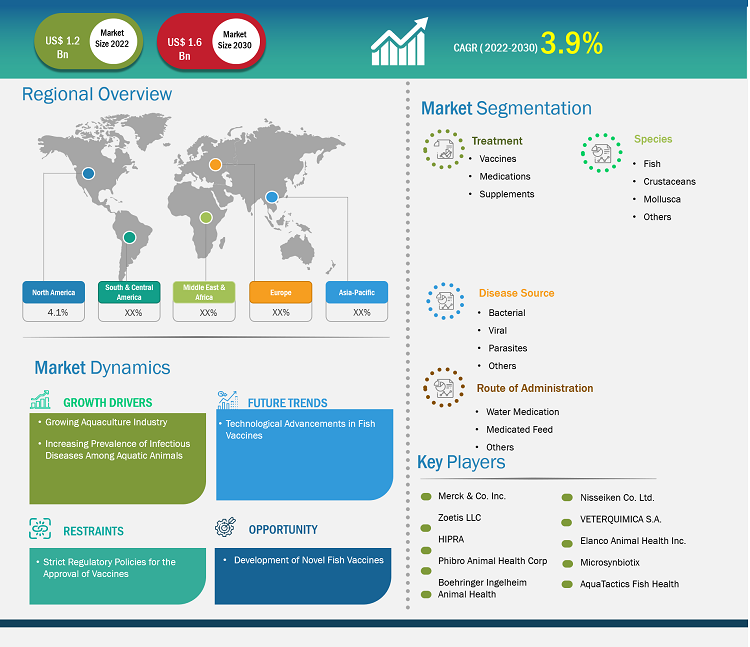

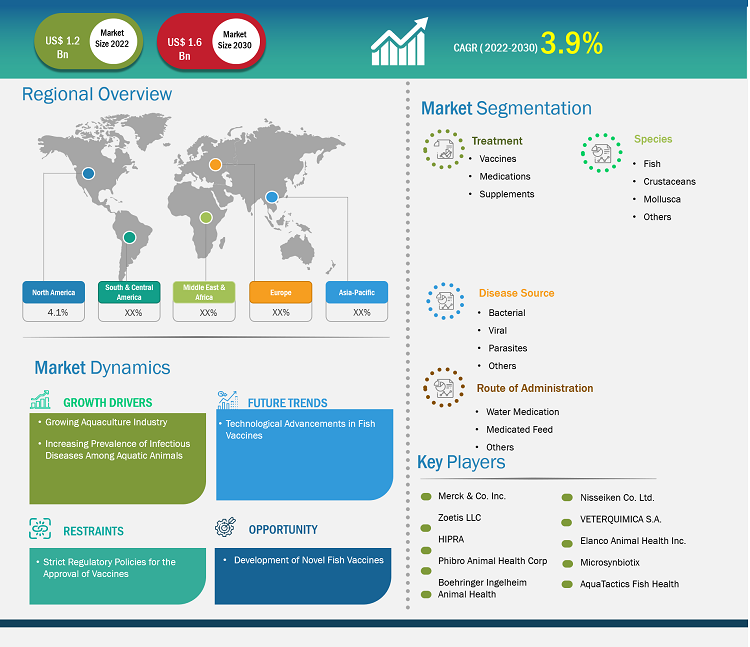

[Research Report] The aquatic veterinary treatment market size is projected to grow from US$ 1.2 billion in 2022 to US$ 1.6 billion by 2030; it is estimated to record a CAGR of 3.9% during 2022–2030.

Market Insights and Analyst View:

The aquatic veterinary treatment discipline involves complete healthcare for aquatic animals, including fish, mollusks, and other aquatic animals. The aquatic veterinary treatment market is growing due to the development of aquaculture industries worldwide, growing infectious diseases among aquatic animals, and the surging demand for food products derived from them. Additionally, ongoing efforts for the development of novel fish vaccines are projected to create ample opportunities for the growth of the market.

Growth Drivers:

The aquatic veterinary treatment market trends include technological innovations in fish and aquatic animal vaccines.

As per the National Oceanic and Atmospheric Administration, and National Ocean Service, aquaculture is used to generate food, rehabilitate habitats, replenish wild stocks, and rebuild endangered species populations in both fresh and salt water. The main aquaculture regions are Asia Pacific, Europe, and South Asia, which account for more than 70% of global aquaculture production. Fish dominate aquaculture, accounting for 66% of the market, followed by crustaceans and mollusca. According to the data from a report titled "The State of World Fisheries and Aquaculture,” published by the Food and Agriculture Organization of the United Nations in 2022, worldwide consumption of aquatic foods, excluding algae, has increased by over five times the quantity consumed almost 60 years ago.

