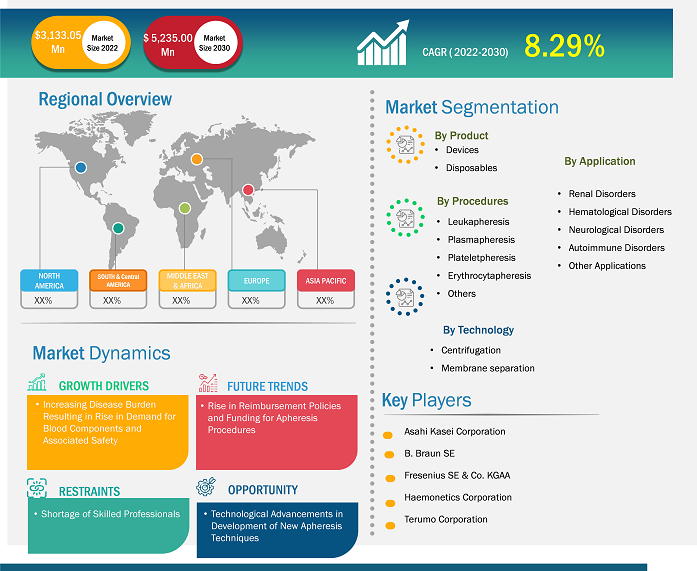

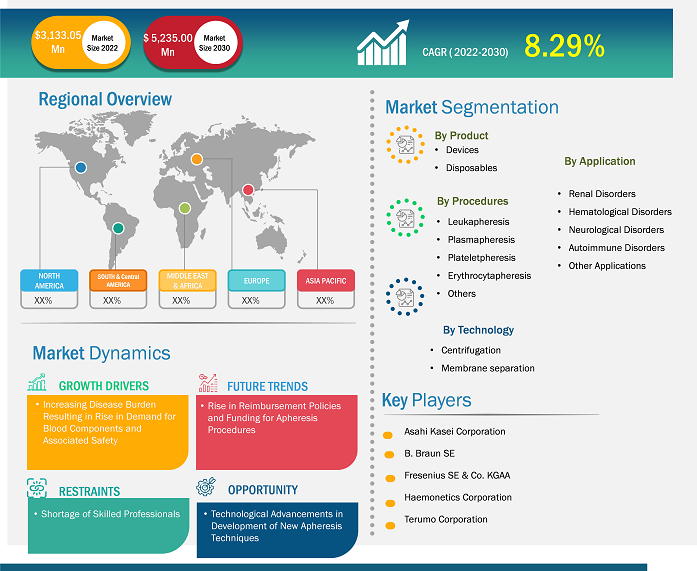

[Research Report] The global apheresis market was valued at US$ 3,133.05 million in 2022, and the apheresis market size is projected to reach US$ 5,235.00 million by 2031. It is expected to register a CAGR of 8.29% in the forecast period.

Market Insights and Analyst View:

Apheresis, or pheresis, is a medical procedure that involves separating and extracting specific blood components from a donor or patient. This therapeutic intervention utilizes a specialized machine called an apheresis machine, which can selectively collect particular blood components while returning the remainder of the blood to the individual. Depending on the targeted medical indication, the process typically involves removing, isolating, and returning specific blood constituents, such as plasma, platelets, red blood cells, or white blood cells. Apheresis is critical in treating various medical conditions, including autoimmune disorders, hematological malignancies, and certain neurological diseases. This procedure enables healthcare practitioners to manipulate an individual's blood components therapeutically, addressing certain disease states or harvesting specific blood constituents for therapeutic use in others.

