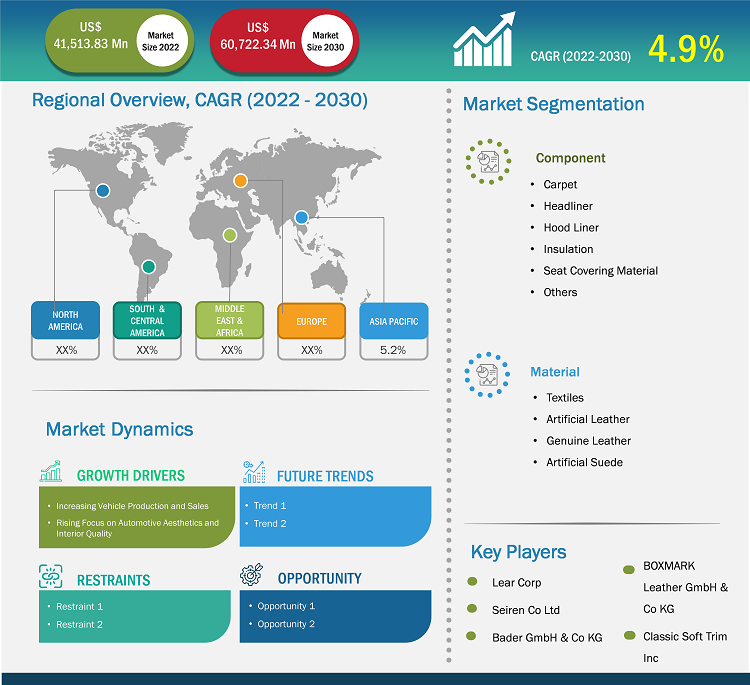

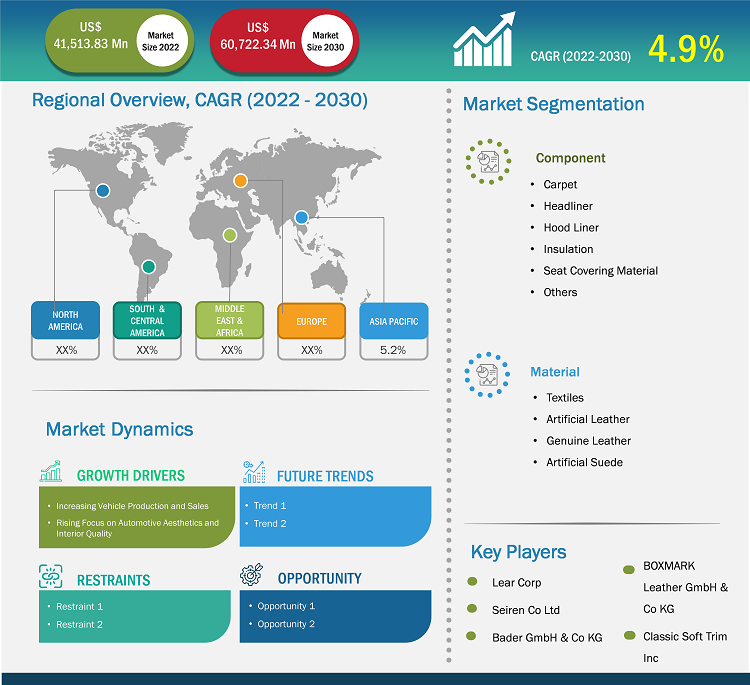

[Research Report] The automotive fabric market size was valued at US$ 41,513.83 million in 2022 and is projected to reach US$ 60,722.34 million by 2030; it is anticipated to record a CAGR of 4.9% from 2022 to 2030.

MARKET ANALYSIS

Automotive fabrics are the types of fabrics available in the form of woven, nonwoven, and coated. These type of fabric materials is quite flexible and possesses features such as resistance to UV rays and cold cracking along with durability and lightweight in design. Automotive fabrics provide seating comfort as well as promote the overall aesthetic experience. The growth of the market is strongly driven by advancements in technology, along with a preference toward superior comfort and high-quality materials. With the increasing production of automobiles, the demand for automobile accessories has also increased, which is expected to contribute to the growth of the automotive fabric market in the coming years.