Global aquatic food consumption increased from 28 million metric tons in 1961 to 158 million metric tons in 2019. The consumption increased at an average annual rate of 3.0% from 1961, compared with a population growth rate of 1.6%. A dramatic increase in the demand for live aquatic animal trade, unpredictable expansion in aquaculture and ornamental fish trade, and increased urbanization and industrialization are factors fueling the growth of the aquaculture industry.

As per the World Bank’s income level classification, the 1990–2020 period witnessed quick development in aquaculture, with 51 of low-middle-income countries and 53 of upper-middle-income countries reporting aquaculture production. In 2020, aquaculture contributed 61.7% to total production in upper-middle-income countries, up from 19.8% in 1990. The share of aquaculture in lower-middle-income countries also increased from 14.7% to 46.2% in the same period. Per capita consumption is expanding due to increasing supplies, changing consumer preferences, and rising income. The rising consumption demand of aquatic animals has fueled the production of these aquatic animals, which, in turn, accelerates the growth of the aquaculture industry. Aquaculture medications such as vaccines and supplements lower the chance of infection in aquatic animals and increase the yield of products. Therefore, the growing aquaculture industry is expected to continue to drive the aquatic veterinary treatment market growth during the forecast period.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Aquatic Veterinary Treatment Market: Strategic Insights

Market Size Value in US$ 1.2 billion in 2022 Market Size Value by US$ 1.6 billion by 2030 Growth rate CAGR of 3.9% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Aquatic Veterinary Treatment Market: Strategic Insights

| Market Size Value in | US$ 1.2 billion in 2022 |

| Market Size Value by | US$ 1.6 billion by 2030 |

| Growth rate | CAGR of 3.9% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The aquatic veterinary treatment market analysis has been carried out by considering the following segments: treatment, species, disease source, route of administration, and geography. Based on treatment, the market is classified into vaccines, medications, and supplements. In terms of species, the market is classified into fish, crustaceans, mollusca, and others. By disease source, the market is segmented into bacterial, viral, parasites, and others. In terms of route of administration, the market is categorized into water medication, medicated feed, and others.

The scope of the aquatic veterinary treatment market report covers North America (the US, Canada, and Mexico), Europe (France, Germany, the UK, Spain, Italy, and the Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), the Middle East & Africa (Saudi Arabia, the UAE, South Africa, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

The aquatic veterinary treatment market, by treatment, is categorized into vaccines, medications, and supplements. The medications segment held a significant market share in 2022. It is anticipated to register the highest CAGR in the market during 2022–2030.

Based on species, the market is segmented into fish, crustaceans, mollusca, and others. In 2022, the fish segment held the largest share of the market and is anticipated to register the fastest CAGR during 2022–2030.

Based on disease source, the market is categorized into bacterial, viral, parasites, and others. The bacterial segment held a significant aquatic veterinary treatment market share in 2022 and is estimated to register the highest CAGR during 2022–2030.

Based on route of administration, the market is segmented into water medication, medicated feed, and others. The water medication segment held a significant aquatic veterinary treatment market share in 2022. It is expected to register the highest CAGR during 2022–2030.

Regional Analysis:

Geographically, the aquatic veterinary treatment market is primarily divided into North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In 2022, North America captured a significant share of the market. In 2022, the US held the largest share of the market in the region. The market growth in North America is attributed to the expanding aquaculture industry, rising demand for aquatic animal-derived food products, increasing prevalence of infectious diseases in the aquaculture sector, and growing development and launch of new aquaculture vaccines. According to the World Bank data, ~5.6 million fish were produced by the North American aquaculture industry in 2021. According to the National Oceanic and Atmospheric Administration, aquaculture generates ~US$ 1.5 billion annually in the US. Thus, the flourishing aquaculture industry fuels the growth of the aquatic veterinary treatment market.

