Asia Pacific SiC Fibers Market to Reach US$ 854.8 Mn at a CAGR of 34.9% in 2027 | The Insight Partners

The Asia Pacific SiC fibers market accounted for US$ 55.6 Mn in 2018 and is predicted to grow at a CAGR of 34.9% during the forecast period 2019 – 2027, to account for US$ 854.8 Mn by 2027.

In 2018, Japan accounted for a significant share of the Asia Pacific SiC fibers market. Asia Pacific has presence of some world leading automobile and aircraft manufacturing companies which generate significant demand for SiC fibers. The region is expected to turn into a lucrative SiC fibers market as it has a robust manufacturing base in countries such as China and Japan as well as countries in Rest of Asia Pacific such as India and Philippines. Moreover, rising investments in the manufacturing ability and production facility of SiC fibers is further expected to fuel the growth of the SiC fibers market in the Asia Pacific region. The construction of efficient nuclear power plants and the rising use of technical ceramics used in their constructions across Asia Pacific is anticipated to drive the sales for SiC fibers. The large number of industrial bases in industrialized countries such as Japan and China are expected to propel the growth of SiC fibers in Asia Pacific in the forecast period.

Asia Pacific SiC Fibers Market

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Market Insights

Growing Demand from Various End-Use Industries

High strength along with a lightweight, stability over high temperature, and resistance from oxidation and corrosion make SiC fibers an ideal material used across various ends use industries such as aerospace and defense, power and energy, chemical, automotive, and others. The rising focus towards the advancement of the performance of commercial and military aircraft is continuously driving the demand for high performance structural materials in the aerospace industry. Composite materials have gained acceptance for aviation and aerospace applications owing to exceptional strength coupled with superior physical properties and stiffness-to-density ratios. The aerospace industry is considered as the prime user of SiC fibers. The use of SiC fibers is important for application dealing in extreme mechanical loads at high temperatures (up to 1900 K in the air) and cannot be met out with any metallic material or intermetallic materials. The growing application of silicon carbide fibers reinforced composites is motivating the manufacturers to replace the metal parts in aircraft with the fibers so as to boost the fuel efficiency of aircraft engines. They are used in manufacturing of aircraft engines, thermal protection systems, and turbopumps. Thus, the growing application base along with a rapid rise in urbanization and industrialization is boosting the demand for SiC fibers in the industry.

Form Insights

Based on form, the Asia Pacific SiC fibers market is bifurcated as continuous, woven cloth and others. The SiC fibers have a strong oxidation resistance and are extremely strong fibers that are specially used for high-temperature applications. Composition of carbon, silicon or acute proportions of oxygen present in the fiber depend on the manufacturing process of the SiC fiber. The continuous SiC fiber segment is anticipated to account for a significant share of the SiC fiber market in Asia Pacific region for the year 2018. The continuous SiC fiber is widely used in the nuclear environment due to its chemical stability, high toughness, relatively low neutron absorption and mature fabrication technology. These fibers have been gaining growing inclination in the nuclear industry and are being studied all over the globe and are being applied mainly to the engine combustion chamber, friction materials and aerospace heat shield. The continuous SiC fibers are also noted to possess excellent electronic properties too. These fibers are prepared by the hot pressing and vacuum bag infiltration method using the SiC fabric performs. The expansion of power and energy sector in less developed economies of Asia Pacific region has generated significant demand for technical ceramics such as continuous SiC fibers used in construction of nuclear reactors.

Usage Insights

The SiC fiber market is bifurcated on the basis of usage into composites and non-composites. The SiC fibers market is anticipated to witness strong growth in Asia Pacific owing to large demand for SiC fibers from its energy, aviation, and industrial sector. The composite SiC fibers is anticipated to hold a major share of the Asia Pacific SiC fibers market by usage in 2018. The composites usage comprises of ceramic matrix composites (CMC), Polymer Matrix Composites (PMC) and Metal Matrix Composites (MMC). The PMC is poised to be a new alternative ceramic in various domestic and engineering applications. This composite that is influenced by the distinguished properties of SiC fiber is used in engineering applications such as marine, automobile, mechanical and others. The versatility offered by the use of composite SiC fibers has made them the preferred material in the construction of turbine engine components, and thermal protection systems in the aerospace applications. The remarkable properties of composite SiC fibers such as high chemical, mechanical and thermal stability with high tensile strength is anticipated to drive the demand for composite SiC fibers in the forecast period.

