The arterial blood gas kits market size is projected to reach US$ 1,298.03 million by 2031 from US$ 712.46 million in 2023. The market is expected to register a CAGR of 7.8% during 2023–2031. The development of safe and automated kits, and the integration of electronic medical records is likely to remain a key trend in the market.

Arterial Blood Gas Kits Market Analysis

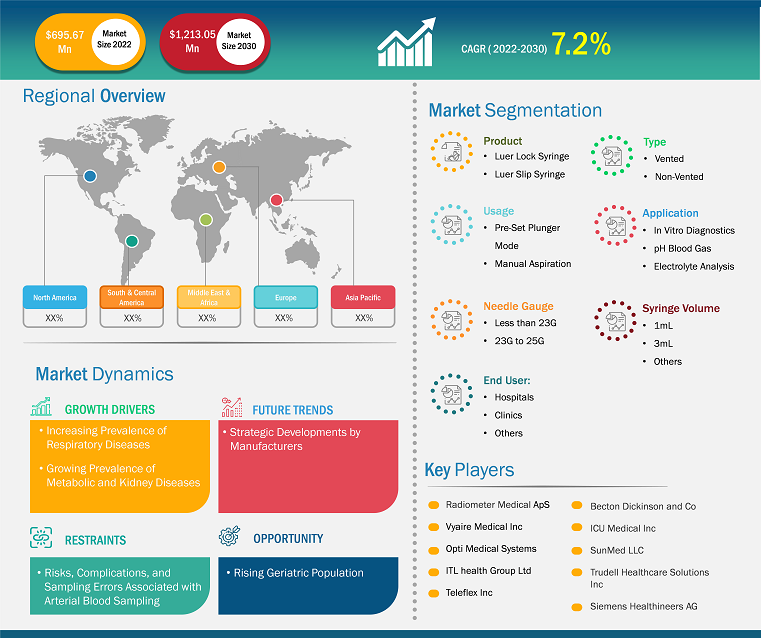

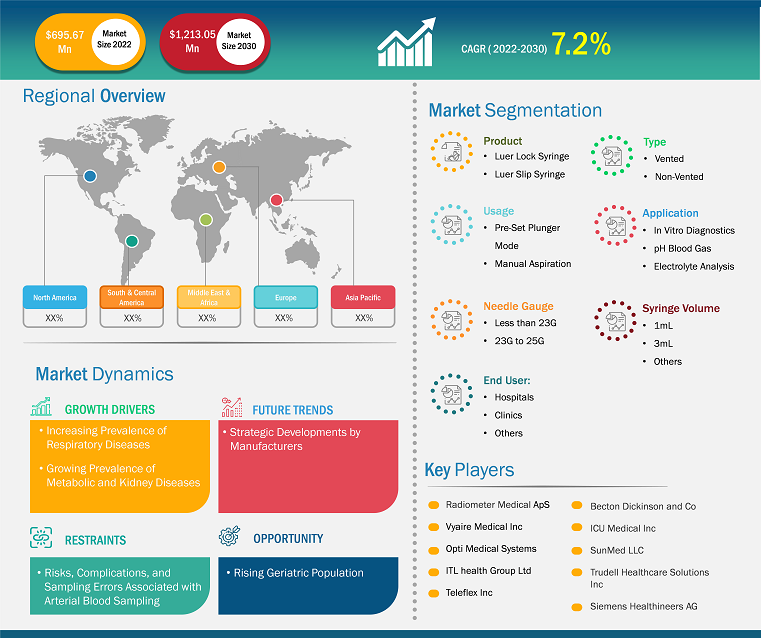

The increasing prevalence of kidney diseases and metabolic diseases, technological advancements in arterial blood gas kits, and growing emphasis on personalized medicines in developed countries are the factors favoring the arterial blood gas kits market progress. The surging adoption of point-of-care diagnostics in emerging countries is also expected to benefit the market in the coming years.

Arterial Blood Gas Kits Market Overview

India is expected to register the highest CAGR in the global arterial blood gas kits market during 2023–2031. In India, respiratory diseases are responsible for the poor quality of life among the people. A surge in the awareness of respiratory diseases such as asthma, COPD, and respiratory syndrome would offer lucrative growth opportunities to the market in the country. Respiratory distress syndrome (RDS) is a common breathing disorder observed in premature babies in India, causing 150,000 deaths annually. According to a report by the Global Burden of Disease (GBD), chronic obstructive pulmonary disease (COPD) is the second leading cause of death and disability-adjusted life years (DALYs) in India. As per the Lancet Global Health data released in April 2020, asthma was a cause of illness in ~300 million people in the world, and 37.9 million of these people were Indians. Statistics by the Government of India indicate that India, the world's second-most populated country, has seen a tremendous demographic shift in the last 50 years, with nearly a tripling of the elderly population over the age of 60. According to a BQ Prime article, ~138 million people in India aged 60 years and above in 2021, and the number is expected to reach 194 million by the end of 2031. The elderly population in India is estimated to surpass the population of children under 14 years by 2050. Aging is an independent predictor of acute respiratory disease, particularly in critically ill older individuals. For instance, Dr. M.G.R. Educational and Research Institute University is conducting a study named the "Analysis of Arterial Blood Gas (ABG) Profile in Patients with Acute Heart Failure in Tertiary Care Centre at ACS Medical College," in which they studied the pattern of arterial blood gas results in heart failure patients that are admitted to tertiary care center. Thus, the arterial blood gas kits market in India is likely to flourish in the coming years due to the growing geriatric population and ongoing research activities in respiratory care.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Arterial Blood Gas Kits Market: Strategic Insights

Market Size Value in US$ 695.67 million in 2022 Market Size Value by US$ 1,213.05 million by 2030 Growth rate CAGR of 7.2% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Arterial Blood Gas Kits Market: Strategic Insights

| Market Size Value in | US$ 695.67 million in 2022 |

| Market Size Value by | US$ 1,213.05 million by 2030 |

| Growth rate | CAGR of 7.2% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Arterial Blood Gas Kits Market Drivers and Opportunities

Increasing Incidence of Respiratory Diseases Favors Market

Respiratory diseases such as asthma, chronic obstructive pulmonary disease (COPD), and pneumonia lead to a huge burden on public healthcare systems in various countries across the world. Infections, smoking, and genetic factors can cause serious respiratory complications. In 2021, the American Lung Association ranked COPD third among the leading causes of death in the US, and over 16.4 million people are diagnosed with the condition that year. The article "Effectiveness of a Home Telemonitoring Program for Patients with Chronic Obstructive Pulmonary Disease in Germany," published by the National Library of Medicine in 2022, estimates that Germany reported ∼6 million COPD cases. The article titled "What Knows a Frail Swiss Population About Chronic Obstructive Pulmonary Disease?", published in 2021, estimated that ~400,000 people were affected by COPD in Switzerland. As per the Asthma and Allergy Foundation of America, ∼26 million people in the US suffered from asthma in 2022. The United Nations International Children's Emergency Fund (UNICEF) stated that nearly 1,400 per 100,000 children, i.e., 1 case per 71 children, are diagnosed with pneumonia every year. Breathing issues and oxygen shortages are common in patients suffering from respiratory disorders. Arterial blood gas (ABG) tests are performed to measure oxygen and carbon dioxide gases dissolved in blood. The test serves as a basis of care delivered to patients suffering from acute and chronic respiratory disease. Thus, the surging incidences of acute and chronic respiratory diseases propel the demand for arterial blood gas test kits.