Growth Drivers and Opportunities:

The primary drivers of the apheresis market's growth are the ongoing technological advancements in developing new techniques, which have significantly expanded the scope and sophistication of this therapeutic procedure, offering enhanced precision and therapeutic potential. Modern innovations have led to the evolution of more targeted and efficient apheresis methodologies, facilitating the selective extraction, modulation, and reinfusion of specific blood constituents with heightened accuracy and reduced invasiveness. These advancements have paved the way for the customization of apheresis procedures, enabling tailored treatment regimens for diverse medical indications. Furthermore, technological progress has given rise to integrating automated apheresis systems equipped with advanced software, real-time monitoring capabilities, and improved biocompatibility, enhancing safety, procedural efficiency, and patient comfort. The development of novel apheresis techniques, including selective immune modulation and cellular engineering strategies, exemplifies the transformative impact of technological advancements in expanding the therapeutic repertoire of apheresis, offering promising avenues for personalized medicine and targeted disease intervention. As a result, these technological strides are poised to elevate the clinical utility and impact of apheresis across a broad spectrum of medical specialties, underscoring its pivotal role in addressing complex disease states and advancing the frontiers of therapeutic hemapheresis.

On the other hand, the shortage of skilled professionals presents a significant challenge hindering the growth of the apheresis market. Apheresis procedures require specialized expertise in operating apheresis machines, meticulous patient monitoring, and a comprehensive understanding of each procedure's therapeutic goals. The scarcity of trained professionals adept in performing apheresis techniques can result in limited accessibility to these critical procedures, potentially impeding the timely and optimal delivery of apheresis-based therapies. Addressing this limitation necessitates strategic investments in training programs, educational initiatives, and professional development efforts to cultivate a proficient workforce capable of meeting the escalating demand for apheresis services. By mitigating the shortage of skilled professionals in the apheresis domain, the healthcare industry can effectively bolster the capacity to deliver high-quality, specialized treatments, thereby fostering the sustained advancement and expansion of the apheresis market.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Apheresis Market: Strategic Insights

Market Size Value in US$ 3,133.05 million in 2022 Market Size Value by US$ 5,235.00 million by 2030 Growth rate CAGR of 8.29% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Apheresis Market: Strategic Insights

| Market Size Value in | US$ 3,133.05 million in 2022 |

| Market Size Value by | US$ 5,235.00 million by 2030 |

| Growth rate | CAGR of 8.29% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The “Global apheresis market” is segmented based on the product, apheresis procedure, technology, application, and region. The apheresis market is broadly segmented into devices and disposables. The apheresis market is classified based on procedures, such as leukapheresis, plasmapheresis, plateletpheresis, erythrocytapheresis, and others. The technology segment of the apheresis market is broadly segmented into centrifugation and membrane separation. Based on application, the market is classified into renal disorders, hematological disorders, neurological disorders, autoimmune disorders, and other applications. The apheresis market based on geography is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America)

Segmental Analysis:

Based on the application, the apheresis market is segmented into renal disorders, hematological disorders, neurological disorders, autoimmune disorders, and other applications. In 2022, the apheresis market revenue was mostly attributed to hematological disorders, which had the largest share. Hematologic disorders refer to conditions affecting blood and organs that create blood, such as issues with platelets, white blood cells, red blood cells, bone marrow, lymph nodes, and the spleen. Worldwide, hematological illnesses have a significant impact on people's morbidity and mortality. About 100,000 Americans have sickle cell disease (SCD), according to the CDC's May 2022 update. About one in every 365 Black or African American births experience it. Early detection and therapy are the greatest strategies to preserve a patient's life if they have a blood cell problem. Therefore, the studied segment is anticipated to increase throughout the forecast period due to the rising burden of hematological occurrences and expanding applications of apheresis as a therapy strategy for hematological disorders.

The apheresis market is segmented into disposable apheresis kits and devices based on the product segment. Due to significant advancements in the production of blood bags, disposable kits, and tubing, the disposable apheresis kit category is expected to continue its dominant position in the market, holding a share of about 73% in 2022 and continuing to do so throughout the forecast period. The segment is growing due to rising demand for automated component separation processes, particularly in developed economies.

Based on procedure, the apheresis market is classified into leukapheresis, plasmapheresis, plateletpheresis, erythrocyte apheresis, and other apheresis procedures. Patients with compromised immune systems are given plasma-based drugs to increase their resistance to infection and disease. The market is anticipated to expand with the growth in blood-related illnesses and the increasing need for treatments generated from plasma. White blood cells (WBC) are extracted from the blood drained from the body using plasmapheresis. Treatment for graft-versus-host disease (GvHD) and T-cell lymphoma (CTCL) requires this kind of surgery, which is anticipated to increase demand for plasmapheresis.