GROWTH DRIVERS AND CHALLENGES

The advancement in automotive manufacturing capabilities and rising demand for electric vehicles are a few factors boosting the global automotive industry growth. Automotive is one of the leading industries in Europe as it contributes significantly to the GDPs of European countries, including Germany, Italy, and the UK, among others. The focus on developing automotive interior and exterior aesthetics and properties has increased, owing to consumer emphasis on quality and aesthetics, which drives the demand for automotive fabrics. Governments of various countries imposed stringent safety regulations, including the mandatory installation and use of seat belts, airbags, and anti-lock braking systems to promote in-vehicle safety, which is boosting the demand for high-performing and safe automotive fabric materials. Thus, the increasing vehicle production and rising focus on automotive aesthetics fuels the automotive fabric market growth.

Polyvinyl chloride (PVC) and polyurethane (PU) are two of the most used synthetic plastic polymers to make synthetic leather. The process of manufacturing synthetic leather made by using plastic is not an eco-friendly method. The production process of plastics used in most synthetic leathers is often a relatively energy-intensive and chemical-filled process that also produces significant waste. Hence, the harmful effects of PVC and PU, coupled with less durability of synthetic leather compared to leather, restrain the automotive fabric market growth.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Automotive Fabric Market: Strategic Insights

Market Size Value in US$ 41,513.83 million in 2022 Market Size Value by US$ 60,722.34 million by 2030 Growth rate CAGR of 4.9% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Automotive Fabric Market: Strategic Insights

| Market Size Value in | US$ 41,513.83 million in 2022 |

| Market Size Value by | US$ 60,722.34 million by 2030 |

| Growth rate | CAGR of 4.9% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

REPORT SEGMENTATION AND SCOPE

The "Global Automotive Fabric Market Analysis and Forecast to 2030" is a specialized and in-depth study with a significant focus on global market trends and growth opportunities. The report aims to provide an overview of the global market with detailed market segmentation on the basis of component, material, and geography. The report provides key statistics on the consumption of automotive fabric across the world, along with their demand in major regions and countries. In addition, the report provides a qualitative assessment of various factors affecting the automotive fabric market performance in major regions and countries. It also includes a comprehensive analysis of the leading players in the automotive fabric market and their key strategic developments. Analysis of the market dynamics is also included to help identify the key driving factors, market trends, and lucrative opportunities, which, in turn, aid in identifying the major revenue pockets.

The ecosystem analysis and Porter’s five forces analysis provide a 360-degree view of the global automotive fabric market, which helps understand the entire supply chain and various factors affecting the market growth.

SEGMENTAL ANALYSIS

The global automotive fabric market is divided on the basis of component and material. Based on component, the automotive fabric market is segmented into carpet, headliner, hood liner, insulation, seat covering material, and others. Based on material, the market is segmented into textiles, artificial leather, genuine leather, and artificial suede. Further, the carpet segment accounted for a significant share of the automotive fabric market in 2022. Fabrics for carpets are exclusively designed by a needle-punched, nonwoven, or tufted fabric. Polyester, polyamide, polypropylene, and aramid are preferably used as fiber materials in designing carpets to enhance automotive interiors. Headliners are composed of tricot knit fabric that offers a soft touch and uniform appeal and adds to overall interior styling. A hood liner is composed of a thin layer of insulating material with a proper sound barrier element, which prevents noise arising from the engine due to faulty hood insulation. Acoustic and thermal insulation is considered one of the essential features deployed across various automotive parts such as engine covers, under trays, bonnets, and other such automotive parts. Tri-laminate polyester is used as automotive seat fabric for many types of car seats.