Surging Adoption of Point-of-Care Diagnostics in Emerging Countries to Create Market Opportunities

The inability to run rapid diagnoses is a significant cause of deaths resulting from various diseases in emerging countries. An effective diagnostic infrastructure requires stable electrical power, sophisticated instruments, expensive reagents, and highly trained professionals; thus, diagnoses in developing countries are often limited by the unavailability of these resources. Moreover, the existing diagnostic capabilities result in long assay times, rendering them unsuitable for settings with limited resource availability. Point-of-care testing offers immediate diagnostic results at or near the patient's location, enabling rapid clinical decision-making, streamlined workflows, and enhanced patient outcomes. The need for timely interventions, efficient diagnostic processes, and personalized healthcare delivery fuels the demand for decentralized testing solutions. Point-of-care arterial blood gas kits allow healthcare providers to perform critical diagnostic tests at the patient's bedside, in emergency departments, or in remote settings, facilitating on-the-spot assessment of blood gas parameters, electrolyte levels, and acid-base status. The accessibility and immediacy of point-of-care analyzers empower clinicians to promptly initiate appropriate treatments, monitor patient responses in real-time, and optimize clinical decision-making in acute care scenarios. The shift toward point-of-care diagnostics also drives technological advancements in arterial blood gas kits as manufacturers focus on developing compact, automated, and easy-to-use devices that deliver accurate and fast results. The seamless integration of point-of-care analyzers into healthcare workflows enhances operational efficiency, reduces turnaround times, and improves overall patient care quality. Thus, as healthcare settings embrace the advantages of point-of-care testing, the demand for portable and user-friendly arterial blood gas kits is rising in developing countries, which is likely to create growth opportunities for the market in the coming years.

Arterial Blood Gas Kits Market Report Segmentation Analysis

Key segments that contributed to the derivation of the arterial blood gas kits market analysis are syringe type, usage, type, needle gauge, syringe volume , application, and end user.

- Based on syringe type, the arterial blood gas kits market is segmented into adult Luer slip syringe and Luer lock syringe. The Luer lock syringe segment held a larger market share in 2023.

- By type, the market is segmented into vented and non-vented. The vented segment held a larger share of the market in 2023.

- Based on usage, the market is segmented into pre-set plunger mode and manual aspiration. The pre-set plunger mode segment held a larger share of the market in 2023.

- By application, the market is segmented into in vitro diagnostics and electrolyte analysis. The vitro diagnostics segment is further segmented into pH blood gas, oxygen content, and others. The in vitro diagnostics segment held a larger share of the market in 2023.

- Based on needle gauge, the arterial blood gas kits market is segmented into 23G, 23G to 25G, and greater than 25G. The 23G to 25G segment held the largest market share in 2023.

- Based on syringe volume, the arterial blood gas kits market is segmented into 1 ml, 3 ml, and others. The 3 ml segment held the largest market share in 2023.

- Based on end user, the market is segmented into hospitals and clinics, diagnostic laboratories, and others. The hospitals and clinics segment dominated the market in 2023.

Arterial Blood Gas Kits Market Share Analysis by Geography

The geographic scope of the arterial blood gas kits market report is mainly divided into five regions: North America, Asia Pacific, Europe, the Middle East & Africa, and South & Central America. North America dominated the market in 2023. The North America arterial blood gas kits market has been analyzed on the basis of the US, Canada, and Mexico. Increasing prevalence and incidence of chronic heart and respiratory diseases result in the increased use of arterial blood gas test kits in North American countries. The US held the largest share of the arterial blood gas kits market in North America in 2023. The growing prevalence of chronic diseases necessitating arterial blood gas analysis, including respiratory failure, acute respiratory distress syndrome (ARDS), asthma, diabetic ketoacidosis, renal tubular acidosis, heart failure (HF), and congenital metabolic diseases, is the major factor contributing to the largest share of the US in the arterial blood gas kits market. Additionally, the rising number of collaboration initiatives by research organizations to explore innovative therapeutic applications are projected to accelerate the demand for arterial blood gas kits. Radiometer, BD, and Siemens Healthineers AG are among the major arterial blood gas kit manufacturers operating across North America.

Arterial Blood Gas Kits Market Report Scope

Arterial Blood Gas Kits Market News and Recent Developments

The arterial blood gas kits market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the arterial blood gas kits market are listed below:

- AirLife (formerly SunMed) announced the opening of its newest distribution center in Glendale, Arizona. This milestone signifies AirLife's dedication to providing exceptional customer service through improved shipping efficiency and order fulfillment. The new distribution center, spanning an area of 326,018 square feet, comprises 2,520 square feet of front office space, 323,498 square feet of air-conditioned operational space, 59 shipping/receiving docks, and 1,065 square feet of cold room storage. The facility's material handling equipment operates using advanced lithium-ion batteries for energy efficiency. [Source: AirLife (SunMed Medical), Company Website, February 2024]

Arterial Blood Gas Kits Market Report Coverage and Deliverables

The "Arterial Blood Gas Kits Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Arterial blood gas kits market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Arterial blood gas kits market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter's Five Forces and SWOT analysis

- Arterial blood gas kits market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the arterial blood gas kits market

- Detailed company profiles

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Type, Usage, Application, Needle Gauge, Syringe Volume, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The arterial blood gas kits market is anticipated to record a CAGR of 7.8% during 2023–2031.

BD, Radiometer Medical ApS, Vyaire Medical Inc, Opti Medical Systems, Siemens Healthineers AG, AdvaCare Pharma USA LLC, Becton Dickinson and Co, ICU Medical Inc, SunMed Group Holdings LLC ( AirLife), Trudell Healthcare Solutions Inc, Siemens Healthineers, SARSTEDT AG & Co KG, Lepu Medical Technology Beijing Co Ltd, and Levram Lifesciences Pvt. Ltd. are among the key players operating in the market.