Based on the technology segment, the apheresis market is segmented into centrifugation and membrane separation. Centrifugation produces results more quickly, easily, and precisely than membrane filtering; it is used more frequently. The market is also anticipated to increase due to the rising demand for automated apheresis systems. To increase the efficiency of their products, businesses are developing automated and highly modern technical gadgets. The manufacturers are developing an automated interface system, a customized anticoagulant infusion system, and automatic apheresis equipment with continuous flow centrifugation.

Regional Analysis:

Based on geography, the global apheresis market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa.

Due to the rising prevalence of blood-related illnesses like kidney disease, metabolic diseases, cancer, and neurological disorders, as well as the region's well-established healthcare system and high patient awareness, North America is predicted to increase throughout the forecast period. In the United States, a person is diagnosed with blood cancer roughly every three minutes, according to the Leukemia & Lymphoma Society (LLS) 2021. Leukemia, lymphoma, and myeloma cases made up 9.8% of the 1,898,160 new cases of cancer that were diagnosed in the US in 2021. The market under study is expanding due to the rising prevalence of the target disorders.

The demand for apheresis is rising due to the nation's expanding reimbursement regulations for operations and equipment. The UnitedHealthcare Commercial Medica Policy, published in January 2022 by United Healthcare Group, offers a medical policy for apheresis procedures for various indications, except stem cell harvesting or collection for bone marrow/stem cell transplantation. The country's market for apheresis is ultimately driven by the policies now in place for the procedures, which are raising demand for the treatments among the target demographic.

In addition, Apheresis Awareness Day was proclaimed by the American Society for Apheresis (ASFA) on September 21, 2021, and it will subsequently be observed on the third Tuesday in September each year. Using evidence-based practice to advance apheresis medicine and increase awareness was meant to honor the many donors, patients, and apheresis practitioners who have committed their lives to save others. Therefore, during the forecast period, these previously mentioned variables are anticipated to enhance the apheresis market in North America greatly.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global apheresis market are listed below:

- In September 2023, The FDA approved APHEXDA (motixafortide) and filgrastim (G-CSF) by BioLineRx Ltd. to mobilize hematopoietic stem cells in peripheral blood for patients with multiple myeloma. The stem cells will be collected and then autologously transplanted. Subcutaneous usage of APHEXDA is achieved through injectable administration.

- In July 2022, Eliaz Therapeutics and Terumo Blood and Cell Technologies worked together to develop and market a unique therapeutic apheresis treatment for acute kidney damage (AKI).

- In June 2022, Using the company's Spectra Optia Apheresis System, an automated red blood cell exchange (RBCX) procedure was chosen by NHS England to treat sickle cell disease. Terumo Blood and Cell Technologies is a medical technology company specializing in products, software, and services for blood component collection, therapeutic apheresis, and cellular technologies. This decision will lead to a wider implementation of Spectra Optia in hospitals throughout England. Patients with sickle cell illness will now have better access to this game-changing medication.

- In October 2021, The US FDA granted Haemonetics 510(k) certification for their Persona-enabled NexSys PCS system.

Competitive Landscape and Key Companies:

Some of the prominent players operating in the global apheresis market are Asahi Kasei Corporation, B. Braun SE, Fresenius SE & Co. KGAA (Fresenius Kabi AG), Haemonetics Corporation, Terumo Corporation (Terumo BCT Inc.), Kaneka Corporation, Sumitomo Bakelite Company Limited (Kawasumi Laboratories Inc.), Medica SPA, Baxter International, Cerus Corporation, Macopharma SA, Otsuka Holdings Co. Ltd (JIMRO Co. Ltd) and amongst others. These apheresis markets focus on new product launches and geographical expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. They have a widespread global presence, allowing them to serve many customers and subsequently increase their market share. The report offers apheresis market trends analysis emphasizing various parameters such as technological advancements, market dynamics, and competitive landscape analysis of leading global market players.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Apheresis Procedure, Technology, Application, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

