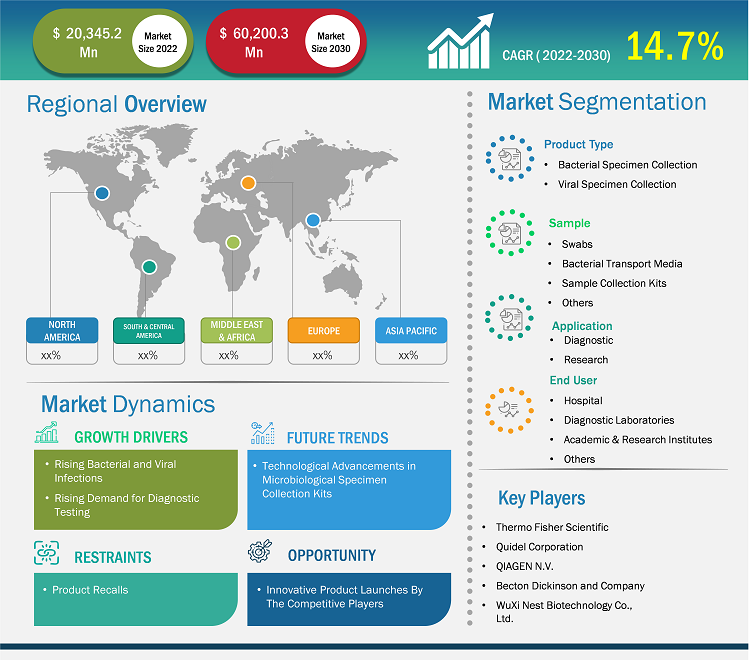

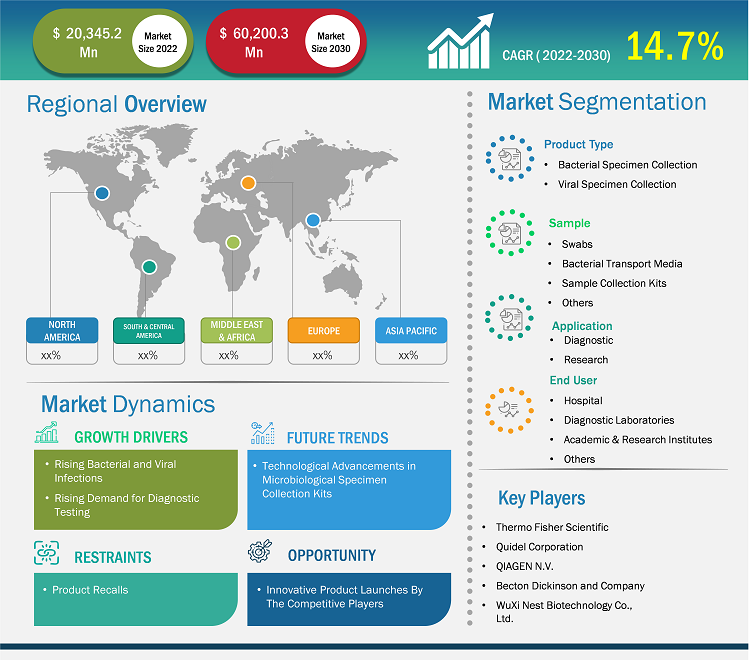

[Research Report] The bacterial and viral specimen collection market size is expected to grow from US$ 20,345.2 million in 2022 to US$ 60,200.3 million by 2031; it is estimated to register a CAGR of 14.7% from 2022 to 2031.

Analyst’s View Point

The bacterial and viral specimen collection market analysis explains market drivers, such as the rising prevalence of bacterial and viral diseases, which is a standalone factor responsible for influential market growth. Further, technological advancement is expected to introduce new trends in the market during 2022–2031. Based on product type, the market is bifurcated into bacterial specimen collection and viral specimen collection. The bacterial specimen collection segment accounted for a larger share in 2022. Based on application, the diagnostic segment dominated the market by accounting for the maximum share. By sample, the market is segmented as swabs, bacterial transport media, sample collection kits, and others. By end-user segment, the hospitals segment is likely to account for a considerable share of the bacterial and viral specimen collection market during the forecast period.

Bacterial and viral specimen collection is used for the isolation, identification, and characterization of bacterial & viral agents, proper collection and transport of clinical specimens. The specimens are collected and comply with the required biosafety guidelines when dealing with potentially infectious clinical specimens to maintain a safe working environment for healthcare workers, patients, and laboratories.