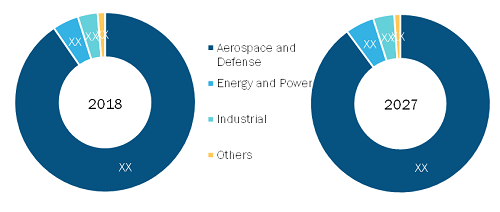

End-Use Industry Insights

The SiC fibers market is bifurcated on basis of end-use industry into aerospace and defense, energy and power, industrial, and others. The aerospace and defense industry is expected to generate significant demand for SiC fibers in 2018. Whereas the demand for SiC fibers in energy and power sector is anticipated to grow at a rapid pace in the forecast period 2019–2027. SiC fibers have gained importance in the aviation sector owing to their lightweight, high strength, and resistance towards oxidation and corrosion. These fibers are preferred over metal alloys in manufacturing aircraft components such as nozzles, combustors, shrouds, and blades of aircraft engines. The SiC fibers composites impart durability and toughness to the various aircraft components. The high modulus of SiC fibers composite makes it structurally suitable in the production of aircraft components. Moreover, the demand for silicon carbide fiber composites is high for manufacturing turbine & combustion section of aero-propulsion engines, which is expected to result in high product demand. The increasing use of aerospace composite materials like SiC fibers has played a significant role in the increased fuel efficiency and weight reduction of aircrafts. These properties of the SiC fibers composites have encouraged its use in the aerospace and spacecraft industry.

Rest of Asia Pacific SiC Fibers Market by End-Use Industry

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Asia Pacific SiC Fibers Market: Strategic Insights

Market Size Value in US$ 55.6 Million in 2018 Market Size Value by US$ 854.8 Million by 2027 Growth rate CAGR of 34.9% from 2019-2027 Forecast Period 2019-2027 Base Year 2019

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Asia Pacific SiC Fibers Market: Strategic Insights

| Market Size Value in | US$ 55.6 Million in 2018 |

| Market Size Value by | US$ 854.8 Million by 2027 |

| Growth rate | CAGR of 34.9% from 2019-2027 |

| Forecast Period | 2019-2027 |

| Base Year | 2019 |

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

New product development, market initiatives and merger and acquisition were observed as the most adopted strategies in Asia Pacific SiC fibers market. Few of the recent developments in the Asia Pacific SiC fibers market are listed below:

2017:

In March 2017, Nippon Carbon Co., Ltd. announced the creation of the new business division “Global Business Development Division”. The new division will work cross-sectionally for worldwide market survey and analysis, new business development and global organization enforcement.

2016:

NGS Advanced Fibers Co., Ltd announced the completion of it’s second plant. The addition of new plant facility would increase production capacity of HI-NICALON (including TypeS) by 10 tonnes per annum.ASIA PACIFIC SiC FIBERS MARKET SEGMENTATION

Asia Pacific SiC Fibers Market - By Form

- Continuous

- Woven Cloth

- Others

Asia Pacific SiC Fibers Market - By Usage

- Composites

- Non-Composites

Asia Pacific SiC Fibers Market - By End-Use Industry

- Aerospace and Defense Industrial, Others

- Energy and Power

- Industrial

- Others

Asia Pacific SiC Fibers Market - By Country

- Japan

- China

- Rest Of Asia Pacific

Company Profiles

- American Elements

- General Electric Company

- Haydale Technologies Inc.

- NGS Advanced Fibers Co., Ltd.

- Suzhou Saifei Group Co., Ltd

- Ube Industries, Ltd

- Ceramdis GmbH

- Nippon Carbon Co Ltd.

- Hongwu International Group Ltd

- SNAM Group of Companies

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Form, Usages, End-Use Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, China, Japan, South Korea

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 Asia Pacific SiC Fibers Market – By Form

1.3.2 Asia Pacific SiC Fibers Market – By Usage

1.3.3 Asia Pacific SiC Fibers Market – By End-Use Industry

1.3.4 Asia Pacific SiC Fibers Market – By Country

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. SiC Fibers Market Landscape