TABLE OF CONTENTS

1. INTRODUCTION

1.1. SCOPE OF THE STUDY

1.2. THE INSIGHT PARTNERS RESEARCH REPORT GUIDANCE

1.3. MARKET SEGMENTATION

1.3.1 Apheresis Market - By Product

1.3.2 Apheresis Market - By Procedure

1.3.3 Apheresis Market - By Technology

1.3.4 Apheresis Market - By Application

1.3.5 Apheresis Market - By End Use

1.3.6 Apheresis Market - By Region

1.3.6.1 By Country

2. KEY TAKEAWAYS

3. RESEARCH METHODOLOGY

4. APHERESIS MARKET LANDSCAPE

4.1. OVERVIEW

4.2. PEST ANALYSIS

4.2.1 North America - Pest Analysis

4.2.2 Europe - Pest Analysis

4.2.3 Asia-Pacific - Pest Analysis

4.2.4 Middle East and Africa - Pest Analysis

4.2.5 South and Central America - Pest Analysis

4.3. EXPERT OPINIONS

5. APHERESIS MARKET - KEY MARKET DYNAMICS

5.1. KEY MARKET DRIVERS

5.2. KEY MARKET RESTRAINTS

5.3. KEY MARKET OPPORTUNITIES

5.4. FUTURE TRENDS

5.5. IMPACT ANALYSIS OF DRIVERS AND RESTRAINTS

6. APHERESIS MARKET - GLOBAL MARKET ANALYSIS

6.1. APHERESIS - GLOBAL MARKET OVERVIEW

6.2. APHERESIS - GLOBAL MARKET AND FORECAST TO 2028

6.3. MARKET POSITIONING

7. APHERESIS MARKET - REVENUE AND FORECASTS TO 2028 - PRODUCT

7.1. OVERVIEW

7.2. PRODUCT MARKET FORECASTS AND ANALYSIS

7.3. APHERESIS DISPOSABLES

7.3.1. Overview

7.3.2. Apheresis Disposables Market Forecast and Analysis

7.4. APHERESIS DEVICES

7.4.1. Overview

7.4.2. Apheresis Devices Market Forecast and Analysis

7.5. APHERESIS SOFTWARE

7.5.1. Overview

7.5.2. Apheresis Software Market Forecast and Analysis

8. APHERESIS MARKET - REVENUE AND FORECASTS TO 2028 - PROCEDURE

8.1. OVERVIEW

8.2. PROCEDURE MARKET FORECASTS AND ANALYSIS

8.3. AUTOMATED APHERESIS

8.3.1. Overview

8.3.2. Automated Apheresis Market Forecast and Analysis

8.4. THERAPEUTIC APHERESIS

8.4.1. Overview

8.4.2. Therapeutic Apheresis Market Forecast and Analysis

9. APHERESIS MARKET - REVENUE AND FORECASTS TO 2028 - TECHNOLOGY

9.1. OVERVIEW

9.2. TECHNOLOGY MARKET FORECASTS AND ANALYSIS

9.3. CENTRIFUGATION

9.3.1. Overview

9.3.2. Centrifugation Market Forecast and Analysis

9.3.3. Continuous-flow Centrifugation Market

9.3.3.1. Overview

9.3.3.2. Continuous-flow Centrifugation Market Forecast and Analysis

9.3.4. Intermittent-flow Centrifugation Market

9.3.4.1. Overview

9.3.4.2. Intermittent-flow Centrifugation Market Forecast and Analysis

9.4. MEMBRANE SEPARATION

9.4.1. Overview

9.4.2. Membrane Separation Market Forecast and Analysis

10. APHERESIS MARKET - REVENUE AND FORECASTS TO 2028 - APPLICATION

10.1. OVERVIEW

10.2. APPLICATION MARKET FORECASTS AND ANALYSIS

10.3. PLASMAPHERESIS

10.3.1. Overview

10.3.2. Plasmapheresis Market Forecast and Analysis

10.4. PLATELETPHERESIS

10.4.1. Overview

10.4.2. Plateletpheresis Market Forecast and Analysis

10.5. ERYTHROCYTAPHERESIS

10.5.1. Overview

10.5.2. Erythrocytapheresis Market Forecast and Analysis

10.6. LEUKAPHERESIS

10.6.1. Overview

10.6.2. Leukapheresis Market Forecast and Analysis

10.7. PHOTOPHERESIS

10.7.1. Overview

10.7.2. Photopheresis Market Forecast and Analysis

10.8. OTHER APPLICATIONS

10.8.1. Overview

10.8.2. Other Applications Market Forecast and Analysis

11. APHERESIS MARKET - REVENUE AND FORECASTS TO 2028 - END USE

11.1. OVERVIEW

