Asia Pacific Telecom Billing and Revenue Management Market to Grow at a CAGR of 18.3% to reach US$ 23007.6 Million from 2020 to 2027

The telecom billing and revenue management market in Asia Pacific was valued at US$ 6350.5 million in 2019 and is projected to reach US$ 23007.6 million by 2027; it is expected to grow at a CAGR of 18.3% from 2020 to 2027.

The telecom billing and revenue management market growth is significantly driven by the increasing mobile penetration in emerging market. At present, mobile phones have become the center point for the development of evolving digital ecosystem, as the world is experiencing a high adoption rate of connected devices, smartphones, and tablets, owing to which there is continuous surge and requirement of high-speed broadband and mobile networks. In the last 5 years, smartphone and internet in particular have experienced significant adoption trends in both developing and developed economies. In 2017, around 3.3 billion people were connected to the mobile internet, signifying an increase of almost 300 million compared to 2016. Based on the adoption rate of mobile phones among population, Asia Pacific is experiencing a significant increase between 2017 and 2025, due to rising mobile network coverage in rural areas and growing affordability of both mobile devices and tariffs. Further, highly developing countries such as India and China in the APAC region provide lucrative opportunities for telecom services and equipment providers. Hence increasing mobile penetration and subscriber base in the emerging market is further accelerating the growth of the telecom billing and revenue management market.The telecom billing and revenue management market is a highly fragmented and competitive marketplace. The leading companies in this market continue to broaden their clientele by expanding their current offerings. Prominent players face an increasing level of competition, both from start-ups and leading established companies across the world. Several companies in the value chain are acquiring other players in the telecom billing and revenue management market to provide efficient products and services to its customers, and thus, to maintain or uplift their position in the market.

The ongoing COVID-19 is anticipated to cause huge disruptions in the growth of various industries of Asia Pacific. For instance, China is the global hub of manufacturing and largest raw material supplier for various industries and it is one of the worst affected COVID-19 countries. India is another country where cases are rising constantly and business activities are halted due to nationwide lockdown. The COVID-19 crisis had a positive impact on the growth of some sectors such as IT and telecommunications. The demand for digital services especially has grown at a high rate in past few months. Nevertheless, the decrease in business activities such as partnerships to increase the adoption of telecom billing and revenue management solutions in various countries is anticipated to impact the telecom billing and revenue management provider’s expansion growth negatively. Hence, there will be a mixed impact due to which the growth will drop a little in 2020 and 2021.

APAC holds the largest market revenue share within the global telecom billing and revenue management market. The increase in the demand and requirement for communication and various types of services such as pay TV and broadband services is positively impacting the growth of the market. The growth of telecom and media industries is the major factor driving the growth of the APAC telecom billing and revenue management market. China is expected to hold the largest market share in APAC, while Indian telecom billing and revenue management market is expected to grow at the highest rate during the forecast period. Additionally, growing awareness of efficient billing and revenue management solutions and increasing mobile usage along with subscriber base in emerging economies are expected to boost the growth of telecom billing and revenue management market.

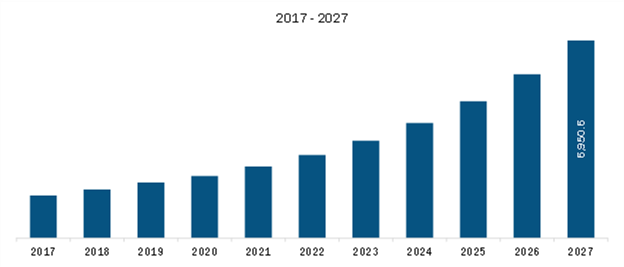

Rest of APAC Telecom Billing and Revenue Management Market Revenue and Forecasts to 2027 (US$ Mn)

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Asia Pacific Telecom Billing and Revenue Management Market–Segmentation

Asia Pacific Telecom Billing and Revenue Management Market, by Component

- Solution

- Billing Management

- Account Management

- Others

- Services

- Professional Services

- Managed services

Asia Pacific Telecom Billing and Revenue Management Market, by Type

- Telecom Billing

- Cloud Billing

- IoT Billing

Asia Pacific Telecom Billing and Revenue Management Market, by Deployment Type

- On-Premise

- Cloud-Based

- Hybrid

Asia Pacific Telecom Billing and Revenue Management Market, by Country

- Japan

- China

- India

- Australia

- Rest of APAC

Asia Pacific Telecom Billing and Revenue Management Market-Companies Mentioned

- Accenture PLC

- Nokia Corporation

- Amdocs, Inc.

