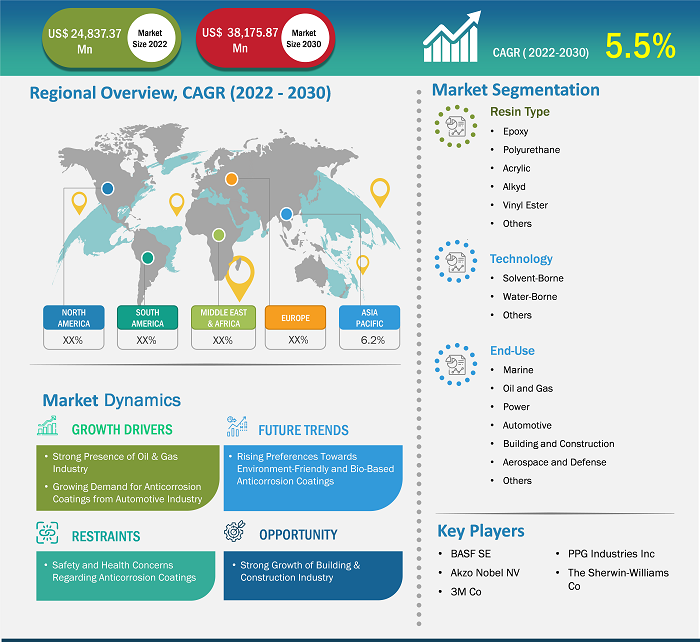

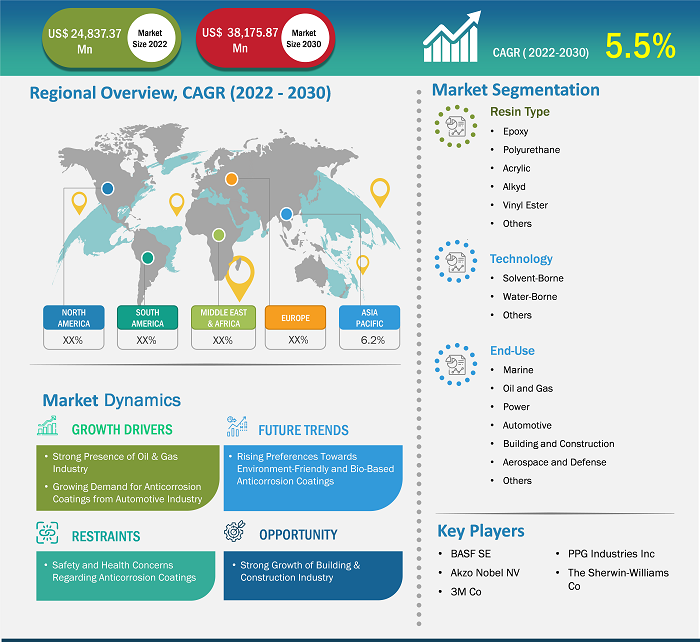

[Research Report] The global anticorrosion coatings market was valued at US$ 24,837.37 million in 2022 and is expected to reach US$ 38,175.87 million by 2030; it is estimated to record a CAGR of 5.5% from 2022 to 2030.

MARKET ANALYSIS

The expanding industrial sector, particularly in oil and gas, petrochemicals, power generation, and water and wastewater treatment, propels the demand for anticorrosion coatings. The oil & gas industry is a major contributor to the growing anticorrosion coatings market. With the presence of large oil reserves in countries such as Saudi Arabia, Iraq, Iran, and the UAE, there is a continuous need for corrosion protection in pipelines, storage tanks, offshore platforms, and refineries. The harsh environmental conditions in the region, such as high temperatures and humidity, further increase the demand for effective anticorrosion coatings. The demand for high-performance coatings has escalated significantly across the global as it is a global hub for oil & gas production. The global anticorrosion coatings market size is likely to surge by 2030 owing to the strong growth of the building & construction industry. Major factors driving the market growth are the strong presence of oil & gas industry and growing demand for anticorrosion coatings from the automotive industry.