11.2. END USE MARKET FORECASTS AND ANALYSIS

11.3. BLOOD CENTERS

11.3.1. Overview

11.3.2. Blood Centers Market Forecast and Analysis

11.4. HOSPITALS

11.4.1. Overview

11.4.2. Hospitals Market Forecast and Analysis

11.5. OTHERS

11.5.1. Overview

11.5.2. Others Market Forecast and Analysis

12. APHERESIS MARKET REVENUE AND FORECASTS TO 2028 - GEOGRAPHICAL ANALYSIS

12.1. NORTH AMERICA

12.1.1 North America Apheresis Market Overview

12.1.2 North America Apheresis Market Forecasts and Analysis

12.1.3 North America Apheresis Market Forecasts and Analysis - By Product

12.1.4 North America Apheresis Market Forecasts and Analysis - By Procedure

12.1.5 North America Apheresis Market Forecasts and Analysis - By Technology

12.1.6 North America Apheresis Market Forecasts and Analysis - By Application

12.1.7 North America Apheresis Market Forecasts and Analysis - By End Use

12.1.8 North America Apheresis Market Forecasts and Analysis - By Countries

12.1.8.1 United States Apheresis Market

12.1.8.1.1 United States Apheresis Market by Product

12.1.8.1.2 United States Apheresis Market by Procedure

12.1.8.1.3 United States Apheresis Market by Technology

12.1.8.1.4 United States Apheresis Market by Application

12.1.8.1.5 United States Apheresis Market by End Use

12.1.8.2 Canada Apheresis Market

12.1.8.2.1 Canada Apheresis Market by Product

12.1.8.2.2 Canada Apheresis Market by Procedure

12.1.8.2.3 Canada Apheresis Market by Technology

12.1.8.2.4 Canada Apheresis Market by Application

12.1.8.2.5 Canada Apheresis Market by End Use

12.1.8.3 Mexico Apheresis Market

12.1.8.3.1 Mexico Apheresis Market by Product

12.1.8.3.2 Mexico Apheresis Market by Procedure

12.1.8.3.3 Mexico Apheresis Market by Technology

12.1.8.3.4 Mexico Apheresis Market by Application

12.1.8.3.5 Mexico Apheresis Market by End Use

12.2. EUROPE

12.2.1 Europe Apheresis Market Overview

12.2.2 Europe Apheresis Market Forecasts and Analysis

12.2.3 Europe Apheresis Market Forecasts and Analysis - By Product

12.2.4 Europe Apheresis Market Forecasts and Analysis - By Procedure

12.2.5 Europe Apheresis Market Forecasts and Analysis - By Technology

12.2.6 Europe Apheresis Market Forecasts and Analysis - By Application

12.2.7 Europe Apheresis Market Forecasts and Analysis - By End Use

12.2.8 Europe Apheresis Market Forecasts and Analysis - By Countries

12.2.8.1 Germany Apheresis Market

12.2.8.1.1 Germany Apheresis Market by Product

12.2.8.1.2 Germany Apheresis Market by Procedure

12.2.8.1.3 Germany Apheresis Market by Technology

12.2.8.1.4 Germany Apheresis Market by Application

12.2.8.1.5 Germany Apheresis Market by End Use

12.2.8.2 France Apheresis Market

12.2.8.2.1 France Apheresis Market by Product

12.2.8.2.2 France Apheresis Market by Procedure

12.2.8.2.3 France Apheresis Market by Technology

12.2.8.2.4 France Apheresis Market by Application

12.2.8.2.5 France Apheresis Market by End Use

12.2.8.3 Italy Apheresis Market

12.2.8.3.1 Italy Apheresis Market by Product

12.2.8.3.2 Italy Apheresis Market by Procedure

12.2.8.3.3 Italy Apheresis Market by Technology

12.2.8.3.4 Italy Apheresis Market by Application

12.2.8.3.5 Italy Apheresis Market by End Use

12.2.8.4 Spain Apheresis Market