- Cerillion PLC

- Comarch SA

- CSG Systems International, Inc.

- Fiserv, Inc.

- Ericsson

- Hewlett Packard Enterprise Development LP (HPE)

- Huawei Technologies Co., Ltd.

- Mphasis

- NEC Corporation

- Oracle Corporation

- Optiva Inc.

- Mavenir Systems

- SAP SE

- Tata Consultancy Services Limited (TCS)

- AGILITY CIS

- Comviva

- Enghouse Networks

- PANAMAX INC

- STL.TECH

- Vcare Corporation

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Component, Deployment Type, and Country

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, China, Japan, South Korea

1. Introduction

1.1 Study Scope

1.2 Market Segmentation

1.2.1 APAC Telecom Billing and Revenue Management Market – By Component

1.2.2 APAC Telecom Billing and Revenue Management Market – By Type

1.2.3 APAC Telecom Billing and Revenue Management Market – By Deployment Type

1.2.4 APAC Telecom Billing and Revenue Management Market – By Country

2. Research Methodology

2.1 Coverage

2.2 Secondary Research

2.3 Primary Research

3. Key Takeaways

4. Telecom Billing and Revenue Management Market Landscape

4.1 Market Overview

4.2 Porter’s Five Forces Analysis

4.2.1 Bargaining Power of Suppliers

4.2.2 Bargaining Power of Buyers

4.2.3 Threat of Substitutes

4.2.4 Threat of New Entrants

4.2.5 Degree of Competition

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. Telecom Billing and Revenue Management Market – Key Market Dynamics