The ongoing infrastructure developments across the globe, spanning construction projects and industrial facilities, fuel the need for high-performance anticorrosion coatings. Further, the growing prominence of marine applications, including shipbuilding and offshore structures, has been contributing significantly to the anticorrosion coatings market growth. As the industry evolves, there is a notable shift toward eco-friendly formulations and coatings with advanced functionalities such as self-healing and sensing capabilities.

GROWTH DRIVERS AND CHALLENGES

Strong presence of the oil & gas industry and growing demand for anticorrosion coatings from the automotive industry contribute to the growing anticorrosion coatings market size. Various regions across the world play a vital role in oil production. Saudi Arabia, Iran, the UAE, and other oil-producing countries in the Middle East & Africa comprise many of the largest oil producers. Presence of oil reserves plays a crucial role in the economic growth of different countries in the region, as most of their income depends on the oil industry. Further, the building & construction industry across the world is growing consistently. In April 2016, Saudi Arabia launched its Vision 2030 to diversify its economy, modernize administration, and introduce bold reforms in many sectors. The country is targeting to increase the contribution of its construction sector to the overall GDP. However, there are various health and safety concerns regarding the anticorrosion coatings which might hinder the market growth. Volatile organic compounds (VOCs) are found in anticorrosion coatings and paints. Their high vapor pressure allows molecules to evaporate into the surrounding air. As a result, humans in close proximity can inhale hazardous vapors or gases.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Anticorrosion Coatings Market: Strategic Insights

Market Size Value in US$ 24,837.37 million in 2022 Market Size Value by US$ 38,175.87 million by 2030 Growth rate CAGR of 5.5% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Anticorrosion Coatings Market: Strategic Insights

| Market Size Value in | US$ 24,837.37 million in 2022 |

| Market Size Value by | US$ 38,175.87 million by 2030 |

| Growth rate | CAGR of 5.5% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

REPORT SEGMENTATION AND SCOPE

The "Global Anticorrosion Coatings Market Analysis and Forecast to 2030" is a specialized and in-depth study focusing significantly on global market trends and growth opportunities. The report aims to provide an overview of the global market with detailed market segmentation on the basis of resin type, technology, end-use, and country. The report provides key statistics on the use of anticorrosion coatings across the region, along with their demand in major countries. In addition, it provides a qualitative assessment of various factors affecting the anticorrosion coatings market growth in major countries. It also includes a comprehensive analysis of the leading players in the market and their key strategic developments. Analysis of the market dynamics is also included to help identify the key driving factors, market trends, and lucrative opportunities that would, in turn, aid in identifying the major revenue pockets.

The ecosystem analysis and Porter’s five forces analysis provide a 360-degree view of the global anticorrosion coatings market trends, which helps understand the entire supply chain and various factors influencing the market growth.

SEGMENTAL ANALYSIS

Global anticorrosion coatings market is segmented on the basis of resin type, technology, and end-use. Based on resin type, the market is segmented into epoxy, polyurethane, acrylic, alkyd, vinyl ester, and others. The epoxy segment accounts for the largest anticorrosion coatings market share. Epoxy anticorrosion coatings, formulated with epoxy resins as their primary constituents, belong to the class of thermosetting polymers, imparting robustness and durability to the protective layer they create. Deployed across diverse industries such as oil & gas, maritime, automotive, and infrastructure, epoxy anticorrosion coatings serve as a frontline defense mechanism for metal surfaces. The application process involves the precise amalgamation of epoxy resins with curing agents, resulting in a chemically resistant and adhesive compound. Upon application, these coatings solidify into a tough, impermeable barrier that shields metal surfaces from corrosive agents, preventing oxidation and deterioration over extended periods. Based on technology, the market is segmented into solvent-borne, water-borne, and others. The water-borne segment accounts for the largest market share. Solvent-borne anticorrosion coatings are sophisticated formulations engineered to provide robust protection against the detrimental effects of corrosion, particularly on metallic surfaces. These coatings employ organic solvents as carriers for a meticulously crafted blend of components, each contributing to the coating's effectiveness. The primary constituents include resins, which form the structural backbone of the coating; pigments that impart color and additional barrier properties; and corrosion inhibitors strategically integrated to thwart the corrosive process.