12.2.8.4.1 Spain Apheresis Market by Product

12.2.8.4.2 Spain Apheresis Market by Procedure

12.2.8.4.3 Spain Apheresis Market by Technology

12.2.8.4.4 Spain Apheresis Market by Application

12.2.8.4.5 Spain Apheresis Market by End Use

12.2.8.5 United Kingdom Apheresis Market

12.2.8.5.1 United Kingdom Apheresis Market by Product

12.2.8.5.2 United Kingdom Apheresis Market by Procedure

12.2.8.5.3 United Kingdom Apheresis Market by Technology

12.2.8.5.4 United Kingdom Apheresis Market by Application

12.2.8.5.5 United Kingdom Apheresis Market by End Use

12.2.8.6 Rest of Europe Apheresis Market

12.2.8.6.1 Rest of Europe Apheresis Market by Product

12.2.8.6.2 Rest of Europe Apheresis Market by Procedure

12.2.8.6.3 Rest of Europe Apheresis Market by Technology

12.2.8.6.4 Rest of Europe Apheresis Market by Application

12.2.8.6.5 Rest of Europe Apheresis Market by End Use

12.3. ASIA-PACIFIC

12.3.1 Asia-Pacific Apheresis Market Overview

12.3.2 Asia-Pacific Apheresis Market Forecasts and Analysis

12.3.3 Asia-Pacific Apheresis Market Forecasts and Analysis - By Product

12.3.4 Asia-Pacific Apheresis Market Forecasts and Analysis - By Procedure

12.3.5 Asia-Pacific Apheresis Market Forecasts and Analysis - By Technology

12.3.6 Asia-Pacific Apheresis Market Forecasts and Analysis - By Application

12.3.7 Asia-Pacific Apheresis Market Forecasts and Analysis - By End Use

12.3.8 Asia-Pacific Apheresis Market Forecasts and Analysis - By Countries

12.3.8.1 Australia Apheresis Market

12.3.8.1.1 Australia Apheresis Market by Product

12.3.8.1.2 Australia Apheresis Market by Procedure

12.3.8.1.3 Australia Apheresis Market by Technology

12.3.8.1.4 Australia Apheresis Market by Application

12.3.8.1.5 Australia Apheresis Market by End Use

12.3.8.2 China Apheresis Market

12.3.8.2.1 China Apheresis Market by Product

12.3.8.2.2 China Apheresis Market by Procedure

12.3.8.2.3 China Apheresis Market by Technology

12.3.8.2.4 China Apheresis Market by Application

12.3.8.2.5 China Apheresis Market by End Use

12.3.8.3 India Apheresis Market

12.3.8.3.1 India Apheresis Market by Product

12.3.8.3.2 India Apheresis Market by Procedure

12.3.8.3.3 India Apheresis Market by Technology

12.3.8.3.4 India Apheresis Market by Application

12.3.8.3.5 India Apheresis Market by End Use

12.3.8.4 Japan Apheresis Market

12.3.8.4.1 Japan Apheresis Market by Product

12.3.8.4.2 Japan Apheresis Market by Procedure

12.3.8.4.3 Japan Apheresis Market by Technology

12.3.8.4.4 Japan Apheresis Market by Application

12.3.8.4.5 Japan Apheresis Market by End Use

12.3.8.5 South Korea Apheresis Market

12.3.8.5.1 South Korea Apheresis Market by Product

12.3.8.5.2 South Korea Apheresis Market by Procedure

12.3.8.5.3 South Korea Apheresis Market by Technology

12.3.8.5.4 South Korea Apheresis Market by Application

12.3.8.5.5 South Korea Apheresis Market by End Use

12.3.8.6 Rest of Asia-Pacific Apheresis Market

12.3.8.6.1 Rest of Asia-Pacific Apheresis Market by Product

12.3.8.6.2 Rest of Asia-Pacific Apheresis Market by Procedure

12.3.8.6.3 Rest of Asia-Pacific Apheresis Market by Technology

12.3.8.6.4 Rest of Asia-Pacific Apheresis Market by Application