4.1 Market Overview

4.1.1 PEST Analysis: APAC SiC Fibers Market

5. SiC Fibers Market – Key Industry Dynamics

5.1 Market Drivers

5.1.1 Growing Demand from Various End-Use Industries

5.1.2 Higher Temperature Stability in Comparison to Substitutes

5.2 Key Market Restraints

5.2.1 High-CostAssociated With SiC Fibers

5.3 Key Market Opportunities

5.3.1 Growing Demand of SiC Fibers from Nuclear Industry

5.4 Future Trends

5.4.1 Rising Application of Cost-Efficient Alpha Silicon Carbide Fiber

5.5 Impact Analysis of Drivers and Restraints

6. SiC Fibers – Asia Pacific Market Analysis

6.1 Asia Pacific SiC Fibers Market Overview

6.2 Asia Pacific SiC Fibers Market Forecast and Analysis

7. Asia Pacific SiC Fibers Market Analysis – By Form

7.1 Overview

7.2 Asia Pacific SiC Fibers Market Breakdown, By Form, 2018 & 2027

7.3 Continuous

7.3.1 Overview

7.3.2 Asia Pacific Continuous SiC Fibers Market Revenue Forecasts To 2027 (US$ Mn)

7.4 Woven Cloth

7.4.1 Overview

7.4.2 Asia Pacific Woven Cloth SiC Fibers Market Revenue Forecasts To 2027 (US$ Mn)

7.5 Others

7.5.1 Overview

7.5.2 Asia Pacific Others Market Revenue Forecasts To 2027 (US$ Mn)

8. Asia Pacific SiC Fibers Market Analysis – By Usage

8.1 Overview

8.2 Asia Pacific SiC Fibers Market Breakdown, By Usage, 2018 & 2027

8.3 Composites

8.3.1 Overview

8.3.2 Asia Pacific Composites SiC Fibers Market Revenue Forecasts To 2027 (US$ Mn)

8.4 Non–Composites

8.4.1 Overview

8.4.2 Asia Pacific Non–Composites SiC Fibers Market Revenue Forecasts To 2027 (US$ Mn)

9. Asia Pacific SiC Fibers Market Analysis – By End-Use Industry

9.1 Overview

9.2 Asia Pacific SiC Fibers Market Breakdown, By End-Use Industry, 2018 & 2027

9.3 Aerospace and Defense

9.3.1 Overview

9.3.2 Asia Pacific Aerospace and Defense Market Revenue Forecasts To 2027 (US$ Mn)

9.4 Energy and Power

9.4.1 Overview

9.4.2 Asia Pacific Energy and Power Market Revenue Forecasts To 2027 (US$ Mn)

9.5 Industrial

9.5.1 Overview

9.5.2 Asia Pacific Industrial Market Revenue Forecasts To 2027 (US$ Mn)

9.6 Others

9.6.1 Overview

9.6.2 Asia Pacific Others Market Revenue Forecasts To 2027 (US$ Mn)

10. SiC Fibers Market – Country Analysis

10.1 Overview

10.1.1 Asia Pacific SiC Fibers Market Breakdown, by Country

10.1.1.1 Japan SiC Fibers Market Revenue Forecasts To 2027 (US$ Mn)

10.1.1.1.1 Japan SiC Fibers Market Breakdown By Form

10.1.1.1.2 Japan SiC Fibers Market Breakdown by Usage

10.1.1.1.3 Japan SiC Fibers Market Breakdown By End-Use Industry

10.1.1.2 China SiC Fibers Market Revenue and Forecasts to 2027 (US$ MN)

10.1.1.2.1 China SiC Fibers Market Breakdown by Form

10.1.1.2.2 China SiC Fibers Market Breakdown by Usage

10.1.1.2.3 China SiC Fibers Market Breakdown by End-Use Industry

10.1.1.3 Rest of APAC SiC Fibers Market Revenue and Forecasts to 2027 (US$ MN)

10.1.1.3.1 Rest of Asia Pacific SiC Fibers Market Breakdown by Form

10.1.1.3.2 Rest of Asia Pacific SiC Fibers Market Breakdown by Usage

10.1.1.3.3 Rest of Asia Pacific SiC Fibers Market Breakdown by End-Use Industry

11. Industry Landscape

11.1 Overview

11.2 Strategy And Business Planning

11.3 Market Initiatives

12. Company Profiles

12.1 American Elements

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.2 General Electric Company

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Haydale Technologies Inc.

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 NGS Advanced Fibers Co., Ltd.

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Ube Industries, Ltd.