The solvent component plays a pivotal role in the application process, allowing for ease of spreading and ensuring uniform coverage on the substrate. Upon application, the solvents facilitate the even distribution of the coating, penetrating surface irregularities and creating a seamless, protective film. Based on end-use, the market is segmented into marine, oil and gas, power, automotive, building and construction, aerospace and defense, and others. The utilization of anticorrosion coatings in the marine industry is imperative for preserving the structural integrity and longevity of vessels and marine structures subjected to harsh and corrosive marine environments. Seawater, with its high salt content, poses a significant threat to metal components, making corrosion a pervasive challenge. To overcome this, anticorrosion coatings are applied to these components. These coatings are precisely formulated to withstand the corrosive effects of saltwater, moisture, and atmospheric conditions.

In marine applications, anticorrosion coatings find extensive use on ship hulls, offshore platforms, pipelines, and other submerged or exposed metallic structures. The coatings act as protective barriers, preventing direct contact between corrosive elements and the metal surface. The implementation of anticorrosion coatings in the oil & gas industry is critical for safeguarding infrastructure and equipment from the corrosive challenges posed by harsh operating environments. Pipelines, storage tanks, drilling equipment, and various components in the oil & gas sector are constantly exposed to corrosive elements such as moisture, corrosive gases, and chemicals.

REGIONAL ANALYSIS

The report provides a detailed overview of the global anticorrosion coatings market with respect to major regions, including North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America (SAM). Asia Pacific accounted for the largest anticorrosion coatings market share and was valued at ∼US$ 3,000 million in 2022. The Middle East & Africa comprises a significant number of oil & gas manufacturers and is a hub for mid-sized businesses operating in the region. The market in Europe is expected to reach ∼US$ 2,000 million by 2030. The anticorrosion coatings market in the Middle East & Africa is expected to record a CAGR of ~5% from 2022 to 2030. The demand for high-performance coatings has escalated significantly globally as the deployment of oil & gas infrastructure increasing. According to the National Iranian Oil Company, Iran has ~158 billion barrels of crude oil reserves. As per the data from Gachsaran Oil & Gas Production Company, the oil field, which has been in operation since 1930, currently produces 650,000 bpd (Barrel Per Day) of oil.

Anticorrosion Coatings Market Report Scope

COMPETITIVE LANDSCAPE AND KEY COMPANIES

RPM International Inc, The Sherwin-Williams Co, Akzo Nobel NV, Jotun AS, PPG Industries Inc, 3M Co, The Progressive Center Co for Construction Chemicals Ltd, Nippon Paint Holdings Co Ltd, BASF SE, and HB Fuller Co are among the prominent players profiled in the anticorrosion coatings market report. In addition, several other players have been studied and analyzed during the study to get a holistic view of the market and its ecosystem. The anticorrosion coatings market report also includes company positioning and concentration to evaluate the performance of competitors/players in the market.

INDUSTRY DEVELOPMENTS AND FUTURE OPPORTUNITIES

Various initiatives taken by the key players operating in the anticorrosion coatings market are listed below:

In September 2023, H.B. Fuller Company acquired the UK-based Sanglier Limited, one of Europe's largest manufacturers and fillers of sprayable industrial adhesives. The acquisition expands H.B. Fuller's innovation capabilities and product portfolio across the UK and Europe, particularly in Construction Adhesives and Engineering Adhesives businesses. The acquisition complements technologies acquired through Apollo and Fourny acquisitions and spray capabilities developed in the US. A team of nearly 60 employees will operate in H.B. Fuller's existing Construction Adhesives global business unit.