12.3.8.6.5 Rest of Asia-Pacific Apheresis Market by End Use

12.4. MIDDLE EAST AND AFRICA

12.4.1 Middle East and Africa Apheresis Market Overview

12.4.2 Middle East and Africa Apheresis Market Forecasts and Analysis

12.4.3 Middle East and Africa Apheresis Market Forecasts and Analysis - By Product

12.4.4 Middle East and Africa Apheresis Market Forecasts and Analysis - By Procedure

12.4.5 Middle East and Africa Apheresis Market Forecasts and Analysis - By Technology

12.4.6 Middle East and Africa Apheresis Market Forecasts and Analysis - By Application

12.4.7 Middle East and Africa Apheresis Market Forecasts and Analysis - By End Use

12.4.8 Middle East and Africa Apheresis Market Forecasts and Analysis - By Countries

12.4.8.1 South Africa Apheresis Market

12.4.8.1.1 South Africa Apheresis Market by Product

12.4.8.1.2 South Africa Apheresis Market by Procedure

12.4.8.1.3 South Africa Apheresis Market by Technology

12.4.8.1.4 South Africa Apheresis Market by Application

12.4.8.1.5 South Africa Apheresis Market by End Use

12.4.8.2 Saudi Arabia Apheresis Market

12.4.8.2.1 Saudi Arabia Apheresis Market by Product

12.4.8.2.2 Saudi Arabia Apheresis Market by Procedure

12.4.8.2.3 Saudi Arabia Apheresis Market by Technology

12.4.8.2.4 Saudi Arabia Apheresis Market by Application

12.4.8.2.5 Saudi Arabia Apheresis Market by End Use

12.4.8.3 U.A.E Apheresis Market

12.4.8.3.1 U.A.E Apheresis Market by Product

12.4.8.3.2 U.A.E Apheresis Market by Procedure

12.4.8.3.3 U.A.E Apheresis Market by Technology

12.4.8.3.4 U.A.E Apheresis Market by Application

12.4.8.3.5 U.A.E Apheresis Market by End Use

12.4.8.4 Rest of Middle East and Africa Apheresis Market

12.4.8.4.1 Rest of Middle East and Africa Apheresis Market by Product

12.4.8.4.2 Rest of Middle East and Africa Apheresis Market by Procedure

12.4.8.4.3 Rest of Middle East and Africa Apheresis Market by Technology

12.4.8.4.4 Rest of Middle East and Africa Apheresis Market by Application

12.4.8.4.5 Rest of Middle East and Africa Apheresis Market by End Use

12.5. SOUTH AND CENTRAL AMERICA

12.5.1 South and Central America Apheresis Market Overview

12.5.2 South and Central America Apheresis Market Forecasts and Analysis

12.5.3 South and Central America Apheresis Market Forecasts and Analysis - By Product

12.5.4 South and Central America Apheresis Market Forecasts and Analysis - By Procedure

12.5.5 South and Central America Apheresis Market Forecasts and Analysis - By Technology

12.5.6 South and Central America Apheresis Market Forecasts and Analysis - By Application

12.5.7 South and Central America Apheresis Market Forecasts and Analysis - By End Use

12.5.8 South and Central America Apheresis Market Forecasts and Analysis - By Countries

12.5.8.1 Brazil Apheresis Market

12.5.8.1.1 Brazil Apheresis Market by Product

12.5.8.1.2 Brazil Apheresis Market by Procedure

12.5.8.1.3 Brazil Apheresis Market by Technology

12.5.8.1.4 Brazil Apheresis Market by Application

12.5.8.1.5 Brazil Apheresis Market by End Use

12.5.8.2 Argentina Apheresis Market

12.5.8.2.1 Argentina Apheresis Market by Product

12.5.8.2.2 Argentina Apheresis Market by Procedure

12.5.8.2.3 Argentina Apheresis Market by Technology