Market Insights

Rising Prevalence of Bacterial and Viral Diseases

According to the ReAct published report in 2022, in the past, bacterial infections have been underestimated, causing a global healthcare burden. For instance, the Organisation for Economic Co-operation and Development (OECD) report reveals that microorganisms such as E.coli and Klebsiella pneumonia that are resistant to third-generation cephalosporins, methicillin-resistant Staphylococcus aureus (MRSA) and Pseudomonas aeruginosa cause the healthcare-associated infections (HAIs) pose a significant burden on the healthcare system. Additionally, the report further reveals that 63.5% of the infection cases are caused due to antibiotic-resistant bacteria. Further, the ReAct report reveals that 7.7 million deaths globally were linked to bacterial infection, accounting for 13.6% or 1 in 8 of all global deaths, making bacterial infection the second-leading cause of death globally. Such increasing bacterial infections are due to only five types of bacteria. These include Staphylococcus aureus, Escherichia coli, Streptococcus pneumoniae, Klebsiella pneumoniae, and Pseudomonas aeruginosa.

The American Cancer Society, Inc. 2023 report reveals that viral infections are also on the rise globally. Human Papillomavirus (HPV), HPV and cervical cancer, and HPV and other cancers are examples of the main causes of viral infections. Among these, HPV infections are very common among the population. Therefore, rising bacterial and viral infection among the population is a standalone factor responsible for the influential growth of the market in the forecast period 2021-2031.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Bacterial and Viral Specimen Collection Market: Strategic Insights

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Bacterial and Viral Specimen Collection Market: Strategic Insights

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Future Trend

Technological Advancement in Microbiological Specimen Collection Kits

Specimen for culture must be collected by the technician and processed properly in the laboratories. Specimen collection kits are available for routine culture, and each kit comprises a transport system composed of a sterile swab and transport medium. For proper processing and transportation of collected specimens, companies are developing innovative specimen collection kits. "Fisherbrand Bacteriology Culture Collection and Transport System" by Fischer Scientific is one such example of an innovative specimen collection kit. The specimen collection kit is specialized for the collection and transportation of a wide range of bacteria, viruses, and facultative microorganisms.

Further, Anaerobe Systems, Inc.'s "BIOME-Preserve Anaerobic Microbiome Collection Kit" is another example of a specimen collection kit. BIOME-Preserve is a specialized collection kit that preserves live microbiome samples (such as stool or fecal samples) for the growth and isolation of anaerobic and facultative anaerobic microorganisms. Also, the samples can be directly frozen in BIOME-Preserve for long-term cryogenic storage with multiple collection species such as Bifidobacterium spp., Bacteroides spp., Blautia spp., Eubacterium halii, Akkermansia muciniphila, and Faecalibacterium prausnitzii. Thus, technological advancement in bacterial and viral specimen collections could propel the growth of the bacterial and viral specimen collection market in the future.

Report Segmentation and Scope

Product Type-Based Insights

Based on product type, the bacterial and viral specimen collection market is bifurcated into bacterial specimen collection and viral specimen collection. The bacterial specimen collection segment held a larger market share in 2022. Rising bacterial infection worldwide and routine bacteria clinical testing in the laboratories is a standalone factors responsible for the influential segment growth for the forecast period 2021-2031. This is due to bacteria present in the environment being responsible for causing several diseases and mortality in farm animals. To identify the specific bacteria responsible for causing infection, a bacteria culture test is a common laboratory test performed to help diagnose certain types of infections. The specimens collected for such bacteria test is throat culture, urine culture, sputum culture, blood culture, stool culture, and others. Therefore, rising bacterial infection results in accelerated demand for specimen collection kits, resulting in routine clinical examinations responsible for influential segment growth.

Application-Based Insights

Based on application, the global bacterial and viral specimen collection market is classified into diagnostic and research. The diagnostic segment held the largest market share in 2022 and is anticipated to register the highest CAGR during 2022–2031. A specimen collection kit offers all the components necessary to secure a sample and transport it to the laboratory for diagnostic purposes. Also, companies are developing innovative collection kit products intended for diagnostic clinical purposes. Merck's "Milliflex Rapid System 2.0" is one such example intended for microbial QC testing with a proven rapid microbiology testing method. "Milliflex Rapid System 2.0" is an automated system intended for the diagnostic detection of contaminant microorganisms and is suitable for rapid sterility, bioburden, in-process, and product release testing. Also, the product is equipped with a range of new features and is still based on the same proven ATP-bioluminescence technology, providing lucrative benefits for faster clinical results. These include fast and reproducible results, easy handling & validation, and others.

End User-Based Insights

Based on end users, the global bacterial and viral specimen collection market is segmented as hospitals, diagnostic laboratories, academic & research institutes, and others. The hospitals segment will account for the largest share of the bacterial and viral specimen collections market. Rising patients suffering from respiratory viruses and bacterial infection and subsequently offering a rationale for antimicrobial drug therapies are the contributing factors responsible for the growing demand for specimen collection kits in hospitals. Additionally, surging cases of healthcare-associated infections (HAIs) in acute care hospital raises the utilization of bacterial and viral specimen collection products in hospitals, thereby dominating the market growth for the forecast period 2021-2031.