In March 2023, The PPG Industries launched the PPG ENVIROCRON Primeron primer powder portfolio, designed to provide high corrosion resistance for metal substrates, including steel, hot-dip galvanized steel, metalized steel, and aluminum. The products are tested according to the corrosivity categories and approved by the QUALISTEELCOAT international quality label for coated steel. The products include ZINC coating, PRO coating, EDGE coating, and FLEX coating.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Resin Type, Technology, and End Use

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The major players operating in the global anticorrosion coatings market are RPM International Inc, The Sherwin-Williams Co, Akzo Nobel NV, Jotun AS, PPG Industries Inc, 3M Co, The Progressive Center Co for Construction Chemicals Ltd, Nippon Paint Holdings Co Ltd, BASF SE, HB Fuller Co.

The automotive industry is growing in the Middle East. In Saudi Arabia, the industry is undergoing a transformation with the establishment of local manufacturing plants and the introduction of electric vehicles. The automotive industry in Saudi Arabia is growing owing to the country’s Vision 2030 program and its ambitious goals for clean and autonomous mobility. The industry in the country benefits from the country’s strategic location and investments in advanced technologies.

Based on resin type, the anticorrosion coatings market is segmented into epoxy, polyurethane, acrylic, alkyd, vinyl ester, and others. Epoxy anticorrosion coatings, formulated with epoxy resins as their primary constituents, belong to the class of thermosetting polymers, imparting robustness and durability to the protective layer they create. Deployed across diverse industries such as oil & gas, maritime, automotive, and infrastructure, epoxy anticorrosion coatings serve as a frontline defense mechanism for metal surfaces.

Asia Pacific accounted for the largest share of the global anticorrosion coatings market. The Asia Pacific is home to major oil processing companies; the number of oil processing activities has surged notably in this region in the past few years. Developments in technologies that aid in oil exploration and production operations have propelled the risk of oil spills, driving the demand for anticorrosion coatings and services.

Various countries in the Middle East play a vital role in global oil production. Saudi Arabia, Iran, the UAE, and other oil-producing countries in the region comprise many of the largest oil producers. Presence of oil reserves plays a crucial role in the economic growth of different countries in the region, as most of their income depends on the oil industry. According to the Organization of the Petroleum Exporting Countries, Saudi Arabia possesses around 17% of the world’s proven petroleum reserves.

Based on technology, the water-borne segment is expected to grow fastest during the forecast period. Water-borne anticorrosion coatings have gained popularity in recent years due to their environmentally friendly nature and improved performance. These coatings are formulated using water as the primary solvent instead of organic solvents, significantly reducing the emission of volatile organic compounds (VOCs) and minimizing the impact on air quality and human health.