12.5.8.2.4 Argentina Apheresis Market by Application

12.5.8.2.5 Argentina Apheresis Market by End Use

12.5.8.3 Rest of South and Central America Apheresis Market

12.5.8.3.1 Rest of South and Central America Apheresis Market by Product

12.5.8.3.2 Rest of South and Central America Apheresis Market by Procedure

12.5.8.3.3 Rest of South and Central America Apheresis Market by Technology

12.5.8.3.4 Rest of South and Central America Apheresis Market by Application

12.5.8.3.5 Rest of South and Central America Apheresis Market by End Use

13. IMPACT OF COVID-19 PANDEMIC ON GLOBAL APHERESIS MARKET

13.1 North America

13.2 Europe

13.3 Asia-Pacific

13.4 Middle East and Africa

13.5 South and Central America

14. INDUSTRY LANDSCAPE

14.1. MERGERS AND ACQUISITIONS

14.2. AGREEMENTS, COLLABORATIONS AND JOIN VENTURES

14.3. NEW PRODUCT LAUNCHES

14.4. EXPANSIONS AND OTHER STRATEGIC DEVELOPMENTS

15. APHERESIS MARKET, KEY COMPANY PROFILES

15.1. TERUMO BCT, INC.

15.1.1. Key Facts

15.1.2. Business Description

15.1.3. Products and Services

15.1.4. Financial Overview

15.1.5. SWOT Analysis

15.1.6. Key Developments

15.2. FRESENIUS SE AND CO. KGAA

15.2.1. Key Facts

15.2.2. Business Description

15.2.3. Products and Services

15.2.4. Financial Overview

15.2.5. SWOT Analysis

15.2.6. Key Developments

15.3. HAEMONETICS CORPORATION

15.3.1. Key Facts

15.3.2. Business Description

15.3.3. Products and Services

15.3.4. Financial Overview

15.3.5. SWOT Analysis

15.3.6. Key Developments

15.4. ASAHI KASEI MEDICAL CO. LTD.

15.4.1. Key Facts

15.4.2. Business Description

15.4.3. Products and Services

15.4.4. Financial Overview

15.4.5. SWOT Analysis

15.4.6. Key Developments

15.5. B. BRAUN MELSUNGEN AG

15.5.1. Key Facts

15.5.2. Business Description

15.5.3. Products and Services

15.5.4. Financial Overview

15.5.5. SWOT Analysis

15.5.6. Key Developments

15.6. BAXTER INTERNATIONAL INC.

15.6.1. Key Facts

15.6.2. Business Description

15.6.3. Products and Services

15.6.4. Financial Overview

15.6.5. SWOT Analysis

15.6.6. Key Developments

15.7. CERUS CORPORATION

15.7.1. Key Facts

15.7.2. Business Description

15.7.3. Products and Services

15.7.4. Financial Overview

15.7.5. SWOT Analysis

15.7.6. Key Developments

15.8. KANEKA CORPORATION

15.8.1. Key Facts

15.8.2. Business Description

15.8.3. Products and Services

15.8.4. Financial Overview

15.8.5. SWOT Analysis

15.8.6. Key Developments

15.9. KAWASUMI LABORATORIES, INC.

15.9.1. Key Facts

15.9.2. Business Description

15.9.3. Products and Services

15.9.4. Financial Overview

15.9.5. SWOT Analysis

15.9.6. Key Developments

15.10. NIKKISO CO., LTD

15.10.1. Key Facts

15.10.2. Business Description

15.10.3. Products and Services

15.10.4. Financial Overview

15.10.5. SWOT Analysis

15.10.6. Key Developments

16. APPENDIX

16.1. ABOUT THE INSIGHT PARTNERS

16.2. GLOSSARY OF TERMS

The List of Companies

1. Terumo BCT, Inc.

2. Fresenius SE & Co. KGaA

3. Haemonetics Corporation

4. Asahi Kasei Medical Co. Ltd.

5. B. Braun Melsungen AG

6. Baxter International Inc.

7. Cerus Corporation

8. Kaneka Corporation

9. Kawasumi Laboratories, Inc.

10. Nikkiso Co., Ltd.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For