North America dominated the market in 2023.

The increasing incidence of respiratory diseases and rising number of admissions to emergency units in hospitals are among the most influential factors bolstering the market growth.

The development of safe & automated kits and integration of electronic medical records are likely to remain key trends in the arterial blood gas kits market.

The arterial blood gas kits market value is estimated to reach US$ 1,298.03 million in 2031.

The development of safe & automated kits and integration of electronic medical records are likely to remain key trends in the arterial blood gas kits market.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

3. Research Methodology

3.1 Secondary Research

3.2 Primary Research

3.2.1 Hypothesis formulation:

3.2.2 Macro-economic factor analysis:

3.2.3 Developing base number:

3.2.4 Data Triangulation:

3.2.5 Country level data:

4. Arterial Blood Gas Kits Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Pricing Analysis

4.4 Patient Portfolio

4.5 Pre and Post COVID 19 Market Scenario

4.6 Domestic vs Branded ABG Syringes Manufacturing in Developing Countries

4.7 Venous Gas Analysers vs Arterial Blood Gas Analyzers

4.8 Venous Gas Analysers Trend:

5. Arterial Blood Gas Kits Market – Key Market Dynamics

5.1 Arterial Blood Gas Kits Market – Key Market Dynamics

5.2 Market Drivers

5.2.1 Increasing Incidence of Respiratory Diseases

5.2.2 Rising Number of Admissions to Emergency Units in Hospitals

5.3 Market Restraints

5.3.1 High Cost of Kits and Complications Associated with Arterial Blood Sampling

5.4 Market Opportunities

5.4.1 Surging Adoption of Point-of-Care Diagnostics in Emerging Countries

5.5 Future Trends

5.5.1 Development of Safe & Automated Kits and Integration of Electronic Medical Records

5.6 Impact of Drivers and Restraints:

6. Arterial Blood Gas Kits Market – Global Market Analysis

6.1 Arterial Blood Gas Kits Market Revenue (US$ Thousand), 2021–2031

6.2 Arterial Blood Gas Kits Market Forecast Analysis

7. Arterial Blood Gas Kits Market Analysis – by Syringe Type

7.1 Luer Slip Syringe

7.1.1 Overview

7.1.2 Luer Slip Syringe: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

7.2 Luer Lock Syringe

7.2.1 Overview

7.2.2 Luer Lock Syringe: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

8. Arterial Blood Gas Kits Market Analysis – by Type

8.1 Vented

8.1.1 Overview

8.1.2 Vented: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

8.2 Non-vented

8.2.1 Overview

8.2.2 Non-vented: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

9. Arterial Blood Gas Kits Market Analysis – by Usage

9.1 Pre-set Plunger Mode

9.1.1 Overview

9.1.2 Pre-set Plunger Mode: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

9.2 Manual Aspiration

9.2.1 Overview

9.2.2 Manual Aspiration: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

10. Arterial Blood Gas Kits Market Analysis – by Application

10.1 In Vitro Diagnostics

10.1.1 Overview

10.1.2 In Vitro Diagnostics: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

10.2 Electrolyte Analysis

10.2.1 Overview

10.2.2 Electrolyte Analysis: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

11. Arterial Blood Gas Kits Market Analysis – by Needle Gauge

11.1 Less Than 23G

11.1.1 Overview

11.1.2 Less Than 23G: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

11.2G to 25G

11.2.1 Overview

11.2.2G to 25G: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

11.3 Greater Than 25G

11.3.1 Overview

11.3.2 Greater Than 25G: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

12. Arterial Blood Gas Kits Market Analysis – by Syringe Volume

12.1 1 ml

12.1.1 Overview

12.1.2 1 ml: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

12.2 3 ml

12.2.1 Overview

12.2.2 3 ml: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

12.3 Others

12.3.1 Overview

12.3.2 Others: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

13. Arterial Blood Gas Kits Market Analysis – by End User

13.1 Hospitals and Clinics

13.1.1 Overview

13.1.2 Hospitals and Clinics: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

13.2 Diagnostic Laboratories

13.2.1 Overview

13.2.2 Diagnostic Laboratories: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

13.3 Others

13.3.1 Overview

13.3.2 Others: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14. Arterial Blood Gas Kits Market – Geographical Analysis

14.1 Overview

14.2 North America

14.2.1 North America Arterial Blood Gas Kits Market Overview

14.2.2 North America: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.2.3 North America: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.2.3.1 North America: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Syringe Type

14.2.4 North America: Arterial Blood Gas Kits Market Breakdown, by Type

14.2.4.1 North America: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Type

14.2.5 North America: Arterial Blood Gas Kits Market Breakdown, by Usage

14.2.5.1 North America: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Usage

14.2.6 North America: Arterial Blood Gas Kits Market Breakdown, by Application

14.2.6.1 North America: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Application

14.2.6.2 North America: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.2.6.3 North America: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by In Vitro Diagnostics

14.2.7 North America: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.2.7.1 North America: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Needle Gauge

14.2.8 North America: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.2.8.1 North America: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Syringe Volume

14.2.8.1.1 North America: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.2.8.1.2 North America: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by 1 ml

14.2.8.1.3 North America: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.2.8.1.4 North America: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by 3 ml

14.2.9 North America: Arterial Blood Gas Kits Market Breakdown, by End User

14.2.9.1 North America: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by End User

14.2.10 North America: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Country

14.2.10.1 North America: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Country

14.2.10.2 United States: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.2.10.2.1 United States: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.2.10.2.2 United States: Arterial Blood Gas Kits Market Breakdown, by Type

14.2.10.2.3 United States: Arterial Blood Gas Kits Market Breakdown, by Usage

14.2.10.2.4 United States: Arterial Blood Gas Kits Market Breakdown, by Application

14.2.10.2.4.1 United States: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.2.10.2.5 United States: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.2.10.2.6 United States: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.2.10.2.6.1 United States: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.2.10.2.6.2 United States: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.2.10.2.7 United States: Arterial Blood Gas Kits Market Breakdown, by End User

14.2.10.3 Canada: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.2.10.3.1 Canada: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.2.10.3.2 Canada: Arterial Blood Gas Kits Market Breakdown, by Type

14.2.10.3.3 Canada: Arterial Blood Gas Kits Market Breakdown, by Usage

14.2.10.3.4 Canada: Arterial Blood Gas Kits Market Breakdown, by Application

14.2.10.3.4.1 Canada: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.2.10.3.5 Canada: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.2.10.3.6 Canada: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.2.10.3.6.1 Canada: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.2.10.3.6.2 Canada: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.2.10.3.7 Canada: Arterial Blood Gas Kits Market Breakdown, by End User