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.6 Ceramdis GmbH

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.7 Suzhou Saifei Group Co., Ltd

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.8 Nippon Carbon Co Ltd

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 Hongwu International Group Ltd

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.10 SNAM Group

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

13. Appendix

13.1 About The Insight Partners

13.2 Glossary

LIST OF TABLES

Table 1. Asia Pacific SiC Fibers Market Revenue and Forecasts to 2027 (US$ Mn)

Table 2. Asia Pacific SiC Fibers Market Revenue and Forecasts to 2027 – By Form (US$ Mn)

Table 3. Asia Pacific SiC Fibers Market Revenue and Forecasts to 2027 – By Usage (US$ Mn)

Table 4. Asia Pacific SiC Fibers Market Revenue and Forecasts to 2027 – By End-Use Industry (US$ Mn)

Table 5. Japan SiC Fibers Market Revenue And Forecasts To 2027 – By Form (US$ Mn)

Table 6. Japan SiC Fibers Market Revenue and Forecasts to 2027 – By Usage (US$ Mn)

Table 7. Japan SiC Fibers Market Revenue And Forecasts To 2027 – By End-Use Industry (US$ Mn)

Table 8. China SiC Fibers Market Revenue And Forecasts To 2027 – By Form (US$ Mn)

Table 9. China SiC Fibers Market Revenue And Forecasts To 2027 – By Usage (US$ Mn)

Table 10. China SiC Fibers Market Revenue And Forecasts To 2027 – By End-Use Industry (US$ Mn)

Table 11. Rest of Asia Pacific SiC Fibers Market Revenue And Forecasts To 2027 – By Form (US$ Mn)

Table 12. Rest of Asia Pacific SiC Fibers Market Revenue And Forecasts To 2027 – By Usage (US$ Mn)

Table 13. Rest of Asia Pacific SiC Fibers Market Revenue And Forecasts To 2027 – By End-Use Industry (US$ Mn)

Table 14. Glossary of Terms, Asia Pacific SiC Fibers Market

LIST OF FIGURES

Figure 1. Asia Pacific SiC Fibers Market Segmentations

Figure 2. Asia Pacific SiC Fibers Market Segmentation – By Country

Figure 3. Asia Pacific SiC Fibers Market Overview

Figure 4. Aerospace and Defense Segment Held Largest Share In The Asia Pacific SiC Fibers Market

Figure 1. Japan Dominated The Asia Pacific SiC Fibers Market In 2018

Figure 2. Asia Pacific SiC Fibers Market, Industry Landscape

Figure 3. PEST Analysis for APAC SiC Fibers Market

Figure 4. SiC Fibers Market Impact Analysis Of Driver And Restraints

Figure 5. Asia Pacific SiC Fibers Market Forecast And Analysis, (US$ Mn)

Figure 6. Asia Pacific SiC Fibers Market Breakdown by Form, 2018 & 2027 (%)

Figure 7. Asia Pacific Continuous SiC Fibers Market Revenue Forecasts To 2027 (US$ Mn)

Figure 8. Asia Pacific Woven Cloth SiC Fibers Market Revenue Forecasts To 2027 (US$ Mn)

Figure 9. Asia Pacific Others Market Revenue Forecasts To 2027 (US$ Mn)

Figure 10. Asia Pacific SiC Fibers Market Breakdown by Usage, 2018 & 2027 (%)

Figure 11. Asia Pacific Composites SiC Fibers Market Revenue Forecasts To 2027 (US$ Mn)

Figure 12. Asia Pacific Non–Composites SiC Fibers Market Revenue Forecasts To 2027 (US$ Mn)

Figure 13. Asia Pacific SiC Fibers Market Breakdown by End-Use Industry, 2018 & 2027 (%)

Figure 14. Asia Pacific Aerospace and Defense Market Revenue Forecasts To 2027 (US$ Mn)

Figure 15. Asia Pacific Energy and Power Market Revenue Forecasts To 2027 (US$ Mn)

Figure 16. Asia Pacific Industrial Market Revenue Forecasts To 2027 (US$ Mn)

Figure 17. Asia Pacific Others Market Revenue Forecasts To 2027 (US$ Mn)

Figure 18. Asia Pacific SiC Fibers Market Breakdown by Country, 2018 & 2027(%)

Figure 19. Japan SiC Fibers Market Forecasts To 2027 (US$ Mn)

Figure 20. China SiC Fibers Market Revenue And Forecasts To 2027 (US$ MN)

Figure 21. Rest of APAC SiC Fibers Market Revenue And Forecasts To 2027 (US$ MN)

The List of Companies - Asia Pacific SiC Fibers Market

- American Elements

- General Electric Company

- Haydale Technologies Inc.

- NGS Advanced Fibers Co., Ltd.

- Suzhou Saifei Group Co., Ltd

- Ube Industries, Ltd

- Ceramdis GmbH

- Nippon Carbon Co Ltd.

- Hongwu International Group Ltd

- SNAM Group of Companies

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For