1. Introduction

1.1 Scope of the Study

1.2 Market Definition, Assumptions and Limitations

1.3 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness Analysis

3. Research Methodology

4. Anti-Corrosion Coating Market Landscape

4.1 Overview

4.2 Porter’s Five Forces Analysis

4.3 Ecosystem Analysis

4.3.1 List of Vendors in the Value Chain

5. Anti-Corrosion Coating Market - Key Market Dynamics

5.1 Key Market Drivers

5.2 Key Market Restraints

5.3 Key Market Opportunities

5.4 Future Trends

5.5 Impact Analysis of Drivers and Restraints

6. Anti-Corrosion Coating Market - Global Market Analysis

6.1 Anti-Corrosion Coating - Global Market Overview

6.2 Anti-Corrosion Coating - Global Market and Forecast to 2030

7. Anti-Corrosion Coating Market – Volume (Tons), Revenue Analysis (USD Million) – By Resin Type, 2020-2030

7.1 Overview

7.2 Epoxy

7.3 Polyurethane

7.4 Acrylic

7.5 Alkyd

7.6 Vinyl Ester

7.7 Others

8. Anti-Corrosion Coating Market – Revenue Analysis (USD Million) – By Technology, 2020-2030

8.1 Overview

8.2 Solventborne

8.3 Waterborne

8.4 Others

9. Anti-Corrosion Coating Market – Revenue Analysis (USD Million) – By End-Use, 2020-2030

9.1 Overview

9.2 Marine

9.3 Oil and Gas

9.4 Power

9.5 Automotive

9.6 Building and Construction

9.7 Aerospace and Defense

9.8 Others

10. Anti-Corrosion Coating Market - Volume (Tons), Revenue Analysis (USD Million), 2020-2030 – Geographical Analysis

10.1 North America

10.1.1 North America Anti-Corrosion Coating Market Overview

10.1.2 North America Anti-Corrosion Coating Market Revenue and Forecasts to 2030

10.1.3 North America Anti-Corrosion Coating Market Volume, Revenue and Forecasts and Analysis - By Resin Type

10.1.4 North America Anti-Corrosion Coating Market Revenue and Forecasts and Analysis - By Technology

10.1.5 North America Anti-Corrosion Coating Market Revenue and Forecasts and Analysis - By End-Use

10.1.6 North America Anti-Corrosion Coating Market Revenue and Forecasts and Analysis - By Countries

10.1.6.1 United States Anti-Corrosion Coating Market

10.1.6.1.1 United States Anti-Corrosion Coating Market, by Resin Type

10.1.6.1.2 United States Anti-Corrosion Coating Market, by Technology

10.1.6.1.3 United States Anti-Corrosion Coating Market, by End-Use

10.1.6.2 Canada Anti-Corrosion Coating Market

10.1.6.2.1 Canada Anti-Corrosion Coating Market, by Resin Type

10.1.6.2.2 Canada Anti-Corrosion Coating Market, by Technology

10.1.6.2.3 Canada Anti-Corrosion Coating Market, by End-Use

10.1.6.3 Mexico Anti-Corrosion Coating Market

10.1.6.3.1 Mexico Anti-Corrosion Coating Market, by Resin Type

10.1.6.3.2 Mexico Anti-Corrosion Coating Market, by Technology

10.1.6.3.3 Mexico Anti-Corrosion Coating Market, by End-Use

Note - Similar analysis would be provided for below mentioned regions/countries

10.2 Europe

10.2.1 Germany

10.2.2 France

10.2.3 Italy

10.2.4 United Kingdom

10.2.5 Russia

10.2.6 Rest of Europe

10.3 Asia-Pacific

10.3.1 Australia

10.3.2 China

10.3.3 India

10.3.4 Japan

10.3.5 South Korea

10.3.6 Rest of Asia-Pacific

10.4 Middle East and Africa

10.4.1 South Africa

10.4.2 Saudi Arabia

10.4.3 U.A.E

10.4.4 Rest of Middle East and Africa

10.5 South and Central America

10.5.1 Brazil

10.5.2 Argentina

10.5.3 Rest of South and Central America

11. Industry Landscape

11.1 Mergers and Acquisitions

11.2 Agreements, Collaborations, Joint Ventures

11.3 New Product Launches

11.4 Expansions and Other Strategic Developments

12. Competitive Landscape

12.1 Heat Map Analysis by Key Players

12.2 Company Positioning and Concentration

13. Anti-Corrosion Coating Market - Key Company Profiles

13.1 RPM International Inc.

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

Note - Similar information would be provided for below list of companies

13.2 The Sherwin-Williams Company

13.3 PPG Industries, Inc.

13.4 AkzoNobel N.V.

13.5 Nippon Paint Holdings Co., Ltd.

13.6 BASF SE

13.7 H.B. Fuller Company

13.8 Jotun

13.9 Eastman Chemical Company

13.10 Oasis Coils and Coatings L.L.C.

14. Appendix

14.1 Glossary

14.2 About The Insight Partners

14.3 Market Intelligence Cloud

The List of Companies - Anticorrosion Coatings Market

- RPM International Inc

- The Sherwin-Williams Co

- Akzo Nobel NV

- Jotun AS

- PPG Industries Inc

- 3M Co

- The Progressive Center Co for Construction Chemicals Ltd

- Nippon Paint Holdings Co Ltd

- BASF SE

- HB Fuller Co

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For