The market players accelerated the production of technologically developed products in the country. For instance, in September 2020, Virbac acquired a range of tilapia vaccines from Ictyogroup, an animal health company specializing in R&D biology. The Virbac Group received rights for the distribution and marketing of registered autogenous vaccines worldwide. In addition, the two companies had partnered for the development of new formulations and new vaccines for the Aqua Virbac division by Ictyogroup. The agreement also allowed the transfer of several employees specialized in technical marketing support and R&D biology from Ictyogroup to Virbac. Thus, the above-mentioned factors propel the aquatic veterinary treatment market growth in the region.

Industry Developments and Future Opportunities:

Apart from emphasizing the factors impacting the market, the aquatic veterinary treatment market report depicts the developments of prominent players. A few initiatives taken by market players operating in the global aquatic veterinary treatment market are listed below:

- In November 2022, Indian Immunologicals Ltd joined hands with the Central Institute of Fisheries Education for the commercial development of India’s first fish vaccine. The vaccine is to be developed to protect freshwater fish against common bacterial diseases.

- In July 2020, Zoetis acquired the Fish Vet Group from Benchmark Holdings as a strategic addition to its Pharmaq business, which advances and commercializes fish vaccines and provides vaccination and diagnostic services for aquaculture. This acquisition improves the geographic reach and enhances the diagnostics expertise and testing services, including environmental testing, that Pharmaq’s reference lab, Pharmaq Analytiq, can offer fish farmers in main aquaculture markets.

Aquatic Veterinary Treatment Market Report Scope

Competitive Landscape and Key Companies:

The aquatic veterinary treatment market forecast can help stakeholders plan their growth strategies. Merck & Co. Inc., Elanco Animal Health Inc., Zoetis LLC, HIPRA, Phibro Animal Health Corp, Boehringer Ingelheim Animal Health, Nisseiken Co. Ltd., VETERQUIMICA S.A., Microsynbiotix, and AquaTactics Fish Health are among the prominent players in the market. The market players focus on introducing new high-tech products, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Treatment, Species, Disease Source, Route of Administration, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The aquatic veterinary medicine discipline involves complete healthcare for aquatic animals, including whales, sharks, alligators, mollusks, and penguins. The aquatic veterinary market size is growing with initiatives taken by various country governments to develop their respective aquaculture industries and the surging demand for food products derived from aquatic animals.

The global aquatic veterinary market majorly consists of the players such as Esox, Zoetis, Elanco Animal Health, Merck KgaA, Virbac Animal Health, Phbro Animal Health Corporation, Aquatic Diagnostics Ltd, Thermo Fisher Scientific, Ceva, and HIPRA

The global aquatic veterinary market, by type, is segmented into diagnostics and treatments. In 2022, the treatment segment accounted for a larger share of the market. The market for this segment is expected to grow at a higher CAGR from 2022 to 2030.

The aquatic veterinary market size is growing with initiatives taken by various country governments to develop their respective aquaculture industries and the surging demand for food products derived from aquatic animals. Further, ongoing efforts for the development of novel fish vaccines are expected to create ample opportunities for the aquatic veterinary market in the coming years.