14.2.10.4 Mexico: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.2.10.4.1 Mexico: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.2.10.4.2 Mexico: Arterial Blood Gas Kits Market Breakdown, by Type

14.2.10.4.3 Mexico: Arterial Blood Gas Kits Market Breakdown, by Usage

14.2.10.4.4 Mexico: Arterial Blood Gas Kits Market Breakdown, by Application

14.2.10.4.4.1 Mexico: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.2.10.4.5 Mexico: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.2.10.4.6 Mexico: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.2.10.4.6.1 Mexico: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.2.10.4.6.2 Mexico: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.2.10.4.7 Mexico: Arterial Blood Gas Kits Market Breakdown, by End User

14.3 Europe

14.3.1 Europe Arterial Blood Gas Kits Market Overview

14.3.2 Europe: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.3.3 Europe: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.3.3.1 Europe: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Syringe Type

14.3.4 Europe: Arterial Blood Gas Kits Market Breakdown, by Type

14.3.4.1 Europe: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Type

14.3.5 Europe: Arterial Blood Gas Kits Market Breakdown, by Usage

14.3.5.1 Europe: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Usage

14.3.6 Europe: Arterial Blood Gas Kits Market Breakdown, by Application

14.3.6.1 Europe: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Application

14.3.6.2 Europe: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.3.6.3 Europe: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by In Vitro Diagnostics

14.3.7 Europe: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.3.7.1 Europe: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Needle Gauge

14.3.8 Europe: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.3.8.1 Europe: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Syringe Volume

14.3.8.1.1 Europe: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.3.8.1.2 Europe: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by 1 ml

14.3.8.1.3 Europe: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.3.8.1.4 Europe: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by 3 ml

14.3.9 Europe: Arterial Blood Gas Kits Market Breakdown, by End User

14.3.9.1 Europe: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by End User

14.3.10 Europe: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Country

14.3.10.1 Europe: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Country

14.3.10.2 United Kingdom: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.3.10.2.1 United Kingdom: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.3.10.2.2 United Kingdom: Arterial Blood Gas Kits Market Breakdown, by Type

14.3.10.2.3 United Kingdom: Arterial Blood Gas Kits Market Breakdown, by Usage

14.3.10.2.4 United Kingdom: Arterial Blood Gas Kits Market Breakdown, by Application

14.3.10.2.4.1 United Kingdom: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.3.10.2.5 United Kingdom: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.3.10.2.6 United Kingdom: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.3.10.2.6.1 United Kingdom: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.3.10.2.6.2 United Kingdom: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.3.10.2.7 United Kingdom: Arterial Blood Gas Kits Market Breakdown, by End User

14.3.10.3 Germany: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.3.10.3.1 Germany: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.3.10.3.2 Germany: Arterial Blood Gas Kits Market Breakdown, by Type

14.3.10.3.3 Germany: Arterial Blood Gas Kits Market Breakdown, by Usage

14.3.10.3.4 Germany: Arterial Blood Gas Kits Market Breakdown, by Application

14.3.10.3.4.1 Germany: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.3.10.3.5 Germany: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.3.10.3.6 Germany: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.3.10.3.6.1 Germany: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.3.10.3.6.2 Germany: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.3.10.3.7 Germany: Arterial Blood Gas Kits Market Breakdown, by End User

14.3.10.4 France: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.3.10.4.1 France: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.3.10.4.2 France: Arterial Blood Gas Kits Market Breakdown, by Type

14.3.10.4.3 France: Arterial Blood Gas Kits Market Breakdown, by Usage

14.3.10.4.4 France: Arterial Blood Gas Kits Market Breakdown, by Application

14.3.10.4.4.1 France: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.3.10.4.5 France: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.3.10.4.6 France: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.3.10.4.6.1 France: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.3.10.4.6.2 France: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.3.10.4.7 France: Arterial Blood Gas Kits Market Breakdown, by End User

14.3.10.5 Italy: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.3.10.5.1 Italy: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.3.10.5.2 Italy: Arterial Blood Gas Kits Market Breakdown, by Type

14.3.10.5.3 Italy: Arterial Blood Gas Kits Market Breakdown, by Usage

14.3.10.5.4 Italy: Arterial Blood Gas Kits Market Breakdown, by Application

14.3.10.5.4.1 Italy: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.3.10.5.5 Italy: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.3.10.5.6 Italy: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.3.10.5.6.1 Italy: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.3.10.5.6.2 Italy: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.3.10.5.7 Italy: Arterial Blood Gas Kits Market Breakdown, by End User

14.3.10.6 Spain: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.3.10.6.1 Spain: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.3.10.6.2 Spain: Arterial Blood Gas Kits Market Breakdown, by Type

14.3.10.6.3 Spain: Arterial Blood Gas Kits Market Breakdown, by Usage

14.3.10.6.4 Spain: Arterial Blood Gas Kits Market Breakdown, by Application

14.3.10.6.4.1 Spain: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.3.10.6.5 Spain: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.3.10.6.6 Spain: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.3.10.6.6.1 Spain: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.3.10.6.6.2 Spain: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.3.10.6.7 Spain: Arterial Blood Gas Kits Market Breakdown, by End User

14.3.10.7 Rest of Europe: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.3.10.7.1 Rest of Europe: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.3.10.7.2 Rest of Europe: Arterial Blood Gas Kits Market Breakdown, by Type

14.3.10.7.3 Rest of Europe: Arterial Blood Gas Kits Market Breakdown, by Usage

14.3.10.7.4 Rest of Europe: Arterial Blood Gas Kits Market Breakdown, by Application

14.3.10.7.4.1 Rest of Europe: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.3.10.7.5 Rest of Europe: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.3.10.7.6 Rest of Europe: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.3.10.7.6.1 Rest of Europe: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.3.10.7.6.2 Rest of Europe: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.3.10.7.7 Rest of Europe: Arterial Blood Gas Kits Market Breakdown, by End User

14.4 Asia Pacific

14.4.1 Asia Pacific Arterial Blood Gas Kits Market Overview

14.4.2 Asia Pacific: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.4.3 Asia Pacific: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.4.3.1 Asia Pacific: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Syringe Type

14.4.4 Asia Pacific: Arterial Blood Gas Kits Market Breakdown, by Type

14.4.4.1 Asia Pacific: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Type

14.4.5 Asia Pacific: Arterial Blood Gas Kits Market Breakdown, by Usage

14.4.5.1 Asia Pacific: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Usage

14.4.6 Asia Pacific: Arterial Blood Gas Kits Market Breakdown, by Application

14.4.6.1 Asia Pacific: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Application

14.4.6.2 Asia Pacific: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.4.6.3 Asia Pacific: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by In Vitro Diagnostics