5.1 Key Market Drivers

5.1.1 Increasing Spending Trends and Requirements on Innovative Solutions

5.1.2 Increasing Mobile Penetration in Emerging Market

5.1.3 Substantial Growth of Telecom Industry in the Last Decade and Growing Data Consumption Trend

5.1.4 Increasing Need for IoT Connections

5.2 Key Market Restraints

5.2.1 High Investments and Legacy Systems

5.3 Key Market Opportunities

5.3.1 Increasing Demand for Cloud-Based Solutions and Services

5.3.2 Inception of Several Trends and Technology

5.4 Future Trends

5.4.1 Developments in Digital Ecosystems

5.5 Impact Analysis of Drivers and Restraints

6. Telecom Billing and Revenue Management Market – APAC Analysis

6.1 Telecom Billing and Revenue Management Market Overview

6.2 Telecom Billing and Revenue Management Market – Revenue and Forecast to 2027 (US$ Million)

6.3 Market Positioning- Top Five Players

7. Telecom Billing and Revenue Management Market Analysis – By Component

7.1 Overview

7.2 Telecom Billing and Revenue Management Market Breakdown, by Component, 2019 & 2027

7.3 Solution

7.3.1 Overview

7.3.2 Solution Market Revenue and Forecast to 2027 (US$ Million)

7.3.2.1 Billing Management

7.3.2.1.1 Overview

7.3.2.2 Billing Management Market Revenue and Forecast to 2027 (US$ Million)

7.3.2.3 Account Management

7.3.2.3.1 Overview

7.3.2.4 Account Management Market Revenue and Forecast to 2027 (US$ Million)

7.3.2.5 Others

7.3.2.5.1 Overview

7.3.2.6 Others Market Revenue and Forecast to 2027 (US$ Million)

7.4 Services

7.4.1 Overview

7.4.2 Services Market Revenue and Forecast to 2027 (US$ Million)

7.4.2.1 Professional Services

7.4.2.1.1 Overview

7.4.2.2 Professional Services Market Revenue and Forecasts to 2027 (US$ Million)

7.4.2.3 Managed Services

7.4.2.3.1 Overview

7.4.2.4 Managed Services Market Revenue and Forecasts to 2027 (US$ Million)

8. Telecom Billing and Revenue Management Market Revenue and Forecast to 2027 – Type

8.1 Overview

8.2 APAC Telecom Billing and Revenue Management Market Breakdown, By Type, 2019 & 2027

8.3 Telecom billing

8.3.1 Overview

8.3.2 Telecom billing Market Forecast and Analysis

8.4 Cloud Billing

8.4.1 Overview

8.4.2 Cloud Billing Market Forecast and Analysis

8.5 IoT Billing

8.5.1 Overview

8.5.2 IoT Billing Market Forecast and Analysis

9. Telecom Billing and Revenue Management Market Revenue and Forecast to 2027 – Deployment Type

9.1 Overview

9.2 APAC Telecom Billing and Revenue Management Market Breakdown, By Deployment Type, 2019 & 2027

9.3 On-Premise

9.3.1 Overview

9.3.2 On-Premise Market Forecast and Analysis

9.4 Cloud-Based

9.4.1 Overview

9.4.2 Cloud-Based Market Forecast and Analysis

9.5 Hybrid

9.5.1 Overview

9.5.2 Hybrid Market Forecast and Analysis

10. Telecom Billing and Revenue Management Market – Country Analysis

10.1.1 APAC: Telecom Billing and Revenue Management Market, by Key Country

10.1.1.1 China: Telecom Billing and Revenue Management Market – Revenue and Forecast to 2027 (US$ Million)

10.1.1.1.1 China: Telecom Billing and Revenue Management Market Breakdown, By Component

10.1.1.1.1.1 China: Telecom Billing and Revenue Management Market Breakdown, By Solution

10.1.1.1.1.2 China: Telecom Billing and Revenue Management Market Breakdown, By Services

10.1.1.1.2 China: Telecom Billing and Revenue Management Market Breakdown, By Type

10.1.1.1.3 China: Telecom Billing and Revenue Management Market Breakdown, By Deployment Type

10.1.1.2 Japan: Telecom Billing and Revenue Management Market, Revenue and Forecast to 2027 (US$ Million)

10.1.1.2.1 Japan: Telecom Billing and Revenue Management Market Breakdown, By Component

10.1.1.2.1.1 Japan: Telecom Billing and Revenue Management Market Breakdown, By Solution

10.1.1.2.1.2 Japan: Telecom Billing and Revenue Management Market Breakdown, By Services

10.1.1.2.2 Japan: Telecom Billing and Revenue Management Market Breakdown, By Type

10.1.1.2.3 Japan: Telecom Billing and Revenue Management Market Breakdown, By Deployment Type

10.1.1.3 India: Telecom Billing and Revenue Management Market, Revenue and Forecast to 2027 (US$ Million)

10.1.1.3.1 India: Telecom Billing and Revenue Management Market Breakdown, By Component

10.1.1.3.1.1 India: Telecom Billing and Revenue Management Market Breakdown, By Solution

10.1.1.3.1.2 India: Telecom Billing and Revenue Management Market Breakdown, By Services

10.1.1.3.2 India: Telecom Billing and Revenue Management Market Breakdown, By Type

10.1.1.3.3 India: Telecom Billing and Revenue Management Market Breakdown, By Deployment Type