Based on material, the textiles segment accounted for a significant share in 2022. Automotive textiles have several applications in cars, trains, buses, and other vehicles. Automotive textiles comprise different types of textile components, such as yarn fibers, filaments, and other fabrics. Artificial leather, also known as faux leather or synthetic leather, is designed with the help of polyvinyl chloride (PVC) or polyurethane (PU). Genuine leather is perceived to be an expensive form of fabric material used in the automotive industry for upholstery components. The demand for synthetic suede continues to grow, often used for designing high-end automobile components. With the shift in consumer lifestyle and rising preference toward luxury driving and car-sharing services, the market for artificial suede is thriving globally.

REGIONAL ANALYSIS

The report provides a detailed overview of the global automotive fabric market with respect to five major regions—North America, Europe, Asia-Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. Asia Pacific accounted for a significant share of automotive fabric market and was valued at more than US$ 20 billion in 2022. Asia Pacific is a hub for automotive manufacturing with a large presence of international and domestic players operating in the region. The International Organization of Motor Vehicle Manufacturers report stated that various countries in Asia Pacific produced ~46.73 million units of motor vehicles in 2021. The Europe market is expected to reach more than US$ 10 billion by 2030. The automotive industry is a major industry in Europe as it contributes significantly to the GDP of many European countries, including Germany, the UK, and Italy. Automotive fabric is extensively used in automotive carpeting, trunk areas, interior trims, soundproofing, and insulation. The North America automotive fabric market is expected to record a CAGR of ~4% from 2022 to 2030. North America has well-established automotive manufacturers such as Audi AG, Bayerische Motoren Werke AG, Stellantis NV, Ford Motor Company, Honda Motor Co Ltd, Hyundai Motor Company, Mercedes Benz, and Volkswagen Group. Therefore, the expansion of the automotive industry is projected to fuel the demand for automotive fabrics in North America in the coming years.

INDUSTRY DEVELOPMENTS AND FUTURE OPPORTUNITIES

Various initiatives taken by the key players operating in the automotive fabric market are listed below:

- In September 2023, Apex Mills acquired the HanesBrands Inc. facility in Stuart, the US. The acquisition has helped in the expansion of elastomeric knitting, dyeing, and finishing capabilities.

- In March 2022, Lear Corp completed the acquisition of Thagora Technology SRL, a Roman company. The acquisition helped Lear Corp to add scalable smart manufacturing technology to its competencies.

- In February 2022, Lear Corp announced the complete acquisition of Kongsberg Automotive’s Interior Comfort Systems business unit. The acquisition enhanced Lear’s seat component capabilities and expanded product offerings.

Automotive Fabric Market Report Scope

IMPACT OF COVID-19 PANDEMIC/IMPACT OF GEOPOLITICAL SCENARIO/IMPACT OF RECESSION

Before the COVID-19 pandemic, many countries across the globe reported economic growth. The key manufacturers invested in the research and development of automotive fabric. They also focused on the expansion of geographic reach through merger and acquisition strategies to cater to a wide customer base. Before the COVID-19 pandemic, the automotive fabric producers reported steady growth in manufacturing, due to increasing demand from the automotive industry. The automotive fabric manufacturers were more focused on developing eco-friendly, durable, and easy-to-clean fabrics. According to the US International Trade Commission (USITC), owing to the high vulnerability of the automotive industry, vehicle sales in the US decreased by 15% in 2020 compared to 2019. During the pandemic, supply chain disruptions, raw material and labor shortages, and operational difficulties created a demand and supply gap, which adversely affected the automotive fabric market growth. Manufacturers reported challenges in sourcing raw materials and ingredients from suppliers, thereby impacting the production rate of automotive fabric.

Further, production shortfall caused by severe disruptions in supply chains and limited skilled laborers created a demand-supply gap in many regions, particularly Asia Pacific, Europe, and North America. The demand and supply gap was also recorded in the aforementioned regions due to fluctuating demand from the automotive industry. In 2021, rising vaccination rates contributed to improvements in the overall conditions in different countries, which led to conducive environments for the chemicals & materials industry. The sales of automotive fabric increased with the resumption of production & sales operations of companies operating in the automotive industry.