14.4.7 Asia Pacific: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.4.7.1 Asia Pacific: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Needle Gauge

14.4.8 Asia Pacific: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.4.8.1 Asia Pacific: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Syringe Volume

14.4.8.1.1 Asia Pacific: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.4.8.1.2 Asia Pacific: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by 1 ml

14.4.8.1.3 Asia Pacific: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.4.8.1.4 Asia Pacific: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by 3 ml

14.4.9 Asia Pacific: Arterial Blood Gas Kits Market Breakdown, by End User

14.4.9.1 Asia Pacific: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by End User

14.4.10 Asia Pacific: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Country

14.4.10.1 Asia Pacific: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Country

14.4.10.2 China: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.4.10.2.1 China: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.4.10.2.2 China: Arterial Blood Gas Kits Market Breakdown, by Type

14.4.10.2.3 China: Arterial Blood Gas Kits Market Breakdown, by Usage

14.4.10.2.4 China: Arterial Blood Gas Kits Market Breakdown, by Application

14.4.10.2.4.1 China: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.4.10.2.5 China: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.4.10.2.6 China: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.4.10.2.6.1 China: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.4.10.2.6.2 China: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.4.10.2.7 China: Arterial Blood Gas Kits Market Breakdown, by End User

14.4.10.3 Japan: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.4.10.3.1 Japan: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.4.10.3.2 Japan: Arterial Blood Gas Kits Market Breakdown, by Type

14.4.10.3.3 Japan: Arterial Blood Gas Kits Market Breakdown, by Usage

14.4.10.3.4 Japan: Arterial Blood Gas Kits Market Breakdown, by Application

14.4.10.3.4.1 Japan: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.4.10.3.5 Japan: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.4.10.3.6 Japan: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.4.10.3.6.1 Japan: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.4.10.3.6.2 Japan: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.4.10.3.7 Japan: Arterial Blood Gas Kits Market Breakdown, by End User

14.4.10.4 India: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.4.10.4.1 India: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.4.10.4.2 India: Arterial Blood Gas Kits Market Breakdown, by Type

14.4.10.4.3 India: Arterial Blood Gas Kits Market Breakdown, by Usage

14.4.10.4.4 India: Arterial Blood Gas Kits Market Breakdown, by Application

14.4.10.4.4.1 India: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.4.10.4.5 India: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.4.10.4.6 India: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.4.10.4.6.1 India: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.4.10.4.6.2 India: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.4.10.4.7 India: Arterial Blood Gas Kits Market Breakdown, by End User

14.4.10.5 Australia: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.4.10.5.1 Australia: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.4.10.5.2 Australia: Arterial Blood Gas Kits Market Breakdown, by Type

14.4.10.5.3 Australia: Arterial Blood Gas Kits Market Breakdown, by Usage

14.4.10.5.4 Australia: Arterial Blood Gas Kits Market Breakdown, by Application

14.4.10.5.4.1 Australia: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.4.10.5.5 Australia: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.4.10.5.6 Australia: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.4.10.5.6.1 Australia: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.4.10.5.6.2 Australia: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.4.10.5.7 Australia: Arterial Blood Gas Kits Market Breakdown, by End User

14.4.10.6 South Korea: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.4.10.6.1 South Korea: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.4.10.6.2 South Korea: Arterial Blood Gas Kits Market Breakdown, by Type

14.4.10.6.3 South Korea: Arterial Blood Gas Kits Market Breakdown, by Usage

14.4.10.6.4 South Korea: Arterial Blood Gas Kits Market Breakdown, by Application

14.4.10.6.4.1 South Korea: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.4.10.6.5 South Korea: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.4.10.6.6 South Korea: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.4.10.6.6.1 South Korea: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.4.10.6.6.2 South Korea: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.4.10.6.7 South Korea: Arterial Blood Gas Kits Market Breakdown, by End User

14.4.10.7 Kazakhstan: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.4.10.7.1 Kazakhstan: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.4.10.7.2 Kazakhstan: Arterial Blood Gas Kits Market Breakdown, by Type

14.4.10.7.3 Kazakhstan: Arterial Blood Gas Kits Market Breakdown, by Usage

14.4.10.7.4 Kazakhstan: Arterial Blood Gas Kits Market Breakdown, by Application

14.4.10.7.4.1 Kazakhstan: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.4.10.7.5 Kazakhstan: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.4.10.7.6 Kazakhstan: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.4.10.7.6.1 Kazakhstan: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.4.10.7.6.2 Kazakhstan: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.4.10.7.7 Kazakhstan: Arterial Blood Gas Kits Market Breakdown, by End User

14.4.10.8 Rest of APAC: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.4.10.8.1 Rest of APAC: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.4.10.8.2 Rest of APAC: Arterial Blood Gas Kits Market Breakdown, by Type

14.4.10.8.3 Rest of APAC: Arterial Blood Gas Kits Market Breakdown, by Usage

14.4.10.8.4 Rest of APAC: Arterial Blood Gas Kits Market Breakdown, by Application

14.4.10.8.4.1 Rest of APAC: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.4.10.8.5 Rest of APAC: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.4.10.8.6 Rest of APAC: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.4.10.8.6.1 Rest of APAC: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.4.10.8.6.2 Rest of APAC: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.4.10.8.7 Rest of APAC: Arterial Blood Gas Kits Market Breakdown, by End User

14.5 Middle East and Africa

14.5.1 Middle East and Africa Arterial Blood Gas Kits Market Overview

14.5.2 Middle East and Africa: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.5.3 Middle East and Africa: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.5.3.1 Middle East and Africa: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Syringe Type

14.5.4 Middle East and Africa: Arterial Blood Gas Kits Market Breakdown, by Type

14.5.4.1 Middle East and Africa: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Type

14.5.5 Middle East and Africa: Arterial Blood Gas Kits Market Breakdown, by Usage

14.5.5.1 Middle East and Africa: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Usage

14.5.6 Middle East and Africa: Arterial Blood Gas Kits Market Breakdown, by Application

14.5.6.1 Middle East and Africa: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Application

14.5.6.2 Middle East and Africa: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.5.6.3 Middle East and Africa: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by In Vitro Diagnostics

14.5.7 Middle East and Africa: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.5.7.1 Middle East and Africa: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Needle Gauge

14.5.8 Middle East and Africa: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.5.8.1 Middle East and Africa: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Syringe Volume