1. Introduction

1.1 Scope of the Study

1.2 Market Definition, Assumptions and Limitations

1.3 Market Segmentation

2. Executive Summary

2.1 Key Insights

3. Research Methodology

4. Aquatic Veterinary Treatment Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Ecosystem Analysis

4.3.1 List of Vendors in the Value Chain

5. Aquatic Veterinary Treatment Market - Key Market Dynamics

5.1 Key Market Drivers

5.2 Key Market Restraints

5.3 Key Market Opportunities

5.4 Future Trends

5.5 Impact Analysis of Drivers and Restraints

6. Aquatic Veterinary Treatment Market - Global Market Analysis

6.1 Aquatic Veterinary Treatment - Global Market Overview

6.2 Aquatic Veterinary Treatment - Global Market and Forecast to 2030

7. Aquatic Veterinary Treatment Market – Revenue Analysis (USD Million) – By Treatment, 2020-2030

7.1 Overview

7.2 Vaccines

7.3 Medications

7.4 Supplements

8. Aquatic Veterinary Treatment Market – Revenue Analysis (USD Million) – By Species, 2020-2030

8.1 Overview

8.2 Fish

8.3 Crustaceans

8.4 Mollusca

8.5 Others

9. Aquatic Veterinary Treatment Market – Revenue Analysis (USD Million) – By Disease Source, 2020-2030

9.1 Overview

9.2 Bacterial

9.3 Viral

9.4 Parasites

9.5 Others

10. Aquatic Veterinary Treatment Market – Revenue Analysis (USD Million) – By Route of Administration, 2020-2030

10.1 Overview

10.2 Water Medication

10.3 Medicated Feed

10.4 Others

11. Aquatic Veterinary Treatment Market - Revenue Analysis (USD Million), 2020-2030 – Geographical Analysis

11.1 North America

11.1.1 North America Aquatic Veterinary Treatment Market Overview

11.1.2 North America Aquatic Veterinary Treatment Market Revenue and Forecasts to 2030

11.1.3 North America Aquatic Veterinary Treatment Market Revenue and Forecasts and Analysis - By Treatment

11.1.4 North America Aquatic Veterinary Treatment Market Revenue and Forecasts and Analysis - By Species

11.1.5 North America Aquatic Veterinary Treatment Market Revenue and Forecasts and Analysis - By Disease Source

11.1.6 North America Aquatic Veterinary Treatment Market Revenue and Forecasts and Analysis - By Route of Administration

11.1.7 North America Aquatic Veterinary Treatment Market Revenue and Forecasts and Analysis - By Countries

11.1.7.1 United States Aquatic Veterinary Treatment Market

11.1.7.1.1 United States Aquatic Veterinary Treatment Market, by Treatment

11.1.7.1.2 United States Aquatic Veterinary Treatment Market, by Species

11.1.7.1.3 United States Aquatic Veterinary Treatment Market, by Disease Source

11.1.7.1.4 United States Aquatic Veterinary Treatment Market, by Route of Administration

11.1.7.2 Canada Aquatic Veterinary Treatment Market

11.1.7.2.1 Canada Aquatic Veterinary Treatment Market, by Treatment

11.1.7.2.2 Canada Aquatic Veterinary Treatment Market, by Species

11.1.7.2.3 Canada Aquatic Veterinary Treatment Market, by Disease Source

11.1.7.2.4 Canada Aquatic Veterinary Treatment Market, by Route of Administration

11.1.7.3 Mexico Aquatic Veterinary Treatment Market

11.1.7.3.1 Mexico Aquatic Veterinary Treatment Market, by Treatment

11.1.7.3.2 Mexico Aquatic Veterinary Treatment Market, by Species

11.1.7.3.3 Mexico Aquatic Veterinary Treatment Market, by Disease Source

11.1.7.3.4 Mexico Aquatic Veterinary Treatment Market, by Route of Administration

Note - Similar analysis would be provided for below mentioned regions/countries

11.2 Europe

11.2.1 Germany

11.2.2 France

11.2.3 Italy

11.2.4 Spain

11.2.5 United Kingdom

11.2.6 Rest of Europe

11.3 Asia-Pacific

11.3.1 Australia

11.3.2 China

11.3.3 India

11.3.4 Japan

11.3.5 South Korea

11.3.6 Rest of Asia-Pacific

11.4 Middle East and Africa

11.4.1 South Africa

11.4.2 Saudi Arabia

11.4.3 U.A.E

11.4.4 Rest of Middle East and Africa

11.5 South and Central America

11.5.1 Brazil

11.5.2 Argentina

11.5.3 Rest of South and Central America

12. Industry Landscape

12.1 Mergers and Acquisitions

12.2 Agreements, Collaborations, Joint Ventures

12.3 New Product Launches

12.4 Expansions and Other Strategic Developments

13. Competitive Landscape

13.1 Heat Map Analysis by Key Players

13.2 Company Positioning and Concentration

14. Aquatic Veterinary Treatment Market - Key Company Profiles

14.1 Merck

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

Note - Similar information would be provided for below list of companies

14.2 Zoetis

14.3 HIPRA

14.4 Phibro Animal Health

14.5 Boehringer Ingelheim Animal Health

14.6 Nisseiken Co. Ltd.

14.7 VETERQUIMICA SA

14.8 Microsynbiotix

14.9 AquaTactics Fish Health

15. Appendix

15.1 Glossary

15.2 About The Insight Partners

15.3 Market Intelligence Cloud

The List of Companies - Aquatic Veterinary Treatment Market

- Merck & Co. Inc.

- Zoetis LLC

- HIPRA

- Phibro Animal Health Corp

- Boehringer Ingelheim Animal Health

- Nisseiken Co. Ltd.

- VETERQUIMICA S.A.

- Elanco Animal Health Inc.

- Microsynbiotix

- AquaTactics Fish Health

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For