COMPETITIVE LANDSCAPE AND KEY COMPANIES

Lear Corp, Bader GmbH & Co KG, BOXMARK Leather GmbH & Co KG, AUNDE Group SE, Grupo Empresarial Copo SA, Classic Soft Trim Inc, Dual Borgstena Textile Portugal Unipessoal Lda, Shawmut Corp; Apex Mills Corp, Seiren Co Ltd are among the key players operating in the automotive fabric market.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, and Material

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The carpet segment held the largest market share. Automotive carpet is effectively designed to keep the vehicle's floor free from dirt, wear, and corrosion from salt, thereby maintaining cleanliness.

The textiles segment held the largest share of the market in 2022. Automotive textiles have several applications in cars, buses, and other vehicles. Automotive textiles comprise different types of textile components such as yarn fibers, filaments, and other fabrics.

Asia Pacific is estimated to register the fastest CAGR in the global automotive fabric market over the forecast period. The growing automotive industry in Asia Pacific is expected to create lucrative business opportunities for the automotive fabric market players in the region during the forecast period.

The carpet segment is estimated to register the fastest CAGR in the global automotive fabric market over the forecast period. Polyester, polyamide, polypropylene, and aramid are preferably used as fiber materials in designing carpets to enhance automotive interiors.

In 2022, Asia Pacific held the largest revenue share of the global automotive fabric market. The automotive fabric market growth in Australia, China, India, and Indonesia is attributed to growing automotive production in the region.

The major players operating in the global automotive fabric market are Lear Corp, Bader GmbH & Co KG, BOXMARK Leather GmbH & Co KG, AUNDE Group SE, Grupo Empresarial Copo SA, Classic Soft Trim Inc, Dual Borgstena Textile Portugal Unipessoal Lda, Shawmut Corp; Apex Mills Corp, Seiren Co Ltd, DK Schweizer Leather Sdn Bhd, Suminoe Textile Co Ltd, JBS Couros SA, Kyowa Leather Cloth Co Ltd, Moriden America Inc, Scottish Leather Group Ltd, Vulcaflex SpA, TB Kawashima Co Ltd, Martur Fompak International, and Sage Automotive Interiors Inc.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness

2.2.1 Market Attractiveness

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Global Automotive Fabric Market Landscape