14.5.8.1.1 Middle East and Africa: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.5.8.1.2 Middle East and Africa: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by 1 ml

14.5.8.1.3 Middle East and Africa: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.5.8.1.4 Middle East and Africa: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by 3 ml

14.5.9 Middle East and Africa: Arterial Blood Gas Kits Market Breakdown, by End User

14.5.9.1 Middle East and Africa: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by End User

14.5.10 Middle East and Africa: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Country

14.5.10.1 Middle East and Africa: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Country

14.5.10.2 South Africa: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.5.10.2.1 South Africa: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.5.10.2.2 South Africa: Arterial Blood Gas Kits Market Breakdown, by Type

14.5.10.2.3 South Africa: Arterial Blood Gas Kits Market Breakdown, by Usage

14.5.10.2.4 South Africa: Arterial Blood Gas Kits Market Breakdown, by Application

14.5.10.2.4.1 South Africa: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.5.10.2.5 South Africa: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.5.10.2.6 South Africa: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.5.10.2.6.1 South Africa: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.5.10.2.6.2 South Africa: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.5.10.2.7 South Africa: Arterial Blood Gas Kits Market Breakdown, by End User

14.5.10.3 Saudi Arabia: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.5.10.3.1 Saudi Arabia: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.5.10.3.2 Saudi Arabia: Arterial Blood Gas Kits Market Breakdown, by Type

14.5.10.3.3 Saudi Arabia: Arterial Blood Gas Kits Market Breakdown, by Usage

14.5.10.3.4 Saudi Arabia: Arterial Blood Gas Kits Market Breakdown, by Application

14.5.10.3.5 Saudi Arabia: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.5.10.3.6 Saudi Arabia: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.5.10.3.7 Saudi Arabia: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.5.10.3.7.1 Saudi Arabia: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.5.10.3.7.2 Saudi Arabia: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.5.10.3.8 Saudi Arabia: Arterial Blood Gas Kits Market Breakdown, by End User

14.5.10.4 United Arab Emirates: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.5.10.4.1 United Arab Emirates: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.5.10.4.2 United Arab Emirates: Arterial Blood Gas Kits Market Breakdown, by Type

14.5.10.4.3 United Arab Emirates: Arterial Blood Gas Kits Market Breakdown, by Usage

14.5.10.4.4 United Arab Emirates: Arterial Blood Gas Kits Market Breakdown, by Application

14.5.10.4.4.1 United Arab Emirates: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.5.10.4.5 United Arab Emirates: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.5.10.4.6 United Arab Emirates: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.5.10.4.6.1 United Arab Emirates: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.5.10.4.6.2 United Arab Emirates: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.5.10.4.7 United Arab Emirates: Arterial Blood Gas Kits Market Breakdown, by End User

14.5.10.5 Kuwait: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.5.10.5.1 Kuwait: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.5.10.5.2 Kuwait: Arterial Blood Gas Kits Market Breakdown, by Type

14.5.10.5.3 Kuwait: Arterial Blood Gas Kits Market Breakdown, by Usage

14.5.10.5.4 Kuwait: Arterial Blood Gas Kits Market Breakdown, by Application

14.5.10.5.4.1 Kuwait: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.5.10.5.5 Kuwait: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.5.10.5.6 Kuwait: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.5.10.5.6.1 Kuwait: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.5.10.5.6.2 Kuwait: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.5.10.5.7 Kuwait: Arterial Blood Gas Kits Market Breakdown, by End User

14.5.10.6 Qatar: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.5.10.6.1 Qatar: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.5.10.6.2 Qatar: Arterial Blood Gas Kits Market Breakdown, by Type

14.5.10.6.3 Qatar: Arterial Blood Gas Kits Market Breakdown, by Usage

14.5.10.6.4 Qatar: Arterial Blood Gas Kits Market Breakdown, by Application

14.5.10.6.4.1 Qatar: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.5.10.6.5 Qatar: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.5.10.6.6 Qatar: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.5.10.6.6.1 Qatar: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.5.10.6.6.2 Qatar: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.5.10.6.7 Qatar: Arterial Blood Gas Kits Market Breakdown, by End User

14.5.10.7 Rest of Middle East and Africa: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.5.10.7.1 Rest of Middle East and Africa: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.5.10.7.2 Rest of Middle East and Africa: Arterial Blood Gas Kits Market Breakdown, by Type

14.5.10.7.3 Rest of Middle East and Africa: Arterial Blood Gas Kits Market Breakdown, by Usage

14.5.10.7.4 Rest of Middle East and Africa: Arterial Blood Gas Kits Market Breakdown, by Application

14.5.10.7.4.1 Rest of Middle East and Africa: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.5.10.7.5 Rest of Middle East and Africa: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.5.10.7.6 Rest of Middle East and Africa: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.5.10.7.6.1 Rest of Middle East and Africa: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.5.10.7.6.2 Rest of Middle East and Africa: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.5.10.7.7 Rest of Middle East and Africa: Arterial Blood Gas Kits Market Breakdown, by End User

14.6 South and Central America

14.6.1 South and Central America Arterial Blood Gas Kits Market Overview

14.6.2 South and Central America: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.6.3 South and Central America: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.6.3.1 South and Central America: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Syringe Type

14.6.4 South and Central America: Arterial Blood Gas Kits Market Breakdown, by Type

14.6.4.1 South and Central America: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Type

14.6.5 South and Central America: Arterial Blood Gas Kits Market Breakdown, by Usage

14.6.5.1 South and Central America: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Usage

14.6.6 South and Central America: Arterial Blood Gas Kits Market Breakdown, by Application

14.6.6.1 South and Central America: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Application

14.6.6.2 South and Central America: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.6.6.3 South and Central America: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by In Vitro Diagnostics

14.6.7 South and Central America: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.6.7.1 South and Central America: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Needle Gauge

14.6.8 South and Central America: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.6.8.1 South and Central America: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Syringe Volume

14.6.8.1.1 South and Central America: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.6.8.1.2 South and Central America: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by 1 ml

14.6.8.1.3 South and Central America: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.6.8.1.4 South and Central America: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by 3 ml

14.6.9 South and Central America: Arterial Blood Gas Kits Market Breakdown, by End User

14.6.9.1 South and Central America: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by End User

14.6.10 South and Central America: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Country

14.6.10.1 South and Central America: Arterial Blood Gas Kits Market – Revenue and Forecast Analysis – by Country

14.6.10.2 Brazil: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.6.10.2.1 Brazil: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.6.10.2.2 Brazil: Arterial Blood Gas Kits Market Breakdown, by Type