10.1.1.4 Australia: Telecom Billing and Revenue Management Market, Revenue and Forecast to 2027 (US$ Million)

10.1.1.4.1 Australia: Telecom Billing and Revenue Management Market Breakdown, By Component

10.1.1.4.1.1 Australia: Telecom Billing and Revenue Management Market Breakdown, By Solution

10.1.1.4.1.2 Australia: Telecom Billing and Revenue Management Market Breakdown, By Services

10.1.1.4.2 Australia: Telecom Billing and Revenue Management Market Breakdown, By Type

10.1.1.4.3 Australia: Telecom Billing and Revenue Management Market Breakdown, By Deployment Type

10.1.1.5 Rest of APAC: Telecom Billing and Revenue Management Market, Revenue and Forecast to 2027 (US$ Million)

10.1.1.5.1 Rest of APAC: Telecom Billing and Revenue Management Market Breakdown, By Component

10.1.1.5.1.1 Rest of APAC: Telecom Billing and Revenue Management Market Breakdown, By Solution

10.1.1.5.1.2 Rest of APAC: Telecom Billing and Revenue Management Market Breakdown, By Services

10.1.1.5.2 Rest of APAC: Telecom Billing and Revenue Management Market Breakdown, By Type

10.1.1.5.3 Rest of APAC: Telecom Billing and Revenue Management Market Breakdown, By Deployment Type

11. Impact of COVID-19 Pandemic on Telecom Billing and Revenue Management Market

11.1 Overview

11.2 Asia-Pacific

12. Telecom Billing and Revenue Management Market - Industry Landscape

12.1 Market Initiative

12.2 New Product Development

12.3 Merger and Acquisition

13. Company Profiles

13.1 Accenture PLC

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Nokia Corporation

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Amdocs, Inc.

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Cerillion PLC

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Comarch SA

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 CSG Systems International, Inc.

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Fiserv, Inc.

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Ericsson

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Hewlett Packard Enterprise Development LP (HPE)

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 Huawei Technologies Co., Ltd.

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

13.11 Mphasis

13.11.1 Key Facts

13.11.2 Business Description

13.11.3 Products and Services

13.11.4 Financial Overview

13.11.5 SWOT Analysis

13.11.6 Key Developments

13.12 NEC corporation

13.12.1 Key Facts

13.12.2 Business Description

13.12.3 Products and Services

13.12.4 Financial Overview

13.12.5 SWOT Analysis

13.12.6 Key Developments

13.13 Oracle Corporation

13.13.1 Key Facts

13.13.2 Business Description

13.13.3 Products and Services

13.13.4 Financial Overview

13.13.5 SWOT Analysis

13.13.6 Key Developments

13.14 Optiva Inc.

13.14.1 Key Facts

13.14.2 Business Description

13.14.3 Products and Services

13.14.4 Financial Overview

13.14.5 SWOT Analysis

13.14.6 Key Developments

13.15 Mavenir Systems

13.15.1 Key Facts

13.15.2 Business Description

13.15.3 Products and Services

13.15.4 Financial Overview

13.15.5 SWOT Analysis

13.15.6 Key Developments

13.16 SAP SE

13.16.1 Key Facts

13.16.2 Business Description

13.16.3 Product and Services

13.16.4 Financial Overview

13.16.5 SWOT Analysis

13.16.6 Key Developments

13.17 Tata Consultancy Services Limited (TCS)

13.17.1 Key Facts

13.17.2 Business Description

13.17.3 Services

13.17.4 Financial Overview

13.17.5 SWOT Analysis

13.17.6 Key Developments

13.18 AGILITY CIS

13.18.1 Key Facts

13.18.2 Business Description

13.18.3 Products and Services

13.18.4 Financial Overview

13.18.5 SWOT Analysis

13.18.6 Key Developments

13.19 Comviva

13.19.1 Key Facts

13.19.2 Business Description

13.19.3 Products and Services

13.19.4 Financial Overview

13.19.5 SWOT Analysis

13.19.6 Key Developments

13.20 Enghouse Networks

13.20.1 Key Facts

13.20.2 Business Description

13.20.3 Products and Services

13.20.4 Financial Overview

13.20.5 SWOT Analysis

13.20.6 Key Developments

13.21 PANAMAX INC

13.21.1 Key Facts

13.21.2 Business Description

13.21.3 Products and Services

13.21.4 Financial Overview

13.21.5 SWOT Analysis

13.21.6 Key Developments

13.22 STL.TECH

13.22.1 Key Facts

13.22.2 Business Description

13.22.3 Products and Services

13.22.4 Financial Overview

13.22.5 SWOT Analysis

13.22.6 Key Developments

13.23 Vcare corporation

13.23.1 Key Facts

13.23.2 Business Description

13.23.3 Products and Services

13.23.4 Financial Overview

13.23.5 SWOT Analysis

13.23.6 Key Developments

There is no recent development by the company from last 5 years

.