4.1 Overview

4.2 Porter's Five Forces Analysis

4.2.1 Bargaining Power of Suppliers

4.2.2 Bargaining Power of Buyers

4.2.3 Threat of New Entrants

4.2.4 Intensity of Competitive Rivalry

4.2.5 Threat of Substitutes

4.3 Ecosystem Analysis

4.3.1 Raw Material Suppliers

4.3.2 Automotive Fabric Manufacturers

4.3.3 Distributors/Suppliers

4.3.4 End-Use Industries

4.4 List of Vendors in the Value Chain

4.4.1 List of Raw Material Suppliers

4.4.2 List of Manufacturers

5. Global Automotive Fabric Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Increasing Vehicle Production and Sales

5.1.2 Rising Focus on Automotive Aesthetics and Interior Quality

5.2 Market Restraints

5.2.1 Harmful Effects of PVC and PU and Durability Issues of Synthetic Leather

5.3 Market Opportunities

5.3.1 Innovative Technological Development in Automotive Fabric Industry

5.4 Future Trends

5.4.1 Adoption of Sustainable Fabrics

5.5 Impact Analysis

6. Global Automotive Fabric Market - Global Market Analysis

6.1 Global Automotive Fabric Market Revenue (US$ Million)

6.2 Global Automotive Fabric Market Forecast and Analysis

7. Global Automotive Fabric Market Analysis - Component

7.1 Carpet

7.1.1 Overview

7.1.2 Carpet Market Revenue and Forecast to 2030 (US$ Million)

7.2 Headliner

7.2.1 Overview

7.2.2 Headliner Market Revenue and Forecast to 2030 (US$ Million)

7.3 Hood Liner

7.3.1 Overview

7.3.2 Hood Liner Market Revenue and Forecast to 2030 (US$ Million)

7.4 Insulation

7.4.1 Overview

7.4.2 Insulation Market Revenue and Forecast to 2030 (US$ Million)

7.5 Seat Covering Material

7.5.1 Overview

7.5.2 Seat Covering Material Market Revenue and Forecast to 2030 (US$ Million)

7.6 Others

7.6.1 Overview

7.6.2 Others Market Revenue and Forecast to 2030 (US$ Million)

8. Global Automotive Fabric Market Analysis - Material

8.1 Textiles

8.1.1 Overview

8.1.2 Textiles Market Revenue, and Forecast to 2030 (US$ Million)

8.2 Artificial Leather

8.2.1 Overview

8.2.2 Artificial Leather Market Revenue and Forecast to 2030 (US$ Million)

8.3 Genuine Leather

8.3.1 Overview

8.3.2 Genuine Leather Market Revenue and Forecast to 2030 (US$ Million)

8.4 Artificial Suede

8.4.1 Overview

8.4.2 Artificial Suede Market Revenue and Forecast to 2030 (US$ Million)

9. Global Automotive Fabric Market - Geographical Analysis

9.1 North America

9.1.1 North America Automotive Fabric Market Overview

9.1.2 North America Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.1.3 North America Automotive Fabric Market Breakdown by Component

9.1.3.1 North America Automotive Fabric Market Revenue and Forecasts and Analysis - By Component

9.1.4 North America Automotive Fabric Market Breakdown by Material

9.1.4.1 North America Automotive Fabric Market Revenue and Forecasts and Analysis - By Material

9.1.5 North America Automotive Fabric Market Revenue and Forecasts and Analysis - By Countries

9.1.5.1 Automotive Fabric Market Breakdown by Country

9.1.5.2 US Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.1.5.2.1 US Automotive Fabric Market Breakdown by Component

9.1.5.2.2 US Automotive Fabric Market Breakdown by Material

9.1.5.3 Canada Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.1.5.3.1 Canada Automotive Fabric Market Breakdown by Component

9.1.5.3.2 Canada Automotive Fabric Market Breakdown by Material

9.1.5.4 Mexico Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.1.5.4.1 Mexico Automotive Fabric Market Breakdown by Component

9.1.5.4.2 Mexico Automotive Fabric Market Breakdown by Material

9.2 Europe

9.2.1 Europe Automotive Fabric Market Overview

9.2.2 Europe Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.2.3 Europe Automotive Fabric Market Breakdown by Component

9.2.3.1 Europe Automotive Fabric Market Revenue and Forecasts and Analysis - By Component

9.2.4 Europe Automotive Fabric Market Breakdown by Material

9.2.4.1 Europe Automotive Fabric Market Revenue and Forecasts and Analysis - By Material

9.2.5 Europe Automotive Fabric Market Revenue and Forecasts and Analysis - By Countries

9.2.5.1 Automotive Fabric Market Breakdown by Country

9.2.5.2 Germany Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.2.5.2.1 Germany Automotive Fabric Market Breakdown by Component

9.2.5.2.2 Germany Automotive Fabric Market Breakdown by Material

9.2.5.3 France Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.2.5.3.1 France Automotive Fabric Market Breakdown by Component

9.2.5.3.2 France Automotive Fabric Market Breakdown by Material

9.2.5.4 Italy Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.2.5.4.1 Italy Automotive Fabric Market Breakdown by Component

9.2.5.4.2 Italy Automotive Fabric Market Breakdown by Material

9.2.5.5 UK Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.2.5.5.1 UK Automotive Fabric Market Breakdown by Component

9.2.5.5.2 UK Automotive Fabric Market Breakdown by Material

9.2.5.6 Russia Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.2.5.6.1 Russia Automotive Fabric Market Breakdown by Component