14.6.10.2.3 Brazil: Arterial Blood Gas Kits Market Breakdown, by Usage

14.6.10.2.4 Brazil: Arterial Blood Gas Kits Market Breakdown, by Application

14.6.10.2.4.1 Brazil: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.6.10.2.5 Brazil: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.6.10.2.6 Brazil: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.6.10.2.6.1 Brazil: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.6.10.2.6.2 Brazil: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.6.10.2.7 Brazil: Arterial Blood Gas Kits Market Breakdown, by End User

14.6.10.3 Argentina: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.6.10.3.1 Argentina: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.6.10.3.2 Argentina: Arterial Blood Gas Kits Market Breakdown, by Type

14.6.10.3.3 Argentina: Arterial Blood Gas Kits Market Breakdown, by Usage

14.6.10.3.4 Argentina: Arterial Blood Gas Kits Market Breakdown, by Application

14.6.10.3.4.1 Argentina: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.6.10.3.5 Argentina: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.6.10.3.6 Argentina: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.6.10.3.6.1 Argentina: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.6.10.3.6.2 Argentina: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.6.10.3.7 Argentina: Arterial Blood Gas Kits Market Breakdown, by End User

14.6.10.4 Colombia: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.6.10.4.1 Colombia: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.6.10.4.2 Colombia: Arterial Blood Gas Kits Market Breakdown, by Type

14.6.10.4.3 Colombia: Arterial Blood Gas Kits Market Breakdown, by Usage

14.6.10.4.4 Colombia: Arterial Blood Gas Kits Market Breakdown, by Application

14.6.10.4.4.1 Colombia: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.6.10.4.5 Colombia: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.6.10.4.6 Colombia: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.6.10.4.6.1 Colombia: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.6.10.4.6.2 Colombia: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.6.10.4.7 Colombia: Arterial Blood Gas Kits Market Breakdown, by End User

14.6.10.5 Rest of South and Central America: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand)

14.6.10.5.1 Rest of South and Central America: Arterial Blood Gas Kits Market Breakdown, by Syringe Type

14.6.10.5.2 Rest of South and Central America: Arterial Blood Gas Kits Market Breakdown, by Type

14.6.10.5.3 Rest of South and Central America: Arterial Blood Gas Kits Market Breakdown, by Usage

14.6.10.5.4 Rest of South and Central America: Arterial Blood Gas Kits Market Breakdown, by Application

14.6.10.5.4.1 Rest of South and Central America: Arterial Blood Gas Kits Market Breakdown, by In Vitro Diagnostics

14.6.10.5.5 Rest of South and Central America: Arterial Blood Gas Kits Market Breakdown, by Needle Gauge

14.6.10.5.6 Rest of South and Central America: Arterial Blood Gas Kits Market Breakdown, by Syringe Volume

14.6.10.5.6.1 Rest of South and Central America: Arterial Blood Gas Kits Market Breakdown, by 1 ml

14.6.10.5.6.2 Rest of South and Central America: Arterial Blood Gas Kits Market Breakdown, by 3 ml

14.6.10.5.7 Rest of South and Central America: Arterial Blood Gas Kits Market Breakdown, by End User

15. Competitive Landscape

15.1 Arterial Blood Gas Kits Market, Company Share Analysis - 2023

15.2 Blood Gas Analyzers Market, Company Share Analysis – 2023

15.2.1 Overview

16. Industry Landscape

16.1 Overview

16.2 Growth Strategies in Arterial Blood Gas Kits Market

16.3 Organic Growth Strategies

16.3.1 Overview

16.4 Inorganic Growth Strategies

16.4.1 Overview

17. Company Profiles

17.1 Radiometer Medical ApS

17.1.1 Key Facts

17.1.2 Business Description

17.1.3 Products and Services

17.1.4 Financial Overview

17.1.5 SWOT Analysis

17.1.6 Key Developments

17.2 Vyaire Medical Inc

17.2.1 Key Facts

17.2.2 Business Description

17.2.3 Products and Services

17.2.4 Financial Overview

17.2.5 SWOT Analysis

17.2.6 Key Developments

17.3 Opti Medical Systems

17.3.1 Key Facts

17.3.2 Business Description

17.3.3 Products and Services

17.3.4 SWOT Analysis

17.3.5 Key Developments

17.4 Siemens Healthineers AG

17.4.1 Key Facts

17.4.2 Business Description

17.4.3 Products and Services

17.4.4 Financial Overview

17.4.5 SWOT Analysis

17.4.6 Key Developments

17.5 AdvaCare Pharma USA LLC

17.5.1 Key Facts

17.5.2 Business Description

17.5.3 Products and Services

17.5.4 Financial Overview

17.5.5 SWOT Analysis

17.5.6 Key Developments

17.6 Becton Dickinson and Co

17.6.1 Key Facts

17.6.2 Business Description

17.6.3 Products and Services

17.6.4 Financial Overview

17.6.5 SWOT Analysis

17.6.6 Key Developments

17.7 ICU Medical Inc

17.7.1 Key Facts

17.7.2 Business Description

17.7.3 Products and Services

17.7.4 Financial Overview

17.7.5 SWOT Analysis

17.7.6 Key Developments

17.8 SunMed Group Holdings LLC (AirLife)

17.8.1 Key Facts

17.8.2 Business Description

17.8.3 Products and Services

17.8.4 Financial Overview

17.8.5 SWOT Analysis

17.8.6 Key Developments

17.9 Trudell Healthcare Solutions Inc

17.9.1 Key Facts

17.9.2 Business Description

17.9.3 Products and Services

17.9.4 Financial Overview

17.9.5 SWOT Analysis

17.9.6 Key Developments

17.10 SARSTEDT AG & Co KG

17.10.1 Key Facts

17.10.2 Business Description

17.10.3 Products and Services

17.10.4 Financial Overview

17.10.5 SWOT Analysis

17.10.6 Key Developments

17.11 Lepu Medical Technology Beijing Co Ltd

17.11.1 Key Facts

17.11.2 Business Description

17.11.3 Products and Services

17.11.4 Financial Overview

17.11.5 SWOT Analysis

17.11.6 Key Developments

17.12 Levram Lifesciences Pvt. Ltd.

17.12.1 Key Facts

17.12.2 Business Description

17.12.3 Products and Services

17.12.4 Financial Overview

17.12.5 SWOT Analysis

17.12.6 Key Developments

18. Appendix

18.1 About The Insight Partners

List of Tables

Table 1. Arterial Blood Gas Kits Market Segmentation

Table 2. Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand) – by Syringe Type

Table 3. Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand) – by Type

Table 4. Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand) – by Usage

Table 5. Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand) – by Application