14. Appendix

14.1 About The Insight Partners

14.2 Glossary of Terms

LIST OF TABLES

Table 1. Telecom Billing and Revenue Management Market – Revenue and Forecast to 2027 (US$ Million)

Table 2. APAC: Telecom Billing and Revenue Management Market, by Component – Revenue and Forecast to 2027 (US$ Million)

Table 3. APAC: Telecom Billing and Revenue Management Market, Revenue and Forecast to 2027 – By Type (US$ Million)

Table 4. APAC: Telecom Billing and Revenue Management Market, Revenue and Forecast to 2027 – By Deployment Type (US$ Million)

Table 5. China: Telecom Billing and Revenue Management Market, Revenue and Forecast to 2027 – By Component (US$ Million)

Table 6. China: Telecom Billing and Revenue Management Market, Revenue and Forecast To 2027 – By Solution (US$ Million)

Table 7. China: Telecom Billing and Revenue Management Market, Revenue and Forecast To 2027 – By Services (US$ Million)

Table 8. China: Telecom Billing and Revenue Management Market, Revenue and Forecast to 2027 – By Type (US$ Million)

Table 9. China: Telecom Billing and Revenue Management Market, Revenue and Forecast to 2027 – By Deployment Type (US$ Million)

Table 10. Japan: Telecom Billing and Revenue Management Market, Revenue and Forecast to 2027 – By Component (US$ Million)

Table 11. Japan: Telecom Billing and Revenue Management Market, Revenue and Forecast To 2027 – By Solution (US$ Million)

Table 12. Japan: Telecom Billing and Revenue Management Market, Revenue and Forecast To 2027 – By Services (US$ Million)

Table 13. Japan: Telecom Billing and Revenue Management Market, Revenue and Forecast to 2027 – By Type (US$ Million)

Table 14. Japan: Telecom Billing and Revenue Management Market, Revenue and Forecast to 2027 – By Deployment Type (US$ Million)

Table 15. India: Telecom Billing and Revenue Management Market, Revenue and Forecast To 2027 – By Component (US$ Million)

Table 16. India: Telecom Billing and Revenue Management Market, Revenue and Forecast To 2027 – By Solution (US$ Million)

Table 17. India: Telecom Billing and Revenue Management Market, Revenue and Forecast To 2027 – By Services (US$ Million)

Table 18. India: Telecom Billing and Revenue Management Market, Revenue and Forecast to 2027 – By Type (US$ Million)

Table 19. India: Telecom Billing and Revenue Management Market, Revenue and Forecast to 2027 – By Deployment Type (US$ Million)

Table 20. Australia: Telecom Billing and Revenue Management Market, Revenue and Forecast to 2027 – By Component (US$ Million)

Table 21. Australia: Telecom Billing and Revenue Management Market, Revenue and Forecast To 2027 – By Solution (US$ Million)

Table 22. Australia: Telecom Billing and Revenue Management Market, Revenue and Forecast To 2027 – By Services (US$ Million)

Table 23. Australia: Telecom Billing and Revenue Management Market, Revenue and Forecast To 2027 – By Type (US$ Million)

Table 24. Australia: Telecom Billing and Revenue Management Market, Revenue and Forecast to 2027 – By Deployment Type (US$ Million)

Table 25. Rest of APAC: Telecom Billing and Revenue Management Market, Revenue and Forecast to 2027 – By Component (US$ Million)

Table 26. Rest of APAC: Telecom Billing and Revenue Management Market, Revenue and Forecast to 2027 – By Solution (US$ Million)

Table 27. Rest of APAC: Telecom Billing and Revenue Management Market, Revenue and Forecast to 2027 – By Services (US$ Million)

Table 28. Rest of APAC: Telecom Billing and Revenue Management Market, Revenue and Forecast to 2027 – By Type (US$ Million)

Table 29. Rest of APAC: Telecom Billing and Revenue Management Market, Revenue and Forecast to 2027 – By Deployment Type (US$ Million)