9.2.5.6.2 Russia Automotive Fabric Market Breakdown by Material

9.2.5.7 Poland Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.2.5.7.1 Poland Automotive Fabric Market Breakdown by Component

9.2.5.7.2 Poland Automotive Fabric Market Breakdown by Material

9.2.5.8 Sweden Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.2.5.8.1 Sweden Automotive Fabric Market Breakdown by Component

9.2.5.8.2 Sweden Automotive Fabric Market Breakdown by Material

9.2.5.9 Rest of Europe Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.2.5.9.1 Rest of Europe Automotive Fabric Market Breakdown by Component

9.2.5.9.2 Rest of Europe Automotive Fabric Market Breakdown by Material

9.3 Asia Pacific

9.3.1 Asia Pacific Automotive Fabric Market Overview

9.3.2 Asia Pacific Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.3.3 Asia Pacific Automotive Fabric Market Breakdown by Component

9.3.3.1 Asia Pacific Automotive Fabric Market Revenue and Forecasts and Analysis - By Component

9.3.4 Asia Pacific Automotive Fabric Market Breakdown by Material

9.3.4.1 Asia Pacific Automotive Fabric Market Revenue and Forecasts and Analysis - By Material

9.3.5 Asia Pacific Automotive Fabric Market Revenue and Forecasts and Analysis - By Countries

9.3.5.1 Automotive Fabric Market Breakdown by Country

9.3.5.2 Australia Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.3.5.2.1 Australia Automotive Fabric Market Breakdown by Component

9.3.5.2.2 Australia Automotive Fabric Market Breakdown by Material

9.3.5.3 China Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.3.5.3.1 China Automotive Fabric Market Breakdown by Component

9.3.5.3.2 China Automotive Fabric Market Breakdown by Material

9.3.5.4 India Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.3.5.4.1 India Automotive Fabric Market Breakdown by Component

9.3.5.4.2 India Automotive Fabric Market Breakdown by Material

9.3.5.5 Japan Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.3.5.5.1 Japan Automotive Fabric Market Breakdown by Component

9.3.5.5.2 Japan Automotive Fabric Market Breakdown by Material

9.3.5.6 South Korea Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.3.5.6.1 South Korea Automotive Fabric Market Breakdown by Component

9.3.5.6.2 South Korea Automotive Fabric Market Breakdown by Material

9.3.5.7 Rest of Asia Pacific Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.3.5.7.1 Rest of Asia Pacific Automotive Fabric Market Breakdown by Component

9.3.5.7.2 Rest of Asia Pacific Automotive Fabric Market Breakdown by Material

9.4 Middle East and Africa

9.4.1 Middle East and Africa Automotive Fabric Market Overview

9.4.2 Middle East and Africa Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.4.3 Middle East and Africa Automotive Fabric Market Breakdown by Component

9.4.3.1 Middle East and Africa Automotive Fabric Market Revenue and Forecasts and Analysis - By Component

9.4.4 Middle East and Africa Automotive Fabric Market Breakdown by Material

9.4.4.1 Middle East and Africa Automotive Fabric Market Revenue and Forecasts and Analysis - By Material

9.4.5 Middle East and Africa Automotive Fabric Market Revenue and Forecasts and Analysis - By Countries

9.4.5.1 Automotive Fabric Market Breakdown by Country

9.4.5.2 South Africa Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.4.5.2.1 South Africa Automotive Fabric Market Breakdown by Component

9.4.5.2.2 South Africa Automotive Fabric Market Breakdown by Material

9.4.5.3 Saudi Arabia Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.4.5.3.1 Saudi Arabia Automotive Fabric Market Breakdown by Component

9.4.5.3.2 Saudi Arabia Automotive Fabric Market Breakdown by Material

9.4.5.4 UAE Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.4.5.4.1 UAE Automotive Fabric Market Breakdown by Component

9.4.5.4.2 UAE Automotive Fabric Market Breakdown by Material

9.4.5.5 Morocco Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.4.5.5.1 Morocco Automotive Fabric Market Breakdown by Component