Table 6. Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand) – by Needle Gauge

Table 7. Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand) – by Syringe Volume

Table 8. Arterial Blood Gas Kits Market – Revenue and Forecast to 2031 (US$ Thousand) – by End User

Table 9. North America: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Type

Table 10. North America: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Type

Table 11. North America: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Usage

Table 12. North America: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Application

Table 13. North America: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by In Vitro Diagnostics

Table 14. North America: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Needle Gauge

Table 15. North America: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Volume

Table 16. North America: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 1 ml

Table 17. North America: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 3 ml

Table 18. North America: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by End User

Table 19. North America: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Country

Table 20. United States: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Type

Table 21. United States: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Type

Table 22. United States: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Usage

Table 23. United States: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Application

Table 24. United States: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by In Vitro Diagnostics

Table 25. United States: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Needle Gauge

Table 26. United States: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Volume

Table 27. United States: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 1 ml

Table 28. United States: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 3 ml

Table 29. United States: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by End User

Table 30. Canada: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Type

Table 31. Canada: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Type

Table 32. Canada: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Usage

Table 33. Canada: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Application

Table 34. Canada: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by In Vitro Diagnostics

Table 35. Canada: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Needle Gauge

Table 36. Canada: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Volume

Table 37. Canada: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 1 ml

Table 38. Canada: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 3 ml

Table 39. Canada: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by End User

Table 40. Mexico: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Type

Table 41. Mexico: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Type

Table 42. Mexico: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Usage

Table 43. Mexico: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Application

Table 44. Mexico: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by In Vitro Diagnostics

Table 45. Mexico: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Needle Gauge

Table 46. Mexico: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Volume

Table 47. Mexico: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 1 ml

Table 48. Mexico: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 3 ml

Table 49. Mexico: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by End User

Table 50. Europe: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Type

Table 51. Europe: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Type

Table 52. Europe: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Usage

Table 53. Europe: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Application

Table 54. Europe: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by In Vitro Diagnostics

Table 55. Europe: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Needle Gauge

Table 56. Europe: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Volume

Table 57. Europe: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 1 ml

Table 58. Europe: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 3 ml

Table 59. Europe: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by End User

Table 60. Europe: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Country

Table 61. United Kingdom: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Type

Table 62. United Kingdom: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Type

Table 63. United Kingdom: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Usage

Table 64. United Kingdom: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Application

Table 65. United Kingdom: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by In Vitro Diagnostics

Table 66. United Kingdom: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Needle Gauge

Table 67. United Kingdom: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Volume

Table 68. United Kingdom: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 1 ml

Table 69. United Kingdom: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 3 ml

Table 70. United Kingdom: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by End User

Table 71. Germany: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Type

Table 72. Germany: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Type

Table 73. Germany: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Usage

Table 74. Germany: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Application

Table 75. Germany: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by In Vitro Diagnostics

Table 76. Germany: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Needle Gauge

Table 77. Germany: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Volume

Table 78. Germany: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 1 ml

Table 79. Germany: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 3 ml

Table 80. Germany: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by End User

Table 81. France: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Type

Table 82. France: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Type

Table 83. France: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Usage

Table 84. France: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Application

Table 85. France: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by In Vitro Diagnostics

Table 86. France: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Needle Gauge

Table 87. France: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Volume

Table 88. France: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 1 ml

Table 89. France: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 3 ml

Table 90. France: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by End User

Table 91. Italy: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Type

Table 92. Italy: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Type

Table 93. Italy: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Usage

Table 94. Italy: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Application

Table 95. Italy: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by In Vitro Diagnostics

Table 96. Italy: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Needle Gauge

Table 97. Italy: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Volume

Table 98. Italy: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 1 ml

Table 99. Italy: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 3 ml

Table 100. Italy: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by End User

Table 101. Spain: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Type

Table 102. Spain: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Type

Table 103. Spain: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Usage

Table 104. Spain: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Application

Table 105. Spain: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by In Vitro Diagnostics

Table 106. Spain: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Needle Gauge

Table 107. Spain: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Volume

Table 108. Spain: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 1 ml

Table 109. Spain: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 3 ml

Table 110. Spain: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by End User

Table 111. Rest of Europe: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Type

Table 112. Rest of Europe: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Type

Table 113. Rest of Europe: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Usage

Table 114. Rest of Europe: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Application

Table 115. Rest of Europe: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by In Vitro Diagnostics

Table 116. Rest of Europe: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Needle Gauge

Table 117. Rest of Europe: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Volume

Table 118. Rest of Europe: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 1 ml

Table 119. Rest of Europe: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 3 ml

Table 120. Rest of Europe: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by End User

Table 121. Asia Pacific: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Type

Table 122. Asia Pacific: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Type

Table 123. Asia Pacific: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Usage

Table 124. Asia Pacific: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Application

Table 125. Asia Pacific: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by In Vitro Diagnostics

Table 126. Asia Pacific: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Needle Gauge

Table 127. Asia Pacific: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Volume

Table 128. Asia Pacific: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 1 ml

Table 129. Asia Pacific: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 3 ml

Table 130. Asia Pacific: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by End User

Table 131. Asia Pacific: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Country

Table 132. China: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Type

Table 133. China: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Type

Table 134. China: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Usage

Table 135. China: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Application

Table 136. China: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by In Vitro Diagnostics

Table 137. China: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Needle Gauge

Table 138. China: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Volume

Table 139. China: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 1 ml

Table 140. China: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 3 ml

Table 141. China: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by End User

Table 142. Japan: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Type

Table 143. Japan: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Type

Table 144. Japan: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Usage

Table 145. Japan: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Application

Table 146. Japan: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by In Vitro Diagnostics

Table 147. Japan: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Needle Gauge

Table 148. Japan: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Volume

Table 149. Japan: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 1 ml

Table 150. Japan: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 3 ml

Table 151. Japan: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by End User

Table 152. India: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Type

Table 153. India: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Type

Table 154. India: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Usage

Table 155. India: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Application

Table 156. India: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by In Vitro Diagnostics

Table 157. India: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Needle Gauge

Table 158. India: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Volume

Table 159. India: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 1 ml

Table 160. India: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 3 ml

Table 161. India: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by End User

Table 162. Australia: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Type

Table 163. Australia: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Type

Table 164. Australia: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Usage

Table 165. Australia: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Application

Table 166. Australia: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by In Vitro Diagnostics

Table 167. Australia: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Needle Gauge

Table 168. Australia: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by Syringe Volume

Table 169. Australia: Arterial Blood Gas Kits Market – Revenue and Forecast to 2031(US$ Thousand) – by 1 ml