Table 30. Glossary of Term: Telecom Billing and Revenue Management Market

LIST OF FIGURES

Figure 1. Telecom Billing and Revenue Management Market Segmentation

Figure 2. Telecom Billing and Revenue Management Market Segmentation - Country

Figure 3. Telecom Billing and Revenue Management Market, by Component

Figure 4. Telecom Billing and Revenue Management Market, by Type

Figure 5. Telecom Billing and Revenue Management Market, by Country

Figure 6. Telecom Billing and Revenue Management Market Overview

Figure 7. Telecom Billing and Revenue Management Market Porter’s Five Forces Analysis

Figure 8. Telecom Billing and Revenue Management Market- Ecosystem Analysis

Figure 9. Global Mobile Internet Penetration (%), 2017

Figure 10. Global Internet Users, 2005-2019

Figure 11. IoT connections worldwide, 2015-2025

Figure 12. Telecom Billing and Revenue Management Market Impact Analysis of Driver and Restraints

Figure 13. Telecom Billing and Revenue Management Market – Revenue and Forecast to 2027 (US$ Million)

Figure 14. Telecom Billing and Revenue Management Market Breakdown, by Component (2019 and 2027)

Figure 15. Solution Market Revenue and Forecast to 2027(US$ Million)

Figure 16. Billing Management Market Revenue and Forecasts to 2027 (US$ Million)

Figure 17. Account Management Market Revenue and Forecasts to 2027 (US$ Million)

Figure 18. Others Market Revenue and Forecasts to 2027 (US$ Million)

Figure 19. Services Market Revenue and Forecast to 2027(US$ Million)

Figure 20. Professional Services Market Revenue and Forecasts to 2027 (US$ Million)

Figure 21. Managed Services Market Revenue and Forecasts to 2027 (US$ Million)

Figure 22. APAC Telecom Billing and Revenue Management Market Breakdown, By Type, 2019 & 2027 (%)

Figure 23. Telecom billing Market Revenue and Forecast to 2027 (US$ Million)

Figure 24. Cloud Billing Market Revenue and Forecast to 2027 (US$ Million)

Figure 25. IoT Billing Market Revenue and Forecast to 2027 (US$ Million)

Figure 26. APAC Telecom Billing and Revenue Management Market Breakdown, By Deployment Type, 2019 & 2027 (%)

Figure 27. APAC On-Premise Market Revenue and Forecast to 2027(US$ Million)

Figure 28. Cloud-Based Market Revenue and Forecast to 2027(US$ Million)

Figure 29. Hybrid Market Revenue and Forecast to 2027(US$ Million)

Figure 30. APAC: Telecom Billing and Revenue Management Market Revenue Share, By Key Country (2019 and 2027)

Figure 31. China: Telecom Billing and Revenue Management Market – Revenue and Forecast to 2027 (US$ Million)

Figure 32. Japan: Telecom Billing and Revenue Management Market, Revenue and Forecast to 2027 (US$ Million)

Figure 33. India: Telecom Billing and Revenue Management Market, Revenue and Forecast to 2027 (US$ Million)

Figure 34. Australia: Telecom Billing and Revenue Management Market, Revenue and Forecast to 2027 (US$ Million)

Figure 35. Rest of APAC: Telecom Billing and Revenue Management Market, Revenue and Forecast to 2027 (US$ Million)

Figure 36. Impact of COVID-19 Pandemic in Asia Pacific Country Markets

- Accenture PLC

- Nokia Corporation

- Amdocs, Inc.

- Cerillion PLC

- Comarch SA

- CSG Systems International, Inc.

- Fiserv, Inc.

- Ericsson

- Hewlett Packard Enterprise Development LP (HPE)

- Huawei Technologies Co., Ltd.

- Mphasis

- NEC Corporation

- Oracle Corporation

- Optiva Inc.

- Mavenir Systems

- SAP SE

- Tata Consultancy Services Limited (TCS)

- AGILITY CIS

- Comviva

- Enghouse Networks

- PANAMAX INC

- STL.TECH

- Vcare Corporation

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For