9.4.5.5.2 Morocco Automotive Fabric Market Breakdown by Material

9.4.5.6 Rest of Middle East & Africa Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.4.5.6.1 Rest of Middle East & Africa Automotive Fabric Market Breakdown by Component

9.4.5.6.2 Rest of Middle East & Africa Automotive Fabric Market Breakdown by Material

9.5 South & Central America

9.5.1 South & Central America Automotive Fabric Market Overview

9.5.2 South & Central America Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.5.3 South & Central America Automotive Fabric Market Breakdown by Component

9.5.3.1 South & Central America Automotive Fabric Market Revenue and Forecasts and Analysis - By Component

9.5.4 South & Central America Automotive Fabric Market Breakdown by Material

9.5.4.1 South & Central America Automotive Fabric Market Revenue and Forecasts and Analysis - By Material

9.5.5 South & Central America Automotive Fabric Market Revenue and Forecasts and Analysis - By Countries

9.5.5.1 Automotive Fabric Market Breakdown by Country

9.5.5.2 Brazil Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.5.5.2.1 Brazil Automotive Fabric Market Breakdown by Component

9.5.5.2.2 Brazil Automotive Fabric Market Breakdown by Material

9.5.5.3 Argentina Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.5.5.3.1 Argentina Automotive Fabric Market Breakdown by Component

9.5.5.3.2 Argentina Automotive Fabric Market Breakdown by Material

9.5.5.4 Rest of South & Central America Automotive Fabric Market Revenue and Forecasts to 2030 (US$ Million)

9.5.5.4.1 Rest of South & Central America Automotive Fabric Market Breakdown by Component

9.5.5.4.2 Rest of South & Central America Automotive Fabric Market Breakdown by Material

10. Impact of COVID-19 Pandemic on Global Automotive Fabric Market

10.1 Pre & Post Covid-19 Impact

11. Competitive Landscape

11.1 Heat Map Analysis By Key Players

11.2 Company Positioning & Concentration

12. Industry Landscape

12.1 Overview

12.2 New Product Development

12.3 Merger and Acquisition

13. Company Profiles

13.1 Lear Corp

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Bader GmbH & Co KG

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 BOXMARK Leather GmbH & Co KG

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 AUNDE Group SE

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Grupo Empresarial Copo SA

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Classic Soft Trim Inc

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Dual Borgstena Textile Portugal Unipessoal Lda

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Shawmut Corp

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Apex Mills Corp

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 Seiren Co Ltd

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

14. Appendix

List of Tables

Table 1. Global Automotive Fabric Market Segmentation

Table 2. Global Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Table 3. Global Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – Component

Table 4. Global Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – Material

Table 5. North America Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 6. North America Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 7. US Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 8. US Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 9. Canada Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 10. Canada Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 11. Mexico Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 12. Mexico Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 13. Europe Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 14. Europe Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 15. Germany Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 16. Germany Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 17. France Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 18. France Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 19. Italy Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 20. Italy Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 21. UK Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 22. UK Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 23. Russia Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 24. Russia Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 25. Poland Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 26. Poland Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 27. Sweden Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 28. Sweden Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 29. Rest of Europe Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 30. Rest of Europe Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 31. Asia Pacific Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 32. Asia Pacific Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 33. Australia Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 34. Australia Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 35. China Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 36. China Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 37. India Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 38. India Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 39. Japan Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 40. Japan Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 41. South Korea Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 42. South Korea Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 43. Rest of Asia Pacific Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 44. Rest of Asia Pacific Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 45. Middle East and Africa Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 46. Middle East and Africa Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 47. South Africa Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 48. South Africa Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 49. Saudi Arabia Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 50. Saudi Arabia Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 51. UAE Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 52. UAE Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 53. Morocco Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 54. Morocco Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 55. Rest of Middle East & Africa Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 56. Rest of Middle East & Africa Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 57. South & Central America Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 58. South & Central America Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 59. Brazil Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 60. Brazil Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 61. Argentina Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 62. Argentina Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 63. Rest of South & Central America Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Component