Regional Analysis

The North American bacterial and viral specimen collection market is segmented into the US, Canada, and Mexico. The market growth in this region is attributed to the rising viral diseases–a standalone factor positively influencing the growth of the market. As per the Icahn School of Medicine at Mount Sinai 2023 report, in the United States, encephalitis is commonly caused by a viral infection caused by the herpes virus and arboviruses. The National Institute of Health (NIH) report reveals that, in the US, encephalitis has been associated with an estimated 19,000 hospitalizations, 230,000 hospital delays, and US$650 million in hospitalization costs annually. Therefore, with rising encephalitis viral infection, there is an accelerated demand for bacterial and viral specimen collection kits.

Further, companies are developing innovative products through bacterial and viral specimen collection kits. Abbott's "multi-Collect Specimen Collection Kit" is one such example. The product specializes in collecting multiple specimens, providing real-time CT/NG samples. Also, the product specializes in collecting and transporting male and female specimens such as swabs & urine for the detection of bacteria, including Chlamydia trachomatis and Neisseria gonorrhoeae. Such notable developments will accelerate the adoption of bacterial and viral specimen collections in the US for the forecast period 2021-2031.

Likewise, Asia Pacific will account for the highest CAGR for the bacterial and viral specimen collections market for the forecast period 2021-2031. This is due to top players' presence in the Asia Pacific region involved in the development of bacterial and viral specimen collection kits. Marken is one such example involved in the production and delivery of biological sample kits. Marken is also an end-to-end solution partner for patient-centric global kit services, including customized sample collection kits intended for project management and developing products of any specifications. For instance, in June 2021, Marken announced the production of COVID-19 test kits with Marken's service portfolio, including direct-to-patient (DTP) and home healthcare (HHC) services, allowing the company to support ongoing clinical trials by delivering patients remotely in 80 countries globally. Therefore, innovative product launches by the top competitive players in the Asia Pacific region enhance the market growth of bacterial and viral specimen collection for the forecast period 2021-2031.

The report profiles leading players operating in the global bacterial and viral specimen collection market. These include Thermo Fisher Scientific, Quidel Corporation, QIAGEN N.V., WuXi Nest Biotechnology Co., Ltd., DiaSorin S.p.A, Titan Biotech Ltd, Spectrum Solutions LLC, Becton Dickinson and Company, COPAN Diagnostic Inc., Longhorn Vaccines and Diagnostic LLC.

- In January 2023, QIAGEN announced the launching of the EZ2 Connect MDx platform intended for automated sample processing in diagnostic labs. The new product launch is making an in-vitro diagnostic (IVD) platform for automated sample processing available globally from a research perspective. Also, the EZ2 Connect MDx enables labs to purify DNA and RNA from 24 samples in as little as 30 minutes, and the new device carries the European Union (EU) CE-IVD compliance available in the US, Canada, and other countries.

- In September 2021, Thermo Fisher Scientific announced the launching of the "SpeciMAX Stabilized Saliva Collection Kit" to safely collect saliva for a research perspective. The SpeciMAX Stabilized Saliva Collection Kit preserves viral nucleic acids in a non-hazardous stabilization solution that inactivates common respiratory viruses for safer sample collection.

- In August 2021, Cardinal Health announced a partnership with Abbott and Quidel for rapid over-the-counter (OTC) COVID-19 tests. Also, through this partnership, Cardinal Health's laboratory product portfolio can now support customized testing and surveillance programs intended for the workplace, travel & hospitality industry. Further, the partnership provides comprehensive solutions, including at-home tests, rapid on-site testing, PCR (molecular testing), and on-site or at-home specimen collection.

- In May 2021, the Food and Drug Administration (FDA) announced Everlywell's standalone, at-home COVID-19 test sample collection kit amid the pandemic. The kit is specialized to collect and transport the sample to the laboratory for processing.

Company Profiles

- Thermo Fisher Scientific

- Quidel Corporation

- QIAGEN N.V.

- WuXi Nest Biotechnology Co., Ltd.

- DiaSorin S.p.A

- Titan Biotech Ltd

- Spectrum Solutions LLC

- Becton Dickinson and Company

- COPAN Diagnostic Inc.

- Longhorn Vaccines and Diagnostic LLC

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

- Thermo Fisher Scientific

- Quidel Corporation

- QIAGEN N.V.

- WuXi Nest Biotechnology Co., Ltd.

- DiaSorin S.p.A

- Titan Biotech Ltd

- Spectrum Solutions LLC

- Becton Dickinson and Company

- COPAN Diagnostic Inc.

- Longhorn Vaccines and Diagnostic LLC

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Get Free Sample For

Get Free Sample For