Table 64. Rest of South & Central America Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million) – By Material

Table 65. Company Positioning & Concentration

List of Figures

Figure 1. Global Automotive Fabric Market Segmentation, By Geography

Figure 2. Porter's Five Forces Analysis

Figure 3. Ecosystem: Automotive Fabric Market

Figure 4. Market Dynamics: Global Automotive Fabric Market

Figure 5. Global Automotive Fabric Market Impact Analysis of Drivers and Restraints

Figure 6. Global Automotive Fabric Market Revenue (US$ Million), 2020 – 2030

Figure 7. Automotive Fabric Market Share (%) – Component, 2022 and 2030

Figure 8. Carpet Market Revenue and Forecasts To 2030 (US$ Million)

Figure 9. Headliner Market Revenue and Forecasts To 2030 (US$ Million)

Figure 10. Hood Liner Market Revenue and Forecasts To 2030 (US$ Million)

Figure 11. Insulation Market Revenue and Forecasts To 2030 (US$ Million)

Figure 12. Seat Covering Material Market Revenue and Forecasts To 2030 (US$ Million)

Figure 13. Others Market Revenue and Forecasts To 2030 (US$ Million)

Figure 14. Global Automotive Fabric Market Share (%) – Material, 2022 and 2030

Figure 15. Textiles Market Revenue and Forecasts To 2030 (US$ Million)

Figure 16. Artificial Leather Market Revenue and Forecasts To 2030 (US$ Million)

Figure 17. Genuine Leather Market Revenue and Forecasts To 2030 (US$ Million)

Figure 18. Artificial Suede Market Revenue and Forecasts To 2030 (US$ Million)

Figure 19. Automotive Fabric Market Breakdown by Geography, 2022 and 2030 (%)

Figure 20. Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 21. Automotive Fabric Market Breakdown by Component (2022 and 2030)

Figure 22. Automotive Fabric Market Breakdown by Material (2022 and 2030)

Figure 23. Automotive Fabric Market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 24. US Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 25. Canada Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 26. Mexico Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 27. Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 28. Automotive Fabric Market Breakdown by Component (2022 and 2030)

Figure 29. Automotive Fabric Market Breakdown by Material (2022 and 2030)

Figure 30. Automotive Fabric Market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 31. Germany Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 32. France Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 33. Italy Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 34. UK Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 35. Russia Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 36. Poland Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 37. Sweden Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 38. Rest of Europe Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 39. Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 40. Automotive Fabric Market Breakdown by Component (2022 and 2030)

Figure 41. Automotive Fabric Market Breakdown by Material (2022 and 2030)

Figure 42. Automotive Fabric Market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 43. Australia Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 44. China Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 45. India Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 46. Japan Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 47. South Korea Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 48. Rest of Asia Pacific Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 49. Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 50. Automotive Fabric Market Breakdown by Component (2022 and 2030)

Figure 51. Middle East and Africa Automotive Fabric Market Breakdown by Material (2022 and 2030)

Figure 52. Automotive Fabric Market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 53. South Africa Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 54. Saudi Arabia Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 55. UAE Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 56. Morocco Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 57. Rest of Middle East & Africa Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 58. Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 59. Automotive Fabric Market Breakdown by Component (2022 and 2030)

Figure 60. South & Central America Automotive Fabric Market Breakdown by Material (2022 and 2030)

Figure 61. Automotive Fabric Market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 62. Brazil Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 63. Argentina Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 64. Rest of South & Central America Automotive Fabric Market Revenue and Forecasts To 2030 (US$ Million)

Figure 65. Heat Map Analysis By Key Players

The List of Companies - Automotive Fabric Market

- Lear Corp

- Bader GmbH & Co KG

- BOXMARK Leather GmbH & Co KG

- AUNDE Group SE

- Grupo Empresarial Copo SA

- Classic Soft Trim Inc

- Dual Borgstena Textile Portugal Unipessoal Lda

- Shawmut Corp

- Apex Mills Corp

- Seiren Co Ltd

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For